- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: Starting to get a little irritated with USAA i...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Starting to get a little irritated with USAA insurance

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Starting to get a little irritated with USAA insurance

So, I've been with them since 1991/full member, and I've been tracking my insurance rates with them over the last several years, and they take "into consideration" several things....(BTW, they pull LN everytime policy is up for renewal)

-Public records

-personal credit

-payment history with USAA

-driving record (within the last 5 years)

-and probably umpteen more factors.

When they got wind of me filing for BK in 2013, my rates went up even WITH all the discounts they apply to my policy for various things. Every year since then, my rates have been slowly creeping up, even with NO changes to the policy itself. Matter of fact, all coverages Ive had have been the same for the last 20 years! Only thing changed was my new vehicle I bought in 2012.

Last year I got pulled over because a cop said I didnt come fully to a stop before proceding, and I got a ticket (which shows in PR on LN). I should have fought that but I didnt, because I DID stop. My rates increased of that, but before that happened, I hadnt had a ticket or an accident in like 15 years, and my rates have literally doubled in the last 10 years. I have the highest amount of coverage, and lowest deductibles, and few other added coverages, that have been the same for 20 years.

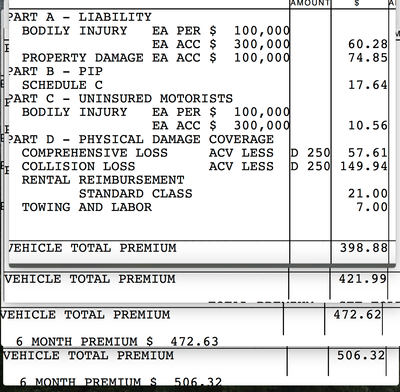

Picture below is my policy from the last 2 years 04/2017, 10/2017, 10/2018, 04/2019, is the amount I was paying for a 6 month premium. I really need to send off for my FULL disclosure report from LN. ![]() Also, they were IIB on a CC, so I'm sure they have jacked my rates up to make me pay for that as well

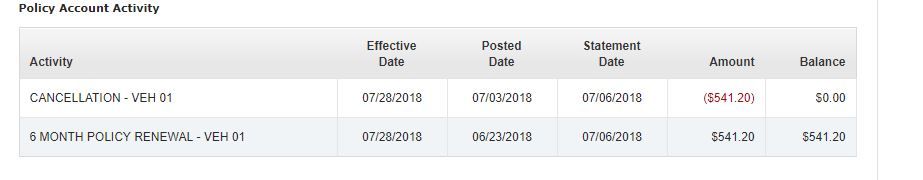

Also, they were IIB on a CC, so I'm sure they have jacked my rates up to make me pay for that as well ![]() They take everything into considertion.

They take everything into considertion.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Starting to get a little irritated with USAA insurance

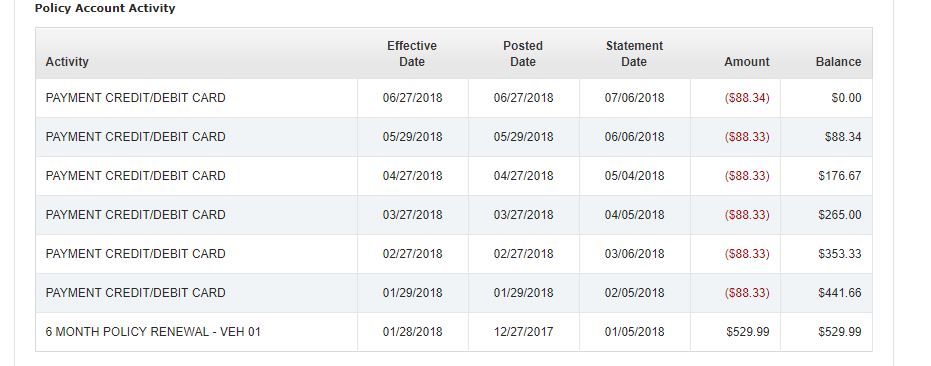

I agree that their rates are steadily increasing. I got rid of them for good last year because I felt that I was paying too much. When they sent me the renewal policy, I saw my rates were increasing again. My rates went to $88, renewal would have been $90, and a recent quote has me at $94. I ended up going with Progressive and my first 6 month premium was $278($46.33/month) compared to the $90.20/month that USAA wanted.

Progressive raised my rates for my last premium and now I pay $309 (51.50/month) which is still much better than the $94 that USAA just quoted me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Starting to get a little irritated with USAA insurance

Hrm.

I might go test the waters elsewhere, I never thought my payments were out of line because I admittedly have some stupid things in my driving record (speeding back in the day, suspended license cause I'm an idiot sometimes, and a new comparitively expensive car), but I basically thought it was just cost of getting insurance for someone who is awkward even if I haven't had an accident in decades.

It's just not transparent, I wonder how good the quotes are... I do know USAA saved me a boatload of money compared to my old Progressive insurance but I'm not in the same place now that I was then so things might have changed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Starting to get a little irritated with USAA insurance

I don't know anything about USAA since I don't qualify for membership, but it seems to me insurance companies in general have been sticking it to current customers with rate increases while keeping rates lower for new customers to attract new customers.

I'd been with American Family for 15+ years for home & auto with never a claim, never a traffic ticket since the mid 1980s, my one car had been the same Kia since I bought it new in 2003. When I bought a 2016 Mazda in Sept. 2017 AmFam quoted me almost $600 for 6 months. That seemed a bit high so I shopped around and went with Geico for under $400, but I kept the Kia with AmFam as the premium was low with only mid-range liability coverage, no collision or comprehensive for a 14 year old car. But then the AmFam renewal came in Sept. 2018 with over a 30% rate increase! So I shopped around and got home insurance for 40% less than AmFam, and moved the Kia to Geico for less that I had been paying AmFam.

The moral of the story is when your insurance starts taking you for granted and raise your rates it's time to shop around. But DON'T use those insurance "comparison" sites, they shoot your contact info all over and your email inbox will be full of spam and your phone will be ringing with calls from pushy sales people. For home insurance I used a local insurance broker who found me a great rate. Car insurance is easiest online, but just go directly to 2-3 insurance company websites for a good comparison of rates. And as those insurance comparison sites get a commission of you buy a policy it just makes sense to me the insurance company is going to give you the best rate if you go directly to them.

And pizza, the property coverage (comp. & collision) for your 2012 vehicle is around 40% of your premium, have you checked kbb.com (Kelly Blue Book) for the value of your car? When my car drops to under $3k or so in value I drop my property coverage and just have liability. Yeah, a $3k loss is a lot, but my cynical way of looking at it is completely totaling a car is rare, and your being around to worry about it after an accident that totals your car is even more rare. And insurance companies never pay you the full retail value of your car anyway.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Starting to get a little irritated with USAA insurance

Sorry about your rate hikes with USAA. Maybe try another insurance company? You have a lot of history there but if you can get a better deal elsewhere....

Lol on a self-absorbed note, if you think your rates are bad, try being a 23-year old. I would kill for your idea of a high rate. And I have a perfect driving record. Lol okay. Pity party is over. All packed up. Gone.

Amex Cash Magnet: 18k

Fidelity Visa: 16.5k

Apple Card: 4.25k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Starting to get a little irritated with USAA insurance

I know for me i have seen a steady increase on rates over the last several years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Starting to get a little irritated with USAA insurance

@pinkandgrey wrote:Sorry about your rate hikes with USAA. Maybe try another insurance company? You have a lot of history there but if you can get a better deal elsewhere....

Lol on a self-absorbed note, if you think your rates are bad, try being a 23-year old. I would kill for your idea of a high rate. And I have a perfect driving record. Lol okay. Pity party is over. All packed up. Gone.

Bah! It's you young whippersnapper speed demons that raise the rates for all of us!!!

![]() Just kidding. When I was your age I'd already had one accident and a couple tickets. My car insurance was so high I bought a motorcycle because the rates were much lower. And it was a good thing, I'm fond of saying that if you live long enough riding motorcycles you learn to be a really good defensive driver and never trust any driver to do what they're supposed to do because old farts like me don't notice small things like a motorcycles and pull out or turn in front of you.

Just kidding. When I was your age I'd already had one accident and a couple tickets. My car insurance was so high I bought a motorcycle because the rates were much lower. And it was a good thing, I'm fond of saying that if you live long enough riding motorcycles you learn to be a really good defensive driver and never trust any driver to do what they're supposed to do because old farts like me don't notice small things like a motorcycles and pull out or turn in front of you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Starting to get a little irritated with USAA insurance

@CreditCuriosity wrote:I know for me i have seen a steady increase on rates over the last several years.

Well, in fairness insurance companies have had to cover some pretty big losses lately from fires in the west, flooding in the midwest, and hurricanes & tornadoes in the east. But, we all feel they can make it from someone other than me. And they seem to think they can make it up with higher premiums on currently policy holders thinking many won't notice. And they may be on to something, I know folks who have had the same insurance company forever and wouldn't think of changing, fearing they'd somehow risk coverage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Starting to get a little irritated with USAA insurance

@DaveInAZ wrote:

@CreditCuriosity wrote:I know for me i have seen a steady increase on rates over the last several years.

Well, in fairness insurance companies have had to cover some pretty big losses lately from fires in the west, flooding in the midwest, and hurricanes & tornadoes in the east. But, we all feel they can make it from someone other than me. And they seem to think they can make it up with higher premiums on currently policy holders thinking many won't notice. And they may be on to something, I know folks who have had the same insurance company forever and wouldn't think of changing, fearing they'd somehow risk coverage.

I agree I work in the insurance business, just not auto and the juries have been putting it to us hard recently being juries are awarding higher claims paid out. We also invest in LLoyd's of London and have been taking huge losses due to the hurricanes, fires, etc. I think we might be getting out of that investment as hasn't been a good investment for our reserves at all in the last several years. We as a company are still profitable, but are also doing rate increases as it starts to become a "hard" market. Just ranting, although out of all people I should understand.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Starting to get a little irritated with USAA insurance

@DaveInAZ wrote:

@CreditCuriosity wrote:I know for me i have seen a steady increase on rates over the last several years.

Well, in fairness insurance companies have had to cover some pretty big losses lately from fires in the west, flooding in the midwest, and hurricanes & tornadoes in the east. But, we all feel they can make it from someone other than me. And they seem to think they can make it up with higher premiums on currently policy holders thinking many won't notice. And they may be on to something, I know folks who have had the same insurance company forever and wouldn't think of changing, fearing they'd somehow risk coverage.

I don't even think it's that... I'm pretty ruthless when it comes to optimizing my expenses and even I wasn't really questioning USAA's rates. I'd saved a bunch of money in the past when I wasn't pretty in any sense of the word and I have my condo insurance through them (and CEA too but that's third party). Discounts some cash/profit sharing, why question and admittedly when you *do* need it USAA is great in both my and some people I know's direct experience.

I should probably do a sanity check at some point, but saving $120/year or whatever isn't enough to get me to switch, I should really figure out what amount it would take me to switch... I'm at $90/month now for the Tesla, which doesn't seem absurd but I don't know how the wider market is pricing currently.