- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Best secured or unsecured credit cards to build c...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best secured or unsecured credit cards to build credit score fast

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Best secured or unsecured credit cards to build credit score fast

Also what are the advantages and disadvantage is a cloud with dates secured versus unsecured credit card if you have the option to do so yes your name purpose is to just build credit Quickly

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best secured or unsecured credit cards to build credit score fast

Well, you cant build credit quickly, because you cant speed up the time

If by quickly you mean getting as many useless cards as one can get approved for, that can be done with store cards but you wont be building credit that way. You'll end up with cards you cant use and denials for cards you could, because of excessive new accounts and inq. So, I'd let go of this notion that credit can be build quickly. It cant.

If you're asking for yourself, you will need to provide more info such as your current fico scores. If you dont know those, that's a good starting point.

You can use CCT trial, just make sure you cancel before trial period is up

Also, we'd need to know which cards you currently have, their limits and balances, when they were opened, any loans, and any negative info on your CR.

Once you have all that, we'll be able to advise you better

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best secured or unsecured credit cards to build credit score fast

If you do not have credit (positive credit) and then add accounts and maintain them in good standing you can jump start credit score bumps.

I added a NFCU Secured CC, a SSL loan, then a Discover Secured, Apple CU Secured and NFCO decided to give me a Flagship Visa... My scores rose 120-150 points (Fico 08). Now when my derogs go away in 16-18 months, I will be doing very well score wise.

Biz |

Current F08 -

Current 2,4,5 -

Current F09 -

No PG Biz Credit in Order of Approval - Uline, Quill, Grainger, SupplyWorks, MSC, Amsterdam, Citi Tractor Supply Rev .8k, NewEgg Net 30 10k, Richelieu 2k, Wurth Supply 2k, Global Ind 2k, Sam's Club Store 11.k, Shell Fleet 19.5k, Citi Exxon 2.5k, Dell Biz Revolving $15k, B&H Photo, $5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best secured or unsecured credit cards to build credit score fast

IHMO, Discover It Secured is one of the best-secured credit cards for no or limited credit, poor credit, and bad credit applicants — and one of the best gas credit cards you can get with bad credit. Disco offers 2% cash back at restaurants and gas stations (one up to $1,000 in combined purchases each quarter) and 1% cash back on other purchases. You’ll need an up-front security deposit of at least $200 to apply for the Discover It Secured Card.

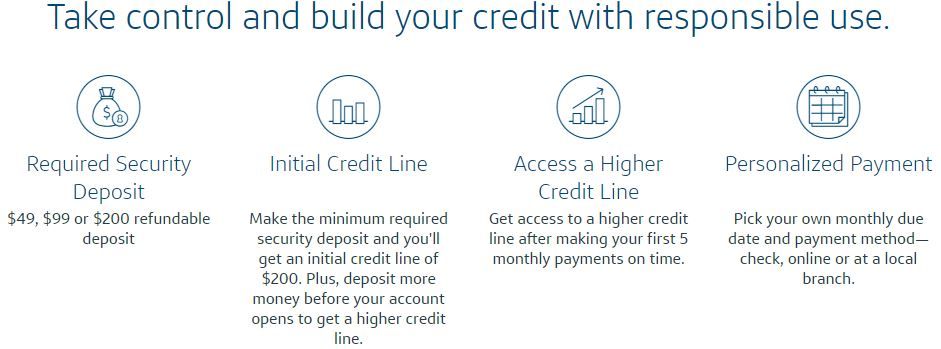

Capital One Secured Mastercard requires a refundable security deposit of $49, $99 or $200 based on your creditworthiness. Make the minimum required security deposit and you'll get an initial credit line of $200. Plus, deposit more money before your account opens to get a higher credit line. Get access to a higher credit line after making your first 5 monthly payments on time.

The Citi Diamond Secured Mastercard can help you establish, improve or rebuild your credit. Build your credit history by using your card responsibly. Best of all, there's no annual fee. Applicants must meet Citi Bank's credit qualification criteria for this card, which includes a review of your income and your debt. If approved, a minimum of $200 security deposit is required. The security deposit is always equal to your credit limit and will be held for an initial term of up to 18 months. You must not have any bankruptcy history within the last two years.

Bank of America's BankAmericard Secured Credit Card is designed to help establish, strengthen or rebuild credit for an annual fee of $39. A minimum refundable security deposit of $300 is required to open this account. Your maximum credit limit will be determined by the amount of the security deposit you provide, your income and your ability to pay the credit line established. If you provide a deposit that exceeds the calculated maximum amount based on your ability to pay, a will be returned to you for the difference. BoA periodically reviews your account and, based on your overall credit history (including your account with BoA and other credit cards and loans), you may qualify to have your security deposit returned. Not all cardholders will qualify.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best secured or unsecured credit cards to build credit score fast

@Medic981 wrote:IHMO, Discover It Secured is one of the best-secured credit cards for no or limited credit, poor credit, and bad credit applicants — and one of the best gas credit cards you can get with bad credit. Disco offers 2% cash back at restaurants and gas stations (one up to $1,000 in combined purchases each quarter) and 1% cash back on other purchases. You’ll need an up-front security deposit of at least $200 to apply for the Discover It Secured Card.

Capital One Secured Mastercard requires a refundable security deposit of $49, $99 or $200 based on your creditworthiness. Make the minimum required security deposit and you'll get an initial credit line of $200. Plus, deposit more money before your account opens to get a higher credit line. Get access to a higher credit line after making your first 5 monthly payments on time.

The Citi Diamond Secured Mastercard can help you establish, improve or rebuild your credit. Build your credit history by using your card responsibly. Best of all, there's no annual fee. Applicants must meet Citi Bank's credit qualification criteria for this card, which includes a review of your income and your debt. If approved, a minimum of $200 security deposit is required. The security deposit is always equal to your credit limit and will be held for an initial term of up to 18 months. You must not have any bankruptcy history within the last two years.

Bank of America's BankAmericard Secured Credit Card is designed to help establish, strengthen or rebuild credit for an annual fee of $39. A minimum refundable security deposit of $300 is required to open this account. Your maximum credit limit will be determined by the amount of the security deposit you provide, your income and your ability to pay the credit line established. If you provide a deposit that exceeds the calculated maximum amount based on your ability to pay, a will be returned to you for the difference. BoA periodically reviews your account and, based on your overall credit history (including your account with BoA and other credit cards and loans), you may qualify to have your security deposit returned. Not all cardholders will qualify.

Cap1 doesnt graduate anymore for now @Medic981

They can fall into the secured for life catagory

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best secured or unsecured credit cards to build credit score fast

@FireMedic1 wrote:

@Medic981 wrote:IHMO, Discover It Secured is one of the best-secured credit cards for no or limited credit, poor credit, and bad credit applicants — and one of the best gas credit cards you can get with bad credit. Disco offers 2% cash back at restaurants and gas stations (one up to $1,000 in combined purchases each quarter) and 1% cash back on other purchases. You’ll need an up-front security deposit of at least $200 to apply for the Discover It Secured Card.

Capital One Secured Mastercard requires a refundable security deposit of $49, $99 or $200 based on your creditworthiness. Make the minimum required security deposit and you'll get an initial credit line of $200. Plus, deposit more money before your account opens to get a higher credit line. Get access to a higher credit line after making your first 5 monthly payments on time.

The Citi Diamond Secured Mastercard can help you establish, improve or rebuild your credit. Build your credit history by using your card responsibly. Best of all, there's no annual fee. Applicants must meet Citi Bank's credit qualification criteria for this card, which includes a review of your income and your debt. If approved, a minimum of $200 security deposit is required. The security deposit is always equal to your credit limit and will be held for an initial term of up to 18 months. You must not have any bankruptcy history within the last two years.

Bank of America's BankAmericard Secured Credit Card is designed to help establish, strengthen or rebuild credit for an annual fee of $39. A minimum refundable security deposit of $300 is required to open this account. Your maximum credit limit will be determined by the amount of the security deposit you provide, your income and your ability to pay the credit line established. If you provide a deposit that exceeds the calculated maximum amount based on your ability to pay, a will be returned to you for the difference. BoA periodically reviews your account and, based on your overall credit history (including your account with BoA and other credit cards and loans), you may qualify to have your security deposit returned. Not all cardholders will qualify.Cap1 doesnt graduate anymore for now @Medic981

They can fall into the secured for life catagory

Thanks, I did not know this. I will update my macro.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best secured or unsecured credit cards to build credit score fast

@FireMedic1 wrote:

@Medic981 wrote:Capital One Secured Mastercard requires a refundable security deposit of $49, $99 or $200 based on your creditworthiness. Make the minimum required security deposit and you'll get an initial credit line of $200. Plus, deposit more money before your account opens to get a higher credit line. Get access to a higher credit line after making your first 5 monthly payments on time.

Cap1 doesnt graduate anymore for now @Medic981

They can fall into the secured for life catagory

I am not sure where you are getting your information but Captial One Secured Mastercard, according to Captial One's website, is still graduating.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best secured or unsecured credit cards to build credit score fast

@Medic981 wrote:

@FireMedic1 wrote:

@Medic981 wrote:Capital One Secured Mastercard requires a refundable security deposit of $49, $99 or $200 based on your creditworthiness. Make the minimum required security deposit and you'll get an initial credit line of $200. Plus, deposit more money before your account opens to get a higher credit line. Get access to a higher credit line after making your first 5 monthly payments on time.

Cap1 doesnt graduate anymore for now @Medic981

They can fall into the secured for life catagory

I am not sure where you are getting your information but Captial One Secured Mastercard, according to Captial One's website, is still graduating.

A number of users have reported Cap1 telling them they no longer graduate.

I didn't see anything about graduation on that site - just that you get your security deposit back when you close and pay off your account.

(I did not watch the video, just went through the links)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best secured or unsecured credit cards to build credit score fast

@calyx wrote:

@Medic981 wrote:

@FireMedic1 wrote:

@Medic981 wrote:Capital One Secured Mastercard requires a refundable security deposit of $49, $99 or $200 based on your creditworthiness. Make the minimum required security deposit and you'll get an initial credit line of $200. Plus, deposit more money before your account opens to get a higher credit line. Get access to a higher credit line after making your first 5 monthly payments on time.

Cap1 doesnt graduate anymore for now @Medic981

They can fall into the secured for life catagory

I am not sure where you are getting your information but Captial One Secured Mastercard, according to Captial One's website, is still graduating.

A number of users have reported Cap1 telling them they no longer graduate.

I didn't see anything about graduation on that site - just that you get your security deposit back when you close and pay off your account.

(I did not watch the video, just went through the links)Sounds like false advertising to me. Captial One needs to update their f*****g website then.

ETA: I just watched the video and you are correct. You will not get your deposit back until you close your account. It does state you will get access to higher credit line after making your first 5 monthly payments on time. It is not clear if you will have to secure that additional credit limit with an additional depost.

Leave it to Capital One to be ambiguous!

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best secured or unsecured credit cards to build credit score fast

It doesnt report as secured. You can still get a CLI. It changed while you were gone for a few months @Medic981