- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Question about Money Market account

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Question about Money Market account

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Money Market account

Hi everyone!

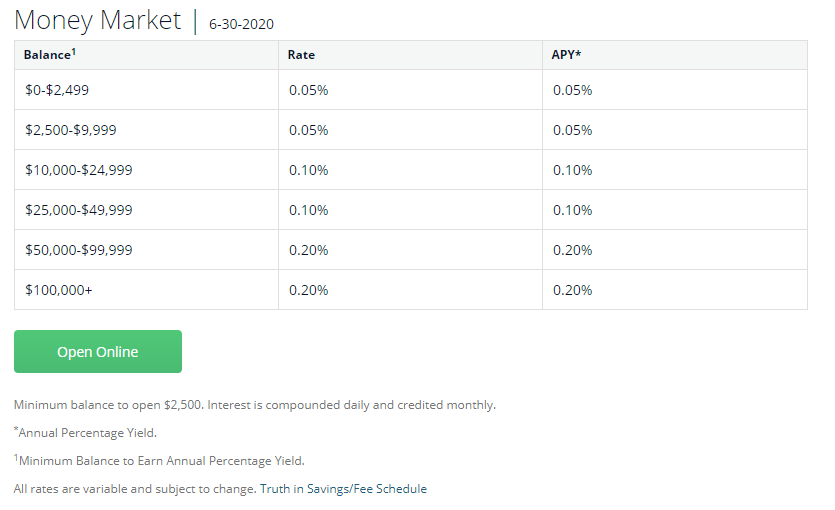

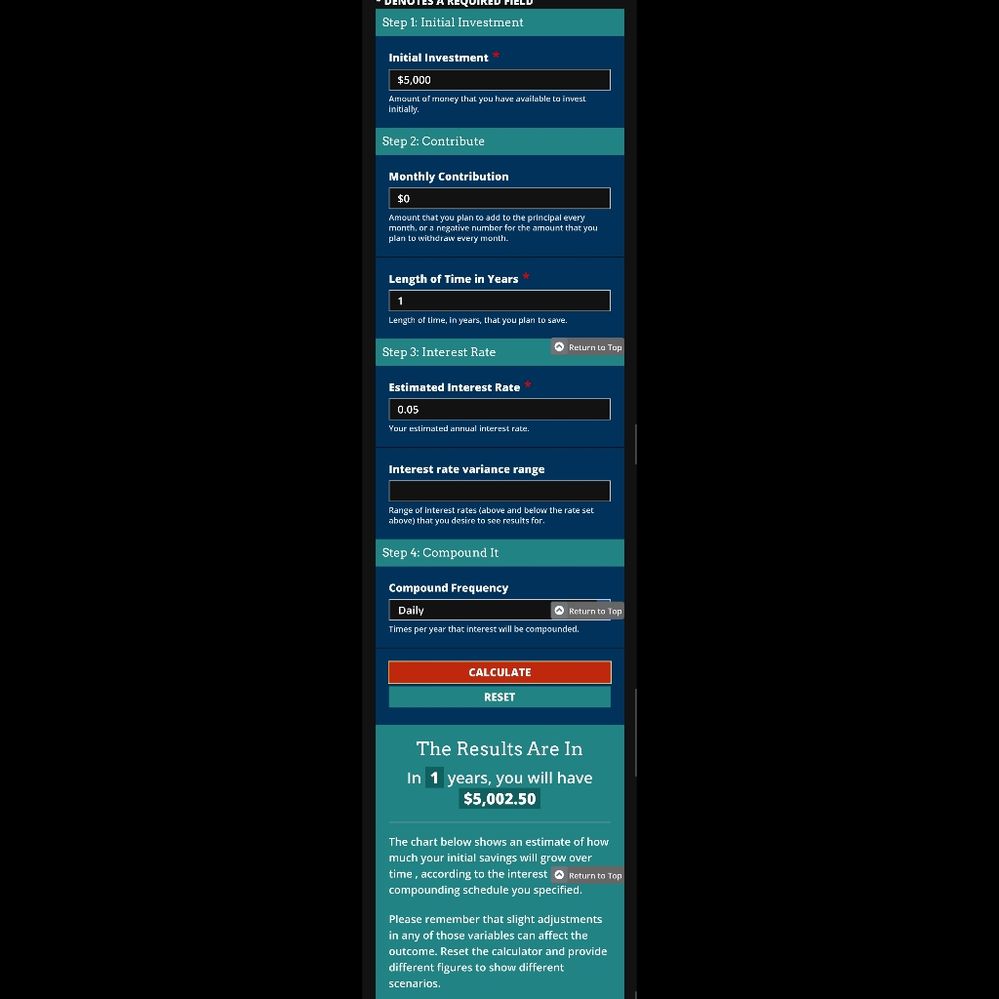

I received an offer today to apply for a Money Market account through my bank. They state it has a 0.05% APY rate, and that interest compounds daily at 0.05%.

I am trying to understand. So if I deposited $5,000 and sat on it for a year, would I have $5,092 or $6,000?

Thank you!

Current Score:

Gardening Started with:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Money Market account

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Money Market account

In comparison, my DCU savings with a cap of $1000 earns just over $3 a month at 6.17%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Money Market account

https://ficoforums.myfico.com/t5/Personal-Finance/CU-s-to-join-for-Savings-Rate-now-and-possible-Cre...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Money Market account

That's not very much...

What, er, why is the daily rate stated as 0.05% and the APY is also 0.05%? If interest is compounding daily, wouldn't that mean 0.05% against the principal each day 365 times?

Current Score:

Gardening Started with:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Money Market account

@AllZero wrote:

I would recommend high yield checking or savings account.

https://ficoforums.myfico.com/t5/Personal-Finance/CU-s-to-join-for-Savings-Rate-now-and-possible-Cre...

+1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Money Market account

@Azza wrote:That's not very much...

What, er, why is the daily rate stated as 0.05% and the APY is also 0.05%? If interest is compounding daily, wouldn't that mean 0.05% against the principal each day 365 times?

It doesn't. Mathematical formula if your curious is here:

https://www.investopedia.com/terms/c/compoundinterest.asp

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Money Market account

@Azza wrote:That's not very much...

What, er, why is the daily rate stated as 0.05% and the APY is also 0.05%? If interest is compounding daily, wouldn't that mean 0.05% against the principal each day 365 times?

The 0.05% is not the daily rate, but the APR. The APR is the annual rate not counting compound interest. The APY is the annual rate including compound interests. Since the interest rate is so small, the daily compounded interest earned on $5000 in one year is only 0.06 cents, which is then rounded to 0. So you are not earning any compound interest. Hence the APR and the APY are both equal to 0.05%.

The daily rate is APR/365=0.05%/365=0.00013...%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about Money Market account

That list of good rates from CU's is great. I personally am using the DCU and Service CU deals.

If you're a T-Mobile customer, the TMobile Money a checking they promote from Bankmobile pays 3% on up to $3k and 1% on amounts over. 1% flat for non TMobile customers or those that don't meet deposit requirements for the month ($200 every month), which still isn't bad.

The Patriot Bank Online Money Market is still at 1.40% as of today where many dropped their rates already July 1 (another online bank I was looking at 1.36% last week and already dropped to 1.06%).