- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Need Advice to Pay off Credit Card Debt

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need Advice to Pay off Credit Card Debt

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Advice to Pay off Credit Card Debt

I need to decide if I should approach the snowball vs avalanche method to pay off my credit card debt. The minimum payments that I'm paying every month only pays about $30-50 every month due to my high interest rates. I incurred some of my debt to damage to my home during Hurricane Harvey, insurance didn't pay for everything that had to be replaced. At the end of the month, I'll have an extra $2100 and I need to decide if I should apply the money to towards the lowest balance cards or my highest interest cards and work my way down to pay off my cards. I have excellent payment history and my credit scores are in the 700's. My utilization across my cards is 89% due to high balances. I can list my card balances with interest rates if that will help. I've cut back on spending due to coronavirus, most of my spending is at the grocery store since I don't go out with friends or eat out. I qualify for pay off, tally, or other lending companies but I want to try to attack this myself to get myself out of debt. Any advice would be appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Advice to Pay off Credit Card Debt

I payed off 50k this year using snowball, starting with highest amount. IF you have any savings, try to use a portion of that to get a head start. I know not everyone approves of Dave Ramsey, but take a look at his Youtube videos and his book "Financial freedom" to get inspired. I do not follow all his advice but following him on YouTube helped me stay focused when I got discouraged and frustrated.

I started with a budget and factored my payments into the budget. Same like you, my highest expense is groceries, so I utilize a cash back card to get some money back on those purchases that you can then apply towards dept. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Advice to Pay off Credit Card Debt

A possible third option is to look at getting a debt consolidation loan through a credit union. The interest rate should be significantly less than your cards and you'd pay it down the same way w/o having to worry about smallest balance vs. highest rate. The big caveat with those is obviously that, since they free up your credit lines, you can go the opposite direction and get yourself into further trouble by running cards up again before the loan is paid off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Advice to Pay off Credit Card Debt

I also used the snowball method and read Dave Ramey's Total Money Makeover book. It might help us to help you if you list your card balances with interest rates. You can list credit limits if you want to lower utilization to increase credit scores, if that's important to you at all. Good luck, you can do it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Advice to Pay off Credit Card Debt

I agree with @Slabenstein's loan suggestion, and warning, even though you specified part of your debt was due to unforseen hurricane damage your ins. company did not paid.

I would like to add a bit more.

A loan will help you by:

1) lowering the the amount of cash destined for interest,

2) lowering your payments,

3) lowering your CC UTIL,

4) increasing your credit diversity, and

5) adding to your AAoA in the long run

However, if your credit score does not support a loan, I would like to offer a possible 4th road to follow. I would try and lower all balances based, not on their interest, or highest balance first, or lower balance first, but by Balance % (which will become the UTIL % when it passes onto the bill.

This is when the balances of each card, as well as their credit limit amounts would come in handy.

Each CC will have its own balance (i.e. $5,720) in relation to its CL (i.e. $7,000).

Divide one by the other to obtain the Balance % (5,720 ÷ 7,000 = 0.8171) // (0.8171 = 81.7%) // (81.7% = 82%)

Do that with all of your cards.

Lets imagine you have 82%, 79%, 72% and 64%.

The first part of the mission is to lower all down to 63%.

You need to do a similar excercise in order to decipher how much money would it take to lower the one at 82% down to 63%.

First, the one at 82% has a CL of 7,000... The 63% of 7,000 (7,000 x 63%) is $4,410.

So the goal is to lower its $5,720 balance, down to $4,410 ($5,720 - $4,410 = $1,310).

Do the same with all of them.

Lets say that, respectively, your cards need

Card 1: $1,310

Card 2: $1,127

Card 3: $965

Card 4: $893

Sum all of it (Total amount needed: $4,295) and divide the amount needed for Card 1 by total amount needed (1,310 ÷ 4,295 = 0.3050... or 30.5%), and do that with all the previous.

Card 1: $1,310 = 30.5%

Card 2: $1,127 = 26.2%

Card 3: $965 = 22.5%

Card 4: $893 = 20.8%

Even when the total amount needed is $4,295... you can distribute the extra $2,100 you will have at the end of the month, using those percentages:

Card 1: 30.5% = $640.50

Card 2: 26.2% = $550.20

Card 3: 22.5% = $472.50

Card 4: 20.8% = $436.80

Now all the cards will have a lower and closer balance %.

A spreadsheet will help with automation, but otherwise, a good ol' calculator can do it too, just like I did on the fly.

Repeat this excercise each month, and see how far down does the extra money you have left at the end of the month can lower their balance %.

Your safe zone is reaching 8.9%.

Your goal should be 1%.

The good thing about this is that you can do a "dry run" and forecast how long will it take you to lower all CC down to your desired goal. And no matter how much is left at the end of the month as payment, you can equally lower their balance % month by month.

Wow... this was long. Hopefully it makes sense and helps you, and/or anyone else looking for options.

If something doesn't make sense, ask away, maybe my fake numbers don't add up, but the technique is still the same.

Thanks for reading! LOL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Advice to Pay off Credit Card Debt

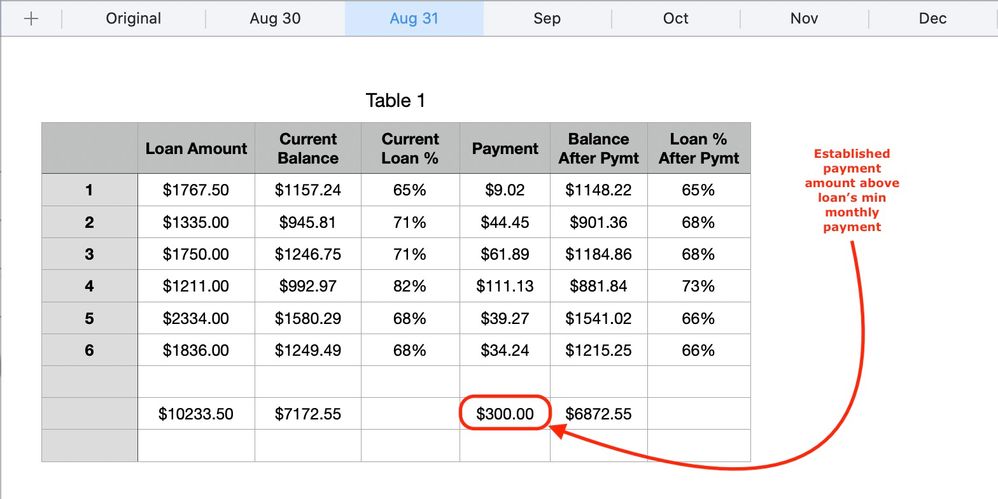

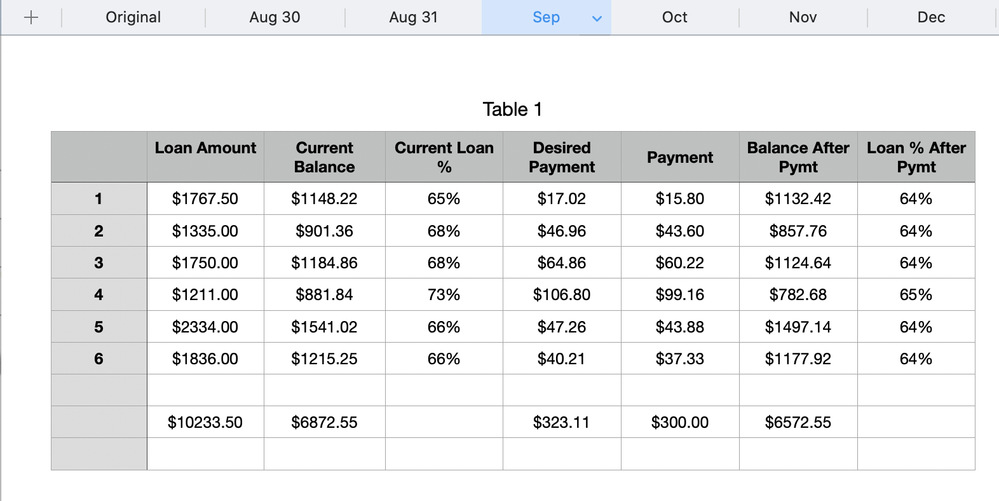

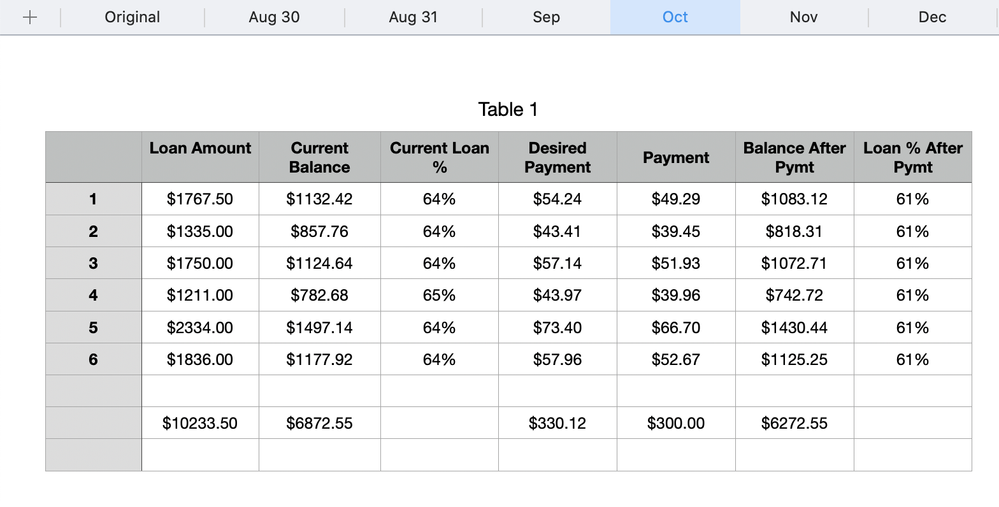

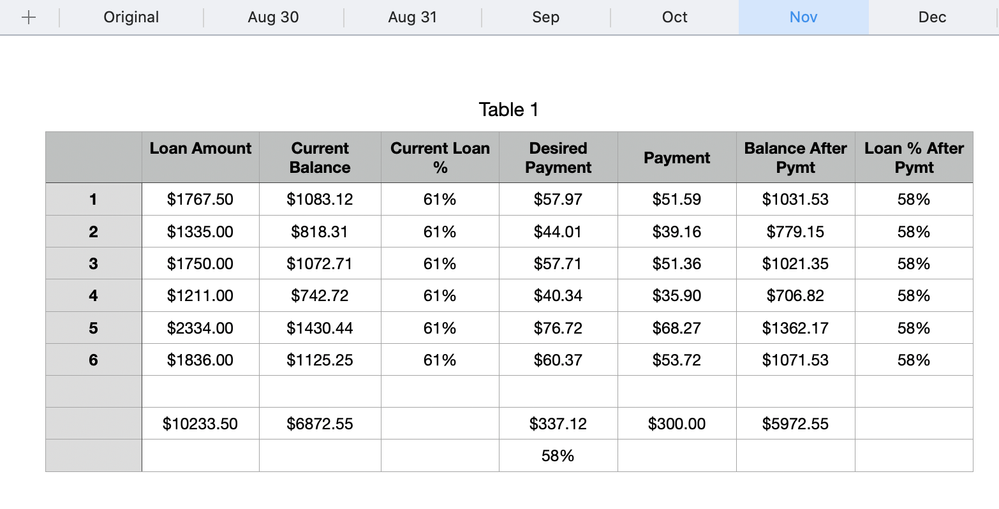

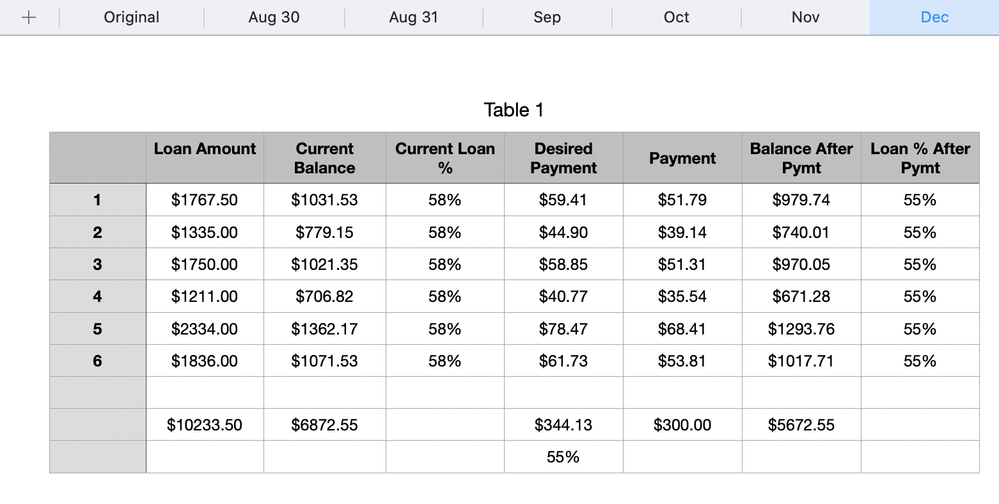

This is a "dry run" I did with DW's student loans.

From the money we have extra at the end of each month, we destined $300 above the loans' min pymts.

There are months in which we would like to put down more in order to reach that month's stretch goal, but otherwise, we would still use whatever left and apply it based on their balance %.

Notice how the 82%, 71%, 71%, 68%, 68%, and 65% would all lower down to 55% by the end of the year!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Advice to Pay off Credit Card Debt

@luckydiva95 wrote:I need to decide if I should approach the snowball vs avalanche method to pay off my credit card debt. The minimum payments that I'm paying every month only pays about $30-50 every month due to my high interest rates. I incurred some of my debt to damage to my home during Hurricane Harvey, insurance didn't pay for everything that had to be replaced. At the end of the month, I'll have an extra $2100 and I need to decide if I should apply the money to towards the lowest balance cards or my highest interest cards and work my way down to pay off my cards. I have excellent payment history and my credit scores are in the 700's. My utilization across my cards is 89% due to high balances. I can list my card balances with interest rates if that will help. I've cut back on spending due to coronavirus, most of my spending is at the grocery store since I don't go out with friends or eat out. I qualify for pay off, tally, or other lending companies but I want to try to attack this myself to get myself out of debt. Any advice would be appreciated.

Since your utilization is high enough to possibly invoke adverse action by one or more lenders, I would concentrate on getting utilization percentages down across the board. I.e., get them all down to 78%; then get them all down to 68%; and so on. Once you've got them all down to 28%, then start zeroing them out. My favorite method for that would be the snowball method.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Advice to Pay off Credit Card Debt

I started the debt snowball 2 months ago. I already have 2 CC payed, and another will be finished next month. It's very encouraging. But it will take a while to set everyting up. And it need regular adjustment and verify and double verification. Put it into a excel spreadsheet.

Here is how I did.

- I took notes of all this in excel.

- All this need to be verify and checked every 2 weeks.

1. I went and check on by one. the minimum payment on all CC. Wrote it down in excel

2. Calculate the total.

3. Check out everything you can save.

* You choose your lowest debt, let's call it the debt blast. The one you will blast.

* When this one is payed you use the money you where paying on that CC and apply it to the new one.

4. Calculate how much you can pay on your blast.

With all your numbers. You will want to know how much total you have to pay minimum payment.

- How much you can contribute to your blast.

- That technique let you do all your minimum payment and blast one.

So the other important step is to do it.

In your bank account, set everything you owe to minimum payment. As automatic payment.

Then DO NOT make an automatic payment on your debt blast. Because you might get cut one month payming it all and go over and for example if your blast amount is 600$/ month and you have auto pay to 600$ and you actually owe only 50$. You will pay 600$ and you CC will be in credit for 550$ and it's going to be sad.

You want manual payment on your debt blast, the one that is the smallest. You want to adjust it every month or at least check the balance and make another manual payment. To be safe you can make an auto pay on the debt blast to make sure you pay the minimum. But not all the way to the full amount.

Remeber it's money, so it's moving. It need constant readjustment. If you suceed to cut something like cable, well use that money on the debt blast amount. Eg: you save 60$ by cutting something, put it on your debt blast.

Also something I do to, is when the month is over, if there is any money left in the bank account, I use it on my debt blast.

Every 2 weeks or more often check if everything work well, everything need to be payed the minimum. That minimum can change and need readjustment. Keep going in your procedure and excel spread sheet every 2 weeks to see if anything can be improved and everything balance.

Remember when something if finished payed, that minimum payment amount will be added to your blast amount. Eg:

CC 1 - min payment 25$, balance 500$

CC 2 - min payment 50$, balance 1000$

So your blast amount is 250$/month.

When CC 1 is finished payed, you apply the min payment 25$ to your blast amount. It is 250+25= 275$.

You then blast CC2 not with 250$ but with your new amount 275$. That is why it's called snowball. It start small and get big.

Eg

Next month I will start a new blast, attacking the 4th CC.

God bless.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Advice to Pay off Credit Card Debt

I used an app called debt quencher. I entered all my debt, minimum payments, and how much "extra" I could pay each month. it immediately gave you 4 pay off plans (just paying minimums, pay lowest balances first, pay highest interest first, or pay highest balance first). Once you see which plans saves you the most you choose it and it tells you how much to pay for each account and when you will be paid off. I just wiped out like $80,000 in credit card debt and $26000 in student loans this year using this method (I was paying off close to $$12,000-15000/month). I was able to do it in 10 months. I found this app so helpful to organize my thoughts. When I tried to do it on paper I was getting it wrong.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Advice to Pay off Credit Card Debt

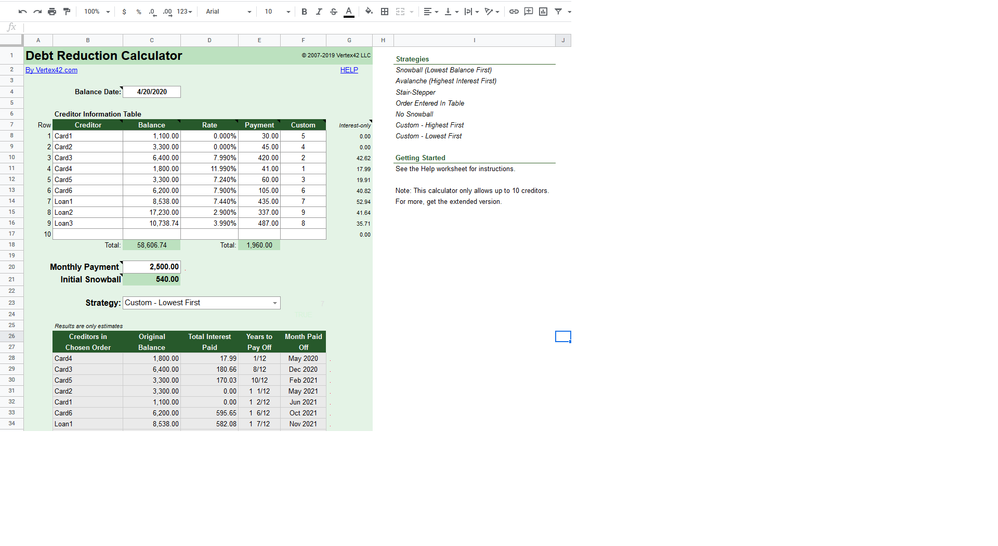

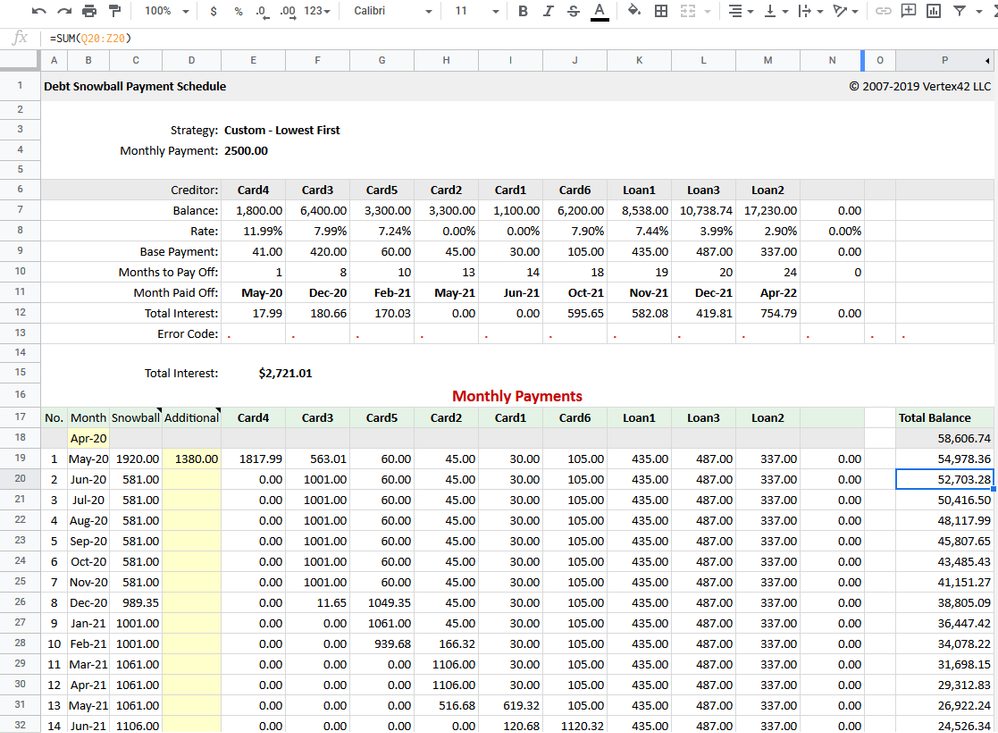

Budgeting and how much you can pay is crucial to know and doing things in mind and rough sheets is not helpful, there are many ways to jot this down, there are apps that help too, I tried couple different things initially keep track in excel sheets and notepads etc and it was just not giving idea of the bigger picture. Finally I used this excel sheet as a template https://www.vertex42.com/Calculators/debt-reduction-calculator.html, good thing is it comes in both excel and google sheet variety, I manage everything in google so I have access to it everywhere, here is a sample of sheet to show an example of how it works. It allows you to make one time payment that is not budgeted if you end up getting a bonus or something else. It did take couple of months trial and erro before I was able to nail how much I really can afford to put aside.