- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What 's next?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What 's next?

First, thanks to everyone on this help as because of your advice, I was able to get out of the hole I was.

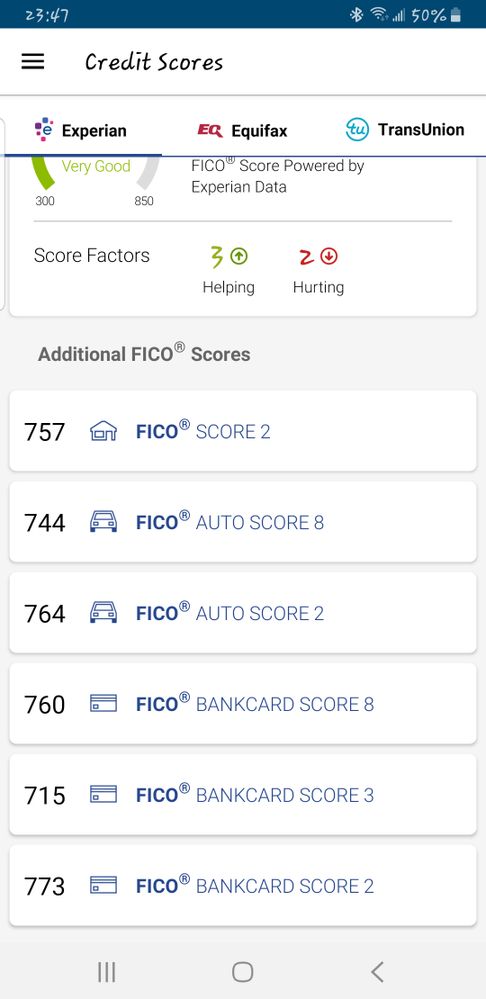

So this is my current credit scores as of 02/01/2020 I got a nice Chase card with a whooping $11,500. CL about a month ago, I really don't need any more credit cards as the Chase has like 12 months of 0% APR (not that I'm planing to carry any balances) but recently I got another offer for Citi DP offering 21 months 0% APR on Balance transfers but I'm not sure I really need this card besides as a nice bump to my general credit limit.

I got a nice Chase card with a whooping $11,500. CL about a month ago, I really don't need any more credit cards as the Chase has like 12 months of 0% APR (not that I'm planing to carry any balances) but recently I got another offer for Citi DP offering 21 months 0% APR on Balance transfers but I'm not sure I really need this card besides as a nice bump to my general credit limit.

There are a few cards that I really don't plan on using anymore such as "Macy's, Merrick, Wayfair" The Cap1 I like about them the no overseas fee as I travel twice a year and is nice to avoid these feeds.

If everything goes according to my plan I should have saved about $20,000 for a house down payment by the end of the 2020.

I want to have more credit, like very nice cards and such but do I really need them if I'm planing to buy a house by 2021?

Current list of credit lines

Should I hold on any more CC apps?

Should I place those card with low CL and no benefits on my drawer?

Now that my Credit is somewhat decent what's the next step to get into perfect score to get the most out of a mortgage loan?

Like always Thanks for the information and sorry if this is the wrong sub forum.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What 's next?

Congrats on the scores! It looks like you're all set. You have a decent set of cards, so unless you need a particular card for anything, I'd leave it as it is. SD the crap cards, and garden until the mortgage. As long as your balances / utilization remain the same, your scores will only go up. Do you know what your mortgage scores are?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What 's next?

This is what Experian says.

Im guessing is the fico 2

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What 's next?

Yep! Fico 2 for Experian. Looks great!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What 's next?

DCU is totally worth it for the Savings rate and free EQ mortgage score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What 's next?

You have nice Fico8 and mortgage scores!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What 's next?

You don't need to, but if you decide to go for the Citi DC, I would close the Macy's and the Cap1 #3

actually I would prob close both either way.

good work on your scores!

Jan 25/2024 EX. 774 EQ. 751 TU 758

Inq. EX 2 EQ 3 TU 6 - - CC 2x24, 0x12

Amex BCP $35k - Apple GS $21k - BMW/Elan $19k - Cap1 QS $16.7k - Chase Amazon $13.6k - Chase Bonvoy Bountiful $10k - Chase United Club Infinite $26k - Citi CustomCash $3k - Citi DC $14.5k - CreditUnion1 $9k - DiscoverIT $31.5k - PayBoo - $15.6k - Penfed Gold - $19.3k - USB AltitudeGO -$19k- USBank Cash+ -$25k - PenFed LOC - $20k - USB LOC - $15k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What 's next?

I guess Im just gonna ride it for this year unless a really tempting Offer comes in the mail.