- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Charge Off removed but not a big bump

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Charge Off removed but not a big bump

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charge Off removed but not a big bump

Hello all!

I wish I could have been a little more specific in the title, but here's the gist of it.

I had a pretty big charge-off from Discover in the amount of almost $4k. The SOL of DoFD showed differently between EX, TU, and EQ.

EQ and TU had the correct information and removed it from my CR a few months ago and I saw an almost 90 point bump in my Fico score immediately (through annualcreditreport.com).

However, EX had the wrong information from Discover regarding the DoFD so I had to wait a few extra months. Well I talked to EX this morning and they were able to remove it. Said it would take a few hours. I got an email saying that it had been removed from my CR but my CR only showed a bump of 29 pts (which is good, but not as high as what I was hoping?)

My Fico scores are as follows:

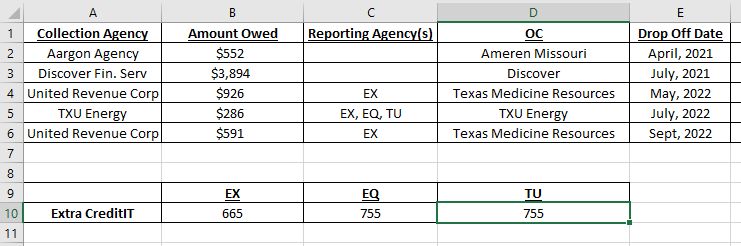

EX: 655

EQ: 755

TU: 755

And what's interesting is that my credit profile (I still have a few collections) is cleaner on EX than it is on the others, yet I have a lower score.

I've scoured all 3 credit reports and can't find out why. Or maybe since all this happened today I just need to wait a little while?

Here's a snapshot of my remaining collections.

Any advice?

Thanks!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Charge Off removed but not a big bump

When you say collections, do you mean charge-off accounts or actual collections? I find it interesting that you have a 755 FICO with two collections reporting on TU and EQ.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Charge Off removed but not a big bump

@Anonymous I had one "charge-off" which was the Discover which has since been removed from all 3 CRA's.

The other 3 derogatories (TXU and United Revenue Corp) are all collection accounts. They are not charge-offs.

The TXU energy is an electric bill. The United Revenue Corp is a medical bill that I was unable to pay.

Prior to me getting the Discover account removed my Fico was about 675. The Discover dropped off and both EQ and TU raised to 755.

I'm in the process of doing a PFD on the TXU and United Revenue Corp.

But that still doesn't explain why EQ and TU incrased so much and EX raised minimally?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Charge Off removed but not a big bump

@Anonymous Maybe it's because the accounts are pretty old and will be falling off in a year? Idk?...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Charge Off removed but not a big bump

@CorySoccer wrote:@Anonymous Maybe it's because the accounts are pretty old and will be falling off in a year? Idk?...

Collections should be affecting you in full until they fall off. That's why I asked if these are Charge-offs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Charge Off removed but not a big bump

@CorySoccer wrote:@Anonymous I had one "charge-off" which was the Discover which has since been removed from all 3 CRA's.

The other 3 derogatories (TXU and United Revenue Corp) are all collection accounts. They are not charge-offs.

The TXU energy is an electric bill. The United Revenue Corp is a medical bill that I was unable to pay.

Prior to me getting the Discover account removed my Fico was about 675. The Discover dropped off and both EQ and TU raised to 755.

I'm in the process of doing a PFD on the TXU and United Revenue Corp.

But that still doesn't explain why EQ and TU incrased so much and EX raised minimally?

Agreed. Definitely seems odd.

@Anonymous any thoughts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Charge Off removed but not a big bump

If these are collections, it looks like Experian has 3, while the other 2 bureaus only have 1, so I would expect Experian to be lower. Am I missing something?

and a public record card responds differently to utilization than a delinquency card.

and as for the discrepancy, was the account in question a chargeoff? If so, whether or not it has been updated in the past two years could've played a role in whether or not it was a revolving Utilization.

if it's a CA, I would expect it to stay static on the old scores and only change at reassignment on the new scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Charge Off removed but not a big bump

@Anonymous No, you're not missing anything which is why this confounds me?

Regarding the discrepancy this is how it went. I had a Discover card. My I racked up a $3,700 bill. In April of 2014 I made my last MINIMUM payment. I lost my job that month so I know for a fact that I did not pay Discover. Equifax and TU removed it immediately.

Here's the rub, Equifax said my first date of delinquency was September of 2015 which is months ahead of the other CRA's. This account had been updated monthly for the past 4 years.

Hope this helps!!?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Charge Off removed but not a big bump

@CorySoccer wrote:@Anonymous No, you're not missing anything which is why this confounds me?

Regarding the discrepancy this is how it went. I had a Discover card. My I racked up a $3,700 bill. In April of 2014 I made my last MINIMUM payment. I lost my job that month so I know for a fact that I did not pay Discover. Equifax and TU removed it immediately.

Here's the rub, Equifax said my first date of delinquency was September of 2015 which is months ahead of the other CRA's. This account had been updated monthly for the past 4 years.

Hope this helps!!?

@CorySoccer what I mean though is you have three collections on EX?. Correct? But you only have one on TransUnion and Equifax correct?

and was the chargeoff reporting regularly? When had it last updated? Was unpaid? Because Score change, the date of last update could've changed it is what I mean.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Charge Off removed but not a big bump

@Anonymous wrote:

@CorySoccer wrote:@Anonymous No, you're not missing anything which is why this confounds me?

Regarding the discrepancy this is how it went. I had a Discover card. My I racked up a $3,700 bill. In April of 2014 I made my last MINIMUM payment. I lost my job that month so I know for a fact that I did not pay Discover. Equifax and TU removed it immediately.

Here's the rub, Equifax said my first date of delinquency was September of 2015 which is months ahead of the other CRA's. This account had been updated monthly for the past 4 years.

Hope this helps!!?

@CorySoccer what I mean though is you have three collections on EX?. Correct? But you only have one on TransUnion and Equifax correct?

and was the chargeoff reporting regularly? When had it last updated? Was unpaid? Because Score change, the date of last update could've changed it is what I mean.

I was under the impression that a collection will suppress your credit through the entire reporting period, regardless of how old, versus a Charge-off that if not updated will stop suppressing your scores until about 4 years or so. So I found it curious that a FICO of 755 could be achieved with a collection still reporting regardless of how old.