- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- What's Your Ultimate Credit Goal?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What's Your Ultimate Credit Goal?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's Your Ultimate Credit Goal?

Great topic!

Financial security is my ultimate credit goal: To get to the point I don't need credit to get what I need/want, but have it just incase. ![]()

I suppose I have some more frivilous goals too:

- reach 800 on all CBs. I've never had that score. I would love to see it on *my* CRs.

- get some CCs I'm interested in (4-5) just because; I currently have only one CC

- increase my CLI just to learn how to

Truth is, I would be quite satisfied getting and maintaining a 760 credit score on all CBs and staying out of debt!

Right now, I'm rebuilding so I can purchase a home at a good rate. I would also like to max out my 401K each year and build up a 1 yr emergency fund. Simple goals, but will gain peace of mind if I reach them. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's Your Ultimate Credit Goal?

@Anonymous wrote:Great topic!

Financial security is my ultimate credit goal: To get to the point I don't need credit to get what I need/want, but have it just incase.

I suppose I have some more frivilous goals too:

- reach 800 on all CBs. I've never had that score. I would love to see it on *my* CRs.

- get some CCs I'm interested in (4-5) just because; I currently have only one CC

- increase my CLI just to learn how to

Truth is, I would be quite satisfied getting and maintaining a 760 credit score on all CBs and staying out of debt!

Right now, I'm rebuilding so I can purchase a home at a good rate. I would also like to max out my 401K each year and build up a 1 yr emergency fund. Simple goals, but will gain peace of mind if I reach them.

If you only have 1 cc, you May want to orphan at least 2 more to maximize your Fico score potential. However, if your close to doing the home loan, I would ignore what I just said.

Current Scores 3/2016 Equifax 676 Transunion 697 Experian 648 Goal Scores: 720's accross the board. Gardening Goal: 3/2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's Your Ultimate Credit Goal?

This is a good thread OP.

Like you my goals have really changed over the years. I have "gotten in" with every major bank. I will definitely pare down to under 5 cards. I don't know the number exactly but it will be under 5.

I started with more cash back cards, and realize I that I really enjoy points better. I went to New York and the trip there for me and my son was free, the hotel stay 4 nights near time square was free and with an upgrade, and my flight back was free. I just accumulate points until I need to use them.

Right now I'm really only accumulating MR, but will need to do more with UR to really compare, and ultimately I only want to deal with 1 point system.

One day I woke up and my credit wasn't the first thing on my mind, and I knew I had gotten that particular monkey off my back.

Now it's just about letting the inquiries fall off, paying of my kitchen reno, and consolidating limits and paring down cards.

I have friend who has 1 card that she uses for everything Amex Plat...she uses her debit card or takes her business elsewhere if Amex is not accepted. I sometimes envy her.

Ultimate Goal re credit only: 800 across the board. I know it won't get me a better rate than 740/760. It is strictly a personal goal.

Last app 09/21/2021. Gardening Goal Oct 2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's Your Ultimate Credit Goal?

@Kidcat wrote:This is a good thread OP.

Like you my goals have really changed over the years. I have "gotten in" with every major bank. I will definitely pare down to under 5 cards. I don't know the number exactly but it will be under 5.

I started with more cash back cards, and realize I that I really enjoy points better. I went to New York and the trip there for me and my son was free, the hotel stay 4 nights near time square was free and with an upgrade, and my flight back was free. I just accumulate points until I need to use them.

Right now I'm really only accumulating MR, but will need to do more with UR to really compare, and ultimately I only want to deal with 1 point system.

One day I woke up and my credit wasn't the first thing on my mind, and I knew I had gotten that particular monkey off my back.

Now it's just about letting the inquiries fall off, paying of my kitchen reno, and consolidating limits and paring down cards.

I have friend who has 1 card that she uses for everything Amex Plat...she uses her debit card or takes her business elsewhere if Amex is not accepted. I sometimes envy her.

Ultimate Goal re credit only: 800 across the board. I know it won't get me a better rate than 740/760. It is strictly a personal goal.

Fantastic!! I really enjoy reading stories about people taking flights and hotels paid for Misty or all with points/cash back. Especially for Ann expensive destination such as New York.

I also would like to see my score climb into the 800 club. There are some benefits available to someone with an 800 vs 760 score.

Thanks for sharing!

Best credit wishes to you.

Current Scores 3/2016 Equifax 676 Transunion 697 Experian 648 Goal Scores: 720's accross the board. Gardening Goal: 3/2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's Your Ultimate Credit Goal?

Honestly for me, I really just want to have a score that is deemed perfect in the eyes of lenders when it comes to obtaining a mortgage, yet not having to solely rely on the impact that my credit score has on my finances. Ideally, to be able to have a credit score across the board of 730+ is what I'm striving for. At the end of the day it is more of a personal feeling and not so much into trying to impress or show off to others on my borrowing capability because I definitely want to have more wealth in terms of assets than knowing I have a perfect score only to be in a position to ask for more money that isn't mine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's Your Ultimate Credit Goal?

@grillandwinemaster wrote:What's your ultimate credit goal? These forums provide an amazing amount of knowledge, experience and direction. Most of us that were in sub 500 land in the past are eternally greatful.

Along this journey, we evolve and become different people, credit wise. Some of us

may dip into "collecting" cards via the SCT for a while. Then we realize, "that's not for me!"

We may try the "rewards" game for a while, and then we again we realize, "hmmm, not fo me!"

We may shoot for large cli's and try to grow our cards, after a while... "nah! not into that!"

Ultimately, we have to ask ourselves, why are we playing the credit game? What's the end result that were seeking?

As for me, I played the sct, i played the rewards game, and the cli game. Then I realized that none of these games

were going to bring me any closer to my ultimate goal. My utlimate goal is to buy investment real estate property.

As such, I don't need to play the above games. I think for my goals, I should take a more conservative approach to

credit building. Specifically, no more than 3 or 4 credit cards, carry less than 5% uti, always pif. Do not apply for any

cc's unless absolutely neccessary!

To be clear, there's nothing wrong with playing the credit card accumulation game, or the cli game, or the rewards game,

I'm not knocking these philosophies, but for me, a more conservative approach works best.

What's your game? What's your ultimate credit goal, and what are you doing to reach it? Just curious...

I never had a credit goal. Only strategy I ever had was getting CC statements and then PIF always before due date. Kind of the same thing with installment loans - just pay installments by due date. By luck my natural spend relative to credit limits fell in the optimum range. You really don't need a lot of accounts for excellent credit scores. One installment loan and three non AU credit cards will do the trick. Don't be an account monger for the sake of a high score - it is not required.

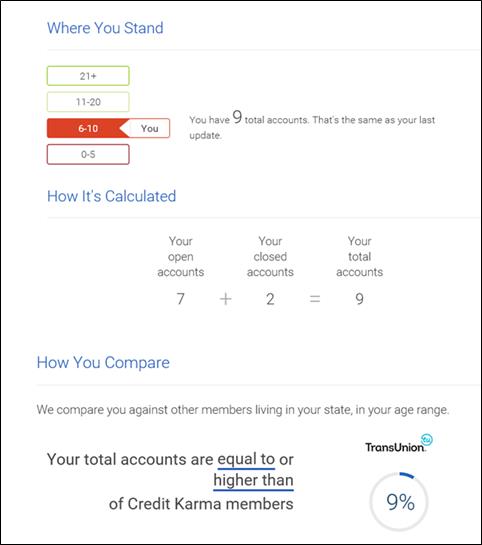

From a total account perspective, I'm near bottom of the barrel according to CK but Fico is ok with it.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's Your Ultimate Credit Goal?

With the dawn of a new year breathing down upon us, I'm resurrecting this thread!

What credit goals have you set for yourself for this coming new year, 2017 and beyond?

For myself for 2017:

Open: Citi Costco Visa and/or Cap1 Venture

Close: Firestone, Barclays, Care Credit (maybe, haven't decided yet) Kay Jewelers. Probably in that order. Maybe one closure per quarter?

Combine: Two Cap1 QS's and Venture, if acquired into one Cap1 with a good limit.

These actions will bring me down to 3 or 4 Credit accounts.

2018:

Open: Chase trifecta! ( freedom, FU, ink Or CSP) Or at least a Daily Double ( freedom and FU) and complete the trifecta in 2019. (CSP Or Ink)

What are Your long term/short term goals?

Current Scores 3/2016 Equifax 676 Transunion 697 Experian 648 Goal Scores: 720's accross the board. Gardening Goal: 3/2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's Your Ultimate Credit Goal?

@grillandwinemaster wrote:

@driftless wrote:

@grillandwinemaster wrote:

@driftless wrote:

We have really rebuilt our wealth over the last few years. A recent inheritance is going to put us well in the comfortable categories. Do scores, matter to me? Perhaps even more. We are considering purchasing rental properties and growing some of my business ventures. I am far more focused now than when my scores were low, but I am guessing that is a chicken - egg discussion.

Excellent point!Investment property is my goal as well.

I have always thought that this board should set up another sub-form: "Beyond the Rebuild". I can appreciate why many collect cards, try to build the total CL's high, etc., but I view those activities as narcissistic and self-defeating. I would rather have a conversation about what you can do to build wealth once you have 4 - 6 cards (max) with high CL's, scores at least 720 - 780 scores, etc., on how you are going to use your new found creditworthiness to grow wealth and not just add meaningless CC's and CL's. Investment and rental properties would certainly be in that conversation.

Any moderators listening?

- Driftless

Yes!! A thousand times Yes!!

A New sub- forum would be much appreciated. We need something that goes a little further than "personal finance."

Mods, Admins, I 2nd that motion.

Well since this thread got ressurected and I'm around and killing time on the forums waiting for my new job to start:

You can blame me completely for both Approvals and CC Apps, and mostly on Personal Finance though it was originally called something different (Retirement, then we lumped it all together as Personal Finance as it didnt have enough traffic).

It's a balancing act between information resolution and user traffic. Approvals and Apps were pretty clear rationale to me as they were overrunning the Credit Card board (it was all one big group mess and it was pretty awful actually as there were threeish types of posters and some overlap: ones that wanted to see approvals, ones who explicitly didn't want to see approvals, and ones who just wanted to talk credit card stuff and didn't really care. Apps was similar, application related information had a bunch of traction though not as much as approvals, but it was worth breaking up the posts so people could actually find stuff.

Personal Finance nee Retirement was a bit of a catchall; there wasn't anything for it, so it wound up everywhere in CC's, Gas, Gen Cred in particular, some over in UFS, and it really made sense just to consolidate it all into one grouping... and even then there's not tons of traffic though I think it's actually done pretty well in it's second incarnation: good information, good discussion, broad number of users both in count and in viewpoint, and that's absolutely a win in my opinion.

Splitting it up though, if it's a niche discussion or something more broad based like what do you do once Rebuilding is done, that's still applicable in CC for that, or still applicable here for most other things, and too many boards really really sucks to navigate in the Lithium interface. As it is forums where there's interesting information for a whole bunch of people like UFS (as I see discussions on CC, Mortgage, RYC) get really very little traction comparitively though I suppose many might be lurking, or if you want the ugly step child example, look at the myFICO Fitness Challenge: we get these goal posts every so often on multiple boards, and that's really what the Fitness Challenge was all about and we've done, well, not much with it unfortunately. Kelsey had plans for it when I stepped away from being a moderator but looking at it a year or so later doesn't seem like anything got done with it. My vote was always for dump it in CC's and call it a community thread and walk away from it and let the userbase make something of it, but I got voted down haha.

Anyway that was some forum history as to why it's they way it is now, and why it really doesn't make sense to have a sub forum here... people just don't often click through multiple boards, they find a home then they stay there. I don't know why it wound up like that other than to suggest it's probably the Lithium software design.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's Your Ultimate Credit Goal?

@Revelate wrote:

@grillandwinemaster wrote:

@driftless wrote:

@grillandwinemaster wrote:

@driftless wrote:

We have really rebuilt our wealth over the last few years. A recent inheritance is going to put us well in the comfortable categories. Do scores, matter to me? Perhaps even more. We are considering purchasing rental properties and growing some of my business ventures. I am far more focused now than when my scores were low, but I am guessing that is a chicken - egg discussion.

Excellent point!Investment property is my goal as well.

I have always thought that this board should set up another sub-form: "Beyond the Rebuild". I can appreciate why many collect cards, try to build the total CL's high, etc., but I view those activities as narcissistic and self-defeating. I would rather have a conversation about what you can do to build wealth once you have 4 - 6 cards (max) with high CL's, scores at least 720 - 780 scores, etc., on how you are going to use your new found creditworthiness to grow wealth and not just add meaningless CC's and CL's. Investment and rental properties would certainly be in that conversation.

Any moderators listening?

- Driftless

Yes!! A thousand times Yes!!

A New sub- forum would be much appreciated. We need something that goes a little further than "personal finance."

Mods, Admins, I 2nd that motion.

Well since this thread got ressurected and I'm around and killing time on the forums waiting for my new job to start:

You can blame me completely for both Approvals and CC Apps, and mostly on Personal Finance though it was originally called something different (Retirement, then we lumped it all together as Personal Finance as it didnt have enough traffic).

It's a balancing act between information resolution and user traffic. Approvals and Apps were pretty clear rationale to me as they were overrunning the Credit Card board (it was all one big group mess and it was pretty awful actually as there were threeish types of posters and some overlap: ones that wanted to see approvals, ones who explicitly didn't want to see approvals, and ones who just wanted to talk credit card stuff and didn't really care. Apps was similar, application related information had a bunch of traction though not as much as approvals, but it was worth breaking up the posts so people could actually find stuff.

Personal Finance nee Retirement was a bit of a catchall; there wasn't anything for it, so it wound up everywhere in CC's, Gas, Gen Cred in particular, some over in UFS, and it really made sense just to consolidate it all into one grouping... and even then there's not tons of traffic though I think it's actually done pretty well in it's second incarnation: good information, good discussion, broad number of users both in count and in viewpoint, and that's absolutely a win in my opinion.

Splitting it up though, if it's a niche discussion or something more broad based like what do you do once Rebuilding is done, that's still applicable in CC for that, or still applicable here for most other things, and too many boards really really sucks to navigate in the Lithium interface. As it is forums where there's interesting information for a whole bunch of people like UFS (as I see discussions on CC, Mortgage, RYC) get really very little traction comparitively though I suppose many might be lurking, or if you want the ugly step child example, look at the myFICO Fitness Challenge: we get these goal posts every so often on multiple boards, and that's really what the Fitness Challenge was all about and we've done, well, not much with it unfortunately. Kelsey had plans for it when I stepped away from being a moderator but looking at it a year or so later doesn't seem like anything got done with it. My vote was always for dump it in CC's and call it a community thread and walk away from it and let the userbase make something of it, but I got voted down haha.

Anyway that was some forum history as to why it's they way it is now, and why it really doesn't make sense to have a sub forum here... people just don't often click through multiple boards, they find a home then they stay there. I don't know why it wound up like that other than to suggest it's probably the Lithium software design.

Interesting info. Thanks Revelate, for that background information on some of the forum history.

Your post made me check on the "Fico Fitness Challenge." I don't think I had gone on that particular board in a few years. May I suggest renaming it? I don't think the name it currently has describes the spirit of the thread.

There would be more traffic if it was "marketed" better. As it stands, the Dec 2016 thread consisted of mainly two people.

FWIW, I've been on these forums for 5 years, and I've certainly learned a lot. I started rebuilding in 2011 and then I had a major financial/credit set back in late 2012, which derailed my progress.

So the importance of goal setting goes without mention. Without goals, I probably would have wallowed in self pity.

Long story short, (i know too late for that...) that Fico Fitness board could serve an excellent purpose. But I don't think people are aware of it. I definitely suggest renaming it to something more appropriate to the spirit of the board.

Current Scores 3/2016 Equifax 676 Transunion 697 Experian 648 Goal Scores: 720's accross the board. Gardening Goal: 3/2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's Your Ultimate Credit Goal?

@grillandwinemaster wrote:

@Revelate wrote:

@grillandwinemaster wrote:

@driftless wrote:

@grillandwinemaster wrote:

@driftless wrote:

We have really rebuilt our wealth over the last few years. A recent inheritance is going to put us well in the comfortable categories. Do scores, matter to me? Perhaps even more. We are considering purchasing rental properties and growing some of my business ventures. I am far more focused now than when my scores were low, but I am guessing that is a chicken - egg discussion.

Excellent point!Investment property is my goal as well.

I have always thought that this board should set up another sub-form: "Beyond the Rebuild". I can appreciate why many collect cards, try to build the total CL's high, etc., but I view those activities as narcissistic and self-defeating. I would rather have a conversation about what you can do to build wealth once you have 4 - 6 cards (max) with high CL's, scores at least 720 - 780 scores, etc., on how you are going to use your new found creditworthiness to grow wealth and not just add meaningless CC's and CL's. Investment and rental properties would certainly be in that conversation.

Any moderators listening?

- Driftless

Yes!! A thousand times Yes!!

A New sub- forum would be much appreciated. We need something that goes a little further than "personal finance."

Mods, Admins, I 2nd that motion.

Well since this thread got ressurected and I'm around and killing time on the forums waiting for my new job to start:

You can blame me completely for both Approvals and CC Apps, and mostly on Personal Finance though it was originally called something different (Retirement, then we lumped it all together as Personal Finance as it didnt have enough traffic).

It's a balancing act between information resolution and user traffic. Approvals and Apps were pretty clear rationale to me as they were overrunning the Credit Card board (it was all one big group mess and it was pretty awful actually as there were threeish types of posters and some overlap: ones that wanted to see approvals, ones who explicitly didn't want to see approvals, and ones who just wanted to talk credit card stuff and didn't really care. Apps was similar, application related information had a bunch of traction though not as much as approvals, but it was worth breaking up the posts so people could actually find stuff.

Personal Finance nee Retirement was a bit of a catchall; there wasn't anything for it, so it wound up everywhere in CC's, Gas, Gen Cred in particular, some over in UFS, and it really made sense just to consolidate it all into one grouping... and even then there's not tons of traffic though I think it's actually done pretty well in it's second incarnation: good information, good discussion, broad number of users both in count and in viewpoint, and that's absolutely a win in my opinion.

Splitting it up though, if it's a niche discussion or something more broad based like what do you do once Rebuilding is done, that's still applicable in CC for that, or still applicable here for most other things, and too many boards really really sucks to navigate in the Lithium interface. As it is forums where there's interesting information for a whole bunch of people like UFS (as I see discussions on CC, Mortgage, RYC) get really very little traction comparitively though I suppose many might be lurking, or if you want the ugly step child example, look at the myFICO Fitness Challenge: we get these goal posts every so often on multiple boards, and that's really what the Fitness Challenge was all about and we've done, well, not much with it unfortunately. Kelsey had plans for it when I stepped away from being a moderator but looking at it a year or so later doesn't seem like anything got done with it. My vote was always for dump it in CC's and call it a community thread and walk away from it and let the userbase make something of it, but I got voted down haha.

Anyway that was some forum history as to why it's they way it is now, and why it really doesn't make sense to have a sub forum here... people just don't often click through multiple boards, they find a home then they stay there. I don't know why it wound up like that other than to suggest it's probably the Lithium software design.

Interesting info. Thanks Revelate, for that background information on some of the forum history.

Your post made me check on the "Fico Fitness Challenge." I don't think I had gone on that particular board in a few years. May I suggest renaming it? I don't think the name it currently has describes the spirit of the thread.

There would be more traffic if it was "marketed" better. As it stands, the Dec 2016 thread consisted of mainly two people.

FWIW, I've been on these forums for 5 years, and I've certainly learned a lot. I started rebuilding in 2011 and then I had a major financial/credit set back in late 2012, which derailed my progress.

So the importance of goal setting goes without mention. Without goals, I probably would have wallowed in self pity.

Long story short, (i know too late for that...) that Fico Fitness board could serve an excellent purpose. But I don't think people are aware of it. I definitely suggest renaming it to something more appropriate to the spirit of the board.

That's actually a good idea and I'll go PM the link to your post to the current Admin now; but yeah I agree the promise is there just execution has been lacking.