- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Building Credit for a refinance.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Building Credit for a refinance.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Building Credit for a refinance.

I bought a house 8 months ago i have an intrest rate of 4.65 the loan was for 650K i put down 25 percent my credit score for the morgage was 680 at the time. and fico 8 was 740-770

After i bought the house i made a lot of new credit cards to finance repairs and credit went tanking my fico 8 dropped to 580-600 and my mortgage score dropped to 630

I slowley started paying back and now i am down to $18,000 debt with a $33,000 limit now my credit went up 640-655 but mortgage score did not budge

I added my self to my hubbys credit card amax where he has a credit line of $12,000 to get myself better credit utilization

want to know what more i can do maybe i was thinking of taking out an installment loan to get my credit up like by avant

any advice would be great

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit for a refinance.

If you already have a mortgage loan reporting, then you don't need another installment loan to boost your scores. Are there any other baddies on your report apart from the CC debt?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit for a refinance.

Does adding myself to my Hubby's CC Help my credit utilization?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit for a refinance.

@Anonymous wrote:

Not really I have 2 missed payments from 2 years ago but have a short credit history. Of 5 years.

Does adding myself to my Hubby's CC Help my credit utilization?

Yes, it does help your utilization. The missed payments play a big part as to why your scores are down. If you don't mind, can you list the credits cards, their limits and how much you owe on each?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit for a refinance.

Chase $1800- $4,800

Us bank $2,989. $5000

Amax $3497. $6000

Discover $1900. $4500

Boa 0. $2500

Now I added an amax from hubby thats 12000 limit and using $1000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit for a refinance.

@Anonymous wrote:

BOA $6,000- $7,000 LIMIT

Chase $1800- $4,800

Us bank $2,989. $5000

Amax $3497. $6000

Discover $1900. $4500

Boa 0. $2500

Now I added an amax from hubby thats 12000 limit and using $1000

Ok.. To see significant increase in your profile and I know you said you are paying them off slowly, the utilization on these cards have to be reduced drastically... The BOA card for example has utilization between 85% - 86% of the limit.

Since the only baddie on your report is the late payment that is two years old, pay down the balances and you will see a significant boost in scores. Although, you added your husbands account, that only has an impact on your overall utilization--

Individually, it doesn't help. So pay down these cards as fast as you can instead of slowly to accomplish your goal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit for a refinance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit for a refinance.

@Anonymous wrote:

How much of a diffrece on my credit report does it make total utilization vs individual card utilization ?

Very good questions so far. Without seeing your report and knowing what is actually in there, it will be hard to tell how much of a difference it will be when it comes to total utilization vs. individual utilization.

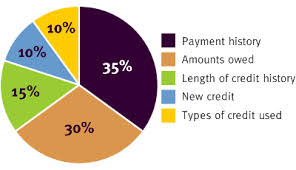

Here is how your scores are calculated incase you are not familiar with the pie chart already...

The amounts owed makes up 30% of your file.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit for a refinance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Building Credit for a refinance.

Was your intent in considering an installment loan to use all of the loan to pay down your higher interest credit cards, thus keeping your overall debt the same, but reducing your revolving % util, and saving $$ on interest? That is how I interpreted the original post.......