- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Charge Off Timeline Help?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Charge Off Timeline Help?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charge Off Timeline Help?

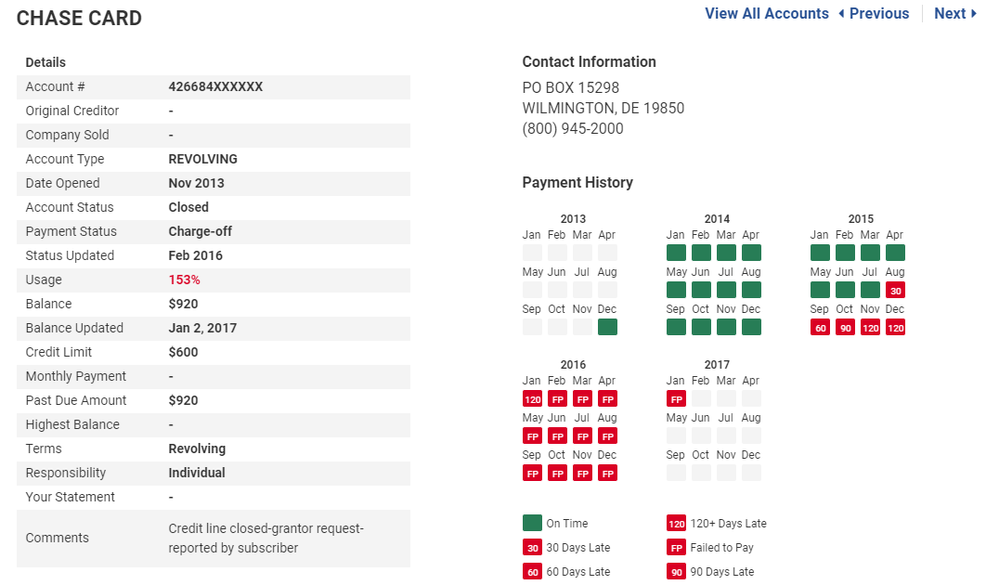

Can anyone explain to me what this is doing to my score? It's the only one that is reporting as a charge off and not a collection. So I need to know if I should take care of it before things that are listed as actual collections.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Charge Off Timeline Help?

They act about the same. They remain as negatives on your report for 7 years since original date of delinquency.

Basically Chase has charged off your balance as a business loss (rather than an interest gaining loan) because they don't expect you to ever repay them. Charge offs commonly get sold to CAs for pennies on the dollar, and the CA attempts to collect that money instead. So it may never be sold to a CA and Chase may accept the loss, or it could be in the process of being sold to a CA right now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Charge Off Timeline Help?

That 153% utilization is factoring into your overall utilization -- so in addition to being dinged for the derogatory charge-off status, you are also losing points for over-max util. Paying it will bring that balance down to $0, reducing both individual and overall util -- depening on the total limit of your other open, revolving accounts, this could yield a bit of score boost if it lowers your util enough to cross a threshold.

Also -- it looks like this account went delinquent in Aug. 2015 --- so it won't fall off til Aug. 2022 -- that's a while. If they sell the debt - you could end up with yet another collection tradeline added in addition to this charge-off. If they keep the debt, then they can update the tradeline with a new 'failure to pay' notation whenever they want -- which will make the charge-off look 'newer' to FICO and hurt your scores again. If you pay it, the account will update with a $0 balance and no further updates will occur - allowing the derog to age and hurt a little less over time (though it will continue to hurt until it falls off).

If you can afford to pay it in full or settle it... then I suggest you do so asap. The other collections will stll be there after you settle this account and by taking care of this one first, you'll prevent a new collection from popping up or future negative updating of the account - and improve your utilization which could potentially help your scores a bit

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()