- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: What should we do?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What should we do?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should we do?

Hello Everyone with myFico, hope your doing well.

Let me get to the point, I have a question for my wife.

| –$608.03 | $1,891.97 | $2,500.00 | 18.24% |

| –$281.80 | $1,918.20 | $2,200.00 | 25.24% |

| –$190.77 | $309.23 | $500.00 | 25.15% |

| –$216.34 | $0.00 (Don't know why Chase has this at 0.) | $1,800.00 | 21.24% |

| -$172.47 | $327.00 | $500.00 | 4.99% (Promo) - Reg: 17.24% |

| -$339.81 | $5,160.19 | $5,500.00 | 21.24% |

I don't know why but I thought she had a "Secured Mastercard®" from Capital One (the one above) however I remember that she used to be charged every year for having this card.

She does not have bad credit anymore, however did Capital One change this? or was she upgraded to the new card?, at one point we was talking about cancelling the card because she did not need to pay fees every year but its also her 1st credit card.

I could simply transfer everything to one of my own credit cards with $15,000 and a 13% apr I think.. with my credit union... I think that would be a better option?

Please share advice thank you.

| 1st CC since 2007 | Last Updated: 09/29/22 | Total: $252.25K |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should we do?

IF the objective is to pay less in interest then sure.

Depending on the CU there may be a BT fee but, some are no charge fees to move balances to their cards. If there's a fee it might be more worthwhile to just tarfet one card per month to PIF and move onto the next one. These aren't 10K balances.

Start with either the smallest balance for the sense of achievment or start with the highest APR to save more $.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should we do?

Mine comes with annual fees ($29) as well. I don't think this is something new from Cap1 however, she can actually call them up and ask for an upgrade/product change to something else that doesn't come with annual fees like venture1.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should we do?

I would not bother.

$1,800 @ 20% = $30 month

$1,800@ 13% = $20 month

We are talking $10 month difference in interest.

Just keep attacking payments.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should we do?

What does your credit profile look like? If you could get a 0% BT card for 14-18 months with a decent CL, this would be ideal.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should we do?

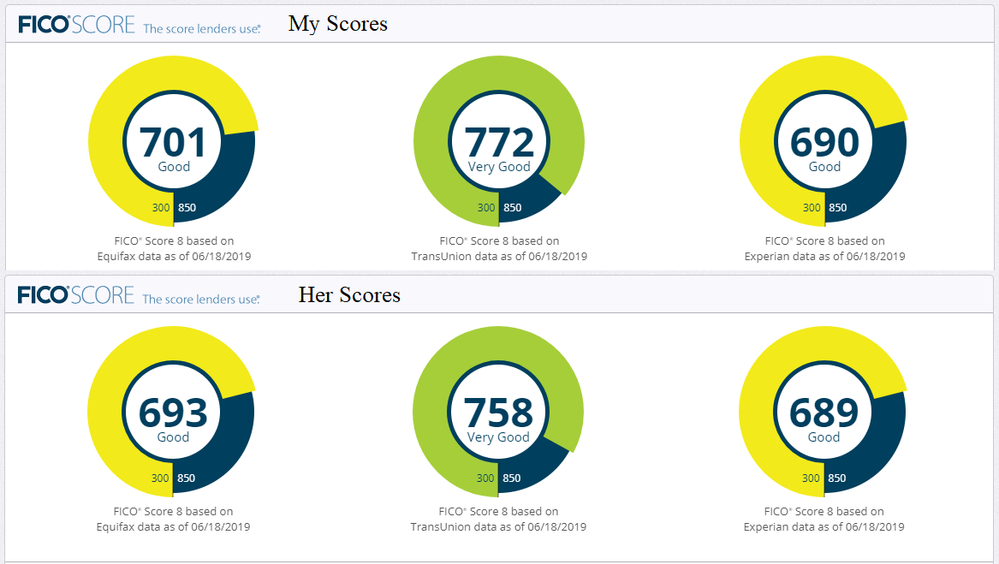

This is her "CreditKarma". - for some reason I've not been able to get high credit with hers as much as my own.

| 1st CC since 2007 | Last Updated: 09/29/22 | Total: $252.25K |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should we do?

@JetOneTV wrote:This is her "CreditKarma". - for some reason I've not been able to get high credit with hers as much as my own.

Sorry, need your FICO scores.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should we do?

| 1st CC since 2007 | Last Updated: 09/29/22 | Total: $252.25K |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should we do?

Throw the CK ratings out the window for apple to apple comarison. Fico wise it doesn't get much closer than what you just posted.

My concern here is why your TU scores are so much higher than the other 2. There's obviously something big weighing them down for both of you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What should we do?

About $9k to $10k used on a PenFed Credit Card.

I have 2 car loans (one of which I do not pay for, because my mother wanted the car so she pays it on behalf because I was going to get rid of it.)

1. Car Loan with Arrowhead CU

Currently $16k (or so)

2. Car Loan also with Arrowhead CU

Currently $11k (I don't pay this one)

3. Biggest debt is the PenFed Credit Card at about $9k - 10k.

As for her.

1. Auto Loan ($7-8k)

2. Credit Card Debt (above) about $2k

3. She does have a odd dog ticket thing which doesn't belong to her. She was like 17-18 years old at the time. But from what i remember it was like $400 in city collections.

Other then this I'm not sure.

| 1st CC since 2007 | Last Updated: 09/29/22 | Total: $252.25K |