- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Need Guidance: Budget, Retirement Planning, Credit...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need Guidance: Budget, Retirement Planning, Credit Card Payoff, Etc.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Guidance: Budget, Retirement Planning, Credit Card Payoff, Etc.

Hi Guys,

Long time lurker -- short time poster here.

I've recently turned the big 30 and am trying to piece together my financial life in a way that can work for me now and in the future. I live in a big city and have a lot of expenses, credit card debt, student loan debt as well as a payment plan with the IRS, a payment plan with my dentist and the usual rigamarole (laundry, food, transportation, health care, etc) and trying to save up for citizenship and lawyer fees (one of my friend is a lawyer and agreed to do the whole thing including the app fee for $1500, {Moderator Edit - See my post below - Irish80}

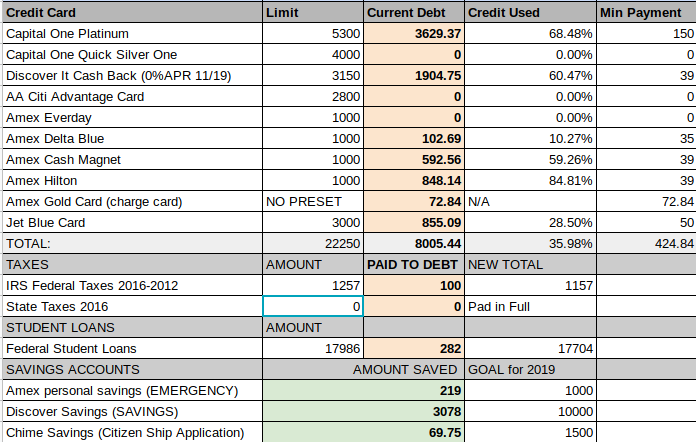

This is my current debt load and what money that I've managed to saved over the last 6-8 to months while I've been trying to get back on my feet:

I need some guidance as to how to best manage it and what you would do if you were in a similar situation and what the best way to truly not feel stuck and in the whole in month would be -- the amounts that I typically pay are far and above the minimums, this guide I made for myself just to keep myself in check and in line with reality -- my debt has decreased a lot the last few months and my credit score is definitely 10X better than what it used to be.

I make between 45-70K in any given year (work in sales, base 40K+comission) but work in a really high cost city in where about 40% of my after tax incomes goes to rent, 6.9-8% to healthcare (and this is with the employer subsidy), about $150 a month in transporation fees, min $242 on student loans (usually throw an extra $40 on it a month just to try an alliviate some of the long term pain).

Its been really tough but finally feel like its all sorta doable in the next few years --- the issue is that my job may be closing up shop at the end of the year and may need to find a new gig -- so the consistency that has come about may be throw into shock -- or not -- who knows. I contemplated taking my savings and throwing it onto my Capital one (highest debt card) but I think I rather have physical money for the end of the year just in case It takes me a while to find a new job (i want to have a least 6 months worth of savings if not more, the goal is 10K, I think realistically I can get it to at least 6-7K no problem.

I also don't want to neglect that I need to start a retirement fund -- i figure -- even if I put a little bit in now its much better than not putting anything in at all -- any advice here? Any percentage you think that may be doable?

I generally live off of about $200-300 every 2 Weeks (this includes food, entertainment, going out, etc ) -- keep in mind I live in a city where going out to eat with a friend at a restaurant can be like $30-50 just for yourself, and do want to try and keep some of my sanity.

So yea, any advice would be appreciated as to how may be the best way to tackle my debt (currently doing the snowball method) , save for retirement, Reduce dental expenses (currently have a dental saving plan --insurance wont cover any of my issues, kinda bs ), and other general personal finance tips would also be greatly appreciated.

I currently have my direct deposit as follows:

Bank 1 Checking - 20% Spending Account

Bank 2 Checking - 20% Debt Payment Account

Bank 1 Savings Acct - 40% Rent

Bank 2 Savings - 15% Personal Savings

Bank 3 Savings - 5% Emergency Fund

I know it sounds crazy having so many accounts (hell, I mean I have like 9 cards or something like that) but I really don't mind all of the apps and keeping up with all of the payments, etc --- I'm really an "out of sight out of mind" guy when it comes to money which is why I've automated the process with each one of my credit cards as well (autopay ftw) -- if I don't see it coming out of my account it just doesn't seem to sting as much -- which is why I love when things come out pre-tax -- its just easier that way.

pretty much just keep an eye on my spending account and don't really focus on any of the others (which is why it helps that I keep my savings seperate from my spending account) .

Also -- please note, I currently DO NOT USE any of the credit cards -- I only use the Amex Gold (Charge card) as to stay within my budget -- truly -- i tell you -- I'm a changed man -- just kinda buried in debt and not enough after tax income it feels like sometimes.

So yea --- advice please!

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Guidance: Budget, Retirement Planning, Credit Card Payoff, Etc.

@Anonymous wrote:Hi Guys,

Long time lurker -- short time poster here.

I've recently turned the big 30 and am trying to piece together my financial life in a way that can work for me now and in the future. I live in a big city and have a lot of expenses, credit card debt, student loan debt as well as a payment plan with the IRS, a payment plan with my dentist and the usual rigamarole (laundry, food, transportation, health care, etc) and trying to save up for citizenship and lawyer fees (one of my friend is a lawyer and agreed to do the whole thing including the app fee for $1500,

This is my current debt load and what money that I've managed to saved over the last 6-8 to months while I've been trying to get back on my feet:

I need some guidance as to how to best manage it and what you would do if you were in a similar situation and what the best way to truly not feel stuck and in the whole in month would be -- the amounts that I typically pay are far and above the minimums, this guide I made for myself just to keep myself in check and in line with reality -- my debt has decreased a lot the last few months and my credit score is definitely 10X better than what it used to be.

I make between 45-70K in any given year (work in sales, base 40K+comission) but work in a really high cost city in where about 40% of my after tax incomes goes to rent, 6.9-8% to healthcare (and this is with the employer subsidy), about $150 a month in transporation fees, min $242 on student loans (usually throw an extra $40 on it a month just to try an alliviate some of the long term pain).

Its been really tough but finally feel like its all sorta doable in the next few years --- the issue is that my job may be closing up shop at the end of the year and may need to find a new gig -- so the consistency that has come about may be throw into shock -- or not -- who knows. I contemplated taking my savings and throwing it onto my Capital one (highest debt card) but I think I rather have physical money for the end of the year just in case It takes me a while to find a new job (i want to have a least 6 months worth of savings if not more, the goal is 10K, I think realistically I can get it to at least 6-7K no problem.

I also don't want to neglect that I need to start a retirement fund -- i figure -- even if I put a little bit in now its much better than not putting anything in at all -- any advice here? Any percentage you think that may be doable?

I generally live off of about $200-300 every 2 Weeks (this includes food, entertainment, going out, etc ) -- keep in mind I live in a city where going out to eat with a friend at a restaurant can be like $30-50 just for yourself, and do want to try and keep some of my sanity.

So yea, any advice would be appreciated as to how may be the best way to tackle my debt (currently doing the snowball method) , save for retirement, Reduce dental expenses (currently have a dental saving plan --insurance wont cover any of my issues, kinda bs ), and other general personal finance tips would also be greatly appreciated.

I currently have my direct deposit as follows:

Bank 1 Checking - 20% Spending Account

Bank 2 Checking - 20% Debt Payment Account

Bank 1 Savings Acct - 40% Rent

Bank 2 Savings - 15% Personal Savings

Bank 3 Savings - 5% Emergency Fund

I know it sounds crazy having so many accounts (hell, I mean I have like 9 cards or something like that) but I really don't mind all of the apps and keeping up with all of the payments, etc --- I'm really an "out of sight out of mind" guy when it comes to money which is why I've automated the process with each one of my credit cards as well (autopay ftw) -- if I don't see it coming out of my account it just doesn't seem to sting as much -- which is why I love when things come out pre-tax -- its just easier that way.

pretty much just keep an eye on my spending account and don't really focus on any of the others (which is why it helps that I keep my savings seperate from my spending account) .

Also -- please note, I currently DO NOT USE any of the credit cards -- I only use the Amex Gold (Charge card) as to stay within my budget -- truly -- i tell you -- I'm a changed man -- just kinda buried in debt and not enough after tax income it feels like sometimes.

So yea --- advice please!

Thanks in advance.

My advice would be to pay off:

-IRS

-4 Amex cards

That would boost your score. Then once those have reported I would apply

to a credit union which has a low interest, no cash advance fee, no balance transfer fee platinum card, such as Unify FCU or Digital FCU.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Guidance: Budget, Retirement Planning, Credit Card Payoff, Etc.

MyFICO's Forums Terms of Service

Prohibits;

Discussions including race, nationality, sex, religion, politics

Please refrain from including any of the above in posts. Thank you for your understanding and cooperation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Guidance: Budget, Retirement Planning, Credit Card Payoff, Etc.

beans & rice, rice & beans. get a side gig.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need Guidance: Budget, Retirement Planning, Credit Card Payoff, Etc.

2. Pay off Amex Hilton

3. Leave yourself a cushion in your savings so you don’t have to rely on cards if you come across a rainy day. $1k should do it

Based off the low end of your income range, I calculate you bring home $2,600/mo. (45k/12-ins*.75) You have roughly 25k in debt; after your transportation costs, rent (guessed $1,050), and day-to-day budget (600/mo) you’ll have at least $800/mo to pay towards debt. At that rate it’ll take about 31mo to pay everything off. On the high end of your range ($70k), it would take about 10mo. It looks like you’ll free up about $625/mo in debt payments when you’re done (not including irs payment since we’re getting rid of that ASAP!) At this point you’ll be about to hit your savings goals and start contributing towards retirement at a much faster rate without all those monthly payments.

A few possibilities to increase your pace would be to:

1. Reduce rent - move

2. No eating out at $30-$50 a pop. Invite friends over for a home cooked meal to socialize, pot luck style

3. Cut cable, change cell phone service, shop utility providers where possible

4. Pick up a second job

You’re actually not in bad shape looking at debt compared to income. I could see you doing this in less than 2 years easily, less than 1 if you really get after it.