- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Don't understand this Item EQ report, Please h...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Don't understand this Item EQ report, Please help.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't understand this Item EQ report, Please help.

All -- Need help in reading this report.

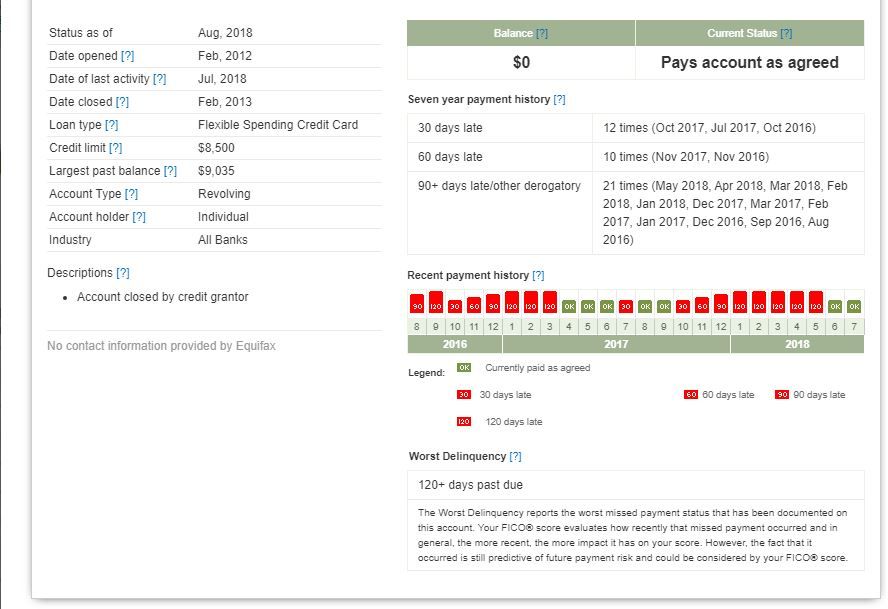

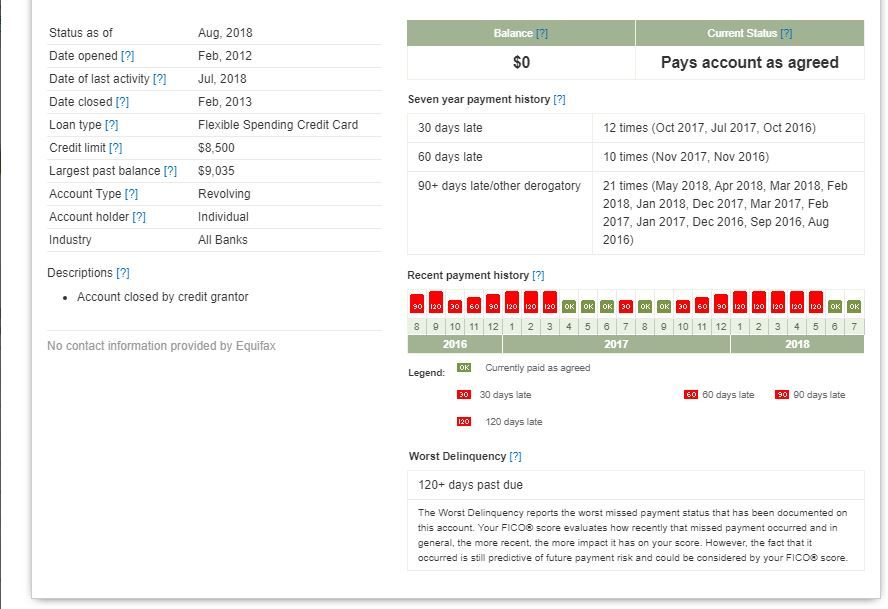

So, This is one of my Derog/Deliq accounts which was CLOSED in Feb 2013. That means the First Deliquency must've been atleast 12 months before closing date (i say because i remember paying this account with delays in 2012).

Now, where i'm confused is the right side of the screenshot. SEVEN YEAR PAYMENT HISTORY. I see that the first derog report per dates below goes back to Sep '16. How is that possible since the account has been closed in feb 2013 because of earlier continous missed payments, which makes be believe that the First Deliq should've been in 2012.

PS. I paid this account in FULL in Jul,2018

I was hoping this account will also fall off early next yr if not end of this year. Please help me identify the Fist Deliq/Derog report date. Am i looking and reading this correctly ?

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Don't understand this Item EQ report, Please help.

Typically OC is gonna post 30 60 90 and then 120 lates and charge off the account after 6 months from DOFD.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Don't understand this Item EQ report, Please help.

Thank you for reassuring my understanding. Now this is my Question, how would i know the DOFD on this or any accoutn since these reports clearly don't show that.

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Don't understand this Item EQ report, Please help.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Don't understand this Item EQ report, Please help.

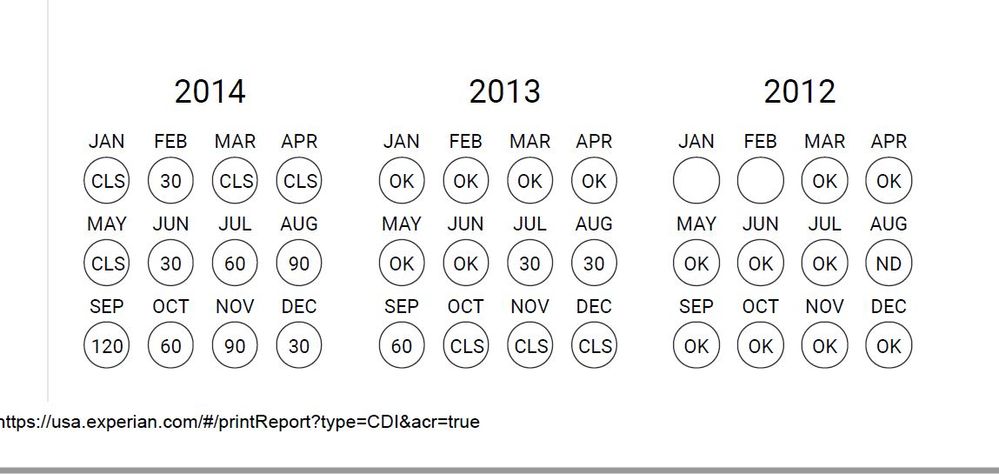

Thanks a lot for the Tip. Went to AnnualCredit now and pulled the report. Confused me even more.See below, the First DOFD reported yr/month (07/2013) & CLS Yr/Month (10/2013).

However the same EX on MyFico is showing closed date as 2/2013. These MFs are so confusing. Sorry about the cuss word.

Both Screenshots are below

Annual Credit Report (EX )

MyFico Report (Ex )

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Don't understand this Item EQ report, Please help.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Don't understand this Item EQ report, Please help.

That is just Weird reporting they do. first DOFD is showing as July 2013. However the account closing date is showing as 2/2013. But this is just EX from AnnualCredit and MyFico. Weird. Also, "On Record until" section is not even shown for this account alone on the report.

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Don't understand this Item EQ report, Please help.

Sorry about the Confusion here. I pulled EX from Annual Credit and was comparing to EQ from My Fico. Ignore. They both reported the DOFDs at a different times. Closing this thread. Will open a new thread in case i have further questions.

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Don't understand this Item EQ report, Please help.

@Chestnut1 wrote:Thanks a lot for the Tip. Went to AnnualCredit now and pulled the report. Confused me even more.See below, the First DOFD reported yr/month (07/2013) & CLS Yr/Month (10/2013).

However the same EX on MyFico is showing closed date as 2/2013. These MFs are so confusing. Sorry about the cuss word.

Both Screenshots are below

Annual Credit Report (EX )

MyFico Report (Ex )

Looking at the chart. The first fall off will be 08/2023 the first string of lates. Then it starts over after the 30 day late 07/2017. The the final string should be 10/2024. They all dont fall off from the very first one with spaces in between. You had made payments that werent late in between the 2 strings. With exception of the lonely 30 day late 07/2017. So to clear it all out with no lates reporting should be 10/2024. Hard to read though. You can keep this thread going to keep us updated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Don't understand this Item EQ report, Please help.

Thanks Much. Just to clear the air. The account was closed in Feb 2013.

Update : To clear my confusion, I called BoFA yesterday and got the confirmation that this Account's DOFD is Dec 2012 and they further confirmed that BoFA will stop reporting this account to CBs starting Dec 15th, 2019. Hoping CBs will tkae another 30-60 days for the same to reflect. Such a relief.

With the above, all my BoFA's Neg/Deliq accounts will be completely gone from the Credit reports ( one BoFa account was dropped from CBs at the beginning of this Month.

That leaves me with One final Chase Auto Loan account as a Negative (this will go off Credit report in April 2022). I'm planning to talk to them to see if they can stop reporiting the same to CBs if i can pay the due $3,587. I'm 100% sure they won't agree to it. But i will give it a shot. if not, i will leave this account as is knowing the fact that this account will have very less bearing on my Credit score over the period becuase all other Neg/Deliqs are gone and my payment history (15+ months ) is running exceptional at the moment and will do go forward . What do you all suggest ?

10/20/19 EX: 671 TU: 665 EQ: 671

11/07/19 EX: 676 TU: 673 EQ: 676

12/31/19 EX: 669 TU: 679 EQ: 673

01/06/20 EX: 670 TU: 682 EQ: 682

Paid Charge off to $0 in Dec 2019, reported Jan 2020

01/15/20 EX: 666 TU: 655 EQ: 660

02/07/20 EX: 676 TU: 668 EQ: 668

05/08/20 EX: 685 TU: 685 EQ: 682

05/18/20 EX: 690 TU: 685 EQ: 682

03/16/21 EX: 702 TU: 697 EQ: 700

04/20/21 EX: 705 TU: 700 EQ: 702

04/19/22 EX: 716 TU: 705 EQ: 716

Mortgage Middle Score 682 (Old)

Mortgage Middle Score 706 (New)