- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Did Navy Federal save me? Does my plan look g...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Did Navy Federal save me? Does my plan look good?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did Navy Federal save me? Does my plan look good?

Today I was approved for a Navy Federal Flagship Visa with a $9k limit. I actually fell out of my chair as I have been working on rebuilding my credit and was suprised I was approved. I am done applying for credit now and will work on grooming what credit I have. Guess I will be meeting some of you in the Garden. Go Navy!

This gives me heartburn...

I have a high interest loan (24.70%) with Upstart that I had to take out late last year to pay legal fees for a child custody matter (which I won). The outstanding balance is about $9,500. The scheduled payments are $323, but I am actually paying $300 every two weeks trying to tackle this debt as quickly as I can, and I estimate that if I continue this path, it should be paid off in June of 2024. I do have about $5,000 in cash savings beyond my emergency fund, but was hesitant in using it with this loan because is does not allow me to apply payments to future payments. I had a bad financial experiance the past few years during covid and was mentally not able to justify risking that money and still having a full payment due each month.

Back to the Flagship card...

The offer I have had a bonus for 30,000 points ($300) if I spend $3,000 in the first 90 Days. There is an intro APR of 1.99% for the first 9 months for new purchases. There is no benefit to balance transfers as they will be at the 18% rate. Standard 3x points for travel and 2x points for everything else.

What I am thinking of doing...

I want to get away from the high interest loan quickly. My thought is to use the $5,000 I have in cash immediatly to apply towards the balance. I would then pay my rent using the new card for the next 2 months and applying what would normally be my rent money towards paying off and closing that high interest loan (about $4200 total - $2100 per month). Obvisouly, I would pay minimum payments on the card until the loan is paid off, but then pay the card aggressively and no longer pay rent with it. My apartment does charge a 2% service fee for paying with the card, but I should get the 2% back in points -- so it is a wash. Also, I should get the bonus $300 because I would have met the spend requirements.

What am I missing?...

I have been diligent and pay my cards in full each month. This would be the first time in about four years I have even entertained the idea of carying a balance. But with an interest rate of 1.99% compared to 24.70%, I am willing to take a leap of faith towards knocking out that loan. Is there anything wrong with my thinking? Has anyone else done something similar?

Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did Navy Federal save me? Does my plan look good?

Congrats on the approval!!

I'll say this. If its going to save you money. Yes. But. You have to make sure its all paid before the low rate runs out or here comes the trailing interest. On the other side. I'm not a fan of pulling $ out of savings though. Never know when lightning strikes. Then a bigger mess. Either or. JMO. Others will help out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did Navy Federal save me? Does my plan look good?

Pulling money out of savings was a big concern I had too, which is why I had not pulled the trigger before. If I stick to the plan and focus, I can have this done and paid for in about 6 months, limiting my risk timewise. I have 2 other car loans with single digit interest rates -- I will probably slow down on those and just pay interest on them as they are already paid out a few months in advance. I do have other resources I can tap into if there is a dire emergency.

Once this is paid off, I do see myself recouping my savings fairly quickly. Having a 24% loan is no fun if you look at the numbers. I am paying over $0.65 per day for every $1000 thats outstanding. That is a lot of money.

@FireMedic1 wrote:Congrats on the approval!!

I'll say this. If its going to save you money. Yes. But. You have to make sure its all paid before the low rate runs out or here comes the trailing interest. On the other side. I'm not a fan of pulling $ out of savings though. Never know when lightning strikes. Then a bigger mess. Either or. JMO. Others will help out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did Navy Federal save me? Does my plan look good?

@FireMedic1 You got me thinking about another alternative. I could cancel my nRwards card and get my deposit back ($2k) -- leaving me only having to do one month of rent instead of 2. I would be done with the debt in 3 months then.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did Navy Federal save me? Does my plan look good?

Thats doable. Or even refi the loan with someone else for a lower rate. Heck Best Egg and others are like 11%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did Navy Federal save me? Does my plan look good?

@FireMedic1 wrote:Thats doable. Or even refi the loan with someone else for a lower rate. Heck Best Egg and others are like 11%.

I tried looking at re-fi options with everyone I could try and pre-qualify with, and unfortinatly, I was not able to find anyone below about 20%. Biggest reason stated by most was that I have too many inquiries and too many new accounts -- which is true bacause at the same time, I also bought a new car and have since added a few more revolving lines. Honestly, if I was a lender, I would throw caution too.

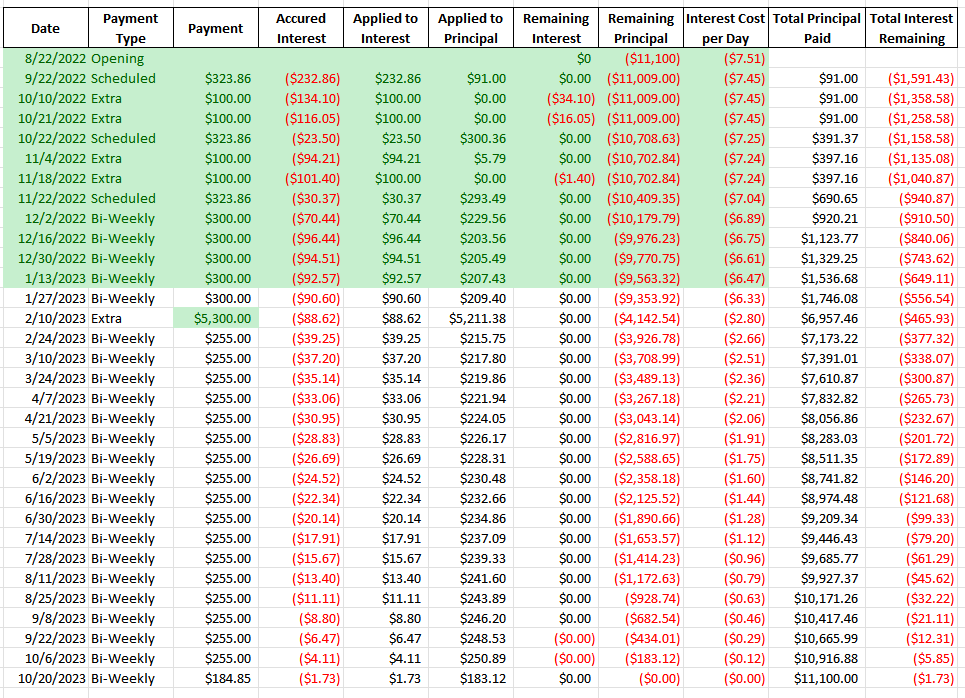

But after your comments, a good pause for thought, and a little sleep, I have put together a plan that is a little less agressive and will still help me achieve my overall goal. Thanks for challenging me on this, that is really what I was looking for! I will not use the card and swap debt, I will keep my nRewards card open, and I will just pay with some brute force -- putting this behind me in October. I do have about 8k in a tax refund I should be getting when I file in February (waiting on my broker to finish their 1099's) and that should replenish my savings quickly. At the end of the day, with this plan, I will have paid $1,591.43 in interest compared to $8,348.24 if I had followed the original 60 month amatorizteion schedule -- Saving me $6,756.81 over the life of the loan. If I am reading my loan documents correctly, I should also see a pro-rated refund for the origination fees too since I will be closing the loan early.

Below is my accellerated payment schedule. Original loan was for about $10,100 with a $1,000 origination fee at 24.70% over 60 months. The scheduled payment was $323.86 per month. I plan on pulling the trigger in February on this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did Navy Federal save me? Does my plan look good?

You keep adding goodies and your starting to talk your way into getting this over with without our help. ![]() And save $ in the process. Thats the best part. Keep at it. You got it now. Good luck!

And save $ in the process. Thats the best part. Keep at it. You got it now. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did Navy Federal save me? Does my plan look good?

Thanks @FireMedic1 . You (and other posts on this site) definatly helped me get the wheels churning in my brain. Thanks for being my sounding board, I am feeling confident about this now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did Navy Federal save me? Does my plan look good?

Excellent. You talked yourself on the right path! Please keep us updated!