- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Adverse Account Info on TU Report. Help Me Und...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Adverse Account Info on TU Report. Help Me Understand this please.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adverse Account Info on TU Report. Help Me Understand this please.

Hello All --

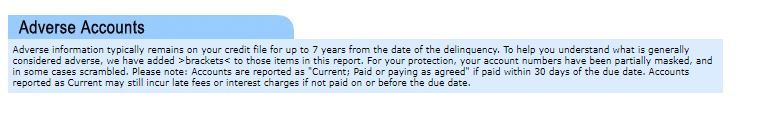

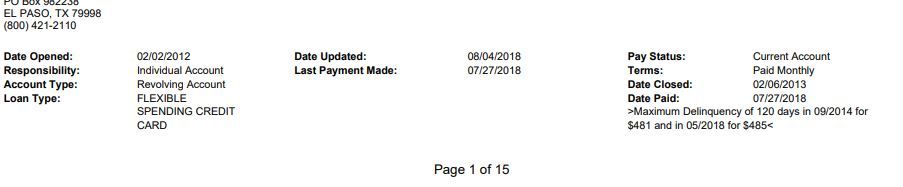

Could you please help me understand what the below section on my TU Report actually mean.

Based on the above, Lets say I have a CC and here are the negative details

- Opened 2/2012

- >Maximum Delinquency of 120 days in 09/2014 for

$481 and in 05/2018 for $485< - Date Account closed by Grantor 2/2013

- No Activity Until 6/2016

- Started small payments starting 7/2016

- Finally paid off everything and caught up by 8/2018

Now My Question is, Here is what i have been struggling to understand for the last one week. This account doesn't say "Charged Off". No remarks. No On report Until date too. Based on above Description under the Adverse accounts section. Would this Entire ACCOUNT fall off 7 years from the DoFD or its just the late payment remark alone that will fall off 7 Years after ? and i have to wait for each late payment to age 7 years for them to completely fall off?

Below are more details. I'm really sorry if i'm repeating my question around this account. However, i'm learning the nitty gritty details everyday as i read more and more. Again. Thank you Very much for all your help.

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Account Info on TU Report. Help Me Understand this please.

Here is a reprint of how Experian handles your issue, as included in their web page:

_______________________

When Does the 7 Year Rule Begin For Delinquent Accounts?

June 13, 2017

Dear Experian,

I had a 30-day late payment in April 2011 and one 90 days late in September of 2011. When would the seven-year rule start? April or September?

– BAJ

____________________________________

Dear BAJ,

Late payments remain on the credit report for seven years. The seven-year period is based on when the delinquency occurred. Whether the entire account will be deleted is determined by whether you brought the account current after the missed payment. If the account was brought current, the late payments that have reached seven years old will be removed, but the rest of the account history will remain.

If you had a single late payment in April of 2011, that late payment will fall off by April of 2018. If the account was brought current between April and September of 2011 and then the second series of late payments occurred, those late payments would be removed seven years from the first missed payment in that series.

How to Calculate When Late Payments Will Be Deleted

Late payments, called delinquencies, are deleted seven years from the original delinquency date of the debt after which it was never again current.

That means that if you have 30-day late payment reported and then bring the account current the next month, the late payment will fall off seven years from when it was reported.

If you miss three payments in a row, your account would be reported 90 days late. The seven-year period would begin with the first payment you missed in that series. All three payments would be deleted seven years from that date. The date is called the “original delinquency date,” or sometimes the “date of first delinquency.”

If you have a late payment and never bring the account current, it will eventually be written off as a loss. The debt then could be sold or transferred to a collection agency. In this case, the entire account will be removed seven years from that original delinquency date, along with the subsequent collection account.

You didn’t indicate whether the 90-day delinquency began with a first missed payment in September of 2011, or a couple of months earlier in July. If the account became 30 days delinquent in July, then 60 days delinquent in August, and 90 days delinquent in September, that series of late payments would be removed seven years from July of 2011.

If the initial 30-day late payment was in September of 2011, that string of delinquencies would be removed by September of 2018.

Experian removes late payments automatically after seven years, so you won’t have to request they be deleted when the time comes.

What Happens to Your Account Once Delinquencies are Removed?

If your account has been current ever since, the status will change to show “never late” when the last series of late payments falls off, and the account will appear as positive. However, if the account was never brought current, then the entire account will be removed seven years from the original delinquency date.

Thanks for asking.

The “Ask Experian” team

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Account Info on TU Report. Help Me Understand this please.

Put it all aside. That 120 day late from 05/2018 will hurt the entire 7 yrs. So it comes down to whatever it says really doesnt mean much. That will will be the killer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Account Info on TU Report. Help Me Understand this please.

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Account Info on TU Report. Help Me Understand this please.

@Chestnut1 wrote:

Thank you both for taking time and detailing everything. Bummer, this account gonna stay around till 2025 since latest late being in 2018. I know BOFA won’t bend down to GWs. What would be the next course of action. Wait for each one of those lates to age out ? Or I wait (can do) for the account to fall off after 10 years (from the date of opening ?). No DoFD which was last payment made. Add 7 yrs 07/2025.

The account will turn good when the last late string hits and falls off. Last 120 day was 05/18. Go back to the first 30 day of that string. So 01/2025 will be when the account turns positive. You'll just have to wait it out just like all the other accounts you post about will have to do the same.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Account Info on TU Report. Help Me Understand this please.

@FireMedic1 wrote:

@Chestnut1 wrote:

Thank you both for taking time and detailing everything. Bummer, this account gonna stay around till 2025 since latest late being in 2018. I know BOFA won’t bend down to GWs. What would be the next course of action. Wait for each one of those lates to age out ? Or I wait (can do) for the account to fall off after 10 years (from the date of opening ?). No DoFD which was last payment made. Add 7 yrs 07/2025.The account will turn good when the last late string hits and falls off. Last 120 day was 05/18. Go back to the first 30 day of that string. So 01/2025 will be when the account turns positive. You'll just have to wait it out just like all the other accounts you post about will have to do the same.

Thank you. based on what you said, looks like waiting until 2025 on this account is certain.. Could you please help me understand that bit. I was under the impression that an account Falls off 10 Years from the Date of Opening (Closing ?). Sadly, No CRA Report has a DoFD date set for this account alone. That being said, i assumed that this account will fall off (including late payment history) in 2023 ( 10 years from the closing date )

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)