- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: WTH is up with my ChexSystems????

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

WTH is up with my ChexSystems????

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

WTH is up with my ChexSystems????

Titles says it WTH ChexSystems.. As far as I know my ChexSystems is clean other the some inquiries for checking account bonuses etc and what not.. Anyways I went to open a checking today at 5/3rd(no bonus) and guess what DENIED to ChexSystem as expected they didn't know what issue was so shrugged it off and with to Simmon's next to office to open a local checking account again no bonus offer just a checking account and DENIED again due to ChexSystems.. This has me freaked out at this point as I have never bounced a check in my adult life and nothing other then inquiries on ChexSystems that I know of... So I went ahead and ordered a report today to see what might or might not be o it that is causing me grief.. I am hoping if just inquiries that I can get the bank managers to override the denials as I have never done a bank wrong other then collecting an occasional checking bonus.

Here are my thoughts thanks to another awesome MF member suggesting this could be the cause... I recently moved about 3 months ago to a new house is it possible that ChexSystems might have my old address or something along that lines and causing my Chexsystems score to plumit due to risk of be a BS address at the new place I live or something along those lines?

I am certainly interested to see my report as this is kinda scary to me as only way negative stuff can be on there is if someone did something to my checking without me knowing about it although suspect I would of heard from said bank or a CA by now... So hoping it is something simple..

Thoughts from anyone? I am certainly not happy about this at all. I know they recently also if i am not mistaken added a score risk aspect to a person meaning a move could cause score to plumit or something along those lines.

I am lost and would like to know other peoples inputs/thoughts about this as sitting with two different Adverse Action letters in front of me and managers business cards from both banks I tried to open a checking account with today. My hopes is to see a clean report and bring it into a bank and have the managers override this BS.

Signed

Frustrated ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH is up with my ChexSystems????

I hope you get it sorted out quickly... I'm looking to make between $3-4k on banking bonuses this year and would be pissed if I couldn't open up any more accounts. let us know what happens

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH is up with my ChexSystems????

CreditCuriosity I suspect you have many transactions and that may be scaring the banks (found I had frozen my ChexSystems Report but do not have the actual report - time to order). Somewhere I read the use of ChexSystems is variable by bank and that with some more than five account openings runs a flag up the pole while others get shy at two openings. Hmm ... these comments were speficially vague. I will go order my report and see what is going on.

Don't check your Early Warning Report. Just got mine and find they take every current bank statement and place it in the Early Warning files. WHY? Unreal. Note, not every one of my banks does it. Is there some reason that we don't see data leakage out of Early Warnings? Can't believe all the information my banks are dumping to them every month. Who needs a three bureau credit leak ... just hit Early Warning and they do not allow Security Freezes as they are considered and information gather not a credit bureau. Nice ...

Time to RANT!!! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH is up with my ChexSystems????

That's a lot of checking accounts to open.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH is up with my ChexSystems????

@Anonymous wrote:CreditCuriosity I suspect you have many transactions and that may be scaring the banks (found I had frozen my ChexSystems Report but do not have the actual report - time to order). Somewhere I read the use of ChexSystems is variable by bank and that with some more than five account openings runs a flag up the pole while others get shy at two openings. Hmm ... these comments were speficially vague. I will go order my report and see what is going on.

Don't check your Early Warning Report. Just got mine and find they take every current bank statement and place it in the Early Warning files. WHY? Unreal. Note, not every one of my banks does it. Is there some reason that we don't see data leakage out of Early Warnings? Can't believe all the information my banks are dumping to them every month. Who needs a three bureau credit leak ... just hit Early Warning and they do not allow Security Freezes as they are considered and information gather not a credit bureau. Nice ...

Time to RANT!!!

Ya EWS is something special... We cant freeze it, but banks have access to it.. The best way to avoid EWS or just not deal with them is refuse to do businesses with banks that provide information to them.. I hate the whole idea of EWS and that is why i ended my relationship with BofA when I found out they reported to them.

W/regards to ChexSystems it certainly could be alot of checking account openings for the bonuses but i dont think 2 denials for checking accounts in a row with no bonuses would cause an auto chex denial although I certainly could be wrong. I will see when I get my report if anything else is on their other than inquiries.. If it is just inquiries I can most likely get that overridden by the bank manager as they enjoy money in their bank accounts as quite honestly I was just trying to get a bank account next to my office was all I was trying to do! I honestly think it was the move that tripped something with the report, but as stated we shall see when i get the report and if clean I will bring it into one of the local banks and have the manager override the denial (hopefully) or just do business with a bank that doesn't use ChexSystem until my inquiries go down on it, but as stated I dont think it is just inquiries but the move and it messed my score up or something along those lines? I can only speculate atm until the report comes. I would be shocked if anything adverse is truly on the report.

Opened a few accounts a a month or two before I moved not issues tried after I moved and all hell breaks loose... Too much of a corelation imo.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH is up with my ChexSystems????

I obtained a ChexSystems report last year. All it says is no information found for each category. A separate score report lists my consumer score as 9999 and says insufficient data found. What's up with that?

I have a personal and a joint checking account. Both accounts were opened in 2005. I've re-ordered checks multiple times. I also had a business checking account. In addition, I have personal and joint savings accounts. All accounts are through Wells Fargo.

I read somewhere on the forums that Wells Fargo may not report data to ChexSystems. Is that true? Could that be the reason why I don't exist in the CS database?

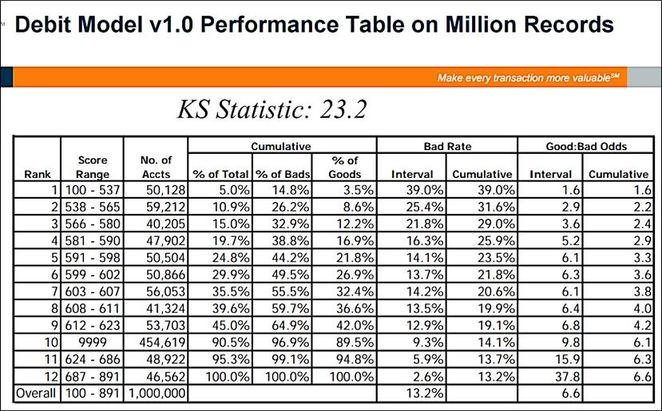

I found the below chart which appears to be a ChexSystems summary. It indicates 45% of the population lacks sufficient data in the CS database for scoring.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH is up with my ChexSystems????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH is up with my ChexSystems????

CreditCuriosity ... don't forget to order your ChexSystem Score ... who knows what you may find? Just ordered mine (did not know they even had scores). How can we have privacy and protection from hackers when ChexSystems and Early Warning lay in the background collecting a lot of what we do with Social Security, Date of Birth and current Driver's License Numbers? Nothing else needed to develop a false ID.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH is up with my ChexSystems????

@Thomas_Thumb wrote:I obtained a ChexSystems report last year. All it says is no information found for each category. It lists my consumer score as 9999 and says insufficient data found. What's up with that?

I have a personal and a joint checking account. Both accounts were opened in 2005. I've re-ordered checks multiple times. I also had a business checking account. The accounts are through Wells Fargo.

I read somewhere on the forums that Wells Fargo may not report data to ChexSystems. Is that true? Could that be the reason why I don't exist in the CS database?

I found the below chart which appears to be a ChexSystems summary. It indicates 45% of the population lacks sufficient data in the CS database for scoring.

Lack of information for scoring ... hmm ... what is the point?! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH is up with my ChexSystems????

It all depends whether a bank use ChexSystem scoring or not or just sees whether derogatory information is on there being a bounced check that was never repaid or the likes... I haven't ordered my score yet as it is a bit of more of a PITA than ordering my report online as for the score you gotta hand fill out a form and fax it in or mail it in, what a PITA.. I will probably request this as well, but my first priority was to get my report to see WTH was going on if anything on it.. I suspect I should have the report Tuesday or Wednesday of next week as they are pretty quick to get them out as ordered one like 4 years ago if I recall correctly and got it quickly.. Mise well order my EWS as well since you can get one of those a year as well to see if any of my current checking accounts report to that "wonderful" system.. Ya it is hard to keep up with all these databases especially ones like EWS that claim they arent a CRA agency, but certainly can impact your ability to get certain things I would call that a public CRA and a freeze should be warranted.. A few years ago I went at an agent over the phone about lack of a freeze although I know it was to no avail I made her here me out and my logic ![]() . I doubt they will be exempt forever and have to provide freeze ability cause they have very sensitive information.

. I doubt they will be exempt forever and have to provide freeze ability cause they have very sensitive information.