- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Robinhood Checking and Savings Coming out 2019

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Robinhood Checking and Savings Coming out 2019

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Robinhood Checking and Savings Coming out 2019

This just in! What do you think about this you guys?? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Robinhood Checking and Savings Coming out 2019

@Anonymous wrote:This just in! What do you think about this you guys??

https://checking.robinhood.com/

When I first joined robinhood, I was ecstatic until their front end rejected my bank login twice and I was charged a fee twice for the reversal.

(Yes i am sure it was the correct information, but they admitted to me that many have had issues with adding bankplus the initial way provided)

They refunded one fee and then told me how to link my account a different way. I was put off by them not refunding the other fee as it was my not my fault, it was theirs, their system was faulty. As I explained to them, the first time I thought I mistakenly entered the wrong information, the second time I was positive I entered the correct information both times. They said they only refund fee's once.

I'll eventually call them to pay the fee but I personally am skeptical about trusting them with my money, when there is an obvious issue with their programming. I am scared to add my account again to only be charged another fee, just to pay one fee. Plus they refuse to allow you to call and speak with someone. Which can be a major issue when 10's of thousands are at stake. This is no slam, just a sharing of my experience.

On a good note, I love the outlay of their phone app, and the free trading, just unsure about them after that ordeal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Robinhood Checking and Savings Coming out 2019

They are offering it now to most customers and by referrals, I sent my brother a referral earlier today.

Personally, I'm in.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Robinhood Checking and Savings Coming out 2019

@rprisco wrote:

I personally love Robinhood! Free trades and now free checking and savings, no fees and both pay a whopping 3% paid monthly. I also do not believe chex systems will be a problem.

They are offering it now to most customers and by referrals, I sent my brother a referral earlier today.

Personally, I'm in.

I really wished this was my experience to be honest. I think they have a great model that will only grow.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Robinhood Checking and Savings Coming out 2019

I personally run thousands through robinhood day trading each month without so much as a hiccup, same day deposits and if I withdraw, it's in my bank the next day.

Maybe it's time you give them a second chance?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Robinhood Checking and Savings Coming out 2019

@rprisco wrote:

@Anonymous, I can appreciate that, I just feel compelled to add that I've been with them since October 2015, referred many friends and family and not one time has there been a single problem.

I personally run thousands through robinhood day trading each month without so much as a hiccup, same day deposits and if I withdraw, it's in my bank the next day.

Maybe it's time you give them a second chance?

Oh you don't know how bad I want to, as anyone with any financial sense knows free trading is heaven sent in these times. However, I do not feel as though I was in the wrong to be charged a fee. This post triggered me, and I emailed them again just now about the issue. Their response will dictate my plans. I know this issue is directly related to the "bankplus" link they have on the account additions page. So I doubt many would have this issue unless they had clicked that link.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Robinhood Checking and Savings Coming out 2019

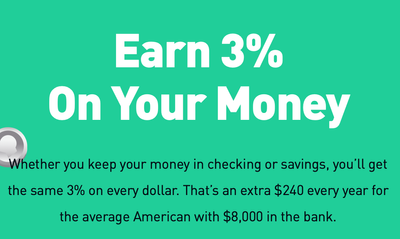

Most banks that offer a very high interest rate (much higher than their high-interest competitors, say) cap that rate as only applying to the first X dollars. E.g. DCU gives a 5% rate (last time I looked) but it applied only to the first $1000. Likewise NetSpend (5% on the first 5k which has since been lowered to the first 1k).

Or the great rate only applies for a limited time (e.g. first 6 or 12 months).

Has anyone read through all the fine print to determine that none of these limitations apply? E.g. if I open a checking account in a couple weeks (Jan 1 say) and put 90k in it will I be earning $2700 in interest annually indefinately (possibly more if they raise their rates down the road)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Robinhood Checking and Savings Coming out 2019

@Anonymous wrote:Most banks that offer a very high interest rate (much higher than their high-interest competitors, say) cap that rate as only applying to the first X dollars. E.g. DCU gives a 5% rate (last time I looked) but it applied only to the first $1000. Likewise NetSpend (5% on the first 5k which has since been lowered to the first 1k).

Or the great rate only applies for a limited time (e.g. first 6 or 12 months).

Has anyone read through all the fine print to determine that none of these limitations apply? E.g. if I open a checking account in a couple weeks (Jan 1 say) and put 90k in it will I be earning $2700 in interest annually indefinately (possibly more if they raise their rates down the road)?

Thank you for bringing this up, I'm still searching for more fine print on the issue, but the fine print currently states

"Users of Robinhood Checking and Savings earn 3% interest annually on each of their Checking and Savings balances. Robinhood does not charge account maintenance, account minimum, overdraft, ATM, transaction, foreign transaction, transfer, or card replacement fees for Robinhood Checking and Savings. Robinhood Checking and Savings is offered through Robinhood Financial LLC. Robinhood Checking and Savings is an added feature to existing Robinhood accounts and is not a separate account or a bank account."

Then this is on the main page. Could this be a hint to the limit you're disclosing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Robinhood Checking and Savings Coming out 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content