- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Credit solutions Corp help!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit solutions Corp help!

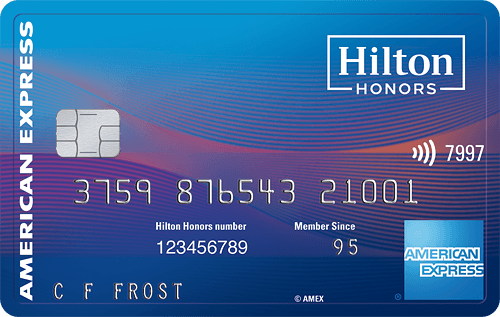

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit solutions Corp help!

Hey guys so I have a car repossession reported back in 2015 for an amount of $7,857 by partners FEDERAL CREDIT UNION. It looks like they sold the account to Credit collection services. I tried to dispute the account with no success which is kind of obvious, well 2 days ago they finally contacted me and said “hey you’ve been trying to dispute a repo and we want to help you resolve the matter, would you be willing to pay 5,000 and we will mark as paid in full” I told them sorry I can’t afford that... the most I can pay is 2,000 and they said we’ll call you back tomorrow. 24 hours later they call me and say they will accept 2,000 and I said pay for delete? And they said no, but you can dispute after paying the balance and we will not respond to dispute so more than likely it will fall off.

They are willing to mark as paid in full.

What should I do?

Are they lying?

Or are they finally calling me cause I signed up for CS360?

Idk what to do?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit solutions Corp help!

I followed the Dave Ramsey approach when dealing with collections. Get it in writing and never give electronic access to your account. The agencies I dealt with never had any issues sending a letter describing the payment schedule and the terms of the settlement. IMO I'd get that and proceed from there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit solutions Corp help!

@MI-Aviator wrote:I followed the Dave Ramsey approach when dealing with collections. Get it in writing and never give electronic access to your account. The agencies I dealt with never had any issues sending a letter describing the payment schedule and the terms of the settlement. IMO I'd get that and proceed from there.

Yeah, I agree with @MI-Aviator . For most collections you really want to get the PFD in writing because some of these companies are a tad deceptive to get that money.

Perhaps try doing a forum search on that Collections Company so you can judge by other member results?

If they said no several times and suddenly switched to a yes... I'd be way suspicious with out seeing it in writing. The reps often get a bonus for collecting on an acct.

Well, good luck! And pls let us know how it went.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit solutions Corp help!

@Anonymous wrote:

@MI-Aviator wrote:I followed the Dave Ramsey approach when dealing with collections. Get it in writing and never give electronic access to your account. The agencies I dealt with never had any issues sending a letter describing the payment schedule and the terms of the settlement. IMO I'd get that and proceed from there.

Yeah, I agree with @MI-Aviator . For most collections you really want to get the PFD in writing because some of these companies are a tad deceptive to get that money.

Perhaps try doing a forum search on that Collections Company so you can judge by other member results?

If they said no several times and suddenly switched to a yes... I'd be way suspicious with out seeing it in writing. The reps often get a bonus for collecting on an acct.

Well, good luck! And pls let us know how it went.

@Anonymous wrote:

@MI-Aviator wrote:I followed the Dave Ramsey approach when dealing with collections. Get it in writing and never give electronic access to your account. The agencies I dealt with never had any issues sending a letter describing the payment schedule and the terms of the settlement. IMO I'd get that and proceed from there.

Yeah, I agree with @MI-Aviator . For most collections you really want to get the PFD in writing because some of these companies are a tad deceptive to get that money.

Perhaps try doing a forum search on that Collections Company so you can judge by other member results?

If they said no several times and suddenly switched to a yes... I'd be way suspicious with out seeing it in writing. The reps often get a bonus for collecting on an acct.

Well, good luck! And pls let us know how it went.

CA's wont always send letters. They have agreements with the CRA's to report accurate info. But they still will do a PFD. They just dont want you to more or less turn them in on a letter that goes against the agreement crediotrs have with the CRA's. The big CA's that do PFD's dont send out anything. So its a toss up 50/50. Either they told the truth or pulled the wool obver the OP's eyes. Main thing is getting paid and the monthly updating stops and then can age off.