- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Advice Needed...Seriously

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Advice Needed...Seriously

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advice Needed...Seriously

Sup everybody.

I just paid my car off. i had about 3 years to go on my auto loan with Cap1 but i just couldn't fathom the thought of continuing to pay all of that interest anymore (9.87%) so i forked up the cash and paid that demon off early. i know some people say its not a good thing to do that but i'ma just have to bite the bullet on that one.

the real reason i am here today is because i have 2 medical collections on my CR. one for $1000 even and the other for $952 or something close to that. my thing is.. these are the ONLY negative things i have left on my report. the reason i didn't pay them is because i moved to another state soon after my accident and i never received the bill(s)..

what can i do to get these off my credit? i guess the obvious answer is to pay them.... but is there anything else that can be done instead lol. i already disputed but it doesn't work. i informed them that i never received a bill and still, nothing. i'm just frustrated and now i'm to the point where i don't want to pay them at all. it has to be something i can do. i'm sure i will come to my senses if paying them is the only option, but like i said right now i'm just frustrated. any advice on any steps i can take to get these off? i would very much appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice Needed...Seriously

See if you can work a PFD deal with the collection agency. You'll pay it if they delete if off your report. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice Needed...Seriously

I agree with attempting to obtain a PFD.

However, before contacting the debt collector, a few considerations should be pondered.

Does the debt collector now own the debt, how old is the debt (i.e., what is the date of your first default with the creditor), and what is the SOL on the debt for your state?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice Needed...Seriously

@Anonymous wrote:Sup everybody.

I just paid my car off. i had about 3 years to go on my auto loan with Cap1 but i just couldn't fathom the thought of continuing to pay all of that interest anymore (9.87%) so i forked up the cash and paid that demon off early. i know some people say its not a good thing to do that but i'ma just have to bite the bullet on that one.

the real reason i am here today is because i have 2 medical collections on my CR. one for $1000 even and the other for $952 or something close to that. my thing is.. these are the ONLY negative things i have left on my report. the reason i didn't pay them is because i moved to another state soon after my accident and i never received the bill(s)..

what can i do to get these off my credit? i guess the obvious answer is to pay them.... but is there anything else that can be done instead lol. i already disputed but it doesn't work. i informed them that i never received a bill and still, nothing. i'm just frustrated and now i'm to the point where i don't want to pay them at all. it has to be something i can do. i'm sure i will come to my senses if paying them is the only option, but like i said right now i'm just frustrated. any advice on any steps i can take to get these off? i would very much appreciate it.

HA, loophole number one my friend.

Until Fico09 comes into effect, where medical bills aren't scored as negatively, PFD, and research HIPPA laws.

Shameless plug of general FTC laws regarding Collection Agencies, however I am talking out of my lower sphincter because medical goes under HIPPA as well, and I don't have the link for that, apologies. BUT...here's some fun bathroom reading.

EDIT: I see you disputed and they laughed in your face while sipping on the vat of tears collected from payees, however, PFD. Don't go unarmed. Knowledge is power.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice Needed...Seriously

@RobertEG wrote:I agree with attempting to obtain a PFD.

However, before contacting the debt collector, a few considerations should be pondered.

Does the debt collector now own the debt, how old is the debt (i.e., what is the date of your first default with the creditor), and what is the SOL on the debt for your state?

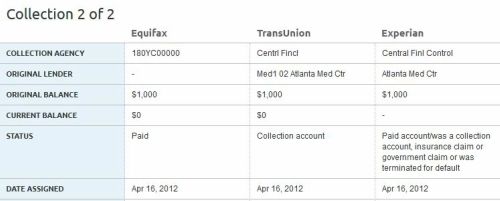

I believe the debt collector does own the debt now. the original creditor never put this on my credit report. But it still shows their name.

See below

The dispute center says that this debt will fall off 11/2018. That's a long time!

So doing a PFD is my best option?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice Needed...Seriously

Current balance is $0 - there is nothing to pay.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice Needed...Seriously

@Anonymous wrote:Current balance is $0 - there is nothing to pay.

i noticed that too. again, i never paid this. what can i do to get this removed?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice Needed...Seriously

I would call the OC and see if they have any information on it. Maybe insurance paid it late or something?