- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: Tools to managing your finance

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Tools to managing your finance

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tools to managing your finance

@Anonymous wrote:

[...]How do you manage yours and make sure you dont miss any payments and is there a tool that you recommend?

Thank you v much!

I am not highly sucessful (yet), but I'll answer the question ![]()

Nearly all my bills are received via my bank's ebill/billpay service and have a similar due date. What isn't paid via my bank's bill pay is either on autopay via the vendor's site or I initiate manual payments . The system is mostly on auto-pilot but I still check my primary accounts 3-5 per week.

I tried YNAB on trial and I wasn't successfuly in adopting the method. I couldn't find any one application or method that was comprehensive but simple. So, I'm winging it using principles from Your Money or Your Life (book).

- Step 1: Pay myself first--I defined pre-tax and after-tax savings commitments. These are non-negotiable & will not adjust until next year.

- Step 2: Pay others second--After I pay myself, I pay the essentials (home, utilities & insurance) and prior month bills.

- Step 3: Living funds represent remaining funds left for general spend (groceries, dining, household goods, and luxeries).The objective is to keep expenses within the living funds range and avoid dipping into after-tax savings to cover expenditures.

- Step 4: Stay informed--Maintain a simple tracking system by digitizing (most) receipts; however, I rely primarily on my credit statements to analyze monthly spending.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tools to managing your finance

@Namaste7 wrote:

@Anonymous wrote:

[...]How do you manage yours and make sure you dont miss any payments and is there a tool that you recommend?

The key word here is AUTOMATION. You would never ever miss any payment if it is drawn from your account automatically. Almost every service provider and absolutely every credit card can draw money automatically from your checking account. Just set it up an I guarantee - you will never ever miss a payment :-)

However....In order for automation to work you need two conditions met:

1) You need to create an initial cash buffer on your checking account.

2) On an ongoing basis, you need to spend less than you earn (or equal to).

The first condition will be achieved by the second one. Establish a habit of spending less than you earn, build initial cash buffer, automate all bills, continue spending less than you earn, get rich stress free! :-)

Once you establish these two conditions, all bills will be paid automatically, your money will be going up and down up and down and never overdraft. Look at this 'ugly' chart - balance goes up when paycheck rolls in and down when bills are paid. It never drops lower than a particular point - Safety Fund (depending on your pay cycle):

Once you established the system you will never ever go back to categorization and manual bill pay, trust me ;-)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tools to managing your finance

@Anonymous wrote:

@Namaste7 wrote:

@Anonymous wrote:

[...]How do you manage yours and make sure you dont miss any payments and is there a tool that you recommend?

The key word here is AUTOMATION. You would never ever miss any payment if it is drawn from your account automatically. Almost every service provider and absolutely every credit card can draw money automatically from your checking account. Just set it up an I guarantee - you will never ever miss a payment :-)

Actually there are credit cards which don't support autopay, JCB was one such recent example much to my scoring detriment (yes yes my fault but autopay would've prevented the issue).

That said I refuse to have an account that doesn't support autopay going forward.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tools to managing your finance

@Anonymous wrote:

@Namaste7 wrote:

@Anonymous wrote:

[...]How do you manage yours and make sure you dont miss any payments and is there a tool that you recommend?

The key word here is AUTOMATION. You would never ever miss any payment if it is drawn from your account automatically. Almost every service provider and absolutely every credit card can draw money automatically from your checking account. Just set it up an I guarantee - you will never ever miss a payment :-)

However....In order for automation to work you need two conditions met:

1) You need to create an initial cash buffer on your checking account.

2) On an ongoing basis, you need to spend less than you earn (or equal to).

The first condition will be achieved by the second one. Establish a habit of spending less than you earn, build initial cash buffer, automate all bills, continue spending less than you earn, get rich stress free! :-)

Once you establish these two conditions, all bills will be paid automatically, your money will be going up and down up and down and never overdraft. Look at this 'ugly' chart - balance goes up when paycheck rolls in and down when bills are paid. It never drops lower than a particular point - Safety Fund (depending on your pay cycle):

Once you established the system you will never ever go back to categorization and manual bill pay, trust me ;-)

I agree that automation is the way to go. However you can't just set it and forget it, becasue odd things will pop up form time to time such as an unexpected car repair where you might need to transfer cash from savings to checking before an autopay processes. Transactions like that can not be automated and there are still a few places where autopay does not work.

Automation does not mean I don't want to track my expenses by catagory. I still want to know where my money is going. Just because I have a positive cash flow does not mean I am not spending more money that I want to in certian catagories. I understand not everyone has the same mindset as me, but I think it is a gross generalization to say that once you are automated you don't need to track where your money is going.

Current Scores

Garden Goal is All Reports Clean – Achieved 11/26/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tools to managing your finance

@MakingProgress wrote:I agree that automation is the way to go. However you can't just set it and forget it, becasue odd things will pop up form time to time such as an unexpected car repair where you might need to transfer cash from savings to checking before an autopay processes. Transactions like that can not be automated and there are still a few places where autopay does not work.

Automation does not mean I don't want to track my expenses by catagory. I still want to know where my money is going. Just because I have a positive cash flow does not mean I am not spending more money that I want to in certian catagories. I understand not everyone has the same mindset as me, but I think it is a gross generalization to say that once you are automated you don't need to track where your money is going.

For full disclosure, I do not have a savings account and see no reason to have one (this is a different topic). So I never have to transfer anything from savings account and back. Once I established the initial cash buffer of approximately just one month of salary, I put everything on autopilot. While establishing a buffer of just one month, I changed my spending habits! I was spending less than I earn so I just continued doing so after automation. Sometime later I built two months of salary on my checking account and my cash buffer was large enough to cover an unexpected expense like a car breakage or ambulance services for my son.

If you have this buffer established, you stop worrying about unexpected expenses as well (as long as it is less than one month of a salary). If my car breaks, I pay for repairs by credit card, earn 1.5% cash back, pay the balance in full next month, replenish the dip over next 2-3 month by just continue my lifestyle and spending less than I earn. For more than 3 years I do not worry about bills at all. No emergency put me off track. Actually, I even forgot how to pay a bill LOL.

If I do not have an emergency for a while and my cash balance grows to let say 3 months of the salary, then I travel, buy an expensive thing I was waiting for a while, acquire new hobby or invest - life is good ;-)

A lot of people just do not have the patience and spend all that they earn emotionally. It is a vicious cycle.

1) Establish a habit of spending less than you earn

2) Pay off credit cards to the levels when you can pay in full every billing cycle

3) Build cash reserve on your checking equal for a month of salary

4) Automate all bills

5) Keep spending less than you earn

6) Build cash reserve on your checking for two months of salary

7) Keep spending less than you earn

8) If an emergency happens - pay by credit card and next month it will be paid in full from your checking automatically.

9) If emergence does not happen and your cash keeps growing on checking - take a chunk of it and pamper yourself or pay to yourself (extra investment?).

10) Keep spending less than you earn

11) Forget about bills.

12) Stop worrying about money, life is good.

Keys to success here are:

1) The desire to solve the problem and stop worrying about money.

2) Initial spending discipline, then it becomes a habit

3) Good tool that tells you how much money you can spend today. Which brings all your incomes, bills, and spends across all your accounts and credit cards into the equation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tools to managing your finance

@Anonymous wrote:

How do you manage yours and make sure you dont miss any payments and is there a tool that you recommend?

Spend less than I make.

Autopay CC statement balances in full.

Autopay

Autopay

For tracking I use my Credit Union's money manager tool. I can assign specific categories to any transaction for visualizing my expenses.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tools to managing your finance

If you want to be so rigidly zealous with your life that you can ignore where your money is going, more power to you.

I will state no successful business in the world works like that, and really if you want to get ahead in your personal finances, you really should know where your money is going just like any business. So few people are good at self analysis and have that much discipline to handle that... and if your financial situation ever needs analysis to see if you change your habits (like switch from an ICE to an EV car) how much you'd be saving over time, you can't really quantify that without the data.

Honestly having an app tell me how much I can spend a day is only half the battle, I need to be able to look back and say "Oh this recent Starbucks habit cost me $100 last month" and optimize that down or out if that money should be spent better.

Really the automation comes in for the categorization thing too. It seriously only took me 2 minutes yesterday to go through all my January expenses and touch up the categorization, everything else was automagic and correct. Assuming that's average, that's less than half an hour spent in an entire year, to have near real time information as to where my money is going. I read very quickly, so assume it's 5 minutes per for others, so an hour over the course of a year.

Unless anyone can tell me that they have a truly better use for that hour a year, giving up that level of data is just financially suboptimal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tools to managing your finance

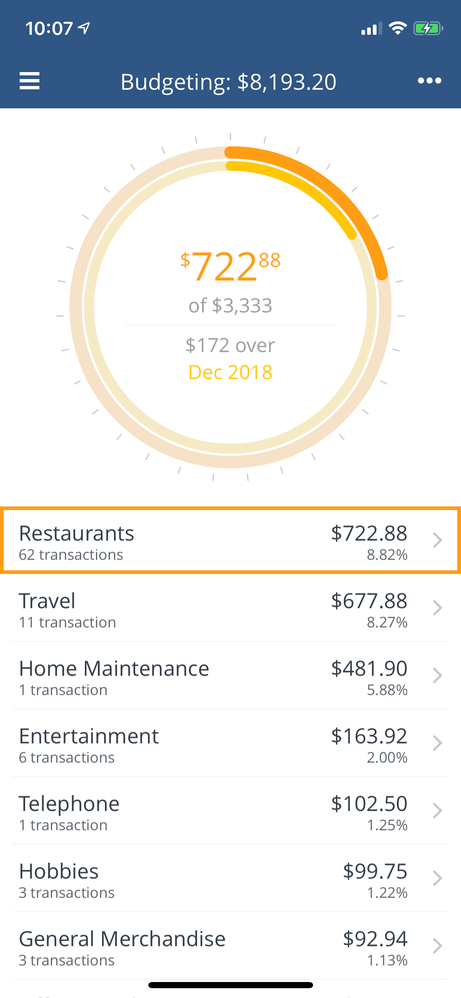

Actually case in point, and now recognizing that I can see about optimizing that expense line down:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tools to managing your finance

@Anonymous wrote:

Actually, I even forgot how to pay a bill LOL.

If I do not have an emergency for a while and my cash balance grows to let say 3 months of the salary, then I travel, buy an expensive thing I was waiting for a while, acquire new hobby or invest - life is good ;-)

A lot of people just do not have the patience and spend all that they earn emotionally. It is a vicious cycle.

1) Establish a habit of spending less than you earn

2) Pay off credit cards to the levels when you can pay in full every billing cycle

3) Build cash reserve on your checking equal for a month of salary

4) Automate all bills

5) Keep spending less than you earn

6) Build cash reserve on your checking for two months of salary

7) Keep spending less than you earn

8) If an emergency happens - pay by credit card and next month it will be paid in full from your checking automatically.

9) If emergence does not happen and your cash keeps growing on checking - take a chunk of it and pamper yourself or pay to yourself (extra investment?).

10) Keep spending less than you earn

11) Forget about bills.

12) Stop worrying about money, life is good.

Keys to success here are:

1) The desire to solve the problem and stop worrying about money.

2) Initial spending discipline, then it becomes a habit

3) Good tool that tells you how much money you can spend today. Which brings all your incomes, bills, and spends across all your accounts and credit cards into the equation.

THIS ^^^^^^^

I love how you keep saying "Keep spending less than you earn" for every other rule.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tools to managing your finance

@Revelate wrote:Actually case in point, and now recognizing that I can see about optimizing that expense line down:

Which app is this and does it ask to link my bank account?