- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Chase Disney Card - A new personal record!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CREDIT REBUILD PROJECT LOG

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

More Button Love from Cap1

I still don't know why there is so much hate for Capital One. They just gave me yet another soft pull increase on my World Card, taking it from 14,000 to 16,500, making that my highest limit yet by a margin of 50% over Chase. They still consistently bump me every six months on request.

This from a card that started as a "Platinum Rebuilder."

My other card, formerly a 300 dollar Orchard Bank secured, is up over 5 grand.

If you're not product changing out of their rebuilder line when your scores improve, you're missing out. They really are two companies; one for rebuilders with limit caps, and another for top tier customers. There is even a different set of customer service reps.

When you get over 700, and your file looks good, you had better be converting these cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Suddenly, a random CLI Spree occurs...

My report is chock full of inquiries. Well, maybe not full, but it's getting there. I did a refi, which resulted in a single hit on all three by penfed. Then later I prequalified, and then initiated a mortgage through Wells Fargo, resulting in multiple inquiries for generation of various pre-qual letters as I shopped for a house. Interestingly enough, now that my report is free of major derogs, the scoring algorithm barely twitched.

In other words, jamming in all of those inquiries took me from mid 800 to low 800. I can live with that.

Then, as mentioned, I got the usual soft CLI from Capital One, and started thinking... All of my other cards are stuck at the limits they have had for years, because I never want to take the hit of a hard pull. So, what better time to bite the bullet and accept a hard inquiry than right now, while I am waiting for some to age off? So I hit the love button on USAA. It's there, but sort of hard to find under "other services." I got a nice instant bump on my $6,000 card, up to $14,000. Thanks USAA!

I can't seem to find a luv button for Chase. I'm not going to call them; what is this, the olden days? So I sent a "secure message" to their "secure message system" politely asking for a CLI. I know I'm going to get the hard pull, but I might as well do it now. When will there be a better time?

So far Cap1 still holds the highest limit for me. Let's see if Chase can top it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Suddenly, a random CLI Spree occurs...

p- wrote: I can't seem to find a luv button for Chase. I'm not going to call them; what is this, the olden days? So I sent a "secure message" to their "secure message system" politely asking for a CLI. I know I'm going to get the hard pull, but I might as well do it now. When will there be a better time?

So far Cap1 still holds the highest limit for me. Let's see if Chase can top it!

Ah, the modern era sure is convenient. Literally as I typed the previous message, I received a note from Chase warning me of the dreaded hard pull, and asking for my income, mortgage amount, and requested new credit line. I asked for a bump from 10k to 25k. Why not?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Suddenly, a random CLI Spree occurs...

Thank you for providing the information we requested to

process a credit line increase.

We have received your request for a credit line increase

on the account ending in ****. You can expect a decision

in 7 to 10 business days. The reference number for your

request is ****************. If you need information about

your request before that time, please call the number

shown below.

We appreciate your patience in this matter. If you need

any other assistance, you can send us a secure message.

Thank you,

^ Not a good sign. I'm going to be really miffed if they deny the CLI after I accepted a hard pull. I might even have to call a recon rep. I have a score in the 800's and a perfect history. I have had the card for four years, and no CLI since 2012. I mean, c'mon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The hard pull was worth it!

@p- wrote:

You can expect a decision

in 7 to 10 business days.^ Not a good sign.

I have yet to receive my 7-10 day letter after allowing Chase to hard pull me for a CLI... But I logged in today to find that they had DOUBLED my CL from 10k to 20k!

Okay, Chase wins, and now holds the title of highest limit among my cards. For those of you doing the same things I recently did, take note. The strategy of selecting a few good cards and growing them over time has paid off. At this point I have far more available credit than I am anywhere near comfortable using, which means my utilization calcs will always be tight. I have to spend over 6k to even top ten percent utilization.

Thank you Chase, and thank you forum members for helping me limp along to this point. The 800 club is worth the effort.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital one wants to be used, but will give up button love

I have a bit of nostalgia for my first real credit card. It started out as an Orchard Bank card, with an exploitative setup fee and annual fee and only a 300 dollar limit. But as time went on, they raised it bit by bit with soft pulls every six months. And eventually removed the fee.

After Capital One acquired the line, I was still able to get a soft pull increase every six months like clockwork.

Last month, I hit the love button or a CLI and was denied. Not for credit, but because "recent use of this credit line has been too low." So I ran all of my expenses through it for a month and tried again.

I am happy to report that my credit line was instantly raised from 5,200 to 8,200. This represents my largest increase on that line to date, and makes this card have a limit over 27 times the original when I first got it.

I considered closing this card several times when I got my first Amex, or my Chase.... but hung onto it. The funny thing is, had I closed it back then, my oldest revolver would be a subprime low limit card. But because the bank information was overwritten, it looks like I have been a premium Cap1 customer all along. I know that doesn't do much for the score, but it has to look good in the manual review.

Sadly, it is still my lowest limit card, excluding Authorized User accounts. My hope is to one day turn this into a 20k World Mastercard, just because the concept is amusing.

Happy Apping!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one wants to be used, but will give up button love

Thank you for sharing, your story is inspirational. As someone who started rebuilding in January of this year, I have a long way to go, but it's nice to see that there's light at the end of the tunnel.

Btw, kudos for keeping up your log all this time. I felt like giving my log up because no one was answering my questions or responding, then I realized that I was doing it more to keep MYSELF in check, and to track MY OWN progress... so I started asking my questions in new threads and now just use my rebuilding log to share my story, as you did here. Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital one wants to be used, but will give up button love

trnl2016 wrote: Wow, incredible journey!! I didn't read all 40 pages, lol, but I got the gist.

Thank you for sharing, your story is inspirational. As someone who started rebuilding in January of this year, I have a long way to go, but it's nice to see that there's light at the end of the tunnel.

Btw, kudos for keeping up your log all this time. I felt like giving my log up because no one was answering my questions or responding, then I realized that I was doing it more to keep MYSELF in check, and to track MY OWN progress... so I started asking my questions in new threads and now just use my rebuilding log to share my story, as you did here. Thanks again!

Thanks, Trnl. The people here really helped me out a lot. It mostly feels like I'm talking to myself in this log, but every once in a while somebody pops up and comments.

Once in a while I'll page through it myself just to remember how much things have changed.

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

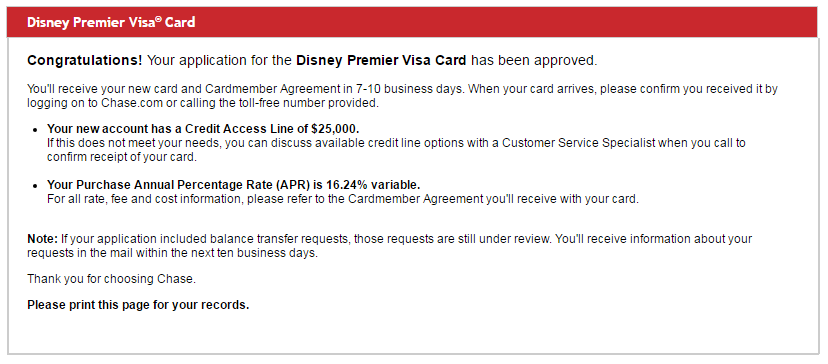

Chase Disney Card - A new personal record!

Wifey and I are taking the kids to socal for a Disney trip this summer, so I thought it might be nice to have a Chase Disney Premier Visa to get some discounts and special access.

Instant approval, 25k, my highest limit to date. And a note to let them know if the credit line doesn't meet my needs, lol.

To think just a few years ago I barely qualified for a 300 dollar card. Yay for FicoForum and the 800 club!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Disney Card - A new personal record!

@p- wrote:Wifey and I are taking the kids to socal for a Disney trip this summer, so I thought it might be nice to have a Chase Disney Premier Visa to get some discounts and special access.

Instant approval, 25k, my highest limit to date. And a note to let them know if the credit line doesn't meet my needs, lol.

To think just a few years ago I barely qualified for a 300 dollar card. Yay for FicoForum and the 800 club!

So jelly, I love this card!

Starting scores 600-640 (2013), current 765-775 (2019); It is possible!