- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Building from 532

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

(8mo update +210pt) Building from 550 - My progress thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

(8mo update +210pt) Building from 550 - My progress thread

Greetings, all. This will be my first post, and I intend to update it as I reach milestones on my way to 700+

A quick bio: I'm 34, single, income 43K, with no assets, no debts, and weak credit. I've paid cash for every car, never owned a home, and never had a credit card. My CU offered me an unsecured $500 loan which I didn't need, but took, just to build payment history. My score rose to 600 during that time, and then dropped to 550 in 12/2020 when the loan was paid off. This puts my average (only) account age at 10 months.

I have three medical collections from 01/2020, totalling $3000.

Besides that, I'm a blank slate. Last week, I applied for three secured cards, back to back. Approved for Capital One ($200 for $99) and Discover ($300); and FNBO denied. I'm pretty happy - no, STOKED, - with 2/3!! I'm waiting for the cards in the mail.

My current scores, including those 6 inquiries:

EQ: 532

TU: 562

EX: 556

[Average 550]

Next steps: Opening a NFCU account and switching over my direct deposit, then applying for the largest SSL I can scrape together (10-12K), using 3K to pay off my medical collections (hopefully for a delete), then paying the principal down and letting it ride. Depending how my credit is looking during that timeframe (Cap1 and Disco should be reporting by then), I'll likely apply for a NFCU secured card.

If all goes well, in three months time I'll be due for a 15-20% raise at work, sitting on 3 decent cards, a 10K+ SSL @ <9%, and no baddies. A good spot to secure some CLIs and an auto loan, me hopes.

The collective knowledge on this forum is mindblowing. I've spent a dozen hours or more this week, researching, developing, and redeveloping this plan. And I'm still such a dummy! Just a slightly less-ignorant dum dum than I was before ![]() I'm open to any critique or advice, if you're willing.

I'm open to any critique or advice, if you're willing.

Thank you all, most kindly. I hope my tiny contibution here will prove helpful to somebody, some day. Cheers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building from 532

@morethan20yaks wrote:

Next steps: Opening a NFCU account and switching over my direct deposit, then applying for the largest SSL I can scrape together (10-12K)...

Question for both @morethan20yaks and anybody else seeing this thread, "Is there any evidence a Secured loan above say $3,000 helps accelerate growth in credit scores?

I ask because I'm curious why you wouldn't just open a lower limit SSL and then invest the rest of the money elsewhere?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building from 532

Good questions. I don't know whether having a 3K vs 10K loan makes a difference on my report for the next 60 months (and 10 years after that) but I suspect the bigger denominator will only help, as I have large purchases in my 3-5 year plan. Curious to see what others have to say.

As for the second part, most of that cash is earmarked for other projects this summer. It seems to me that directly paying the CA with 3K cash == paying CA with 3K SSL == paying CA with 10K SSL then paying the principal down to $800 (thus returning my entire cash deposit, less eight percent) and riding it out. They're functionally equal, the only difference being interest, which is nominal, for my purposes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building from 532 - My progress thread

Hi there OP and welcome to the board ![]()

I updated your title to say its your progress thread this way it wont be locked by the mods after 1 year which is current policy sans certain threads.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building from 550 - My progress thread (8 month update +210 points)

Greetings, all! Here's a recap of the last 8 months, up to current standing

March 2021 :

- $300 Discover CC (secured)

- $200 Capital One CC (secured)

June 2021 :

- $12K NFCU SSL (secured)

- $2K Signature Loan (unsecured)

- $2K Visa CC (unsecured)

- $1150 nRewards CC (secured)

That's 6 new accounts between March and June. In that time, I used my emergency savings to PFD all 3 baddies, yielding a clean scorecard.

September 2021 :

- Capital One CC CLI to $300 (still secured with $99)

October 2021 :

- Discover CC graduated and CLI to $1500

That brings us to today

All Accounts : (6 open, 1 closed)

- Income: 51K (+18%)

- AAoA: 6 months

- AoYA: 4 months

- AoOA: 17 months (the only other account besides the 6 I described. A closed $500 personal loan with 6 months good payment history)

Installments : (2 open, 1 closed)

- AAoIn: 8 months

- AoYIn: 4 months

- AoOIn: 17 months

- Individual Util: 38% (750/2000 unsecured)

- Individual Util: 3% (350/12000 secured)

- Aggregate Util: 8% (1100/14000)

Revolvers : (4 open, 0 closed)

- AAoR: 5 months

- AoYR: 4 months

- AoOR: 7 months

- Util: AZEO 1% (14/4950) 3800 of which is unsecured - hoping NFCU won't be far behind

Inquiries :

- TU: 4/12

- EQ: 2/12

- EX: 4/12

FICO Scores :

- TU8: 752 (+190)

- EQ8: 768 (+236)

- EX8: 761 (+205)

I believe that 17 month old installment loan is helping me a bit, but this more or less reflects what could be done with a 'blank' slate in the same time period. Maybe even a little quicker, though this was plenty aggressive for my liking.

What I would do differently? Probably not much. I had to roll with a few punches, but I believe my execution was more-or-less flawless. I 'wasted' 3 hard pulls. That's inevitable, I suppose, and really not a big deal. Avoid SDFCU - they will lie to your face like it's... their job. My only other real denial was FNBO secured card application. They quoted a 528 score and baddies, so I'm ni mad nor surprised. Fastforward 8 months, and I just prequalified for their Evergreen 2% cashback card with a SL of $8800. DECENT.

What's next? I'm opening two installment loans - a second NFCU SSL for 4K, becuase I plan on paying off the 12K SSL in 18 months and I want a smaller one already established to keep around full-term; And an 8K signature loan at the local CU for some car repairs and hobby stuff. That will bring my total accounts to 9, then I'm going straight back to the garden for 9 months, allowing for all my FOUR new revolvers to hit 1 year old+. July 2022 AA will be 14 months, YA 9 months, OA 26 months, and youngest revolver 13 months. 1/12 on EQ and 0/12 on TU & EX. Then I'm gonna Chase app, quick! cuz I'll probably never be 4/24 again lol. And w/ so few inquiries.

Will use that quiet time to aggressively pay down the 8K signature loan, open & use checking accounts w/ Chase, Affinity, and AOD, seek SP CLIs, and work on wrapping up my bachelors degree. On we go.

Hope these DPs help somebody ![]() I will update in a month or two to establish a new baseline once these upcoming installment accounts are reporting. Cheers, and thanks again. Couldn't have done it without the folks on this board

I will update in a month or two to establish a new baseline once these upcoming installment accounts are reporting. Cheers, and thanks again. Couldn't have done it without the folks on this board ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building from 550 - My progress thread (8 month update +210 points)

@morethan20yaks wrote:Greetings, all! Here's a recap of the last 8 months, up to current standing

March 2021 :

- $300 Discover CC (secured)

- $200 Capital One CC (secured)

June 2021 :

- $12K NFCU SSL (secured)

- $2K Signature Loan (unsecured)

- $2K Visa CC (unsecured)

- $1150 nRewards CC (secured)

That's 6 new accounts between March and June. In that time, I used my emergency savings to PFD all 3 baddies, yielding a clean scorecard.

September 2021 :

- Capital One CC CLI to $300 (still secured with $99)

October 2021 :

- Discover CC graduated and CLI to $1500

That brings us to today

All Accounts : (6 open, 1 closed)

- Income: 51K (+18%)

- AAoA: 6 months

- AoYA: 4 months

- AoOA: 17 months (the only other account besides the 6 I described. A closed $500 personal loan with 6 months good payment history)

Installments : (2 open, 1 closed)

- AAoIn: 8 months

- AoYIn: 4 months

- AoOIn: 17 months

- Individual Util: 38% (750/2000 unsecured)

- Individual Util: 3% (350/12000 secured)

- Aggregate Util: 8% (1100/14000)

Revolvers : (4 open, 0 closed)

- AAoR: 5 months

- AoYR: 4 months

- AoOR: 7 months

- Util: AZEO 1% (14/4950) 3800 of which is unsecured - hoping NFCU won't be far behind

Inquiries :

- TU: 4/12

- EQ: 2/12

- EX: 4/12

FICO Scores :

- TU8: 752 (+190)

- EQ8: 768 (+236)

- EX8: 761 (+205)

I believe that 17 month old installment loan is helping me a bit, but this more or less reflects what could be done with a 'blank' slate in the same time period. Maybe even a little quicker, though this was plenty aggressive for my liking.

What I would do differently? Probably not much. I had to roll with a few punches, but I believe my execution was more-or-less flawless. I 'wasted' 3 hard pulls. That's inevitable, I suppose, and really not a big deal. Avoid SDFCU - they will lie to your face like it's... their job. My only other real denial was FNBO secured card application. They quoted a 528 score and baddies, so I'm ni mad nor surprised. Fastforward 8 months, and I just prequalified for their Evergreen 2% cashback card with a SL of $8800. DECENT.

What's next? I'm opening two installment loans - a second NFCU SSL for 4K, becuase I plan on paying off the 12K SSL in 18 months and I want a smaller one already established to keep around full-term; And an 8K signature loan at the local CU for some car repairs and hobby stuff. That will bring my total accounts to 9, then I'm going straight back to the garden for 9 months, allowing for all my FOUR new revolvers to hit 1 year old+. July 2022 AA will be 14 months, YA 9 months, OA 26 months, and youngest revolver 13 months. 1/12 on EQ and 0/12 on TU & EX. Then I'm gonna Chase app, quick! cuz I'll probably never be 4/24 again lol. And w/ so few inquiries.

Will use that quiet time to aggressively pay down the 8K signature loan, open & use checking accounts w/ Chase, Affinity, and AOD, seek SP CLIs, and work on wrapping up my bachelors degree. On we go.

Hope these DPs help somebody

I will update in a month or two to establish a new baseline once these upcoming installment accounts are reporting. Cheers, and thanks again. Couldn't have done it without the folks on this board

Nice. No need for another SSL with 18 months left on the first one. And bring your total up to 5 loans afterb the other loan app. You only need 1 installment loan reporting. Save the hits to your AoYA and AAoA's. Whichever loan goes the furthest out with the lowest util. Keep it and close out the others. Then grab your Chase card. Nice work and scores!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building from 550 - My progress thread (8 month update +210 points)

@FireMedic1 wrote:Nice. No need for another SSL with 18 months left on the first one. And bring your total up to 5 loans afterb the other loan app. You only need 1 installment loan reporting. Save the hits to your AoYA and AAoA's. Whichever loan goes the furthest out with the lowest util. Keep it and close out the others. Then grab your Chase card. Nice work and scores!

Thanks FireMedic,

Hear me out. I'm curious what you think.

1) I may get some long-term benefit by my SSL being 5 figures, but the downside is the hit to my DTI, since it's based on monthly payment, not my 'true' monthly payment of $5. I've already had to explain this debt to a bank manager, so I'm motivated to close it before any major credit applications (mortgage etc) - likely to be 18 months from now~

2) I plan on having the new 8K signature loan paid off in that same 18 months. That would leave me with no open installments, right before a major credit application.

3) By opening a smaller SSL now, in 18 months, I'll be left with the solid history of the previous high-dollar[lol I'M TRYING] installments I just paid off, and still have a 'mature' installment account with 18 months history, only $70/mo to DTI, reporting util <8%. Versus scrambling to open a new SSL 6 months before a mortgage app and taking that 'youngest account' hit for the next year+

Bonus: One more positive tradeline reporting for the next decade, anchoring my AA

Bonus: More account history with NFCU, with no inquiry required

The only downside I foresee is the hit to my AA, which, 18 months from now, equates to 24.2 vs 24.9 months. My youngest account will be the same, since I'm opening the signature loan the same month.

Really appreicate your feedback, and think I understand why that's great advice, generally. But is my logic sound? My goal is to have the strongest profile possible 18-36 months from now. 0-18 months my FICO score is secondary to that goal, and I expect my short-term wins to come from smart budgeting, academic progress, and career mobility.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building from 550 - My progress thread (8 month update +210 points)

Thats cool. Long as you only have 1 loan open for the FICO bonus low util %. And no HP/Accounts for a year before the homeloan. Its all good. Good Luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building from 532

@Horseshoez wrote:

@morethan20yaks wrote:

Next steps: Opening a NFCU account and switching over my direct deposit, then applying for the largest SSL I can scrape together (10-12K)...

Question for both @morethan20yaks and anybody else seeing this thread, "Is there any evidence a Secured loan above say $3,000 helps accelerate growth in credit scores?

I ask because I'm curious why you wouldn't just open a lower limit SSL and then invest the rest of the money elsewhere?

@Horseshoez Usually the higher the amount the longer the terms. Especially if its for a SSL. You not going to get 3 yrs on $500. $3000 yes depending on which CU is used. Thats why you see the over $3000 for NFCU. $3050 get you the longer terms. Least when I had mine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building from 532

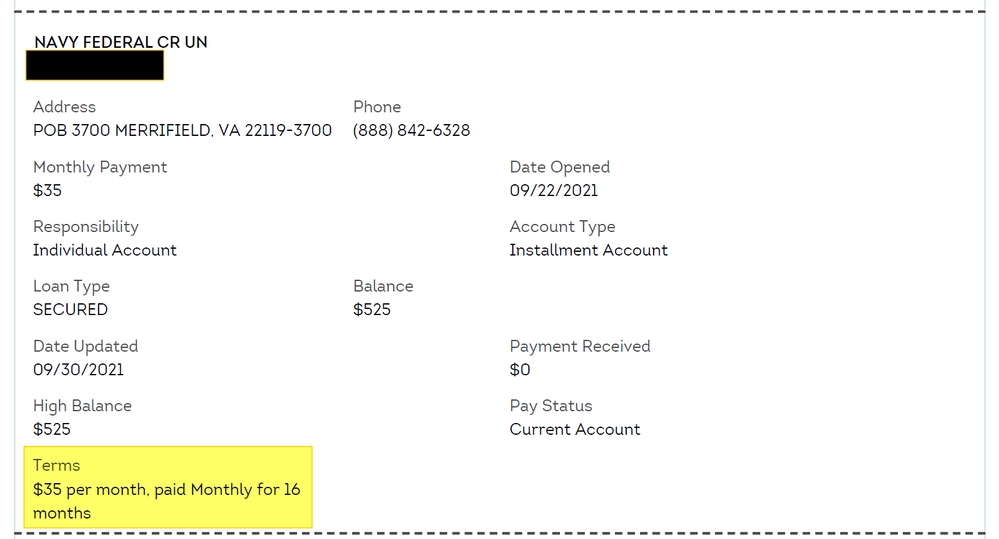

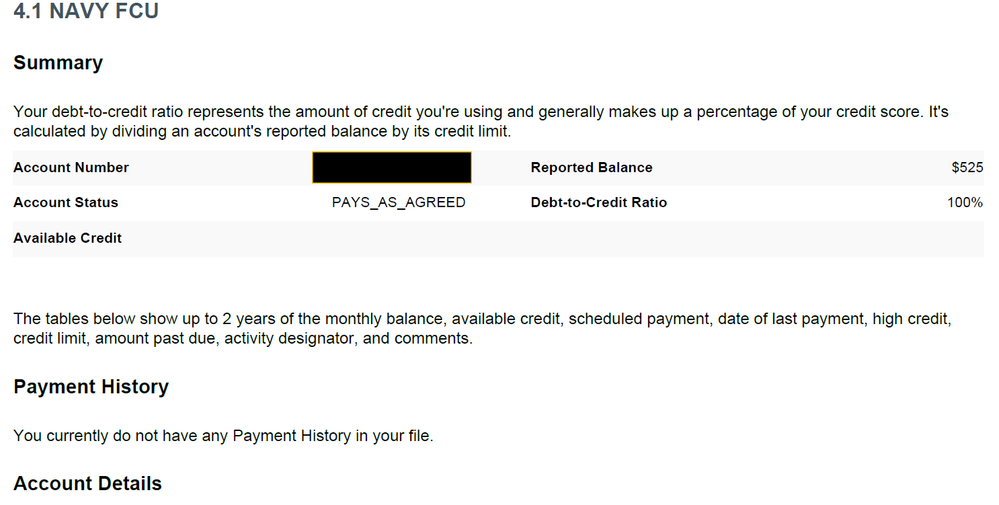

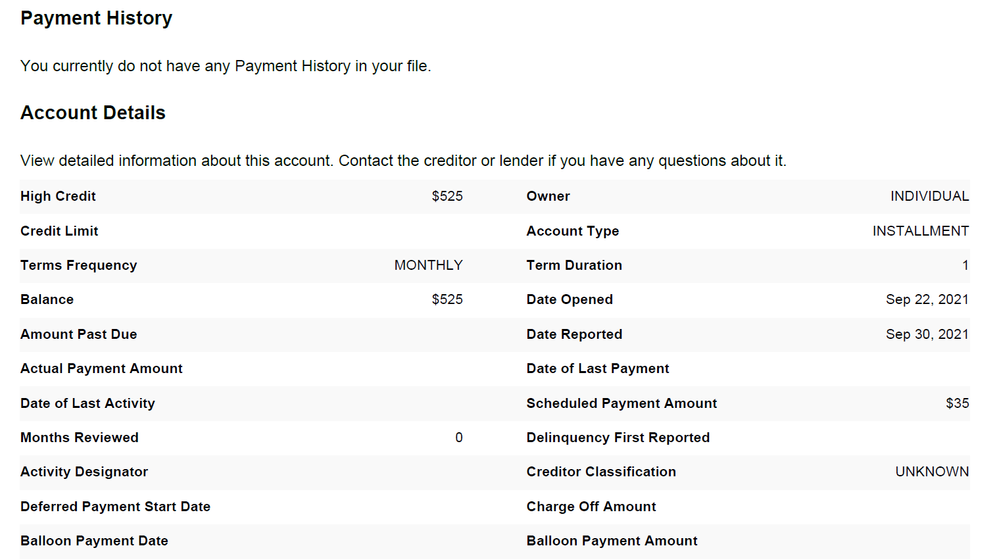

Correct. I just opened up an SSL with NFCU and have these data points for everyone out there....

1. If you get an NFCU SSL for $250 - $500, then the loan terms will be for 6 months to 11 months. You get to pick.

2. If you get an NFCU SSL for $501 - $1,000, then the loan terms will be for 12 months to 17 months (again, you get to pick).

3. If you get an NFCU SSL for $1,001 - $3,000, then the loan terms will be for 18 months to 35 months (again, you get to pick).

4. If you get an NFCU SSL for $3,001 to whatever (I did not ask for details above $3,000 when I did this....)

Mine is for $525 and I picked 15 months.

Now, keep in mind that NFCU is going to tack on and report +1 for the months (loan terms). So, to be clear, NFCU reports my SSL (which just reported to the CRAs) as a $525 Installment Loan for 16 months.

For those interested, here are the Transunion and Equifax screen shots...

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge