- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Closed First subprime

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Closed First subprime

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed First subprime

@HowDoesThisAllWork wrote:

@Suzette2 wrote:

@HowDoesThisAllWork wrote:

@Suzette2 wrote:Hello, all:

thx to this group, I just closed my first subprime: open sky. I had a $800 security deposit and have had the card for 18 months. Since then, my scores have risen from low 500's and today my EX fico 8 is 689.

.

Before I closed it, I I was approved for a care credit CL to $4,500 (it was $300 when opened in 3/21) so it offsets this closure!

yesterday I called another subprime, credit one, with the intent of closing it. However, they refunded my AF, waived this coming years and gave me $200 more credit. I can sock drawer them for a while.

I now have better cards with much better limits.

it felt great and many thanks for the wisdom partially learned from posters here.

I had a Credit One card (had it for a VERY specific purpose....and that worked perfectly in achieving a HUGE success) but as the one year mark approached I contacted them and they were not willing to do much. Not nearly as much as they did for you. So, I closed it. This was awhile back.

While there are people for whom this credit card works well, I would suggest that people pay attention to the detail with Credit One. Now, to be clear, I am not bashing Credit One.

One of the "different" things that Credit One does is to forego the "grace period".

What that means is......with most credit cards you have a Statement Date and then some 21 days later the balance from said Statement Date is due (in order to avoid interest). So, if your billing cycle is the June 15 - July 14 (with July 14th being the so-called Statement Date) then whatever that amount is is "interest free" given that you pay that balance on or before August 7 (making up dates here....but that "due date" is "typically" due some 21 days later....).

Credit One does not have this "feature". With Credit One, as soon as a charge hits your statement, they start charing you interest.

So, using the above example (June 15 - July 14 as a billing cycle....) were I to have the Credit One credit card and I made a purchase on June 20 for $10.93 on June 22nd when that charge hits the Credit One statement they start charging interest. Now, with "most" other credit cards that purchase would not subject you to any interest charges until August 7. And then only if you did not pay off whatever that total statement balance on July 14th was.

Big difference.

I will say this....while I had the card the folks were really nice and helpful and did do some nice things (in that these were "small" things that they do not normally do but that they did do for me).

So, with good spending habits and solid, disciplined behavior, many people might find that a Credit One credit card could be exactly what the doctor ordered. Especially in a rebuild situation. However, most people in a compromised situation are there because of less-than good spending habits and a lack of solid, disciplined behavior. And I include myself (past self....not so much my "today's self") in that.

Congrats on working your goals and, through that work, putting yourself in a better financial situation! It is nice to see good things happen, isn't it?

Boy, it sure is! Kinda old school, but I actually have a notebook to manage all accounts with current and goals....I find physically writing it down and carrying that book with me is motivating and makes me accountable to myself and avoids temptation. I've been doing AZEO for a few months, but this month I will do zero balances reporting on the subprimes (the ones still open) and the better cards will be a 5 percent balance. I am seeing how this impacts my score. Now, I have to figure out how to put the card pictures on my signature line..... !!!!

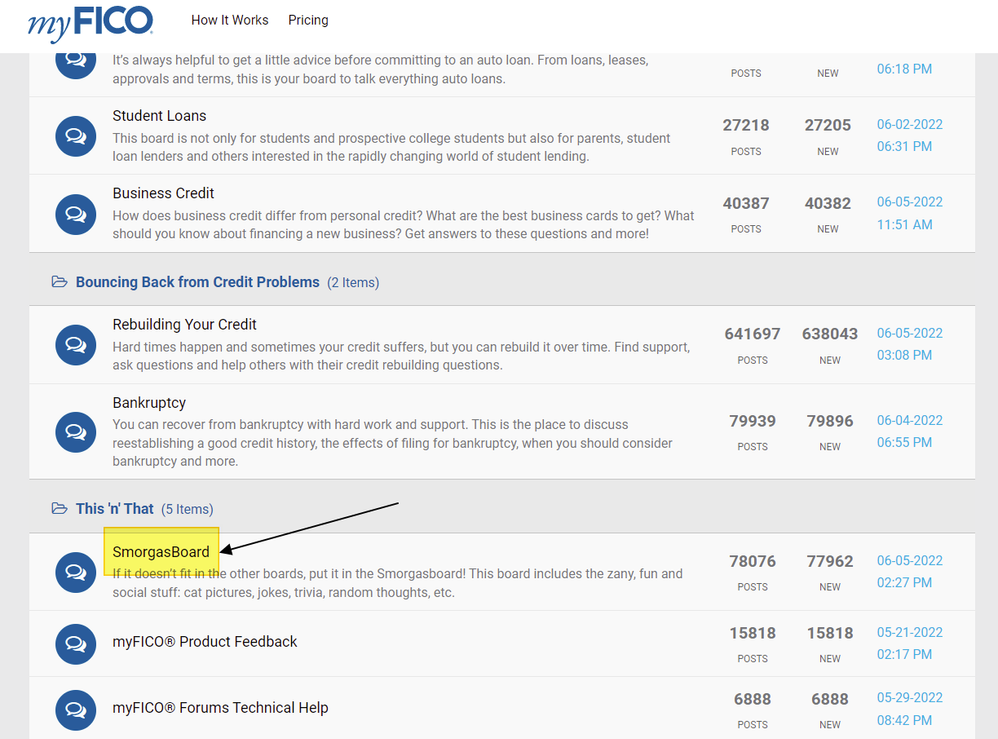

It is in the SmorgasBoard forum.....

Pic attached!

For sure, saw that. Thanks, again!!! I did Imgur...have a folder with the card pics...but.... they are coming out large. I know the code in that thread had a specific command to give for sizing but it does not seem to work.

12/22 :

12/22 :

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed First subprime

@OmarGB9 wrote:

@HowDoesThisAllWork wrote:

@Suzette2 wrote:Hello, all:

thx to this group, I just closed my first subprime: open sky. I had a $800 security deposit and have had the card for 18 months. Since then, my scores have risen from low 500's and today my EX fico 8 is 689.

.

Before I closed it, I I was approved for a care credit CL to $4,500 (it was $300 when opened in 3/21) so it offsets this closure!

yesterday I called another subprime, credit one, with the intent of closing it. However, they refunded my AF, waived this coming years and gave me $200 more credit. I can sock drawer them for a while.

I now have better cards with much better limits.

it felt great and many thanks for the wisdom partially learned from posters here.

I had a Credit One card (had it for a VERY specific purpose....and that worked perfectly in achieving a HUGE success) but as the one year mark approached I contacted them and they were not willing to do much. Not nearly as much as they did for you. So, I closed it. This was awhile back.

While there are people for whom this credit card works well, I would suggest that people pay attention to the detail with Credit One. Now, to be clear, I am not bashing Credit One.

One of the "different" things that Credit One does is to forego the "grace period".

What that means is......with most credit cards you have a Statement Date and then some 21 days later the balance from said Statement Date is due (in order to avoid interest). So, if your billing cycle is the June 15 - July 14 (with July 14th being the so-called Statement Date) then whatever that amount is is "interest free" given that you pay that balance on or before August 7 (making up dates here....but that "due date" is "typically" due some 21 days later....).

Credit One does not have this "feature". With Credit One, as soon as a charge hits your statement, they start charing you interest.

So, using the above example (June 15 - July 14 as a billing cycle....) were I to have the Credit One credit card and I made a purchase on June 20 for $10.93 on June 22nd when that charge hits the Credit One statement they start charging interest. Now, with "most" other credit cards that purchase would not subject you to any interest charges until August 7. And then only if you did not pay off whatever that total statement balance on July 14th was.

Big difference.

I will say this....while I had the card the folks were really nice and helpful and did do some nice things (in that these were "small" things that they do not normally do but that they did do for me).

So, with good spending habits and solid, disciplined behavior, many people might find that a Credit One credit card could be exactly what the doctor ordered. Especially in a rebuild situation. However, most people in a compromised situation are there because of less-than good spending habits and a lack of solid, disciplined behavior. And I include myself (past self....not so much my "today's self") in that.

Congrats on working your goals and, through that work, putting yourself in a better financial situation! It is nice to see good things happen, isn't it?

Actually, many, if not most Credit One cards now include a grace period.

Well, dang! It has been more than one year....so please forgive the incorrect information. I guess that I should verify what I am stating before stating! Thanks, OmarGB9!

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed First subprime

That's awesome....Congratulations on your moving forward!! 👏🏼🍾🥂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed First subprime

@HowDoesThisAllWork wrote:

@Suzette2 wrote:

@HowDoesThisAllWork wrote:

@Suzette2 wrote:Hello, all:

thx to this group, I just closed my first subprime: open sky. I had a $800 security deposit and have had the card for 18 months. Since then, my scores have risen from low 500's and today my EX fico 8 is 689.

.

Before I closed it, I I was approved for a care credit CL to $4,500 (it was $300 when opened in 3/21) so it offsets this closure!

yesterday I called another subprime, credit one, with the intent of closing it. However, they refunded my AF, waived this coming years and gave me $200 more credit. I can sock drawer them for a while.

I now have better cards with much better limits.

it felt great and many thanks for the wisdom partially learned from posters here.

I had a Credit One card (had it for a VERY specific purpose....and that worked perfectly in achieving a HUGE success) but as the one year mark approached I contacted them and they were not willing to do much. Not nearly as much as they did for you. So, I closed it. This was awhile back.

While there are people for whom this credit card works well, I would suggest that people pay attention to the detail with Credit One. Now, to be clear, I am not bashing Credit One.

One of the "different" things that Credit One does is to forego the "grace period".

What that means is......with most credit cards you have a Statement Date and then some 21 days later the balance from said Statement Date is due (in order to avoid interest). So, if your billing cycle is the June 15 - July 14 (with July 14th being the so-called Statement Date) then whatever that amount is is "interest free" given that you pay that balance on or before August 7 (making up dates here....but that "due date" is "typically" due some 21 days later....).

Credit One does not have this "feature". With Credit One, as soon as a charge hits your statement, they start charing you interest.

So, using the above example (June 15 - July 14 as a billing cycle....) were I to have the Credit One credit card and I made a purchase on June 20 for $10.93 on June 22nd when that charge hits the Credit One statement they start charging interest. Now, with "most" other credit cards that purchase would not subject you to any interest charges until August 7. And then only if you did not pay off whatever that total statement balance on July 14th was.

Big difference.

I will say this....while I had the card the folks were really nice and helpful and did do some nice things (in that these were "small" things that they do not normally do but that they did do for me).

So, with good spending habits and solid, disciplined behavior, many people might find that a Credit One credit card could be exactly what the doctor ordered. Especially in a rebuild situation. However, most people in a compromised situation are there because of less-than good spending habits and a lack of solid, disciplined behavior. And I include myself (past self....not so much my "today's self") in that.

Congrats on working your goals and, through that work, putting yourself in a better financial situation! It is nice to see good things happen, isn't it?

Boy, it sure is! Kinda old school, but I actually have a notebook to manage all accounts with current and goals....I find physically writing it down and carrying that book with me is motivating and makes me accountable to myself and avoids temptation. I've been doing AZEO for a few months, but this month I will do zero balances reporting on the subprimes (the ones still open) and the better cards will be a 5 percent balance. I am seeing how this impacts my score. Now, I have to figure out how to put the card pictures on my signature line..... !!!!

Look at you with the shiny new signature!

I have not attempted to play with the pictures of the credit cards so I can not directly provide any assistance there. However, all of "this kind of thing" is indeed located in one of the forums here. Hold on and I will zip out of here and get that name (of the Forum).....

Thanks to your input helping me I have that signature now ![]()

12/22 :

12/22 :