- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Can having a baddie fall off hurt more than it hel...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Can having a baddie fall off hurt more than it helps?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can having a baddie fall off hurt more than it helps?

I know that this is probably going to sound strange but I am trying to figure out if having the last baddie come off my TransUnion report could actually hurt me more than it helps me. At the moment my FICO 8 Transunion score is 778, when I look at the factors of the score through My FICO the only thing that it says is hurting me is not having established a long revolving and/or open-ended account history. (First open-ended account is 4 years 8 months)

My oldest account is 13 years 8 months with the AAOA is 2 years 5 months. The baddie is a Charge off auto loan, it doesn't show any late payments just a charge off. This is the oldest account being 13 years and 8 months. The next oldest account is 4 years and 8 months. It shows that this account was closed 4/29/2018. What is strange that when I look any of the FICO 9 Transunion scores they are much lower and when I look at the factors they all say "Serious delinquency account" "recently missed a payment", "one or more accounts showing missed payments or derogatory indicators". I don't understand how it is only showing up only on the FICO 9 scores and not any of the other scores. Can anyone explain to me how it can show up on the FICO 9 scores but not the others? And if and when this account comes off will it ended up hurting me more because of the age of my accounts more than it helps me?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can having a baddie fall off hurt more than it helps?

Please add some paragraph breaks. Confusing all bunched up.

Tx. Get more responces

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can having a baddie fall off hurt more than it helps?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can having a baddie fall off hurt more than it helps?

Your age of oldest acount will drop off and lose some points when the account falls off. But the good news is your baddie will be gone. And you'll have a clean file again. My TU below is lower due to 9yrs difference in oldest accounts. 22/21yrs on EQ and EX, compared to 13 years on TU.

FICO 8 & 9 look at things differently.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can having a baddie fall off hurt more than it helps?

A reported charge-off is equivalent to the reporting of a delinquency, in that it is an alternate way of expressing that the account was delinquent. An account must be delinquent in order to be charged to profit and loss, and the time since initial delinquency, while not specifically included in the CO reporting (e.g., 150-late) is nonetheless specified by the separate reporting of the DOFD, which then specifies that the account is both dellnquent, and its time since initial delinquency.

REporting as CO can be either only in the prior payment history profile, with a current non-delinquency status of paid or paid/settled for less, OR it can continue to be shown both in payment history profile historical past status and the current status if the debt remains unpaid.

Credit report exclusion will vary depending upon whether the current status remains delinquent (CO) when exclusion of the prior payment history reporting is done, or whether the current status is no longer adverse, and thus no exclusion of current status reporting is also required.

Is the debt paid, or does it remain delinquent?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can having a baddie fall off hurt more than it helps?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can having a baddie fall off hurt more than it helps?

If the current status is charged-off, then the exclusion date for the CO is no later than 7 years plus 180 days from the date for your first delinquency that preceded the CO.

Last activity on the account, or date of any scheduled or actual last payment, is irrelevant to credit report exclusion. Exclusion of a CO is based solely upon one single date-certain, which is the date of first delinquency that led up to the charge-off.

The date of first delinquency must, by definition, be prior to the date of the repo or date of the CO.

If it was repoed in 12/2010, then the DOFD must have been prior to that date.

A DOFD prior to 2010 will necessarily have reached more than 7 years plus 180 days as of today.

The CRA does not base exclusion on any reported date other than the DOFD.

FCRA 623(a)(5) requires the creditor to separately and explicitly report the DOFD to the CRA no later than 90 days after they first reported reference to a charge-off, so the DOFD must be of record in your credit file.

You can usually get it from annualcreditreport.com.

I would pursue a dispute of continued showing of the CO and account in your credit report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can having a baddie fall off hurt more than it helps?

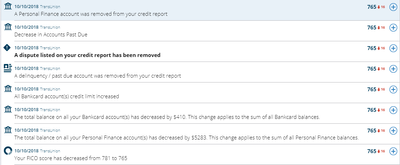

I thought that I would share this with everyone as I found it interesting in trying to figure out how the FICO scoring system worked. My question was really even though I had a baddie on my Transunion report it also happen to be my oldest account. I understand that it was hurting my credit score and in the long run my score would benefit from having it fall off, however I was also concernced with the fact that it was my oldest account (13 years and 10 months) by a lot, and having it come off would also effect the average age of accounts. In the ended I can say that FICO puts more weight on the average age of accounts then a bad mark. See below what happened the day that the account came off.

Just some data my credit file is not thin, my next oldest account is Transunion is only 4 years and 10 months. I still have 3 auto loans showning paid off on my credit report with all being perfect payment history and another 2 still open with perfect payment history. I have nothing on my report that is any type of negative marks, my credit utilzation is below 2% total with a CL of $105K. I am sure that the drop is all because of the AAOA dropping. The bottom line is I am happy it is gone and I am not concerned about the 16 point drop because my FICO 8

Transunion Score is still 765 so I am in good shape there.