- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Can anything be done about this short sale on my r...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Can anything be done about this short sale on my report at this point in time?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can anything be done about this short sale on my report at this point in time?

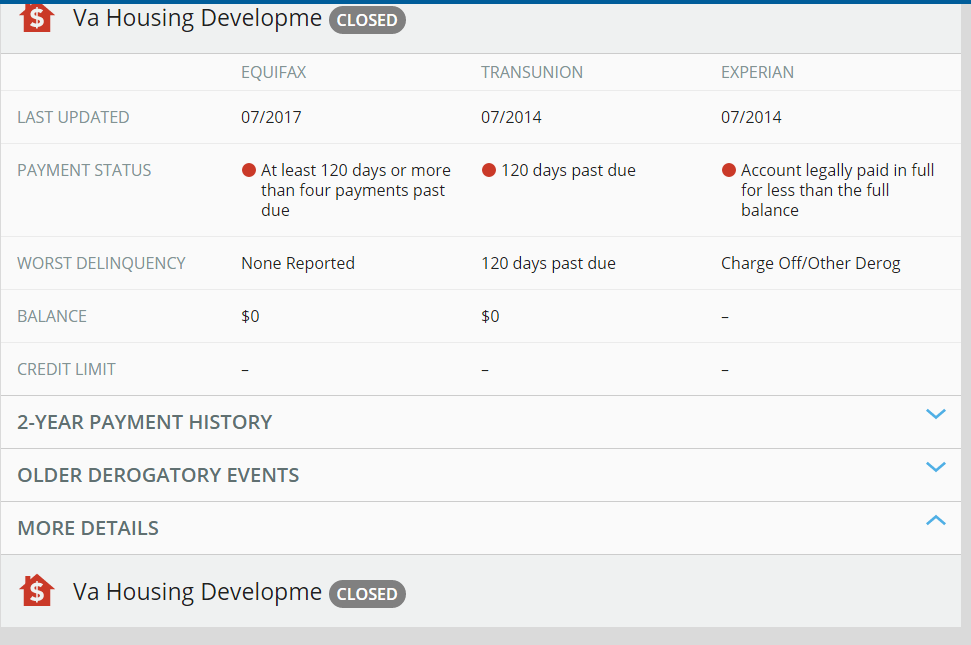

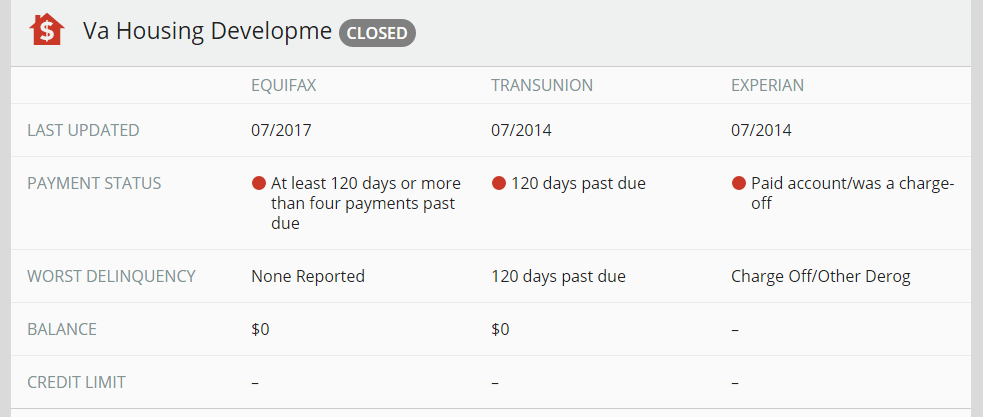

Back in July 2014, I got behind on my mortgage mostly in part to medical issues. Anyway, we ended up doing a short sale and both the mortgage loan and secondary loan went to my CR as a short sale, paid in full for less than balance owed.

It's been 4 years and even though my scores are currently at EQ-705 | TU-696 | EX-699, I wonder if anything can be done with these 2 items or should I just ride it out as nothing can be done.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anything be done about this short sale on my report at this point in time?

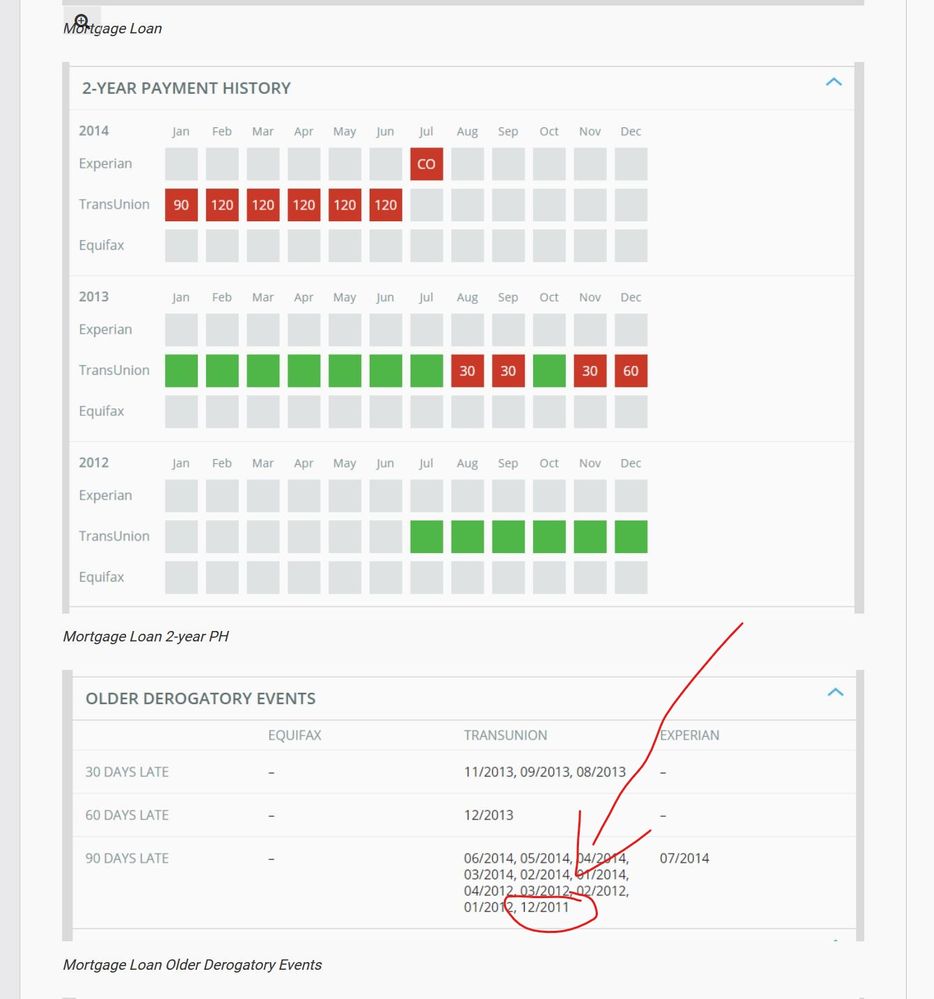

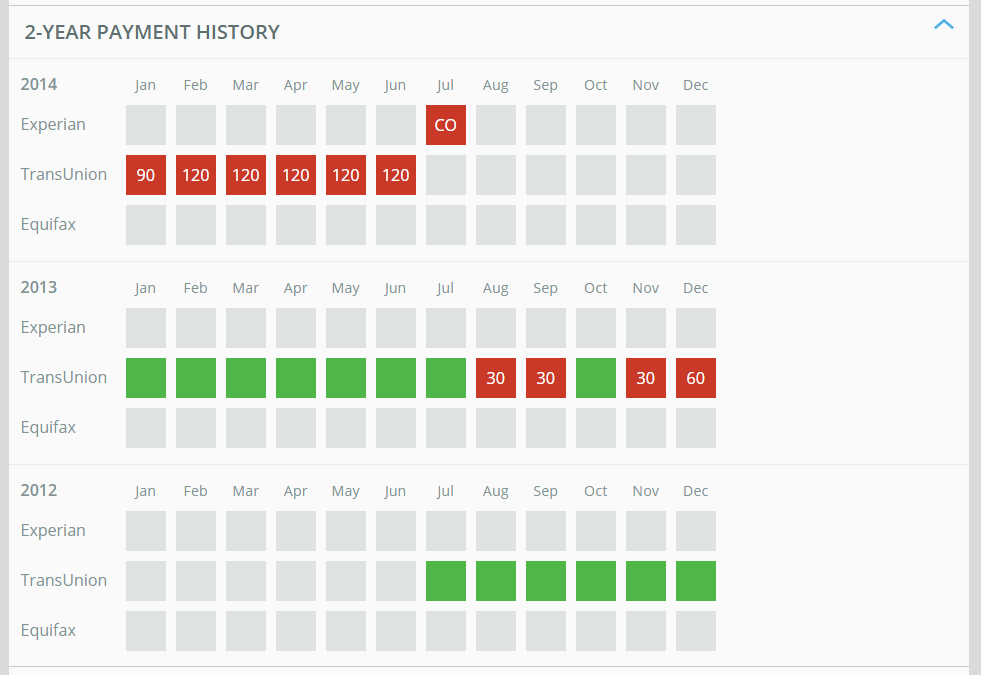

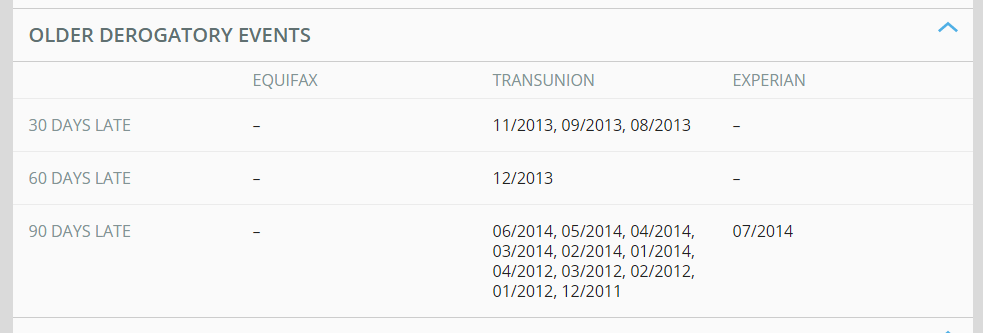

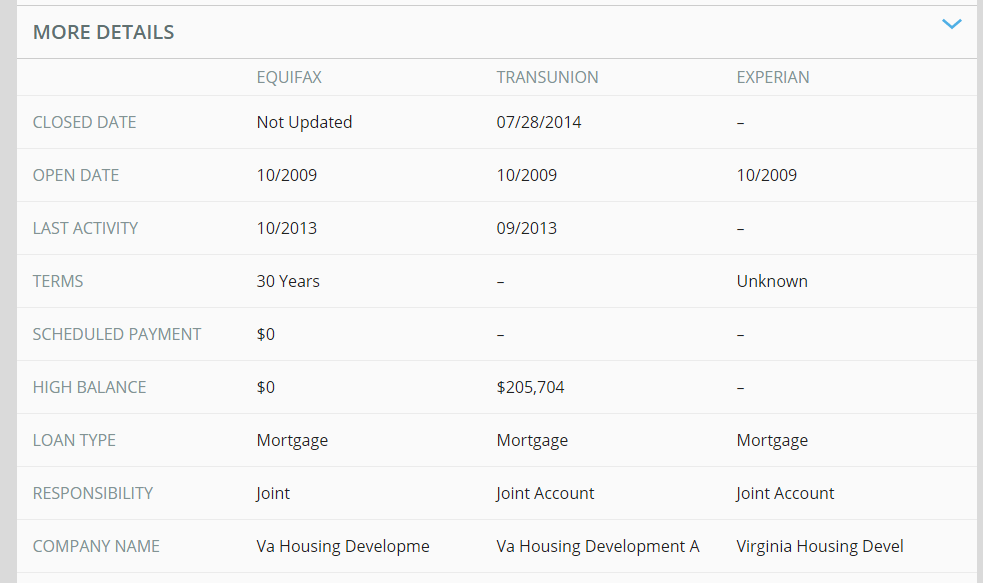

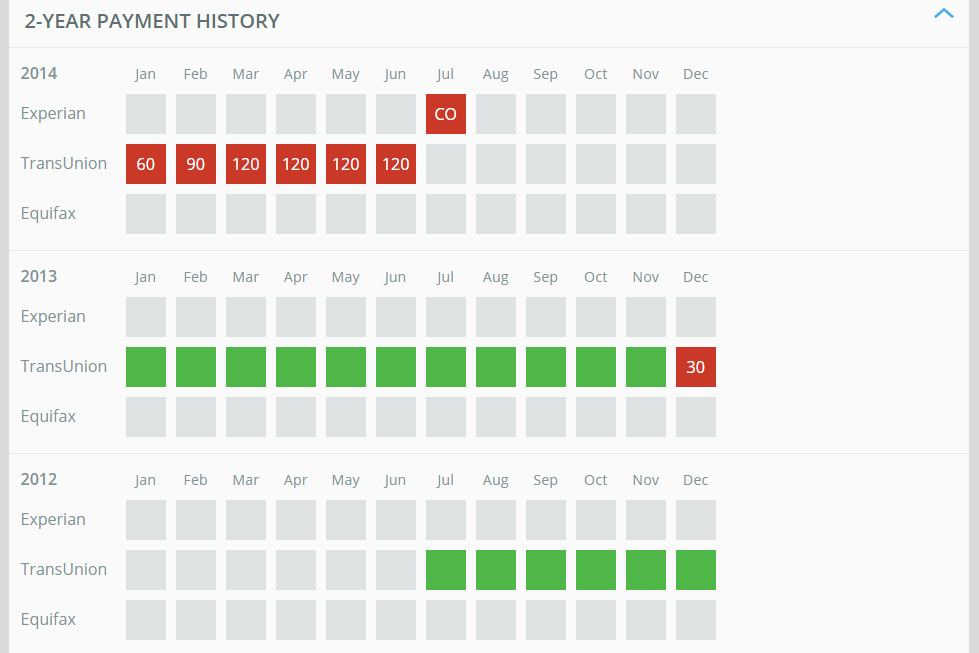

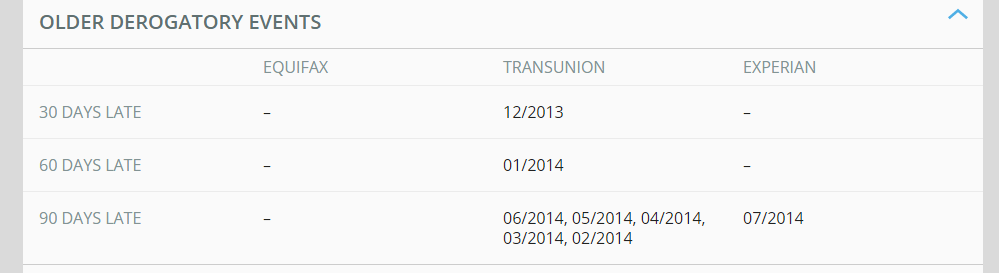

The first trust loan was reported as 30-late in Aug, 2013, implying a date of first delinquency of July, 2013, and the second trust loan was reported as 30-late in Dec, 2013, implying a date of initial delinquency on that debt of Nov, 2013.

The reporting of CO and of its equivalent short sale loss status must become excluded no later than 7 years plus 180 days from the reported DOFD. The exact DOFD was required to have been separately reported to the CRA once the OC status was reported, so the exact DOFD will be of record in your credit file, and should be viewable at annualcreditreport.com.

The CRAs will normally exclude a CO or its equivalent once 7 years has expired from the reported DOFD, so the payment history derogs should become excluded after Jul 2020 for the first trust, and after Nov 2020 for the second trust.

If you seek removal of the prior derogs or of the entire account(s) prior to their normal CRA exclusion dates, you can always make a good-will deletion request to the creditor. Reporting of deletion on their part is purely voluntary/discretionary, but if you have compelling reasons, they may show some mercy and grant a good-will deletion.

A call to someone in their exec offices may find a sympathetic ear.

Many furnishers have a standard practice imposed on their employees that they not grant deletion of accurate reporting, so it is often necessary to direct your GW request to a managment official who has authority to grant exceptions to their normal non-deletion policy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anything be done about this short sale on my report at this point in time?

@RobertEG

Thanks for the thorough and VERY informative reply. Sort of put things into perspective for me. I do have a couple of questions just to make sure I am understanding correctly.

You said that the potential DOFD on the main mortgage loan seems to be July 2013, but I was looking at the image and on that loan, the first delinquency is showing as 12/2011. Why wouldn't this be the DOFD instead of July 2013?

As far as the GW letter, I have always been afraid of poking the bear, because I've read that if they make any updates to the CRA and not remove it, it will reset the "7 years" timeframe! I don't know if there is any truth to this, thus why I have always been afraid of even contacting them for anything related to getting this removed from my CR. If this is not the case, then I will definitely contact them!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anything be done about this short sale on my report at this point in time?

The Oct 2013 box shows green.

That could mean two things.... either you did, in fact, pay the deliquency back into good-standing that month, or they simply made no reporting that month, and the vendor of your report inserted a green box. If you did pay the account back into good-standing,then yes, the new date of first delinquency would be when the account again became delinquent.

I guessed at the DOFD using the payment history, but that is not always definitive.

For that very reason, FCRA 623(a)(5) explicitly requires the separate reporting of the DOFD to the CRA, and the CRA uses that reported DOFD rather than inferring the DOFD from the payment history profile.

There is absolutely no truth to the wive's tale that credit report exclusion is extended by any action, such as payment on the debt.

FCRA 605(c) clearly establishes that it is the DOFD, and the DOFD alone, that sets the date of running of the credit report exclusion period for either a collection or charge-off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anything be done about this short sale on my report at this point in time?

Also, do you have a link to a nice GW letter that could apply to me for medical issues?

BTW, both of your responses have been OUTSTANDING! I really appreciate your help and guidance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anything be done about this short sale on my report at this point in time?

@RobertEG wrote:The Oct 2013 box shows green.

That could mean two things.... either you did, in fact, pay the deliquency back into good-standing that month, or they simply made no reporting that month, and the vendor of your report inserted a green box. If you did pay the account back into good-standing,then yes, the new date of first delinquency would be when the account again became delinquent.

I guessed at the DOFD using the payment history, but that is not always definitive.

For that very reason, FCRA 623(a)(5) explicitly requires the separate reporting of the DOFD to the CRA, and the CRA uses that reported DOFD rather than inferring the DOFD from the payment history profile.

There is absolutely no truth to the wive's tale that credit report exclusion is extended by any action, such as payment on the debt.

FCRA 605(c) clearly establishes that it is the DOFD, and the DOFD alone, that sets the date of running of the credit report exclusion period for either a collection or charge-off.

Quick update...

I went ahead and pulled my 3 CRs from annualcreditreport and Equifax has the DOFDs as OCT 01, 2013 and NOV 01, 2013... You were correct! I guess BOTH will drop off my credit report by December 2020?

I guess it doesn't hurt to send a GW letter and hope they remove them before 12/2020!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anything be done about this short sale on my report at this point in time?

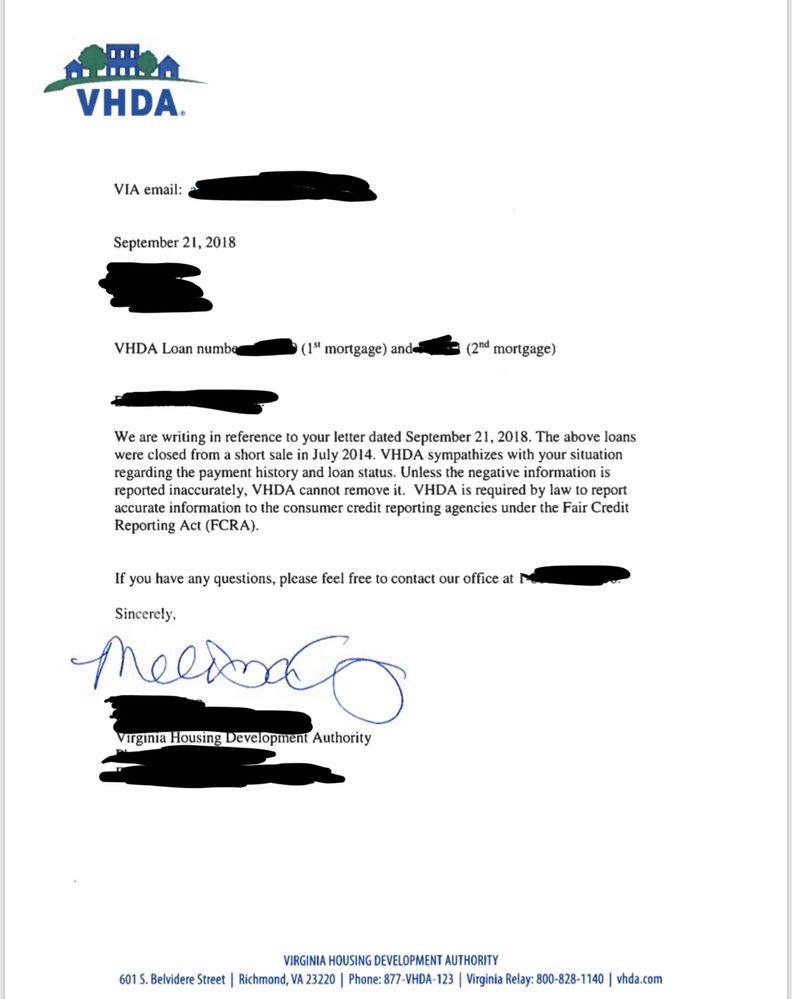

Ok guys, I went the email route directly with VHDA’s Default Reporting Department and this is the response I got from them:

What should be my next course of action? At least I got a response to my GW letter.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anything be done about this short sale on my report at this point in time?

TIA!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anything be done about this short sale on my report at this point in time?

Good luck!

Scores - All bureaus 770 +

TCL - Est. $410K