- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Closing low credit limit cards--good idea or n...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Closing low credit limit cards--good idea or not

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing low credit limit cards--good idea or not

@rchvmz wrote:I am a few months out before my Chpt 13 is to be dismissed. I was able to get some CC here in the last 10 months. One is an Indigo( 3 months old) with a $300.00 limit, and another is a First Access card (6 months old)with same limit..

Would it be of ANY good/usefulness to close these 2, as they are really sub prime with not much use, or would closing them be detrimental to the age factor?....The oldes card is 10 months. I am going to open a PenFed share loan in 2 weeks. I know there are plenty of you folks who have some great experience that can help me------Thanks in advance folks, I really am motivated to not make the same mistakes again, by learning from you folks.

Here's a link to a thread that has good information on how to determine the effects of closing or not closing accounts. Hope this helps.

Goal: FICO 700+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing low credit limit cards--good idea or not

Try this. Is it worth it to pay so many fees to keep a few points? Open or closed counts against your AAoA's. Length of credit history-related calculations apply equally to all open and closed accounts, so there’s no undoing the short history of that newest account by closing it. Fortunately, with every month that goes by, each of your accounts gets a little older and contributes a little more history to your score, so don’t despair. Time and good history after a hiccup is what makes the scores rise. So if you have an account good or bad in the past. It still counts on the AAoA's. But AAoA is only 15% of your FICO score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing low credit limit cards--good idea or not

@FireMedic1 wrote:Try this. Is it worth it to pay so many fees to keep a few points? Open or closed counts against your AAoA's. Length of credit history-related calculations apply equally to all open and closed accounts, so there’s no undoing the short history of that newest account by closing it. Fortunately, with every month that goes by, each of your accounts gets a little older and contributes a little more history to your score, so don’t despair. Time and good history after a hiccup is what makes the scores rise. So if you have an account good or bad in the past. It still counts on the AAoA's. But AAoA is only 15% of your FICO score.

The above is the critical element of what I believe @Zosimus is not understanding.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing low credit limit cards--good idea or not

Nah, I think you need to print out the post you quoted, take out your highlighter, and highlight the words "short history."

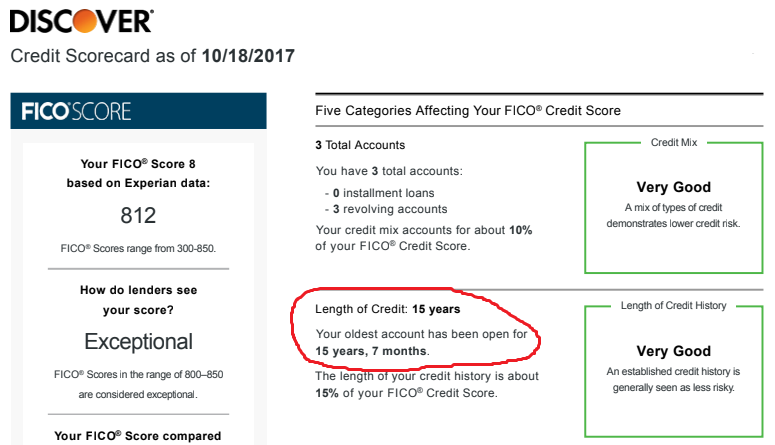

You see, in 2004, I left the United States, moved to South America, and figured I'd never return. But, return I did — in 2017. After 13 years, you would think that all the credit information would have fallen off. I thought so too. I managed to get a credit card from the nice folks at the local credit union. I figured that I would have to wait 6 months to get a score. But, that old closed account gave me a nice juicy score.

Sadly, that old account dropped off of my credit profile about a month later.

What I wouldn't give to have that old account reappear on my credit profile. But, I suppose that I will recover. Sometime in 2032, I will have a 15-year-old account on my credit profile again. Why, that's just around the corner.