- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: Upstart Loans

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Upstart Loans

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upstart Loans

Has anyone gotten an Upstart loan? And what credit score do you need to get the max loan from them which is $50,000?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upstart Loans

I just got a loan through them for $8200 in april. Credit score was in the low 600s. I forget exactly where they pulled. TU and EX I believe.

Anyway I used it for debt consolidation. I plan to pay it off by the end of the year. I applied for 10k and they countered with 8200. There was a $600 origination charge. Set up autopay. So far, everything was smooth. No issues at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upstart Loans

I got one with them once. They look at a lot more than just FICO score. I wouldn't know the answer to your second question, but I'd assume very few people qualify for that large of an amount, regardless of score.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upstart Loans

I agree. Upstart looks at more than just FICO score because I did the pre-qual and was pre-approved for $1,800. I got to Lending Club same day and get $20,000 and the following month I get $20,000 from PenFed. Not sure what Upstarts formula is but my income clearly qualifies me for $40,000 k but they only saw me as $1,800. I declined the $1,800.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upstart Loans

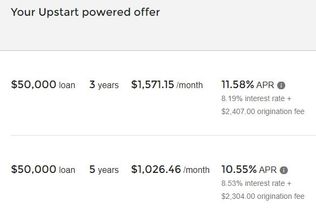

Can quality with mid 700's - This is only the soft pull prequalify... so have no idea how firm an offer it would be.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upstart Loans

I got an upstart loan for $4000 in low to mid 600s. They offered around $6000 but I scaled it back because the monthly payments seemed a little much for me at $44k annual income. They wanted access to my bank accounts to see I had the money I claimed I had. Approved at 27% apr I believe it was.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upstart Loans

I have an Upstart loan as of a couple of weeks ago for $7k to consolidate my cc debt. My credit score is in the low 6000s. The interest rate is a little high, but beats paying that across 6+ cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upstart Loans

6000's?! Thats a pretty high score! 🙃. I agree on rate. Mine is fairly high but the more loans you get and pay off over time, the better the rate. Mine was 29% which might be higher than some cards but I got mine to mostly finish off my first loan at some 200% or whatever rise loans run for 😬😂😂😂🤷♂️ Rise was awesome on speed on giving money and approval but bad on reporting and rates. They've reported like twice so far in the 6-9 months I will have had it. I left like $300 at end to let them report it before paid off which they did.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upstart Loans

@Anonymous wrote:I got an upstart loan for $4000 in low to mid 600s. They offered around $6000 but I scaled it back because the monthly payments seemed a little much for me at $44k annual income. They wanted access to my bank accounts to see I had the money I claimed I had. Approved at 27% apr I believe it was.

27%🥺 That's really high

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upstart Loans

27, 29. Something like that. For some reason I'm bad with rates. I have two car loans both at 14%. I recently read the auto loan section of forum and saw with my fico scores someone paying 8%. I'm really bad with it snd throwing money away. I'm still learning. I'll get it by the time I'm ready to buy a home, which is ultimate reason I started this game which has since gotten me addicted to the free rewards available. What did you think of my rise loan rates?! That thing was like 135%-200%. I forget which and am afraid to even look. It was like $7-$9 a day. I paid that thing off pretty fast lol. Another nice thing about them and upstart is that they show the current interest built up daily which is good motivation to keep on top of it and overpay. The negative reviews on rise were unjust. They were upfront, collateral free, and very flexible on payment extensions. The online text style chats were very clear and on point. Opportun offers zero online chat help and charges something called an origination fee. If Rise offered a rate at least like upstart, I would do business with them again.