- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Debt Pay Off and Settlement: Attack Plans

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Debt Pay Off and Settlement: Attack Plans

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Debt Pay Off and Settlement: Attack Plans

Hello. Folks,

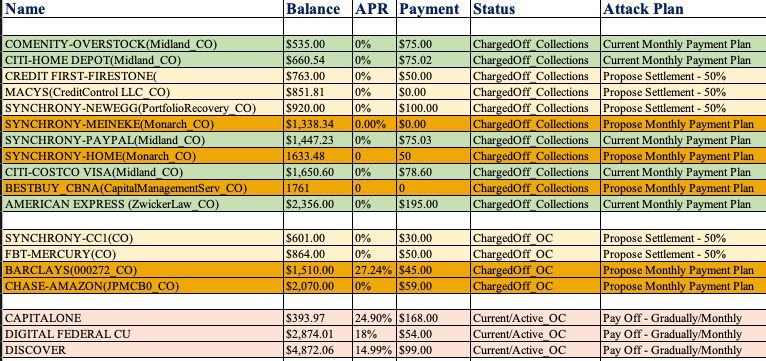

Good evening. I am starting to work on rebuilding my credit. The screenshot below gives you pertinent details about my current baddies (still working on removing some lates from other paid/closed accounts). Almost all accounts were opened between 2014 and 2016, and went delinquent around 2018/2019.

I’ve divided my debt into 3 categories: majority of the accounts are closed and charged off. Most of these charge-offs are already assigned/sold to various collections agencies, of which 1 (Portfolio Recovery) has already reported to the CRA. The other charge-offs are still being hunted for by the OCs.

Currently, I am spending about $700 per month on various debt obligations (my current 3 credit cards, and other payment plans with Zwicker and Midland). I expect some extra $4K coming in between June and July). I am wondering what would be (close to) optimum way to disburse it on my debts. In the “Attack Plan” column, I am planning to propose a settlement for those balances below $1,000, and arranging a fixed payment plan with the other larger balances.

I would be very grateful for some input into my plan. Any other ways of reducing the effect of the charge-offs? Given that they are already derogatory, would a settlement be much worse?

Thanks in advance for your thoughts !

Cheers, Oy

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt Pay Off and Settlement: Attack Plans

Just from my experience, the smaller the balance on the CO/CA, the less likely they are to settle for much lower. I feel like larger-ish balance get bugger discounts. I still say certainly try starting low, but temper your expectations on the lower balances.

I have a small debt with Midland, outside of both the SOL and the 7 year reporting window, and the best offer I have cutrently from them is for 10% off the balance for lump sum payment. This is for a balance sub $300. Most every debt I have had under $1k has had little wiggle room, even closing in at the 7 year mark.

This is not to be discouraging at all. I would definitely work on settling and if needed, work your way up the management chain, don't just settle for the first phone call or a frontline representatives "no".

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt Pay Off and Settlement: Attack Plans

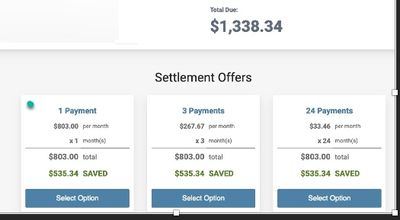

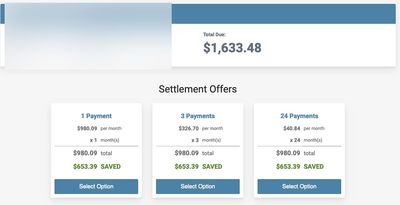

Thanks so much, LaHossBoss: It makes sense to shoot for better settlement with the larger debts. I did receive some offers from Monarch (for two Synchrony Accounts)... here are they>

Any suggestions for offers for each? I hope to start some negotiations with them later this week, and would be very grateful for some input about the above offers.

thakns - Oy