- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: College Student with high limits and high debt...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

College Student with high limits and high debt after it all came crashing down (UPDATED 11/16/19)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

College Student with high limits and high debt after it all came crashing down (UPDATED 11/16/19)

Scores (FICO 8, as per Experian monitoring):

518 Experian

518 Equifax

521 TransUnion

Hello everyone,

I don't know if anyone may remember me (probably not), but I was very active on these forums in 2015/2016, and I was all about getting credit and approvals and getting huge limits. I managed to acquire I believe 11 cards and about $40k in available credit on a $20k income.

Well, life happened, I was forced to help my family out and unfortunately all of my cards with their glorious high limits eventually got maxed out and everything came crashing down in Jan/Feb 2018. I am now about $43k in debt, and I was considering bankruptcy, however, I am up for a potentially huge career change with a significant increase in salary (just graduated from college this past December), and so I would actually be able to pay back this debt over the course of a few years.

All of that being said, I was wondering if anyone had any advice for me, aside from paying off the CO/Collections, as to how to rebuild my credit scores? I have 5 collections reporting, and 8 charge offs/closed accounts. All have balances, although I did just pay off one small collection of about $889 with Citi.

Which of my previous lenders would let me back in once I pay back the debt? Ideally I would like to get back in with Cap One, Discover, and Chase, and maybe even reopen an Amex (Had an Amex PRG from 2015-2017, which I paid off and closed prior to everything going south) if possible. Which of these may give me another shot? Will Amex let me in with collections on my report? Even if they're paid off?

I was looking into maybe opening a secured card like Cap One or Citi Secured, or maybe with my local CU.

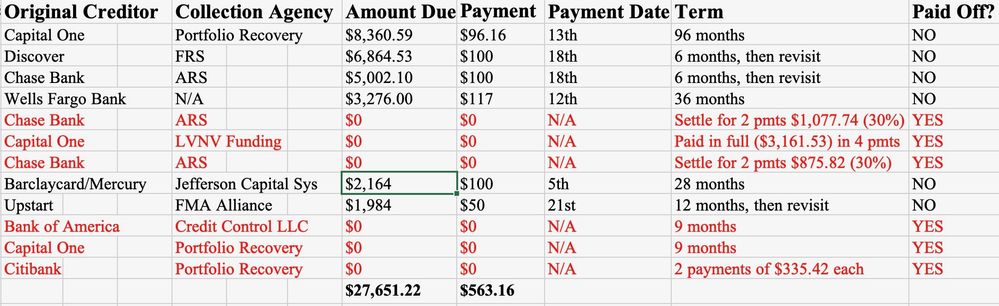

Current Accounts and Balances

- Portfolio Recovery $9,129 (original creditor: Capital One)

- Financial Recovery Services $7,564.53 (original creditor: Discover Bank)

- ARS $5,702.10 (debt first sold to MRS BPO, LLC, original creditor: Chase Bank)

- Wells Fargo $4,201 (debt still with Wells Fargo)

ARS $3,592 (debt first sold to MRS BPO, LLC, original creditor: Chase Bank)LVNV Funding $3,161 (original creditor: Capital One)ARS $2,952.35 (debt first sold to MRS BPO, LLC, orginal creditor: Chase Bank)- Jefferson Capital Systems $2,764 (original creditor: Barclays Bank/Mercury Bank)

- FMA Alliance $2,334 (original creditor: Upstart)

Credit Control, LLC $1,851.40 (original creditor: Bank of America)Portfolio Recovery $1,454 (original creditor: Capital One)Portfolio Recovery $889 (original creditor: CitiBank) - PAID

Updated balances:

Updated FICO scores (as of 11/16/19:

EX 569

EQ 555

TU 575

I figured I would tackle the ones with the highest balances first, and once those are taken care of, I can quickly pay off the remainder; but if anyone has a better plan, please let me know. I want to take care of this as quickly as possible so I can start rebuilding my credit in order to start getting back to high scores so later in a few years I can qualify for a house.

Any and all advice is appreciated. Thank you.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: College Student with high limits and high debt after it all came crashing down

@OmarGB9 wrote:Scores:

518 Experian

518 Equifax

521 TransUnion

Hello everyone,

I don't know if anyone may remember me (probably not), but I was very active on these forums in 2015/2016, and I was all about getting credit and approvals and getting huge limits. I managed to acquire I believe 11 cards and about $40k in available credit on a $20k income.

Well, life happened, I was forced to help my family out and unfortunately all of my cards with their glorious high limits eventually got maxed out and everything came crashing down in Jan/Feb 2018. I am now about $43k in debt, and I was considering bankruptcy, however, I am up for a potentially huge career change with a significant increase in salary (just graduated from college this past December), and so I would actually be able to pay back this debt over the course of a few years.

All of that being said, I was wondering if anyone had any advice for me, aside from paying off the CO/Collections, as to how to rebuild my credit scores? I have 5 collections reporting, and 8 charge offs/closed accounts. All have balances, although I did just pay off one small collection of about $889 with Citi.

Which of my previous lenders would let me back in once I pay back the debt? Ideally I would like to get back in with Cap One, Discover, and Chase, and maybe even reopen an Amex (Had an Amex PRG from 2015-2017, which I paid off and closed prior to everything going south) if possible. Which of these may give me another shot? Will Amex let me in with collections on my report? Even if they're paid off?

I was looking into maybe opening a secured card like Cap One or Citi Secured, or maybe with my local CU.

Any and all advice is appreciated. Thank you.

Please don't take this the wrong way, as I was and still am in your situation, just not as bad as I was off a year ago. The last thing you need to be worried or focused on is acquiring new credit. As it stands, you have many charge off's with balances, as well as collections on your credit reports. Good creditors are not going to touch you, for quite some time. Even though the charge offs / collections are paid, they are still on your report and will show creditors that you don't pay people back. Not trying to sound harsh, but that's the truth.

Your focus should be on paying off / settling the accounts that have balances as those are killing you. You will want to attempt to arrange pay for deletes. List out all of your adverse accounts, with balance, and creditors. This will help others chime in and give you some solid direction.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: College Student with high limits and high debt after it all came crashing down

Welcome back @OmarGB9

It would be very helpful if you were to list those accounts and indicate who currently holds the debt, please include amounts owed.

As far as letting you back in, Cap 1 might eventually, same as Disco. Chase, not so much. I would not go anywhere near Amex till your current situation is somewhat resolved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: College Student with high limits and high debt after it all came crashing down

I would try to figure out one card to get/keep current that won’t close on you.

Then I would negotiate paying 50% or less of balances starting with cards that treat you the best.

It is completely possible to pay 20%-30% of balance of old debt.

Save money and don’t do any direct withdrawals for payments.

GL!

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: College Student with high limits and high debt after it all came crashing down

@Anonymous wrote:

@OmarGB9 wrote:Scores:

518 Experian

518 Equifax

521 TransUnion

Hello everyone,

I don't know if anyone may remember me (probably not), but I was very active on these forums in 2015/2016, and I was all about getting credit and approvals and getting huge limits. I managed to acquire I believe 11 cards and about $40k in available credit on a $20k income.

Well, life happened, I was forced to help my family out and unfortunately all of my cards with their glorious high limits eventually got maxed out and everything came crashing down in Jan/Feb 2018. I am now about $43k in debt, and I was considering bankruptcy, however, I am up for a potentially huge career change with a significant increase in salary (just graduated from college this past December), and so I would actually be able to pay back this debt over the course of a few years.

All of that being said, I was wondering if anyone had any advice for me, aside from paying off the CO/Collections, as to how to rebuild my credit scores? I have 5 collections reporting, and 8 charge offs/closed accounts. All have balances, although I did just pay off one small collection of about $889 with Citi.

Which of my previous lenders would let me back in once I pay back the debt? Ideally I would like to get back in with Cap One, Discover, and Chase, and maybe even reopen an Amex (Had an Amex PRG from 2015-2017, which I paid off and closed prior to everything going south) if possible. Which of these may give me another shot? Will Amex let me in with collections on my report? Even if they're paid off?

I was looking into maybe opening a secured card like Cap One or Citi Secured, or maybe with my local CU.

Any and all advice is appreciated. Thank you.

Please don't take this the wrong way, as I was and still am in your situation, just not as bad as I was off a year ago. The last thing you need to be worried or focused on is acquiring new credit. As it stands, you have many charge off's with balances, as well as collections on your credit reports. Good creditors are not going to touch you, for quite some time. Even though the charge offs / collections are paid, they are still on your report and will show creditors that you don't pay people back. Not trying to sound harsh, but that's the truth.

Your focus should be on paying off / settling the accounts that have balances as those are killing you. You will want to attempt to arrange pay for deletes. List out all of your adverse accounts, with balance, and creditors. This will help others chime in and give you some solid direction.

No I understand, and I'm not saying I'm looking to acquire new credit any time soon. I was just asking for future reference. Although it would be nice to start rebuilding my credit while simultaneously paying off baddies. I was thinking I could do an Open Sky card for that, and obviously manage everything more responsibly than I did previously.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: College Student with high limits and high debt after it all came crashing down

It's been a while, @OmarGB9... good to see you again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: College Student with high limits and high debt after it all came crashing down

As far as my thread, I have updated the inital post with my creditors and debts.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: College Student with high limits and high debt after it all came crashing down

I am bumping this, in case anybody has any suggestions now that the post has been updated.

@OmarGB9 Some of those are rather large amounts and I'd be worried about the possibility of litigation. I hope you've at least contacted some of them and informed them of your intent to pay.

Also, based on those numbers...and i really really hate saying this, I think you should keep BK in mind as an option.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: College Student with high limits and high debt after it all came crashing down

@Remedios wrote:I am bumping this, in case anybody has any suggestions now that the post has been updated.

@OmarGB9 Some of those are rather large amounts and I'd be worried about the possibility of litigation. I hope you've at least contacted some of them and informed them of your intent to pay.

Also, based on those numbers...and i really really hate saying this, I think you should keep BK in mind as an option.

Nope, did consider BK, but no, as I mentioned in my OP, I was up for a career change with a major income increase, and so thanks to that I've paid/settled 3 out of the 12, and I'm about to pay off (in full) 2 more within the next two months. I will update the original post with updated balances.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: College Student with high limits and high debt after it all came crashing down (UPDATED 9/26/19)

Hey,

First I want to say I was in your exact same shoes just a short while ago. I just graduated in May and took a pretty competitive role. I had about 40,000 in CC debt which I let go to charge off status.

You can avoid BK and settle this debt. I was able to settle for about 25k. Honestly, I am glad I did that--I see my scored slowly creeping back up.

I like how you have a spreadsheet ( I did the same thing).

I'm wishing you the best of luck! Like I said I know exactly what it feels like as I was forced to help out family too. Keep us posted