- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- What Should We Do Part 2

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What Should We Do Part 2

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What Should We Do Part 2

NOTE: This is a continue of - What Should We do Part 1 from MyFico Community.

Hello Everyone with myFico, hope your doing well in your lives..

$9,965.69 - (ALLY Online Savings Account) (2.10%)

I also have a Wealthfront Account for (2.57%) but I wasn't sure what to do right now.

Plan and simple, I used to work like 8 hour days etc.. 6 days a week. est example say used to make $700/wk but now due to things that happend at that place. it effected me so much that now I'm scared to go there everyday and now I've only been going

5 - 6 hours a day so = $450/week (This recently started happending in 2019). But back to the numbers.

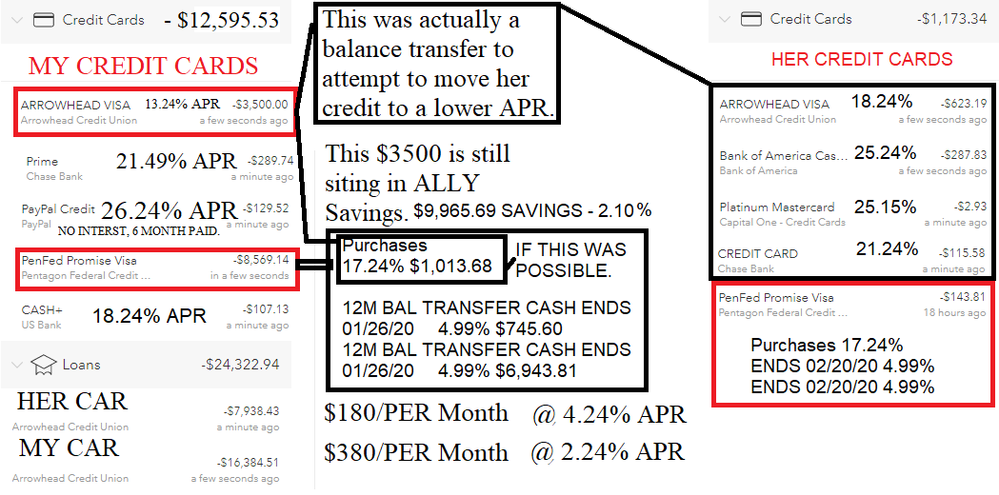

$3,500.00 of the (ALLY Online Savings Account) is actually from a Credit Card from Arrowhead Credit Union, there was no charge for this, it was taken out with the intent to pay off my future wife's credit card loans. (as per the previous post above.)

However these are the other credit card debts we both have.

CHART CREATED HOPEFULLY IT KINDA EXPLAINS MOST OF IT.

I wasn't sure if I should ride these cards out... or pay off the "$8,569.14" with the savings or should I simply transfer the debt she has to arrowhead, using the $3500 from it? or should I use it to pay off one of the cars?.... (I doubt the last one lol)

Hopefully I could get some advice... thank you so much everyone.

| 1st CC since 2007 | Last Updated: 09/29/22 | Total: $252.25K |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Should We Do Part 2

My first question is Will the hours/ income go back up and if so when? If not have you consiredsomethg parttime to suplement your hours.

Here in Smalltown and over in County Seat unemployment is arround 1% and people will gladly hire any one including an Axe Murderer parttime or fulltime. Most jobs have sign on bonus upto $2,000 after 90 days.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Should We Do Part 2

in both your postings, the formatting could be improved to make things a little more clear.

what I would do in your situation...

because you mentioned using savings, I would pay according to the following table:

| ally start | 9965 | $ mo int | % rate | |

| arrow | −623 | −9.47 | 18.24 | |

| bofa | −287 | −6.04 | 25.24 | |

| cap one | −3 | −0.06 | 25.15 | |

| chase | −115 | −2.04 | 21.24 | |

| penfed | −143 | −2.05 | 17.24 | |

| arrow | −3500 | −38.62 | 13.24 | |

| prime | −289 | −5.18 | 21.49 | |

| paypal | −129 | −2.82 | 26.24 | |

| penfed | −1013 | −14.55 | 17.24 | |

| usbank | −107 | −1.63 | 18.24 | |

| ally end | 3756 | |||

| penfed | −7688 | −31.97 | 4.99 |

that will leave you ~$3700 in savings. and definitely stop using the credit cards.

when you pay your penfed $1013, make sure they will apply the payment to the highest interest balance first. that will leave you one balance of $7688@4.99% for 6 more months. dump as much monthly into paying that down and in 2020 seek out a low interest balance transfer for what remains. (hint: I see a citi simplicity in your signature, citi nags me with more than a few 0-1.99% BT offers for anywhere from 12-24 mos.)

lastly, with two car payments (~$560/mo) and 7700 (~$160/mo min) in revolving debt, 1800/mo income is not going to leave much for living.

9/2022 $30000 |  8/2020 $20000 |  12/2018 $30000 |  8/2016 $30000 |  3/2016 $21000 |  5/2014 $20000 |  10/2007 $8900 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Should We Do Part 2

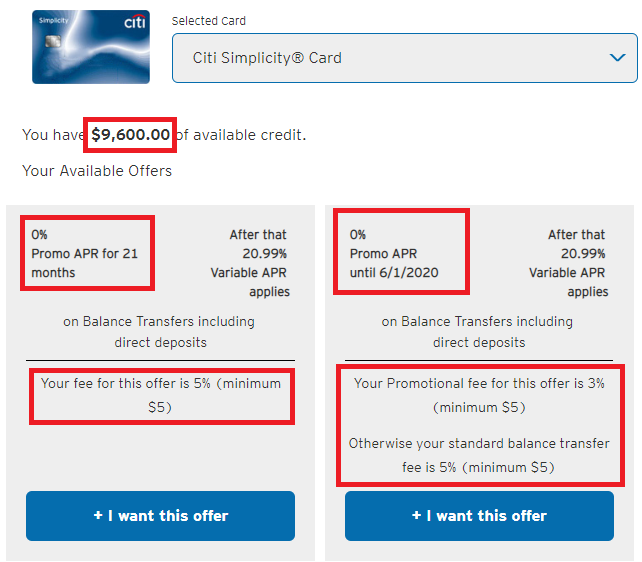

(hint: I see a citi simplicity in your signature, citi nags me with more than a few 0-1.99% BT offers for anywhere from 12-24 mos.)

Response: Yes you are correct! I didn't use it because of the following offers.

lastly, with two car payments (~$560/mo) and 7700 (~$160/mo min) in revolving debt, 1800/mo income is not going to leave much for living.

Response: Yes that would be a issue, if I was alone making those payments ![]() - She works, I should have said that but I guess I thought everyone would have obviously guessed that... I'm not crazy to purchase 2 cars at this level of salary.... no way... simply put we are both college students together I would assuming like "$2500 a month" est.. Not to sure... but its above $2200.

- She works, I should have said that but I guess I thought everyone would have obviously guessed that... I'm not crazy to purchase 2 cars at this level of salary.... no way... simply put we are both college students together I would assuming like "$2500 a month" est.. Not to sure... but its above $2200.

Thank You for your help, anymore advice anyone?

| 1st CC since 2007 | Last Updated: 09/29/22 | Total: $252.25K |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Should We Do Part 2

but with that BT fee the APR is like 5.37% if you pay it off in the 21 months.

| 5.37%=12*rate(21,-(7688*1.05)/21,7688) |

versus 13.24% with a no fee BT from a credit union?

in any case, what is your preference for clearing the revolving debt? two of what three: quickist, cheapest, lowest monthly payment?

9/2022 $30000 |  8/2020 $20000 |  12/2018 $30000 |  8/2016 $30000 |  3/2016 $21000 |  5/2014 $20000 |  10/2007 $8900 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Should We Do Part 2

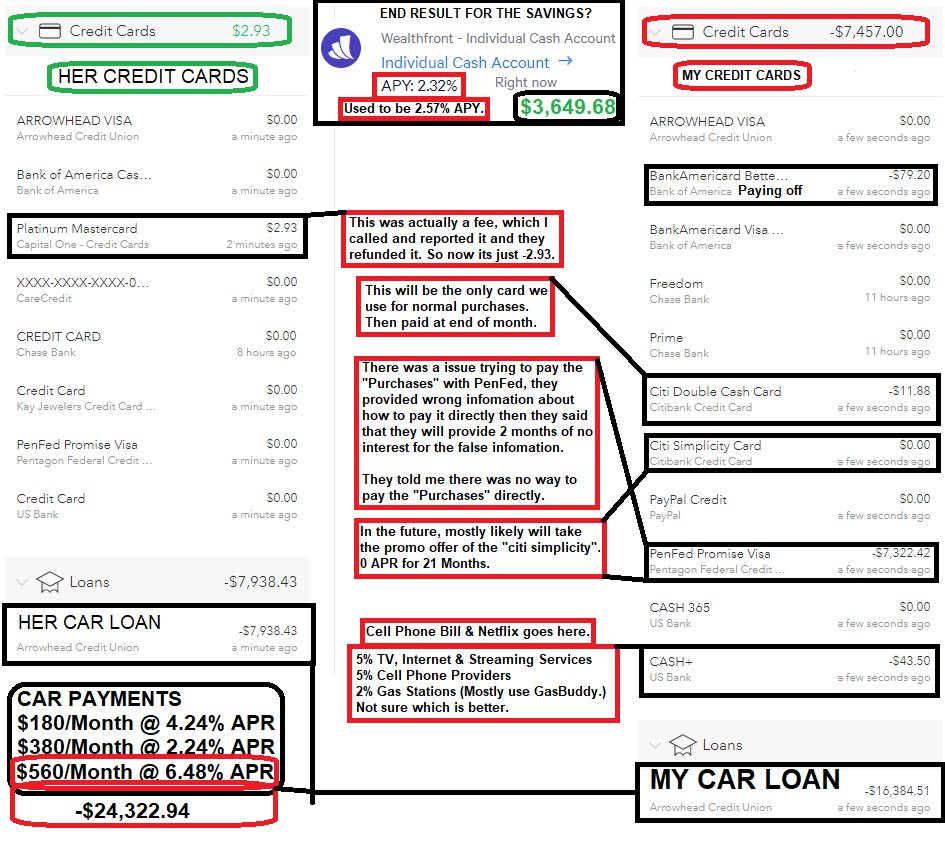

Sorry for my ugly charts ![]()

This is where we are at now basically, anything else to add please provide your knowledge to us.

Thank You.

| 1st CC since 2007 | Last Updated: 09/29/22 | Total: $252.25K |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Should We Do Part 2

Dude. Don't make it difficult for people to help you. Organize your numbers in a table then paste it in your post:

CC name | Balance

| Minimum | Rate (%) | Comments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Then make things clear: How much of your savings are you willing to put towards your debt? How much of your and your wife's salaries are available to go towards the debt? What advice are you actually asking for: the best way to eliminate the debt, the best way to handle your money given your lower salary (you didn't answer the previous question about your prospects of finding another job), etc...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What Should We Do Part 2

at the bottom of your statement, it shows what balances are at what apr. I highly doubt they could not tell what amount was purchases and what amount was balance transfers. google "credit card payment allocation" for more info.

regarding the car loans, consider this:

| blended interest |

| x.xx%=(($loan1*%)+($loan2*%))/($loan1+$loan2) |

| x.xx%=((7938*4.24%)+(16384*2.24%))/(7938+16384) |

| 2.89%=(336.57+367)/24322 |

what's next? ![]()

9/2022 $30000 |  8/2020 $20000 |  12/2018 $30000 |  8/2016 $30000 |  3/2016 $21000 |  5/2014 $20000 |  10/2007 $8900 |