- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- CitiBank Dispute Help!?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CitiBank Dispute Help!?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CitiBank Dispute Help!?

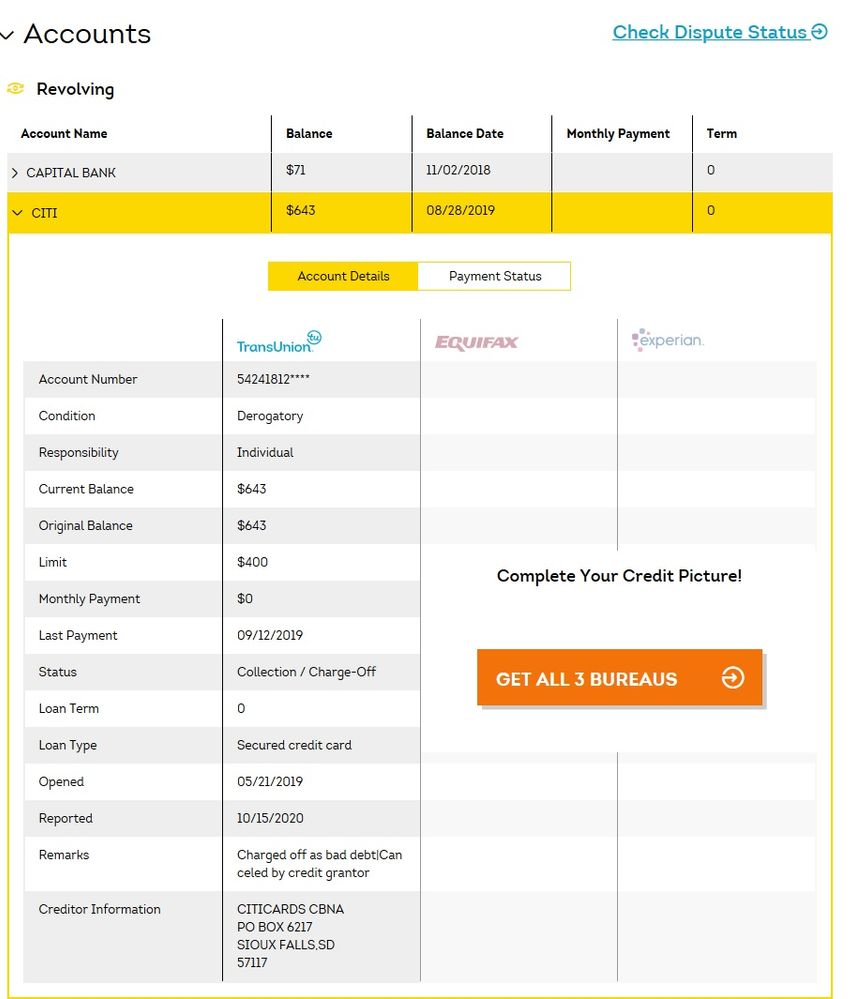

I have a citibank card on my credit file that that is showing as a chargeoff with a balance. I just called citibank to see if i can do a pay to delete as i have disputed this account online already and they have no removed it. When i call they cannot find any account under my SSN or phone number. Can i get this removed if they entered the wrong SSN when they signed me up?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CitiBank Dispute Help!?

If this is your debt, you can't dispute, it's legitimate and they're legally required to report. Disputing will result in validation and lowering of score.

Citi will not PFD, you can PIF or settle for less. Account will show balance of 0. It will stay on report for 7 years from DOFD. Scores will begin to recover when account reports 0 and isn't continuing to update.

Ask for supervisor or debt recovery dept, to locate account and see if in-house or with CA. Who's reporting the account disputed?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CitiBank Dispute Help!?

Thank you,

This was my debt i was just curious but i did call to pay the full balance but they could not find my account. I don't have a collection for it just the original account that shows charged off. Would paying the balance off help my credit?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CitiBank Dispute Help!?

It will allow score to recover over time, regain some points, but CO will always continue to suppress scores until removal. It's a major derogatory.

Paying off looks good to lenders who may do manual review. It shows your responsible enough to settle obligations.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CitiBank Dispute Help!?

The question in paying the delinquent CO account is not so much whether paying will provide instant score improvement, but rather what the future impact might be if you dont pay vs. if you do pay.

A delinquent account, regardless of whether the account has additionally been reported as charged-off, will continue to increase in period since initial delinquency for each and every month where it remains unpaid and the creditor makes updated reporting to the CRA that the current status remains one of delinquency/CO.

If you dont pay, future negative scoring impact can thus continue to increase.

However, once you pay the debt, the account terminates any continued, future reporting of a current delinquency status, and thus the final period of total delinquency terminates, and the account then can begin to age in time and begin to recover some scoring.

Paying wont instantly increase scoring, but will end potential additional damage.

In addition to three-digit scoring impact, update of current status to paid, $0 balance looks much better upon any manual review, as it shows that you do ultimately honor any pay your delinquent debt.