- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Don't get discouraged! +270pts gained to 850!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Don't get discouraged! +270pts gained to 850!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Dont get discouraged! +140pts gained!

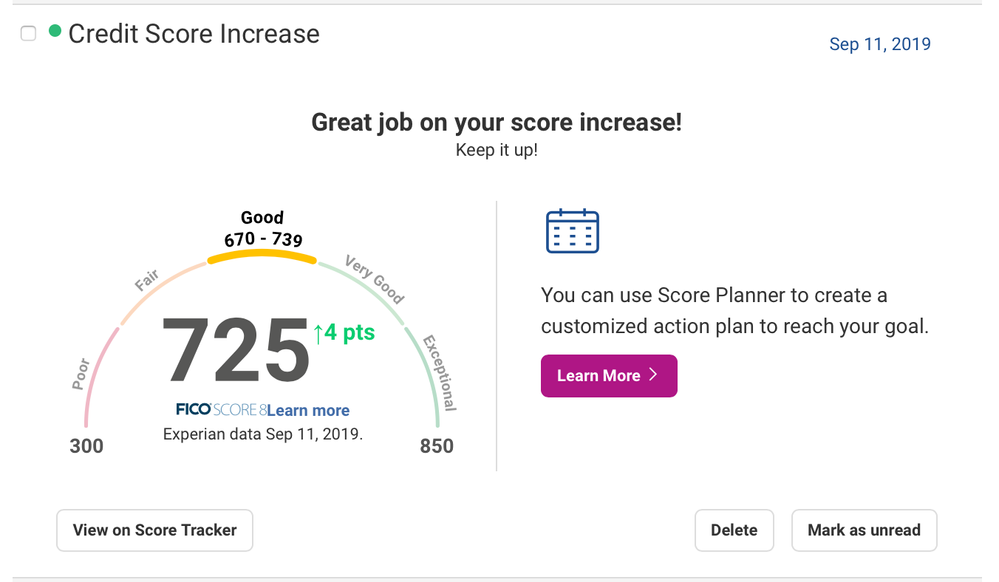

Five days later it goes to 725. No mayor changes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Dont get discouraged! +140pts gained!

On this one, I posted in another thread. Score up after 39 months?

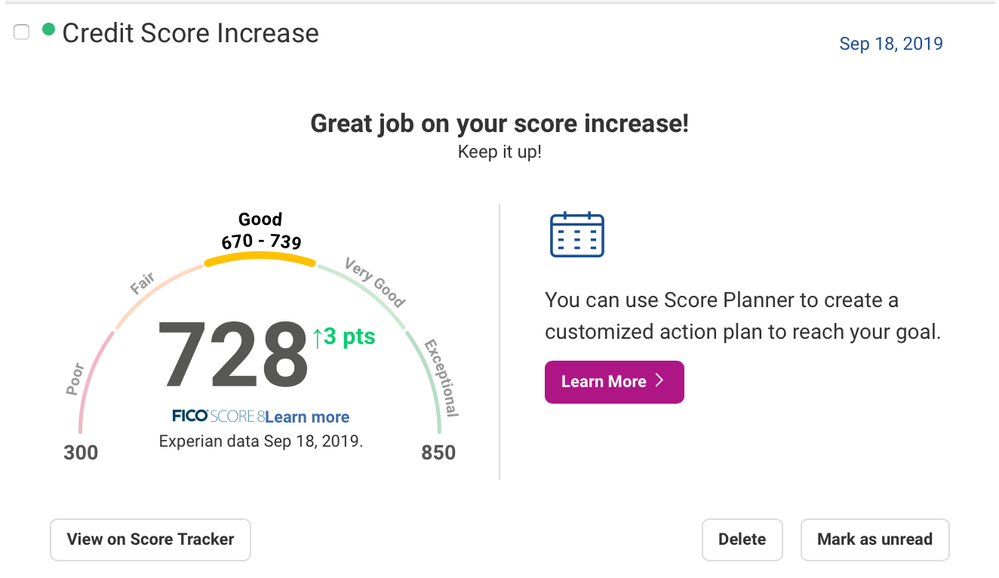

Got a notification from Credit Karma "You've made 39 consecutive payments on your ***** Card". Now, I only use CK to monitor my EQ and TU reports and didnt pay much attention to this. But then CK went up 14pts. So I got curious and checked my FICO scores and they went up 3pts.

Seems to be related to specific threadholds, I might have reached one of those.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Dont get discouraged! +140pts gained!

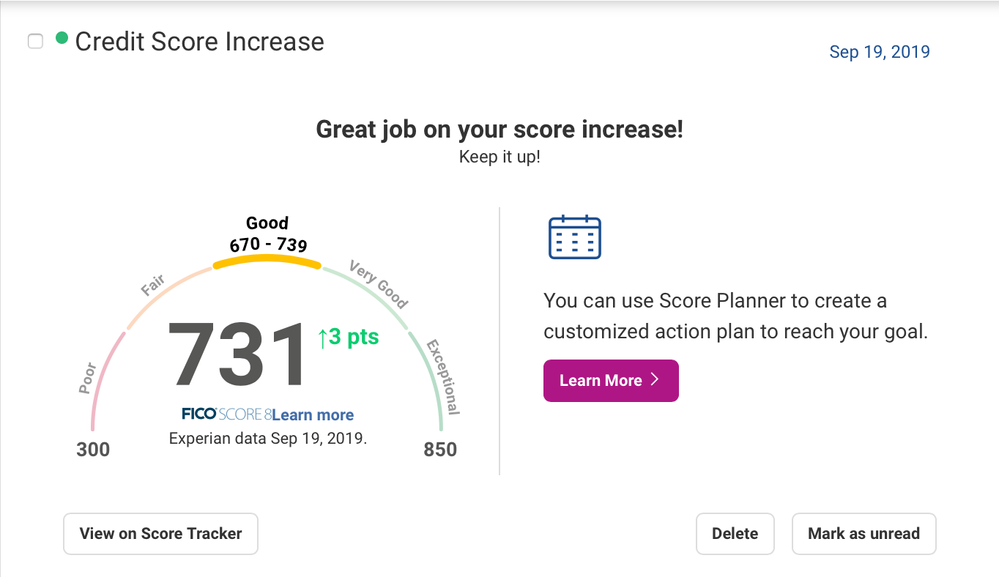

And finally, two days ago I disputed my Capital One account with Experian since they had it listed as "Potentially negative" when its a 100% positive tradeline. Experian concluded the investigation last night, and woke up with another 3pts! woot woot!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Dont get discouraged! +140pts gained!

Awesome progress.

Regarding your last post, seems odd to me that you ‘only’ Got a 4 pmts gain from the correction to your tradeline that modify it from Derog to Positive. Depending on what was being reported to cause that categorization I would Expect a higher point gain!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Dont get discouraged! +140pts gained!

Nice work, appreciate the share!

Question on your collection accounts and disputing them as i have (3) collection accounts over 2 years old so they don't show as collections anymore but they do show as negative.

they are legit and my own fault for defaulting; i haven't see anything in the forums on disputing something like that but just possibly paying them off for a correction on your report is all. most often say not to even pay them off and just leave them since they're greater than 2 years.

just curios to get your opinion since you've proactively disputed - appreciate any thoughts thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Dont get discouraged! +140pts gained!

@Anonymous wrote:Nice work, appreciate the share!

Question on your collection accounts and disputing them as i have (3) collection accounts over 2 years old so they don't show as collections anymore but they do show as negative.

I'm assuming you're talking about your Chase and Amex accounts. They are in collections, either internal (Amex) and between different collection agencies and/or Chase internal collections. Just because there is no separate reporting, it does not mean it's not in collections.

they are legit and my own fault for defaulting; i haven't see anything in the forums on disputing something like that but just possibly paying them off for a correction on your report is all. most often say not to even pay them off and just leave them since they're greater than 2 years.

You wont see anything because disputing correct info leads to credit disasters. Dispute results in validation and score drops again. I dont know why you think 2 year is some magic cut off. That's usually when they start preparing for litigation in some cases. You still have 5 years with those accounts. I suggest you do everything you can to pay them off instead wasting money on TLs you mentioned in your other thread

just curios to get your opinion since you've proactively disputed - appreciate any thoughts thanks!

OP did not dispute correct info, only incorrect. In your case, that's not applicable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Dont get discouraged! +140pts gained!

@Anonymous wrote:Nice work, appreciate the share!

Question on your collection accounts and disputing them as i have (3) collection accounts over 2 years old so they don't show as collections anymore but they do show as negative.

they are legit and my own fault for defaulting; i haven't see anything in the forums on disputing something like that but just possibly paying them off for a correction on your report is all. most often say not to even pay them off and just leave them since they're greater than 2 years.

just curios to get your opinion since you've proactively disputed - appreciate any thoughts thanks!

1. Never dispute information as "not mine".

2. Never dispute information that is reporting correctly.

Now, from my point of view, and according to the FCRA, your credit should be reporting information that is 1. Accurate 2. Verifiable 3. Complete. Based on that, I never move away from an account just because "it's mine". Even if it is mine, it is my right under federal protection that the information is disputing accurately.

In my specific case, I had 2 collections. One was reporting as a loan, with an open balance, terms, etc which constitutes multiple violations and the CA was not able to verify the debt, did not respond to my notice requesting a reinvestigation, so they had 6-7 violations. I notified the creditor and send them copies of all the documentation proving the violations and they removed it after that.

My other collection was a breach of contract. I agreed to a settlement and they agreed to mark the account as "paid in full". They then reported a pending balance and will not update even thought I requested verification, sent multiples letters, etc so I had them on multiple violations. They did not remove the charge off, it is still in my credit, but it has been marked as paid and the payment history removed.

Just understand your rights, follow the law, and honestly, pay what you owe. I paid my accounts because you know what? They are mine and I owed the money, but I still made sure all the information on my credit is complete, accurate & verifiable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Dont get discouraged! +140pts gained!

@Aspireto850 wrote:

@creditnoob,

Awesome progress.

Regarding your last post, seems odd to me that you ‘only’ Got a 4 pmts gain from the correction to your tradeline that modify it from Derog to Positive. Depending on what was being reported to cause that categorization I would Expect a higher point gain!

For some reason Experian had it under "Potentially negative" under their 'Dispute Center', so I dispute it as "This account is positive and its currently showing as potentially negative. Just got the paper report and it has a 30 days late from Dec 2012 that was removed and marked as "ND". Im guessing they tried to verify it and capital one couldnt? Not sure. I`ll take the 4pts though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Dont get discouraged! +140pts gained!

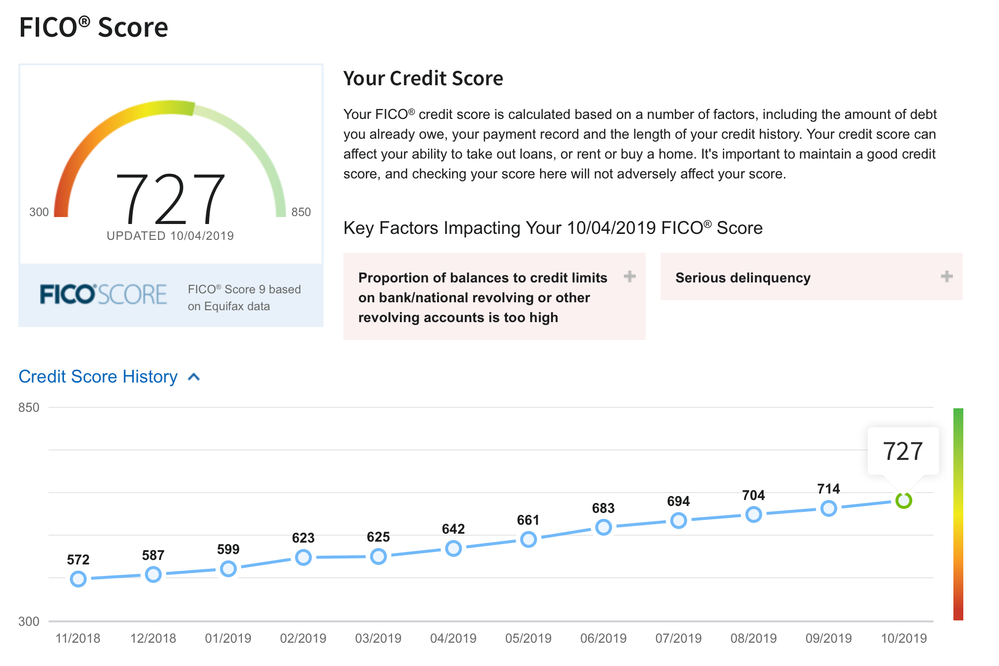

October Update: EQ FICO 09 +13pts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Dont get discouraged! +140pts gained!

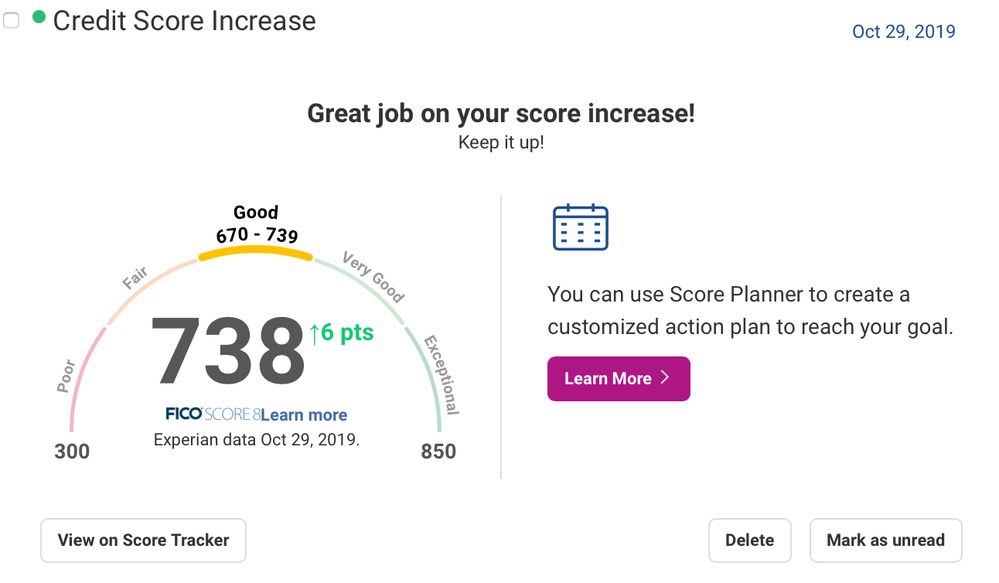

October FICO 08 Update: EX +7pts. Two new tradelines and some CLIs reporting dropped UT to 27% from +30%. Almost reaching my goal! The simulator showd 735 from 731 with a new $25000 tradelines. Counting in the new payments made on the CCs that's probably why it's a bit higher. Still have a chargeoff reporting. Looking to get that removed.