- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: Navy Federal Credit Union (NFCU)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The NFCU vs USAA vs PenFed Guide

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: United Services Automobile Association (USAA)

With great trepidation, I went online to open a USAA savings account today.

As some of you on the forums know, as a result of the great recession of 2008, I burned USAA in 2009 for about $4,000 in credit card debt. Also, I almost lost my vehicle as USAA was looking to repossess it due to being 120 days late on payments. My family was able to help me and loaned me the cash to be able to pay off the auto loan instead of voluntarily surrendering my vehicle.

Last month, my insurance policy was coming up for renewal. I called USAA to see if I could get insurance through them and, yes, I was able to get insurance through them.

With much anxiety, I applied for both a USAA checking and savings account today. I was approved instantly. Perhaps I have been forgiven for my past transgressions. At least I am back in with the banking side of USAA. Who knows, perhaps I will get a preapproved CC offer in the future. I am not going to apply for any CC until I below 5/24 and can apply for my coveted Chase Southwest Airlines Rapid Rewards Priority Visa Signature.

Data Points for those who care:

During the process, the website stated it needed to check my credit, the check would not affect my credit scores. I am going to take this as an SP. I will have to check my 3Bs and update the thread.

I used a CC to fund the accounts. You are allowed to fund the accounts for up to $100 using a CC. I had an unintended overpayment on my Citi DC and used that credit balance to fund the accounts. $50 to savings and $50 to checking.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union (NFCU)

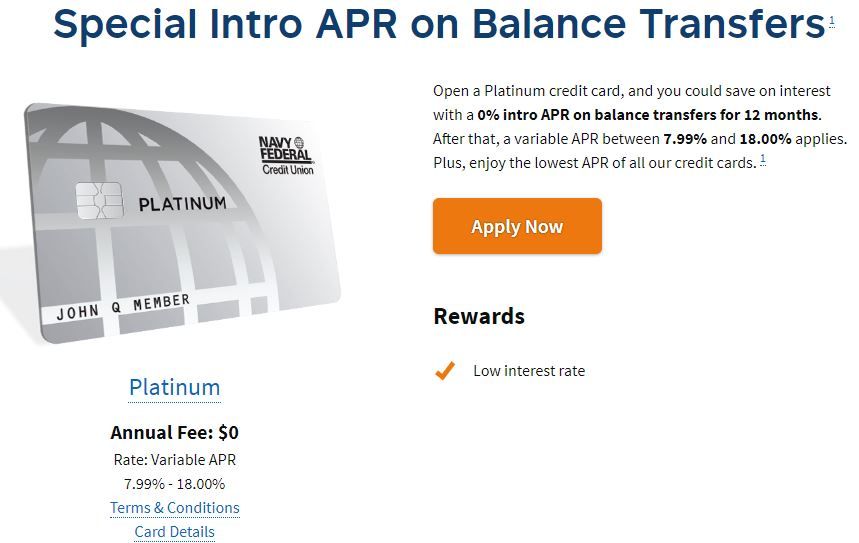

@Hasselfree is reporting "Logged into NFCU to see a lower APR on my CR card. The Platinum is now advertised at 7.99%."

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union (NFCU)

Yes, and USAA is at 8.9% down from 9.15% and PenFed Gold is at 8.99% down from 9.24% - all reductions are realizations from the August Prime Rate reduction of 0.25%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best of the Best

@Medic981 wrote:Update

0.00% Balance Transfer Cards

Sept 03, 2019

NFCU

USAA

PenFed

0% BT card

NFCU Platinum Visa - 0% introductory APR for 12 months - NO balance transfer fee

None Available

PenFed Promise Visa - 0% promotional APR balance transfer rate for 12 months - NO balance transfer fee

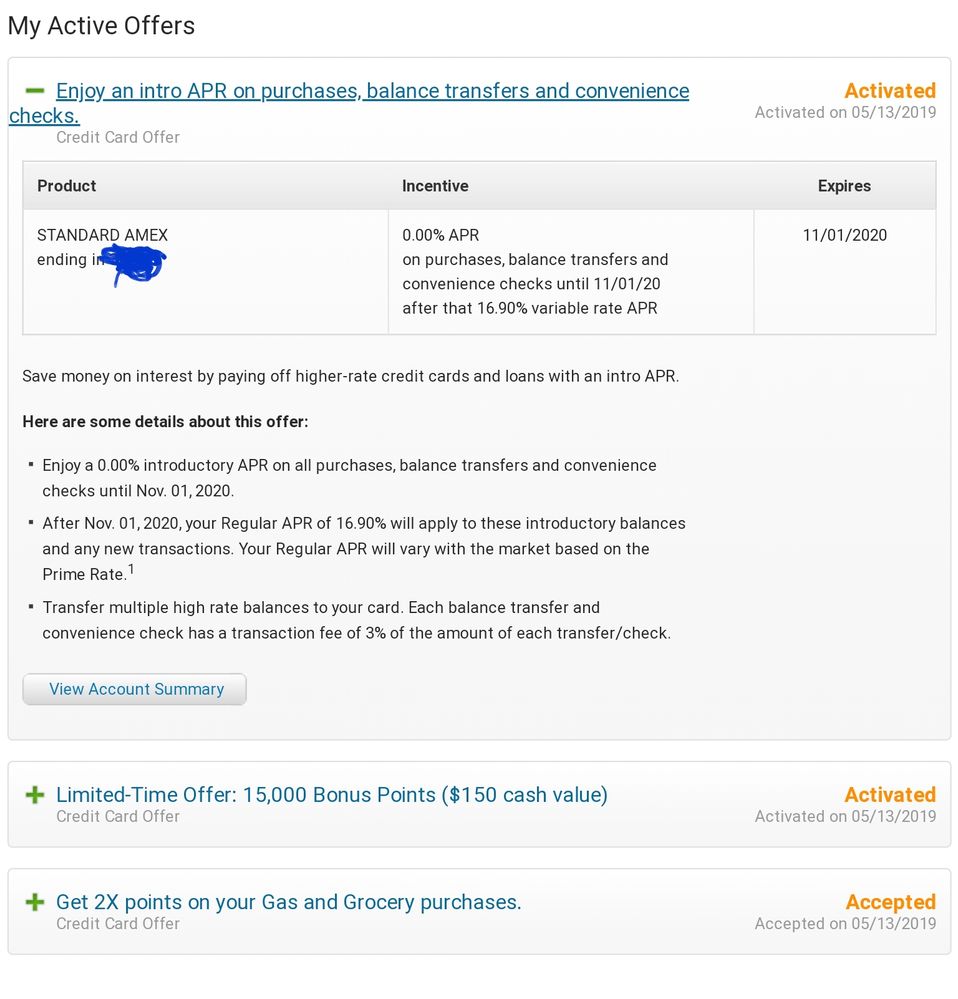

USAA does offer 18 months at 0% BT.

Not sure if everyone gets the offer but I did just a few months back. When the

card came up with a pre-approval under my Offers so did all these intro features.

*************************************************************************************

Then you are a fool. Be thankful that when God gave you a face, he gave you a fool's face

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best of the Best

Thanks for the DP. NFCU does not show that offer when looking at their page using incognito mode.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pentagon Federal Credit Union (PenFed)

@randomguy1 is reporting when he "opened a PenFed CU bank account, followed up by an auto-loan refi and credit card app in the same day which resulted in a double hard pull."

@DaveinAZ, in the same thread, states "Penfed HPs for membership and they use the same HP for bank accounts and usually the same HP for a CC for usually up to 30 days. YMMV. It's a separate HP for secured loans, auto or mortgage/home equity. Penfed has been a bit more HP happy than usual lately."

@randomguy1 update the thread, "I finally called them and the CSR told me that auto and credit loans run through different systems and pull different reports so there will always be two pulls even if it is made in the same day."

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union (NFCU)

Navy Federal Earns “Credit Union of the Year” for the 13th Consecutive Year

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The NFCU vs USAA vs PenFed Guide

American Express' relationship with Financial Institutions.

I have been reading the forums and have seen multiple threads asking about whether getting an AmEx card with NFCU, USAA, PenFed, etc... will help get an actual AmEx card from American Express Bank itself.

Will an NFCU AMEX increase approval odds of regular AMEX card ~@Lpfan2002

Would the NFCU More Rewards open the Amex door? ~@SilverSmith

Cards issued by NFCU, USAA, and PenFed with the AmEx name are only AmEx in the sense that they use the AmEx payment network. They will not help you build a relationship with AmEx. If you are on AmEx's "blacklist", obtaining an NFCU, USAA, or PenFed AmEx card does not mean you are off AmEx's "blacklist". These cards are not issued by AmEx but by the various financial institutions you received them from.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The NFCU vs USAA vs PenFed Guide

Doctor of Credit reports Navy Federal American Express Relaunch + 30,000 Points Signup Bonus (40k Targeted Offer)

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Credit Union (NFCU)

@Medic981 wrote:Navy Federal Earns “Credit Union of the Year” for the 13th Consecutive Year

Can't say I'm surprised to be honest.

I have a CD through them... It pays 3.25% interest which isn't even their highest rate.

Combine that with an increase in credit card rewards on their Flagship and AMEX products over the last year, $10/month in ATM fee rebates, generous credit lines given, and excellent customer service and an app/website experience, and you've got yourself a winner.