- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Questions about retirement investing

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Questions about retirement investing

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions about retirement investing

Hi all

I'm in my mid 40s and I've been contributing to a 401k for a little over a decade. I've had it all coming out pre-tax and going into a target date (2040) fund.

I've noticed the fund hasn't quite kept pace with the market and the talking heads on Youtube seem to agree. Looks like I'd have better results if I switch it out to an S&P 500 fund.

I'm thinking as I get older, though, I should diversify into more secure funds like bonds to mitigate losses. I'm not really close to retirement yet as I've only recently gotten to where I can afford to get aggressive with my deposits. So I'm thinking going full stocks right now makes sense. I am curious, though, how close to retirement should I start mixing in bonds. Sounds like the time horizon is somewhere around the amount of time it takes for the market to recover from a drop. Is there a good rule of thumb around that?

Also, I keep hearing that I should max out a Roth IRA first. I have the option now to contribute to a Roth 401k which I will start doing. However, I'm curious what the advantage would be to switching (above employer match of course) my contributions to a Roth IRA instead of the 401k. Is it just to have access to other investment types? I'm really only interested in a low fee index fund (FXAIX) which is available through my 401k anyway.

Thanks in advance for any answers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about retirement investing

@MrDisco99 wrote:Hi all

I'm in my mid 40s and I've been contributing to a 401k for a little over a decade. I've had it all coming out pre-tax and going into a target date (2040) fund.

I've noticed the fund hasn't quite kept pace with the market and the talking heads on Youtube seem to agree. Looks like I'd have better results if I switch it out to an S&P 500 fund.

I'm thinking as I get older, though, I should diversify into more secure funds like bonds to mitigate losses. I'm not really close to retirement yet as I've only recently gotten to where I can afford to get aggressive with my deposits. So I'm thinking going full stocks right now makes sense. I am curious, though, how close to retirement should I start mixing in bonds. Sounds like the time horizon is somewhere around the amount of time it takes for the market to recover from a drop. Is there a good rule of thumb around that?

Also, I keep hearing that I should max out a Roth IRA first. I have the option now to contribute to a Roth 401k which I will start doing. However, I'm curious what the advantage would be to switching (above employer match of course) my contributions to a Roth IRA instead of the 401k. Is it just to have access to other investment types? I'm really only interested in a low fee index fund (FXAIX) which is available through my 401k anyway.

Thanks in advance for any answers.

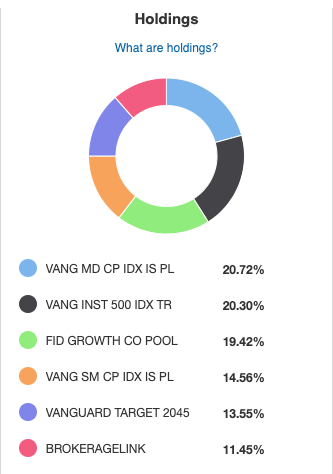

Unless you have a really crappy employer 401k, you can contribute to more than one fund within it. That is, you can send X% of your contributions to a target date fund that will grow more conservative over time and (100-X)% to a S&P ETF, or to that effect. One of my accounts (Fidelity 401k + Roth 401k) looks like this:

I'm also mid-40s like you, and note I too have some funds going to a target date fund (though I chose 2045 as I need to work longer to hit my target number). As for manually bond mixing, my personal thought is that we don't for a while yet. Bond rates are nowhere near where they used to be, and the target date fund will mix in bonds slowly; even then, I probably won't start doing any serious movement toward bonds until my 60s, if then.

The rule of thumb used to be something like you should be 10% in bonds for every 10 years old after 20, so at 50 you'd be 30% bonds and at 70 you'd be 50% bonds. That rule doesn't work anymore for the above reasons.

Roth is an exercise in tax predictions and math, but for most people Roth will likely trump traditional. If you're in the 32/35/37% brackets on income, there's an advantage to using traditional instead of Roth to suppress AGI to minimize income in those brackets -- also assuming you won't be just as deep into those brackets when you retire. If you're not in those brackets today, and/or you expect your tax situation to be only marginally less favorable (or more favorable) than at present, Roth should be a priority, be it IRA or 401k. That income grows tax-free, which is huge. Conversely, you're already mid-40s so it won't have as long to grow.

Long story short on Roth is it's not so slam-dunk and clear-cut as people make it out to be, but the TLDR version is that the younger you are and the less you make, the more Roth is to your advantage. The older you are and the more you make, the less Roth will help, and it can even be a loss in certain circumstances.

The ideal is you max out your Roth IRA and your 401k (be it Roth, traditional, or a mix). If you can't max both, put as much as you can into either. If you have access to a Roth 401k, there's no reason to do IRA instead of 401k, but if you have an employer match, make sure you're putting at least the minimum in to max out that benefit into 401k (it can be Roth and still get a match). You are right that some IRAs have additional access to types 401ks don't, but if you look at my graphic above you'll see BROKERAGELINK. That's the same as having a brokerage account in your 401k, and I can invest in literally anything with it the same as I can an IRA or brokerage. If your employer offers that as an option, the only reason to consider an IRA instead of a 401k (again, contribute to both if you can) is that an IRA may have withdrawal options not available to you in a 401k, not that you should use those options.

My guess is in your case, there's no reason to go IRA over 401k as it'll have all of the advantages with few or no disadvantages and likely lower fees on some of the funds.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about retirement investing

Wow, great info... thanks!

Yeah I'm bailing out of the target fund because I realized the Vanguard 2040 fund is 18% bonds right now, which is silly. Bonds have such low yields right now (thanks Fed) they're not even beating inflation. I've still got a long way to go and don't need that kind of stability right now. Also the expense ratio is not terrible at 0.55% but I know I can do better.

I could do a mix of multiple funds, but honestly that just opens up a huge new dimension in figuring out what to do and I'm trying to keep this simple. I know the S&P 500 has had pretty reliable 10% growth long term, which is way better than my target fund, so I'm putting it there. Large caps seem to be pretty safe as far as stocks go. Fidelity's FXAIX large cap fund tracks the S&P 500 and also has a very nice 0.015% expense ratio which beats nearly every other investment option in my plan.

My 401k doesn't offer anything akin to your "brokeragelink" fund. Neat idea. Never seen that.

As a result, I've decided to open a Roth IRA. My 401k is with Fidelity so I can just open an IRA under the same login which is convenient. My 401k is going into FXAIX, which I mentioned earlier, but I'm putting the IRA into Fidelity's zero expense ratio large cap fund FNILX. Looks to have nearly identical performance but instead of paying 0.015% expense ratio I'll pay 0%.

I guess I'll keep an eye on the bond market and see if I need to diversify later, but I feel like this is still a reasonably conservative approach while not wasting time on stagnant bonds.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about retirement investing

@MrDisco99 wrote:Wow, great info... thanks!

Yeah I'm bailing out of the target fund because I realized the Vanguard 2040 fund is 18% bonds right now, which is silly. Bonds have such low yields right now (thanks Fed) they're not even beating inflation. I've still got a long way to go and don't need that kind of stability right now. Also the expense ratio is not terrible at 0.55% but I know I can do better.

I could do a mix of multiple funds, but honestly that just opens up a huge new dimension in figuring out what to do and I'm trying to keep this simple. I know the S&P 500 has had pretty reliable 10% growth long term, which is way better than my target fund, so I'm putting it there. Large caps seem to be pretty safe as far as stocks go. Fidelity's FXAIX large cap fund tracks the S&P 500 and also has a very nice 0.015% expense ratio which beats nearly every other investment option in my plan.

My 401k doesn't offer anything akin to your "brokeragelink" fund. Neat idea. Never seen that.

As a result, I've decided to open a Roth IRA. My 401k is with Fidelity so I can just open an IRA under the same login which is convenient. My 401k is going into FXAIX, which I mentioned earlier, but I'm putting the IRA into Fidelity's zero expense ratio large cap fund FNILX. Looks to have nearly identical performance but instead of paying 0.015% expense ratio I'll pay 0%.

I guess I'll keep an eye on the bond market and see if I need to diversify later, but I feel like this is still a reasonably conservative approach while not wasting time on bonds.

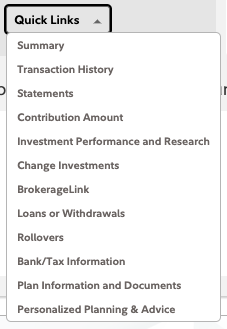

For what it's worth, I'm also Fidelity so they certainly offer BrokerageLink. The Question becomes if you can request it via NetBenefits. When you log in, you should have a QuickLinks button under your 401k account (the box that also shows your balance):

If the link is there, you can go and see if you're allowed to request it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about retirement investing

@iced wrote:

@MrDisco99 wrote:Wow, great info... thanks!

Yeah I'm bailing out of the target fund because I realized the Vanguard 2040 fund is 18% bonds right now, which is silly. Bonds have such low yields right now (thanks Fed) they're not even beating inflation. I've still got a long way to go and don't need that kind of stability right now. Also the expense ratio is not terrible at 0.55% but I know I can do better.

I could do a mix of multiple funds, but honestly that just opens up a huge new dimension in figuring out what to do and I'm trying to keep this simple. I know the S&P 500 has had pretty reliable 10% growth long term, which is way better than my target fund, so I'm putting it there. Large caps seem to be pretty safe as far as stocks go. Fidelity's FXAIX large cap fund tracks the S&P 500 and also has a very nice 0.015% expense ratio which beats nearly every other investment option in my plan.

My 401k doesn't offer anything akin to your "brokeragelink" fund. Neat idea. Never seen that.

As a result, I've decided to open a Roth IRA. My 401k is with Fidelity so I can just open an IRA under the same login which is convenient. My 401k is going into FXAIX, which I mentioned earlier, but I'm putting the IRA into Fidelity's zero expense ratio large cap fund FNILX. Looks to have nearly identical performance but instead of paying 0.015% expense ratio I'll pay 0%.

I guess I'll keep an eye on the bond market and see if I need to diversify later, but I feel like this is still a reasonably conservative approach while not wasting time on bonds.

For what it's worth, I'm also Fidelity so they certainly offer BrokerageLink. The Question becomes if you can request it via NetBenefits. When you log in, you should have a QuickLinks button under your 401k account (the box that also shows your balance):

If the link is there, you can go and see if you're allowed to request it.

Nope... must be plan specific.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about retirement investing

@MrDisco99 wrote:Nope... must be plan specific.

Yes, it certainly is, just like the choice of any funds in the plan.

Re: Roth IRA vs Roth 401(k). Apart from the potential increase in investing choices available in an IRA, the other factor is fees. If your 401(K) fund fees are large, you might do better in an IRA, but hopefully you have a decent 401(K). I (much older) kept most of my funds in my 401(K) once I left my employer, simply because the fees were so low. But then Fidelity started there "0" funds, so I tranferred them to an IRA and had some fun with the increased options.

Re bonds: I agree with @iced that the old rules really don't apply. As you enter retirement, you still need a significant amount of stock for future growth, the amount of fixed income to my mind is better calculated using something like "two years of living costs" (or however many years you want) to avoid having to sell too much stock in a downturn. My financial advisor suggested CDs rather than bonds at the moment, given you can get 18 month CDs returning about 1% if you look around.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about retirement investing

Lots of very knowledgeable financial people here. A forum for investing. https://www.bogleheads.org/forum/index.php?sid=32e6987f47afc0fad8ac2afe44422ca3