- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: moving account from ej to charles schwab

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

moving account from ej to charles schwab

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

moving account from ej to charles schwab

Good morning so I made a dumb mistake about a year ago and opened an account back in april of 2018 and found out how much the fees are. Just this past monday I am in the process of moving my account as well as my roth ira to charles schawb . I do plan on keeping most of the etf's they had me in however they put me and the bridge builder program which they have to sell which is about $33573.79 dollars worth so I need some help my net worth is about 85k and im 26 currently about to be 27 in may. however my biggest question is what to do with the $33573.79 I am thinking of buying 20k of fscsx mutual funds and 10k into vym for the dividend and the leftover into savings or into stocks any suggestions ? I listed all my etf's and mutual funds that are currently getting transfered any suggestions on making any changes ?

etfs I own

scz 28.00 shares

iwb 31.00 shares

iwm 14 shares

iwr 60 shares

vea 162.00 shares

vtv 50 shares

my roth IRA

roth ira

mutual funds

mitjx 62.00 shares

mndkx 60.12 shares

mrskx 98.81 shares

mrbkx 44.53 shares

trgxx 656.89 shares

etfs

iemg 11 shares

ivv 8 shares

spab 26 shares

veu 23 shares

vo 4 shares

I own 43 shares of paypal stock

I own 16 shares of mastercard stock

Thanks Brett

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: moving account from ej to charles schwab

Congrats to an awesome investment start!! I'm really impressed.

If EJ has to sell their special funds because Schwab can't/won't take them, then you will owe taxes on the gains in a regular brokerage fund.

If you're liquidating from your EJ Roth and will rollover all the cash in your Schwab Roth then you'll owe no taxes.

LTCG tax rates are 0-20% depending on your tier. Keep that in mind when you file 2020 taxes next year.

I'm not familiar with the Bridge Builder funds at EJ, but since you're young and looking at 30+ years ahead of investing, then you can afford to invest in a little riskier asset classes like growth funds. Mutual funds like the Fidelity Select ones are well managed, but they may throw off large year end distributions (generally LTCG but preferentially taxable at 15-20%). This is the type of fund you'd want in your Roth, not your regular brokerage account since a 10-12% year end distribution might kick you up into a higher tax bracket.

Ditto VYM - except those distributions are Income and are regularily taxed at your ordinary rate not the preferentially taxed rates.

If you want to hold a Tech fund in a regular brokerage account, then efts are generally, (but not always) more tax efficient. So in your regular account you can look at perhaps IGV but keep FSCUX in the Roth.

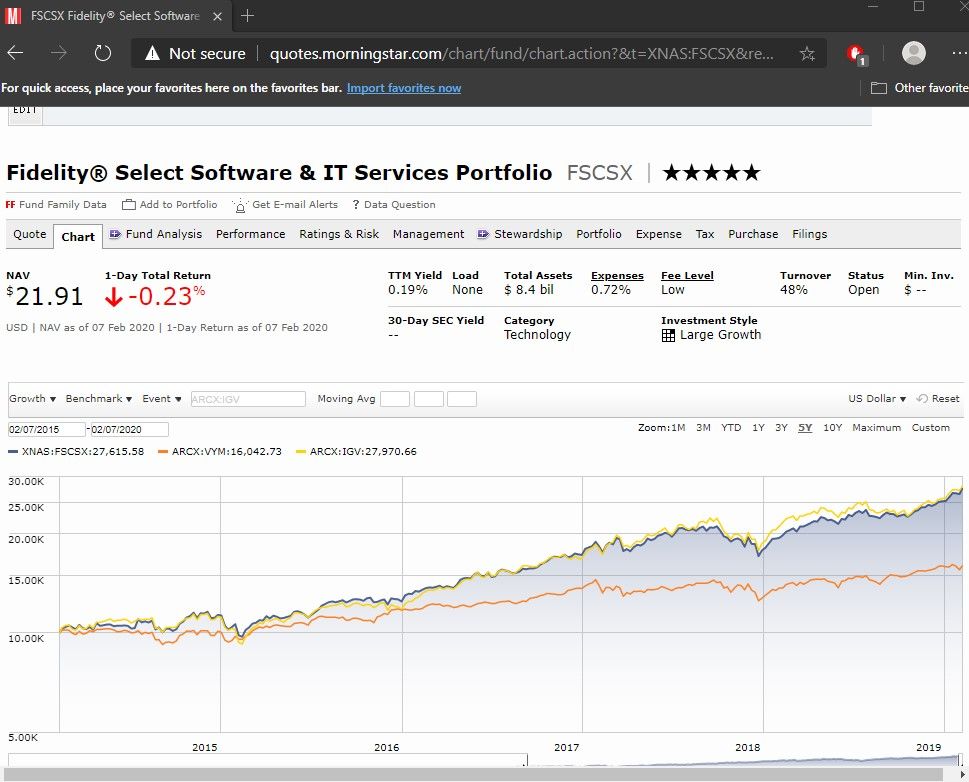

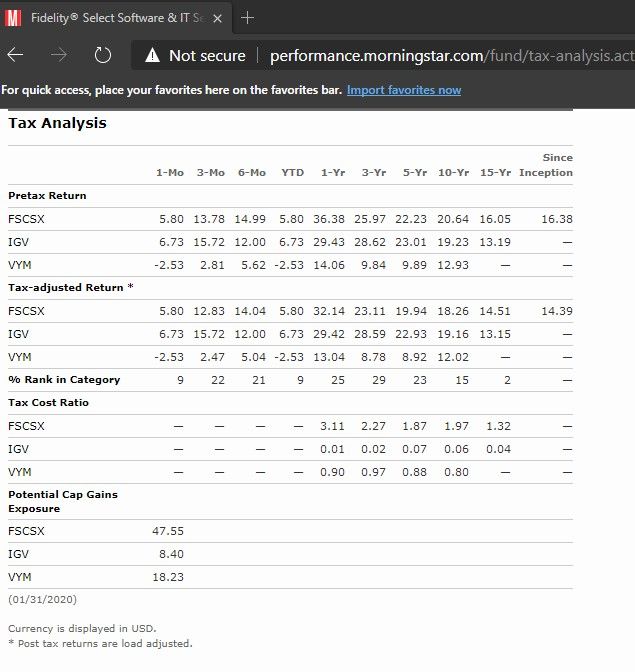

Morningstar used to have a wonderful page on taxes but they redid their interface--i.e. it's now really sucky. Here are screen shots of the old backdoor pages showing comparisons

Compare Blue: FSCSX to Yellow: IGV

On the surface the Fidelity fund looks like it gives slightly higher returns, but after taxes, the the more efficient etf actually has a better performance. The tax cost ratio shows you're losing 2-3% to taxes each year.

General advice only, not specifics:

30 years ago, there was no Venmo, Zelle, Google, Tesla, iphone, Amazon, Uber, Instagram, FB, Twitter, LOL, WOW, eSports, Cloud anything, streaming anything blah...blah... Heck people used to eat carbs and smoke back then, and oil stocks and big hair were a thing. Not anymore.

So, invest for the LONG-TERM. Always look to the future and that's where the growth will be.

Just keep doing what you're doing, and when the stockmarket tanks, and it will, don't panic.

Because when the market tanks, it is certain sectors that drag the market down while other sectors do well, (think the past few recessions tech bubble, real-estate, or financial sector). So maybe look at a whole-market fund to even out the ride.

You're in it for the long haul, and markets recover. You have a great start to your journey.

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: moving account from ej to charles schwab

Awesome thanks for the advice I will go with the etf vs the mutual fund atm just waiting for my cash I guess it has to go thru a residual sweep I am hoping to get the rest of the cash soon and yes I am very aware of the market fluctuations. I opened my account in april of 2018 and things got pretty bad late 2018 my account was -10 percent overall and I invested in nvida (stock) over 13k which lost half of its value and fast foward to late last year 2019 nvdia I sold lost 1k on that (help with taxes for 2019) and my overall account is up 6.5 percent while my roth ira is up 12%

currently my net worth is 85k

Only debt I have is a vehicle owe 22k @ 3.49 percent interest

again I do thank you for the feeback

Brett