- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: 408 credit score; 28 years old;terrible credit...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

408 credit score; 28 years old;terrible credit, finally trying to fix things

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

408 credit score; 28 years old;terrible credit, finally trying to fix things

I will start by saying that I have a credit score of 408.

I have a ton of things in collections that went ignored for years.

2013 was a year of me living lavishly. I had gotten my first real job, and I wasted no time financing a car and opening up like 7 different credit cards:

Bank of America-$700 limit

Exon-$600 limit

Chevron-$500 limit

Express clothing-$200 limit

Dell finance-$1,000 limit

Target-$200 limit

Citi Mastercard-$600 limit

Then, 2014 happened..

My credit cards were stolen by my relatives and they used it to purchase gas. They always lie when I confront them about it and it was basically trying to get money from a brick wall. It was essentially my fault because I assumed no one would go in my dresser and steal my credit cards, especially family members. I called Exon and told them the situation and they said that they cannot help with this because it was a relative and that I need to go to the relative for the money. I told them that what’s happening to me is fraud and it deserves to be disputed. They said no. So I got angry and thought that I was making a statement if I refused to pay. Eventually, that card got sold to collections, and at that time, I ended up losing my job, so I couldn’t afford to pay it anyway.

2014-2015 was a very rough year for me. I’d gotten fired from my steady job and was stuck with a car note and all of these credit card bills. I was moving place to place that year. Eventually leaving my family and moving to another state. It was a scary time. I obtained 10 different jobs throughout 2014-2015 and none of them were steady enough for me to be able to pick up the phone whenever the credit card companies would call.

1. I have like 7 different student loans through navient, all totaling to 11k..and no degree..

2. Although I am in a different state, I rented an apartment out for a family member back in my home state because he needed an apartment and had very bad rental history. He ended up defaulting on it. The apartment complex called and said I owe $1,586. I told them that i don’t live there, don’t even live in that state anymore and that I’m already struggling out here and can barely make ends meet. That eventually got sent to collections and is accruing interest like crazy. I haven’t been able to rent an apartment since then. So I’ve been renting rooms for the last three years and it’s been very depressing, living with people you don’t know and not knowing when you’re going to have to move again. Please don’t ask if I have tried contacting my cousin, because i have. It’s gotten me nowhere but being blocked from his phone and all social media. So I’m on my own with this.

3. All of those credit cards listed above have gone into collections and sold to third party companies

4. I have a sprint bill from 2013 as well that I never paid, it went from being past due $450(original amount) to $827 on my credit report as of 2019

5. I have tons of little stuff in collections like -time Warner- $147

-time Warner-(yes I had two different accounts)$198

-progressive-$297 because I couldn’t afford insurance in 2015, so I defaulted for a while and later got insurance with another company

-just energy-$146

-txu energy-331

The good news:

-the car I bought in 2013..I was struggling to pay it, but last year, I paid it completely off. I had come so close to repossession on that Honda 10 times, but that was the one thing made sure I was going to pay off!

-My capital one card is still open. I opened it in 2016. It has a $300 limit. I always had it maxed out, but just this past month, I have paid it down to $25, and plan to keep it that way. I only want to charge $25 a month and later ask them for a cli one day. I know it won’t be soon because that account has been in collections several times, but cap one are like my guardian angel and have given me so many chances to pull it out of collections and reopen the account. I have gone through this 3 times with them.

-I also just opened a new citi secured credit card with a $200 limit

-my best friend with great credit is going to add me onto a few of his credit cards. He is one of the best people I know with money and he is going to add me to his cards sometime this week.

All these things happened from the years 2014-2015 and I’m finally ready to get back on my feet, tackle my bad credit and move on from this, eventually being able to help others. Please please please help me with any advice. Should I pay the collections? Should I leave it? Should I file for bankruptcy? I was told that paying the collections would do no help to the credit since pay to delete is kind of a thing of the past? Please, someone help. Thanks

-

bad credit

-

bad debt

-

bad decision

-

Collection Agency

-

collections

-

credit card debt

-

credit counseling

-

Credit education

-

credit help please

-

credit improvements

-

credit knowledge

-

credit problems

-

Credit rebuild

-

credit rebuilding

-

Credit Repair

-

credit reports

-

credit scores dropping

-

help

-

Help Boost my Credit

-

help with collections

-

Help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 408 credit score; 28 years old;terrible credit, finally trying to fix things

-dell is paid off

-chevron is closed, since I never really used it

-bank of America is paid off in settlement

-express clothes is paid off and naturally closed since I never used that either

The ones in collections are

-exon

-target

-citi

-student loans(I called last week and deferred it, they said it should update my credit history by the beginning of September)

-progressive

-txu energy

-just energy

-sprint

-rental property debt

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 408 credit score; 28 years old;terrible credit, finally trying to fix things

What state do you live in currently, and what state(s) were the debts incurred in? This matters for a couple of reasons.

What you’re dealing with is rough but not insurmountable. First step - pull your reports for free from www.annualcreditreport.com (free if you haven’t pulled them in the last 12 months). For each debt, please list current balance, limit, owner of the debt (original and collection agency), and the date of first delinquency. The DoFD is the first date that it went negative and didn’t subsequently recover, leading to default. That is the date from which the 7 year clock starts for reporting. Also include this info for your positive accounts.

Next up, please share income and living expenses, so we can figure out how much you have to put toward debts each month and if there are areas to trim that’ll free up more cash. Once we have this info, we can help you plan to tackle the debts strategically for the biggest impact now and later.

You can get past this. It looks like a high mountain for sure, but like they say (paraphrasing) the best way to eat an elephant is one bite at a time. We can help you get back on your feet and put this behind you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 408 credit score; 28 years old;terrible credit, finally trying to fix things

I have pulled my annual credit score already in November of last year. Not much has changed on it, since then.

I work at Costco. Started working there towards the end of 2015(that’s when the things started to settle down for me)

I get paid 17.50 and hour and time and a half on sundays.

Gross pay before taxes is 1,300(give or take, it varies)

I contribute 7% in 401k

After taxes and everything, I’m only seeing $750(more or less) every two weeks

As for collections, given by the annual credit report. I will list the year that annual credit report says that it estimates it’ll fall off:

-sprint(Florida): nov2020 sold to ERC

-Exon(Florida): 2020 sold to Portfolio

-target(Florida): 2022 sold to Diversified

-rental property debt(Florida): 2022 sold to Hunter Warfield

-txu energy(Texas)-2022 still with TXU

-progressive(Texas): 2024 sold to Caine and Wainer

-just energy(Texas): 2022 sold to Credit Management CNTRL

-time Warner(Texas): 2022 sold to ERC

-time Warner(Texas): 2022 sold to Southwest Credit Systems

Literally all this stuff listed above, happened before I started working at Costco, when I was struggling to find a good job.

Should I pay them? Or should I leave it? Or should I file for bankruptcy? Help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 408 credit score; 28 years old;terrible credit, finally trying to fix things

My phone bill with Verizon is $55-63 a month

My insurance with Geico is $97 a month. But I’m looking to switch to State Farm since they are offering $79 a month

My cap one card is $25 a month as of now, since I paid the balance down.

My citi card is only $20 a month because that’s all I charge per month on it, since I’m just using that card to build credit.

Gas on a Honda Civic is about $25 every two weeks

And food and toiletries I buy at Costco since it’s in bulk and since i already work there

Miscellaneous entertainment:

Apple Music $9 I use the credit card for

Netflix $9 I also use the credit card for

I think everything totals to $650-$700 a month

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 408 credit score; 28 years old;terrible credit, finally trying to fix things

This forum is a great place to be, I was just like you my score was hovering in the low 400s as well! Just eat up all of the knowledge these folks will share with you, Create a plan, Create a budget and stick to it. Wish you luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 408 credit score; 28 years old;terrible credit, finally trying to fix things

@Anonymous wrote:

Hi, thank you for welcoming me! My original home state is Florida. Born and raised. I moved to Texas in the end of 2014, and been here ever since.

I have pulled my annual credit score already in November of last year. Not much has changed on it, since then.

I work at Costco. Started working there towards the end of 2015(that’s when the things started to settle down for me)

I get paid 17.50 and hour and time and a half on sundays.

Gross pay before taxes is 1,300(give or take, it varies)

I contribute 7% in 401k

After taxes and everything, I’m only seeing $750(more or less) every two weeks

As for collections, given by the annual credit report. I will list the year that annual credit report says that it estimates it’ll fall off:

-sprint(Florida): nov2020 sold to ERC

-Exon(Florida): 2020 sold to Portfolio

-target(Florida): 2022 sold to Diversified

-rental property debt(Florida): 2022 sold to Hunter Warfield

-txu energy(Texas)-2022 still with TXU

-progressive(Texas): 2024 sold to Caine and Wainer

-just energy(Texas): 2022 sold to Credit Management CNTRL

-time Warner(Texas): 2022 sold to ERC

-time Warner(Texas): 2022 sold to Southwest Credit Systems

Literally all this stuff listed above, happened before I started working at Costco, when I was struggling to find a good job.

Should I pay them? Or should I leave it? Or should I file for bankruptcy? Help!

I dont like to jump on others attempts trying to help a person. But could you edit the above post and place amounts owed for @Anonymous

And what is the total debt all around. You wanna switch states and come back to Fl? I GOT DORIAN COMING RIGHT AT ME.!!!!!!!!! GO AWAY!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 408 credit score; 28 years old;terrible credit, finally trying to fix things

My first step would be to get a second job, working 20 hours a week to help you through this... then talking to the 5 smallest collection accounts and seeing who will agree to a PFD, maybe working on the most recent one.. make sure your current cards are paid on time and no more lates

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 408 credit score; 28 years old;terrible credit, finally trying to fix things

Welcome & don't worry about anyone judging you. Most, if not all of us, have had our own rough road that we have traveled on. What's important is that you tell yourself today is the brokest you'll ever be!

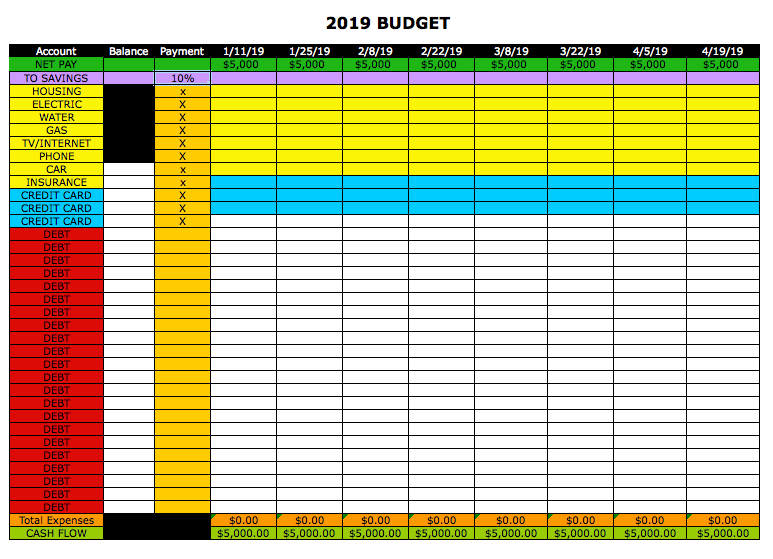

Make yourself a written budget. This is VERY important. You cannot get out of debt doing this all in your head without a written gameplan. Write down EVERYTHING you spend money on, even if it's a soda at the mini-mart.

Having a written budget does several things:

1. It lets you see where your paycheck is going, and allows you to identify any bad spending habits or what can be eliminated as frivulous spending.

2. It lets you plan out how much and when you can pay down your debts.

3. It allows you to see visual progress of your journey as you pay down your debt, which is motivation to keep going.

Your budget should look something like this:

PFD is certainly NOT a thing of the past- but it only works with some collection agencies, not original creditors.

After you have your budget filled out, you will see how much you can afford to spend each paycheck towards paying down your debt.

Start with the smallest amount & keep working your way up. I would start with the newest debts/collections first. Leave the ones that are almost ready to hit 7 years. Between what you pay off & what falls off in the next 18 months will make a BIG difference in your scores.

Now for the elephant in the room- we don't get to choose our family, and sometimes some family members don't return the love and respect shown them. I hope you've learned that you can love your family member(s) without "taking it in the financial shorts" for them. Personally, if a family member had used my cards without my permission I would have filed fraud charges with the credit card companies and the police.

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 408 credit score; 28 years old;terrible credit, finally trying to fix things

Oh kiddo, I am so sorry!

What concerns me most on your list of debts is the rental property as typically dirtbag lawfirms will buy those debts and get judgments against you, doubling or tripling that debt. In my state, they can then file the judgment with the courts and then renew them every 10 years so they never go away, and once they have a judgment they can garnish your wages. I don't know what is is like in the state the apartment you rented in.

Honestly, your credit is so bad, you may want to go see a BK lawyer. Consultations are usually free, so you should explore it as an option. You may not make the means test, but if you do, it is worth a shot, clean slate (except for your student loans of course), if not, you can probably at least get some free information.

Although a lot of your debts may be getting ready to fall off in the next year anyway.

Also, with regards to your student loans, when you pay late or defer, the interest compounds. For instance my husband owed 40k in 2000 when he graduated, because of late payments, deferrment, and eventually a default he owed $48,000 in 2016 - 16 YEARS LATER. When paid off he will have paid at least twice his original balance. Student loans are truly predatory, so start paying a soon as you can.

The good news, is that with 408, you have nowhere to go but UP![]() .

.