- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Need some help focusing my debt repayment plans

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need some help focusing my debt repayment plans

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need some help focusing my debt repayment plans

So... I have recently consolidated several of my personal loans into 2 loans with lower interest rates (lowER.... not LOW) and freed up about $1k a month that I can apply to other debt. My credit score is about 680... based on my income, credit score, and current debt load, I think I'm pretty much maxed out as far as taking on any other loans. My credit report is clean (no baddies anywhere... just high utilization).

I don't have any specific goals right now, but I would like to simplify my finances and start dumping some of my rebuilder cards that I have. I'd also like to keep the most money available on my credit cards (just in case), so I don't really want to start with the cards I'm planning on closing first (its a psychological thing).

Here is what I have left. I want to do something with the credit cards now, which, I hope will increase my scores enough so that I can qualify to consolidate those loans. I've notated the accounts that I plan on closing. I've been making minimum payments (except on Discover) for so long that I know there's a possibility that I'll get balance chased... I'll probably just have to deal with it for now. Do I start smallest balance to largest... higher interest to lower... do I close the accounts as soon as they are paid off, or sock drawer them as long as they don't have fees? I just really need some help on focusing.

As I said earlier, I have $1k a month (I actually budget $260/week) that I can comfortably use to make extra payments. Being able to see progress keeps me motivated.

Thank you!

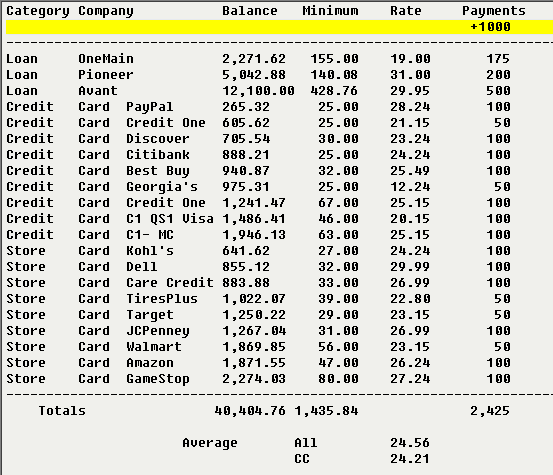

| Category | Company | Balance | Minimum Payment | Rate | Maturity | Credit Limit | Notes |

| Loan | OneMain | $ 2,271.62 | $ 155.00 | 19.00% | 06/20/2020 | Rewards Program | |

| Loan | Pioneer Credit | $ 5,042.88 | $ 140.08 | 31.00% | 10/16/2021 | New | |

| Loan | Avant | $ 12,100.00 | $ 428.76 | 29.95% | 10/26/2022 | New | |

| Credit Card | PayPal - MC | $ 265.32 | $ 25.00 | 28.24% | $300.00 | ||

| Credit Card | Credit One - MC | $ 605.62 | $ 25.00 | 21.15% | $650.00 | Close | |

| Credit Card | Discover Card | $705.54 | $ 30.00 | 23.24% | $800.00 | ||

| Credit Card | Citibank | $ 888.21 | $ 25.00 | 24.24% | $900.00 | ||

| Credit Card | Best Buy Visa | $ 940.87 | $ 32.00 | 25.49% | $1,000.00 | ||

| Credit Card | Georgia's Own Visa | $ 975.31 | $ 25.00 | 12.24% | $1,000.00 | My Bank | |

| Credit Card | Credit One - Visa | $ 1,241.47 | $ 67.00 | 25.15% | $1,300.00 | Close | |

| Credit Card | Capital One QS1 Visa | $ 1,486.41 | $ 46.00 | 20.15% | $1,550.00 | ||

| Credit Card | Capital One - MC | $ 1,946.13 | $ 63.00 | 25.15% | $2,000.00 | Close - Merge w/ CapOne QS (was Orchard) | |

| Store Card | Kohl's | $ 641.62 | $ 27.00 | 24.24% | $700.00 | ||

| Store Card | Dell Financial Services | $ 855.12 | $ 32.00 | 29.99% | $1,000.00 | Close | |

| Store Card | Care Credit | $ 883.88 | $ 33.00 | 26.99% | $3,600.00 | ||

| Store Card | TiresPlus | $ 1,022.07 | $ 39.00 | 22.80% | $1,200.00 | ||

| Store Card | Target | $ 1,250.22 | $ 29.00 | 23.15% | $1,000.00 | Close | |

| Store Card | JCPenney | $ 1,267.04 | $ 31.00 | 26.99% | $1,500.00 | ||

| Store Card | Walmart | $ 1,869.85 | $ 56.00 | 23.15% | $1,900.00 | Close | |

| Store Card | Amazon | $ 1,871.55 | $ 47.00 | 26.24% | $2,000.00 | ||

| Store Card | GameStop | $ 2,274.03 | $ 80.00 | 27.24% | $2,350.00 | ||

| Totals | $ 40,404.76 | $ 1,435.84 | $24,750.00 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some help focusing my debt repayment plans

Hi, C.

There's several ways to go about tackling a large CC debt payoff, mostly revolving around either hit highest int% first (most bang for buck) or hit smallest acct balances first (create payoff momentum). Both are viable. But you raised a good concern: you might get balance chased.

A thought I had looking at your profile: pretty much all the cards are maxed & thus candidates to be balance chased. Not knowing how long you've been at these balances, nor how long you've been paying minimum, I wondered if it might not be effective to: double pay the minimum on every card (from $712 to $1424 monthly) and then use the remaining $328 out of your extra $1040 to target a particular card (either snowball or highest int%)? Note: if you get paid weekly ("I have $260 per week") then know that every 3 months you'll have an extra week and thus, extra $260 -- make sure to use it to pay debt.

One other thought: Your overall CC util is roughly 21,000 owed on 24,750 = 85% so while paying down the balances some more credit "breathing room" might not be a bad thing. It'll help your scores and maybe increase the chances one of your creditors doesn't take AA. It sure can't hurt (might even make you feel better). I'm not suggesting go app, but rather consider paying down Discover and request a CLI. Not so long ago I was owing 18500 on 20750, including 7992 on 8000 to Discover. Once I got my balance with them below 5,000 I requested, and got, a 4000 CLI. Just a thought.

Good luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some help focusing my debt repayment plans

Additional thought: I don't necessarily consider my suggestion a "put it on pilot and stick to it" plan. It seems to me a reasonable and simple way to make some headway across the board. Once headway has been gained -- say all accounts are below 68.9% -- then a more surgical approach might make sense.

I was taught that a worthwhile goal should be challenging and yet attainable. For me, part of attainable is simple. I sure can bog down on minutia given half the chance. But that might only be me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some help focusing my debt repayment plans

Thanks, J.!

Funny that you should mention paying off Discover... I actually just decided to do that (I had some slush in my budget that I needed to get rid of before I spent it on crap). Since I've been making $100 every month to them anyway (4x the minimum due... just kept running it up), I paid it off, put my Netflix, Hulu, and MS Office subscriptions on it, and SD'd it for now. I'll try to for a CLI in a couple of months, once I make some more progress. I love that card!

I think I may tackle the PayPal MC next, since its small... not sure what I'm going to do with it yet, though. Then I'll probably tackle at least one of the Cap1's, so that I can combine those accounts. That might take me a month or so, unless I get another bonus this year. Its pretty haphazard and in no way does it focus on saving me money (I'm kind of ignoring interest rates right now), but it makes me feel good to kill them.

Any idea what I should do with that PayPal? Its a toy limit and my newest card. I haven't dug into the possible perks of having it yet and I have no idea how they handle CLI's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some help focusing my debt repayment plans

@Catatonico wrote:So... I have recently consolidated several of my personal loans into 2 loans with lower interest rates (lowER.... not LOW) and freed up about $1k a month that I can apply to other debt. My credit score is about 680... based on my income, credit score, and current debt load, I think I'm pretty much maxed out as far as taking on any other loans. My credit report is clean (no baddies anywhere... just high utilization).

I don't have any specific goals right now, but I would like to simplify my finances and start dumping some of my rebuilder cards that I have. I'd also like to keep the most money available on my credit cards (just in case), so I don't really want to start with the cards I'm planning on closing first (its a psychological thing).

Here is what I have left. I want to do something with the credit cards now, which, I hope will increase my scores enough so that I can qualify to consolidate those loans. I've notated the accounts that I plan on closing. I've been making minimum payments (except on Discover) for so long that I know there's a possibility that I'll get balance chased... I'll probably just have to deal with it for now. Do I start smallest balance to largest... higher interest to lower... do I close the accounts as soon as they are paid off, or sock drawer them as long as they don't have fees? I just really need some help on focusing.

As I said earlier, I have $1k a month (I actually budget $260/week) that I can comfortably use to make extra payments. Being able to see progress keeps me motivated.

Thank you!

Category Company Balance Minimum Payment Rate Maturity Credit Limit Notes Loan OneMain $ 2,271.62 $ 155.00 19.00% 06/20/2020 Rewards Program Loan Pioneer Credit $ 5,042.88 $ 140.08 31.00% 10/16/2021 New Loan Avant $ 12,100.00 $ 428.76 29.95% 10/26/2022 New Credit Card PayPal - MC $ 265.32 $ 25.00 28.24% $300.00 Credit Card Credit One - MC $ 605.62 $ 25.00 21.15% $650.00 Close Credit Card Discover Card $705.54 $ 30.00 23.24% $800.00 Credit Card Citibank $ 888.21 $ 25.00 24.24% $900.00 Credit Card Best Buy Visa $ 940.87 $ 32.00 25.49% $1,000.00 Credit Card Georgia's Own Visa $ 975.31 $ 25.00 12.24% $1,000.00 My Bank Credit Card Credit One - Visa $ 1,241.47 $ 67.00 25.15% $1,300.00 Close Credit Card Capital One QS1 Visa $ 1,486.41 $ 46.00 20.15% $1,550.00 Credit Card Capital One - MC $ 1,946.13 $ 63.00 25.15% $2,000.00 Close - Merge w/ CapOne QS (was Orchard) Store Card Kohl's $ 641.62 $ 27.00 24.24% $700.00 Store Card Dell Financial Services $ 855.12 $ 32.00 29.99% $1,000.00 Close Store Card Care Credit $ 883.88 $ 33.00 26.99% $3,600.00 Store Card TiresPlus $ 1,022.07 $ 39.00 22.80% $1,200.00 Store Card Target $ 1,250.22 $ 29.00 23.15% $1,000.00 Close Store Card JCPenney $ 1,267.04 $ 31.00 26.99% $1,500.00 Store Card Walmart $ 1,869.85 $ 56.00 23.15% $1,900.00 Close Store Card Amazon $ 1,871.55 $ 47.00 26.24% $2,000.00 Store Card GameStop $ 2,274.03 $ 80.00 27.24% $2,350.00 Totals $ 40,404.76 $ 1,435.84 $24,750.00

I would leave the installment loans alone, just continue to make your payments.

With revolving accounts, I would recommend the snowball method:

1. Stop using cards.

2. Pay off smallest balance first, then next smallest, and so on.

3. On other cards pay minimum + something each month.

As each balance turns to zero, that will free up your remaining monthly cash to apply to the next smallest balance.

After you've paid off a subprime card with an annual fee, close the account.

As to the other accounts, leave them in place.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some help focusing my debt repayment plans

@SouthJamaica wrote:

I would leave the installment loans alone, just continue to make your payments.

With revolving accounts, I would recommend the snowball method:

1. Stop using cards.

2. Pay off smallest balance first, then next smallest, and so on.

3. On other cards pay minimum + something each month.

As each balance turns to zero, that will free up your remaining monthly cash to apply to the next smallest balance.

After you've paid off a subprime card with an annual fee, close the account.

As to the other accounts, leave them in place.

Agree with the above. Do not use any card; spend as little money as you can. Pay off as many cards as you can, as fast as you can. It'll keep you motivated zeroing out balances and having fewer bills to pay every month.

Keep it simple: don't worry about dropping utilization for all the cards (right now you're maxed out for all of them and don't have much room to maneuver), don't apply for new cards, don't apply for credit limit increases -- you'll likely not get them. If you're being balance-chased, who cares? You're not going to be using the cards anyway. Besides, you can the CL back when you're debt is down to a more reasonable level.

In 12 months, you'll have paid off all but 5 of your cc's. At that point, you may think about spreading your payments (which would be around $1500/month) across the remaining cards, looking to lower utilization for all cards preparing to get lower interest loans. In 16 months, you can be free of all credit card debt (providing you weren't adding to them during the payment period).

Once you no longer have revolving debt, you'll have around $1700 extra to put towards your loans (hopefully now at much lower rates), which you can eliminate in another year to year and a half, depending on how aggressive you want to be.

I would start socking away money into savings by the time you're done paying off the credit cards. Close all but a few cards. Keep spending in control. Put all that money you were using for payments into savings. Hopefully you'll build up enough savings that you would never fall into long-term credit card debt again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some help focusing my debt repayment plans

@SouthJamaica wrote:I would leave the installment loans alone, just continue to make your payments.

( 2 of the 3 installment loans are at higher interest than his cards, I would also attack the loans)

With revolving accounts, I would recommend the snowball method:

1. Stop using cards. (Most important)

2. Pay off smallest balance first, then next smallest, and so on.(Works well when one has a lot of cards and loans - Like your situation)

3. On other cards pay minimum + something each month.(Add an extra $ 20 to each)

As each balance turns to zero, that will free up your remaining monthly cash to apply to the next smallest balance.(+1)

After you've paid off a subprime card with an annual fee, close the account.

(+1)

As to the other accounts, leave them in place.

(Until all debt is gone, then some more cleaning might be in order)

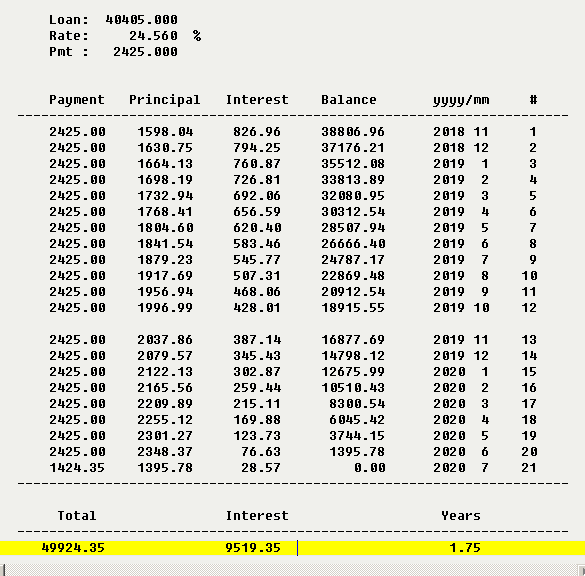

Even without the snowball advantage of freeing up extra money to attack the debt, this is doable in about 1.75 years.

With the snowball about 1.5

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some help focusing my debt repayment plans

So I'm getting there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some help focusing my debt repayment plans

Scores - All bureaus 770 +

TCL - Est. $410K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need some help focusing my debt repayment plans

So... been about a week and I've been busy. I got my annual bonus, so I have now paid off my PayPal MC. The Discover card was paid off last week. I've also paid off my CapOne QS1 Visa and upgraded my CapOne MC to another QS1 (kept the lower annual fee of $19 + added rewards). I also got an $1800 CLI on my CareCredit card (my kid will eventually need braces, so that may come in handy). Once my CapOne Visa reflects as paid, I'm going to try to combine the two accounts.

So, that will be all of my immediate goals accomplished... Now, I just continue with my debt repayment plans and enjoy watching the balances shrink.

Progress feels awesome!