- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: NFCU now has Zelle!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU now has Zelle!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU now has Zelle!

How does this differ between me just transferring money to another navy fed member? As the only person I ever transfer money to is also a navy fed member, so I've always just done the transfer function and they get the money instantly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU now has Zelle!

@Anonymous wrote:How does this differ between me just transferring money to another navy fed member? As the only person I ever transfer money to is also a navy fed member, so I've always just done the transfer function and they get the money instantly.

The main difference is that with Zelle you can do instant transfers to someone who isn't a NFCU member (if their bank/CU has Zelle, of course). Otherwise there's no difference.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU now has Zelle!

@outofcredit wrote:

@UncleB wrote:

@Anonymous wrote:

@Anonymous wrote:Gotcha, so it's a service that can be used between different financial institutions. Kind of like Chase Pay for multiple people that have Chase accounts that can do near immediate transfers, Zelle would allow that between different banks.

Yep! Chase Bank has quickpay and they use Zelle. Actually had Chase checking and closed it months ago when we transferred all of our accounts over to Navy. When we signed up for Navy's Zelle this morning, Navy had to actually pull our Chase Zelle even though the account had been closed. Don't really understand why that had to occur. But, gave them the okay to transfer the Zelle over to Navy. And, soon after, received an email from Chase that the Zelle app was transferred to Navy.

A bit odd. Maybe someone on these boards can explain why you may not be able to have two different banking institutions and use the Zelle app at both.

I'm glad to hear NFCU has the ability to 'fetch' an email or phone number from another institution... when USAA migrated to Zelle there were many complaints by members who's email/phone were erroneously registered to old (closed) accounts at other banks.

USAA would refer them to the old bank to get the email/phone number "freed up" but that was often a problem since the person was many times no longer a customer at the other bank. As you can imagine, there was a lot of frustration.

Either Zelle got that worked out for all participating banks, or NFCU is really on-the-ball... in either case, bravo!

I had the same issues initially with USAA bank also. One thing I did notice while registering for NFCU Zelle, although it "pulled" my phone information into the app, I only "verified" the unique email address for them and didn't bother to verify the phone number because I use the phone number at a different institution. If I had verified the phone number I am sure it would have "pulled" the phone number registration from the other institution.

Hmm....when I go through the process of setting up Zelle for NFCU, it pulled both my primary cell number and my primary email address that I have registered for my NFCU account. I do not see an option to "only verify the email address."

What I really wish is that it would let me delete both my primary cell number and my primary email address (as I am already using both for other Zelle accounts) and allow me to add a different email address instead.

It seems NFCU will only let you use the email address and cell phone that you have listed with the account. Do other financial institutions also have this rule or is that unique to Navy Federal?

It's a bit of a pain to create a different email address for each account, but I wouldn't mind so much if I could still keep the same cell phone number and email address as my primary contact information for each account, so all non-Zelle related communication stays on the one email address and cell phone number. I like getting all of my banking account communication in one place. But using a different email to receive all communication from each financial institution sounds like a lot of work.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU now has Zelle!

@Anonymous wrote:

@outofcredit wrote:

@UncleB wrote:

@Anonymous wrote:

@Anonymous wrote:Gotcha, so it's a service that can be used between different financial institutions. Kind of like Chase Pay for multiple people that have Chase accounts that can do near immediate transfers, Zelle would allow that between different banks.

Yep! Chase Bank has quickpay and they use Zelle. Actually had Chase checking and closed it months ago when we transferred all of our accounts over to Navy. When we signed up for Navy's Zelle this morning, Navy had to actually pull our Chase Zelle even though the account had been closed. Don't really understand why that had to occur. But, gave them the okay to transfer the Zelle over to Navy. And, soon after, received an email from Chase that the Zelle app was transferred to Navy.

A bit odd. Maybe someone on these boards can explain why you may not be able to have two different banking institutions and use the Zelle app at both.

I'm glad to hear NFCU has the ability to 'fetch' an email or phone number from another institution... when USAA migrated to Zelle there were many complaints by members who's email/phone were erroneously registered to old (closed) accounts at other banks.

USAA would refer them to the old bank to get the email/phone number "freed up" but that was often a problem since the person was many times no longer a customer at the other bank. As you can imagine, there was a lot of frustration.

Either Zelle got that worked out for all participating banks, or NFCU is really on-the-ball... in either case, bravo!

I had the same issues initially with USAA bank also. One thing I did notice while registering for NFCU Zelle, although it "pulled" my phone information into the app, I only "verified" the unique email address for them and didn't bother to verify the phone number because I use the phone number at a different institution. If I had verified the phone number I am sure it would have "pulled" the phone number registration from the other institution.

Hmm....when I go through the process of setting up Zelle for NFCU, it pulled both my primary cell number and my primary email address that I have registered for my NFCU account. I do not see an option to "only verify the email address."

What I really wish is that it would let me delete both my primary cell number and my primary email address (as I am already using both for other Zelle accounts) and allow me to add a different email address instead.

It seems NFCU will only let you use the email address and cell phone that you have listed with the account. Do other financial institutions also have this rule or is that unique to Navy Federal?

It's a bit of a pain to create a different email address for each account, but I wouldn't mind so much if I could still keep the same cell phone number and email address as my primary contact information for each account, so all non-Zelle related communication stays on the one email address and cell phone number. I like getting all of my banking account communication in one place. But using a different email to receive all communication from each financial institution sounds like a lot of work.

With both USAA and Wells Fargo I was able to specify which I wanted to use for Zelle transfers (it's either/or, not both).

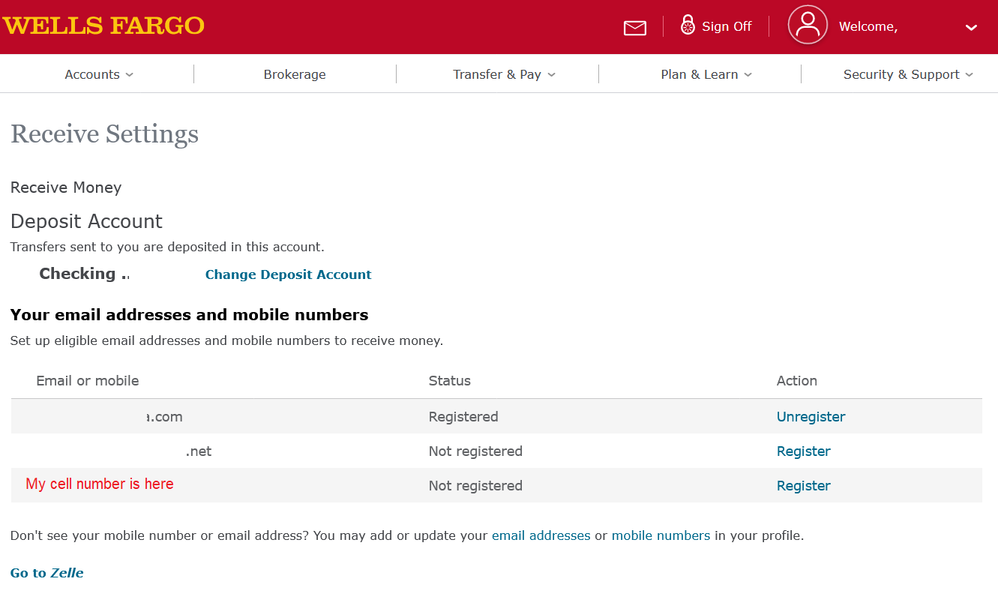

Here's a screenshot of how it looks with Wells Fargo:

I have my primary email address registered for Zelle with Wells Fargo. My cell number is on file as well, but it's already registered with USAA to use for Zelle (I'm assuming if I were to click 'register' it would 'pull' the number away from USAA, but I won't be testing that theory).

With USAA you have to use the mobile app to make any changes/updates, and due to their mobile app settings I can't take a screen shot. It's very similar, though... the email address that I use for transfers for Wells Fargo is on file with USAA as my 'primary' contact email and there's the option to register it for Zelle transfers, but again I won't be trying that out... my current set up is working quite well. ![]()

It might be worth a call to NFCU to see if they are able to manually designate a different email or phone number to use for Zelle transfers. I can't imagine that this hasn't come up before.

If you decide to give them a call, let us know how it goes! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU now has Zelle!

I must say I'm very unimpressed and irritated with the way Navy conducts Zelle transactions.

A $500 daily limit is pathetic.... And clearly Navy doesn't understand what a daily limit is. I've "reached my Daily limit" for the past five days, despite not sending any money, so it continues to prompt me to "send tomorrow instead?"

Useless garbage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU now has Zelle!

I have Zelle setup at DCU. All payments from my other banks get to DCU instantly through Zelle.

When I try to send Zelle payments from NFCU to DCU it says its a 3 day wait.

What gives? This is no different than a normal ACH transfer in terms of transfer times

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU now has Zelle!

@CreditGuy03 wrote:I have Zelle setup at DCU. All payments from my other banks get to DCU instantly through Zelle.

When I try to send Zelle payments from NFCU to DCU it says its a 3 day wait.

What gives? This is no different than a normal ACH transfer in terms of transfer times

I'm not able to answer your question. UncleB, what do you think?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU now has Zelle!

@Anonymous wrote:

@CreditGuy03 wrote:I have Zelle setup at DCU. All payments from my other banks get to DCU instantly through Zelle.

When I try to send Zelle payments from NFCU to DCU it says its a 3 day wait.

What gives? This is no different than a normal ACH transfer in terms of transfer times

I'm not able to answer your question. UncleB, what do you think?

Good question... while none of us can say for certain what the issue is, Wells Fargo gave me the same three day message on my first large(ish) transfer to myself as well.

To get around this, I changed the transfer to a smaller amount and it changed to 'instant'. Now regardless of the amount there's no delay; all I have to be concerned with are the daily/monthly limits. I had a similar issue the first time I sent my brother money with Zelle... the first transfer was only instant if I lowered the amount, but now transfers to him are also instant up to my daily limit(s).

From what I can tell all limits/holds are set by the sending institution, and can vary from bank to bank/CU. For example, the daily/monthly limits with Wells Fargo are more generous than with USAA. Banks can also give you a higher limit depending on your relationship (i.e. at Wells Fargo Private Bank customers can get higher limits).

I hope this helps. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU now has Zelle!

@Anonymous wrote:

@outofcredit wrote:

@UncleB wrote:

@Anonymous wrote:

@Anonymous wrote:Gotcha, so it's a service that can be used between different financial institutions. Kind of like Chase Pay for multiple people that have Chase accounts that can do near immediate transfers, Zelle would allow that between different banks.

Yep! Chase Bank has quickpay and they use Zelle. Actually had Chase checking and closed it months ago when we transferred all of our accounts over to Navy. When we signed up for Navy's Zelle this morning, Navy had to actually pull our Chase Zelle even though the account had been closed. Don't really understand why that had to occur. But, gave them the okay to transfer the Zelle over to Navy. And, soon after, received an email from Chase that the Zelle app was transferred to Navy.

A bit odd. Maybe someone on these boards can explain why you may not be able to have two different banking institutions and use the Zelle app at both.

I'm glad to hear NFCU has the ability to 'fetch' an email or phone number from another institution... when USAA migrated to Zelle there were many complaints by members who's email/phone were erroneously registered to old (closed) accounts at other banks.

USAA would refer them to the old bank to get the email/phone number "freed up" but that was often a problem since the person was many times no longer a customer at the other bank. As you can imagine, there was a lot of frustration.

Either Zelle got that worked out for all participating banks, or NFCU is really on-the-ball... in either case, bravo!

I had the same issues initially with USAA bank also. One thing I did notice while registering for NFCU Zelle, although it "pulled" my phone information into the app, I only "verified" the unique email address for them and didn't bother to verify the phone number because I use the phone number at a different institution. If I had verified the phone number I am sure it would have "pulled" the phone number registration from the other institution.

Hmm....when I go through the process of setting up Zelle for NFCU, it pulled both my primary cell number and my primary email address that I have registered for my NFCU account. I do not see an option to "only verify the email address."

What I really wish is that it would let me delete both my primary cell number and my primary email address (as I am already using both for other Zelle accounts) and allow me to add a different email address instead.

It seems NFCU will only let you use the email address and cell phone that you have listed with the account. Do other financial institutions also have this rule or is that unique to Navy Federal?

It's a bit of a pain to create a different email address for each account, but I wouldn't mind so much if I could still keep the same cell phone number and email address as my primary contact information for each account, so all non-Zelle related communication stays on the one email address and cell phone number. I like getting all of my banking account communication in one place. But using a different email to receive all communication from each financial institution sounds like a lot of work.

There wasn't an actual option to only verify the email. I simply ignored the prompts to verify the phone number listed and only "verified" the email. My NFCU Zelle works fine with only the email being actually "verified."

Instead of waiting for the storm to pass, I've learned to dance in the rain.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU now has Zelle!

same problem 3 days in or out sending 1$ for navy i also have it set up at ally and chase and to or from those instant only navy is 3 day hold customer service is usless they have no idea why

MAJOR BANK CARDS Amex BC 15k, Amex CM 1500, Amex Delta 1k, BB&T Travel 4500, BBVA 6900, CAP1QS 2600, Discover 3300, Marvel MC 6000, Wells Fargo CR 4500, Blispay 2k

CREDIT UNION CARDS DCU 2k , Robbins 10k, United1st 5k

STORE CARDS Amazon 10k, Home Depot 5k, PayPal 4k, Walmart 6k, Lowes 12k