- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: So tell me about Personal Loans....

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

So tell me about Personal Loans....

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So tell me about Personal Loans....

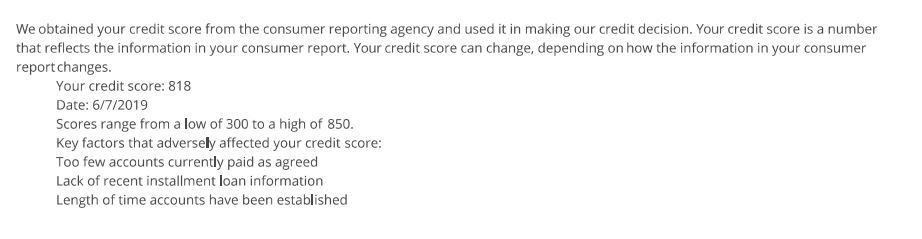

I was on nerd wallet and wanted to see if I could pre-qualify for a $15k personal loan, I clicked on check your rate link and it brought up lenders. I decided to go to the actual lenders website and pre-qualify with Best Egg and got denied. I’m glad I didn’t waste a HP, I thought the alternative lenders were more open to lend vs a conventional bank like Bank of America, hence why they are in the market?

Im rebuilding credit

Cap1 card for 4.5 years

AU on card that is 11 years old

I guess they based my time at being 4.5 years and too short? , apparently it wasn’t good enough for Best Egg

Never had any auto loans or personal loans on my credit profile, which Id like to add to mix it up along with 3 CC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So tell me about Personal Loans....

Your score is good but I feel like the problem here is that you have a thin file. 4.5 years of history is not really a "short" history, it's the fact that (AFAIK), you have one CC and one AU. You haven't told us what your CL is on the CapOne card but regardless, that's not a thick file or likely a lot of available credit.

I can see one of the reasons that you were denied as $15K being too much to ask for an unsecured loan with how little credit you currently have available. If you'd really like to have a loan for the sake of optimizing your credit profile, why not ask for a smaller amount or try one of those secured loans?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So tell me about Personal Loans....

I think what they are saying is your file is too thin. I would beef up your card base a little first. As your file thickens and ages, I think you will be in a much better position to have anything you want. Were you approved for a lower amount or did you try prequals on other sites? If you need the money then a loan could make sense but I wouldn't take a loan out just to have one reporting.

I think there was a report here that Best Egg would report as a CFA(Saeren?) so I would watch who you apply with.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So tell me about Personal Loans....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So tell me about Personal Loans....

With a thicker file you have options, pretty sure I could easily obtain an unsecured loan from Penfed or Alliant (not a long walk they have both somewhat recently sent snail mail offers) but while our credit ages are similar, my file has a silly number of accounts to look at history on, whereas yours isn’t enough.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So tell me about Personal Loans....

Hope I don't derail the thread but are CFA/CFL still penalized in FICO 8? I thought that was only in the older FICO models.

Seems antiquated since the "trouble loans" today are payday loans and as far as I know they don't have any FICO penalty. imho they should.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So tell me about Personal Loans....

CL with Cap1 is $4500 and they wont budge anymore, while it has helped me get credit history, its going to be used only for payment history now. I am being denied for a thin file. You would think 4.5 years is enough lol.....Sofi Loans did pre-quailfy me at 9% vs the 5.99% they advertise for excellent credit....

My point was to get 3 personal credit and a installment loan and garden to continue to grew my credit history.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So tell me about Personal Loans....

I think your easiest and best bet right now is to increase your CC portfolio, with your scores and 4.5 years of history, you can easily qualify for better cards than Capital One. Maybe try for cards that are known to grow fast through SP CLIs like AmEx, Discover, or Synchrony cards. You want to increase both the number of accounts you have and the total available credit (assuming your income can support it). Once you've built out your CC portfolio, loans can come later, especially if you are planning to buy a car or something down the road. Heck, AmEx is known for offering pre-approved SP personal loans after you've built up a bit of history with them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So tell me about Personal Loans....

Income is $70k DTI is 10% (my own) but the reason why I want the $15k loan is for business debts from the past run up on other AU cards not showing up on my personal credit, long story but short version is I’d like to put that debt on my business, so it can show payment history.

I have pre-qualified with all the following below:

Right now, I am talking to a personal Banker at B of A, which I’ve had my business account with them since 2008. Since Business credit cards and personal credits are 1 inquiry, my 1st choice was to apply with Bank of America this month.

2nd choice was to apply with Wells Fargo this month, personal banking and need to see if Credit card, personal loan and line of credit would be run under the same inquiry.

3rd was to apply next month for Discover and Amex and garden….

And yes I agree I am so done with Cap1, they helped but now they are just a bucketed card that will not move. Thanks but those subprime credit days are over and Cap1 one is not worth the triple pulls

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

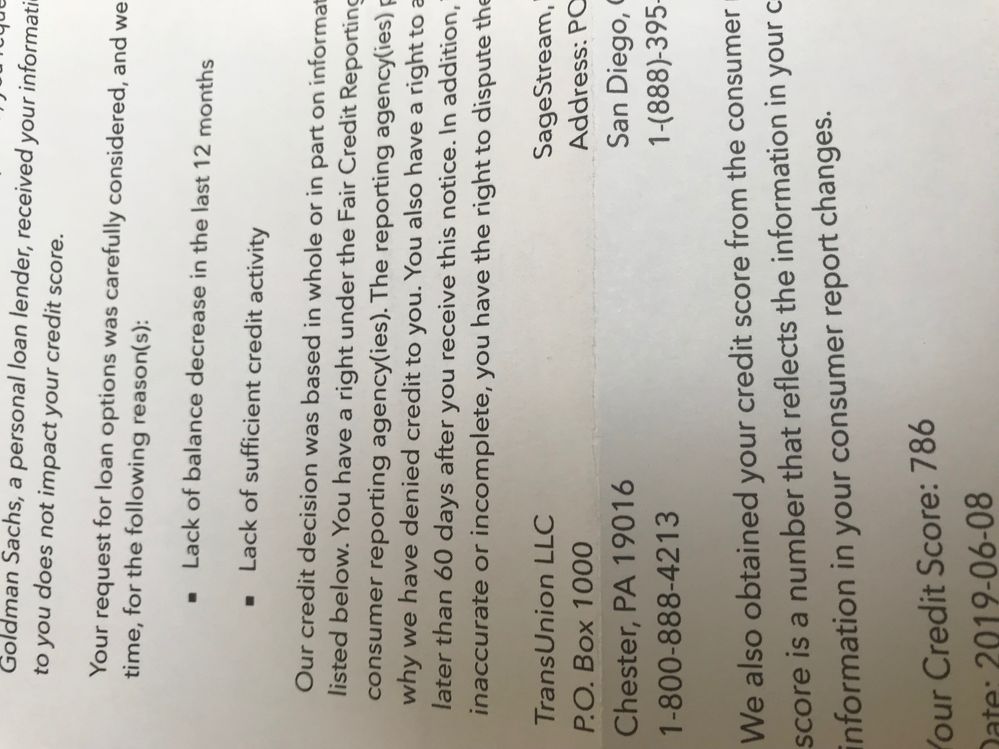

Re: So tell me about Personal Loans....Marcus denial Update

So heres a new one from Marcus Goldman Sachs

: Lack of Balance decrease in the last 12 months

: Lack of sufficient credit activity

and a score of 786, which all the other denials state 802

Oh well Id never get a loan from them anyways...