- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Drop off from report

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Drop off from report

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Drop off from report

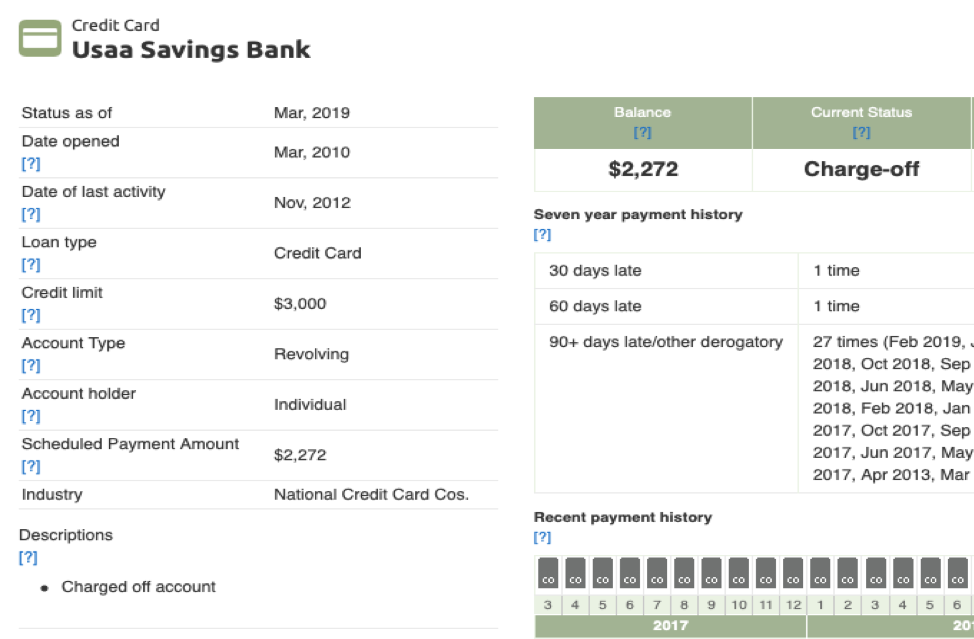

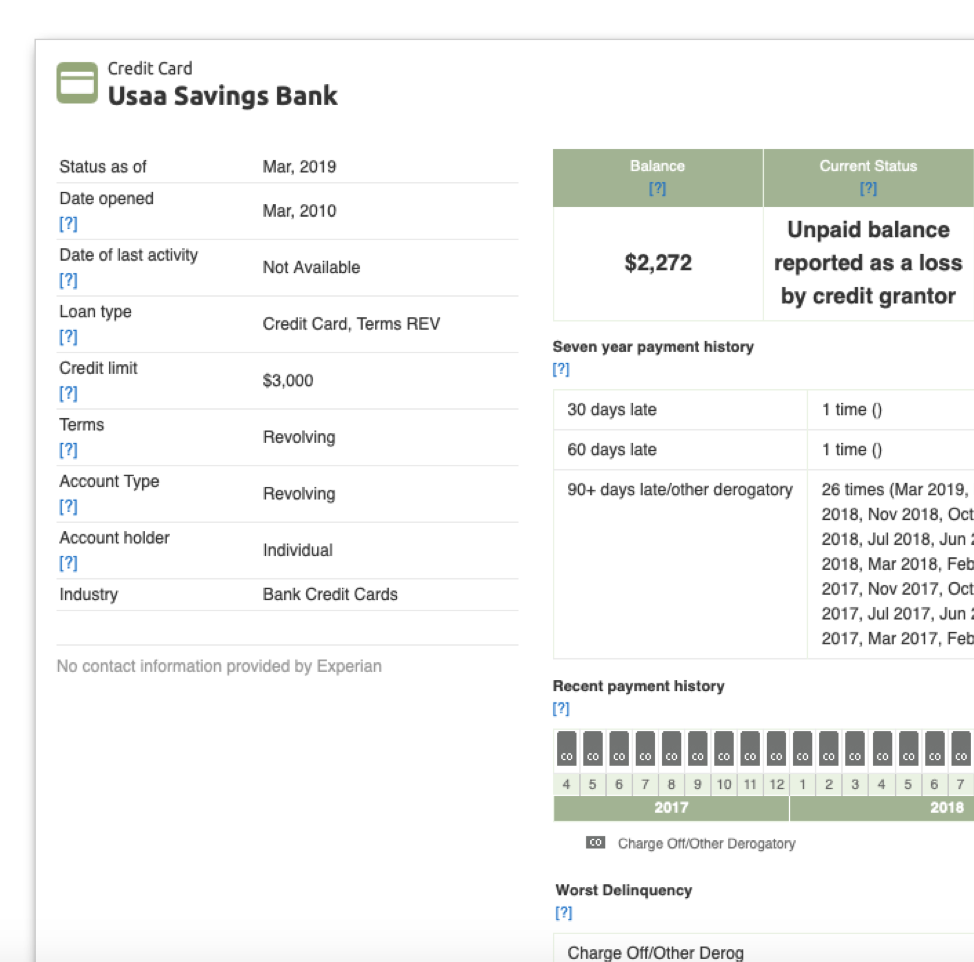

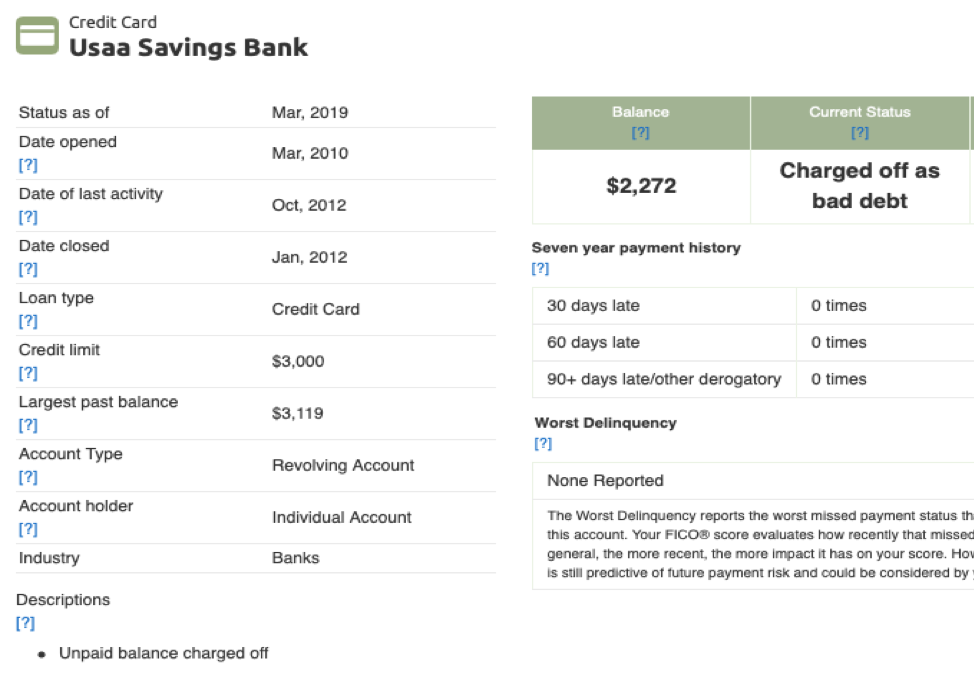

I am in need of some guidance from the experts in the community. I have an account that has been charged off but I am unable to decipher when it is due to fall off of my credit reports. I have done some research and have read that USAA typically doesn't accept a "Pay for Delete" since I was pondering this option as well. Funny thing is that I only have 3 accounts (NFCU CC, NFCU LOC, Military Star Card) and I opted to open up another account (apparently 5 accounts are recommended) and NFCU gave me a CC at 25k credit limit. Nevertheless, I am interested in having this account off of my reports. Thank You in advance!

open

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Drop off from report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Drop off from report

As stated by gdale, you need to know the DOFD that applies to the charge-off.

For various reasons, you cannot rely upon a payment history profile listing of derogs to determine the DOFD.

Each time a delinquent account is returned to good-standing, a new DOFD then applies once the account once again becomes delinquent and then is subject to charged off.

You need to know the date of the first delinquency in the chain of consecutive delinquencies that included their taking of the charge-off.

The required exclusion date is then no later than 7 years plus 180 days after that DOFD.

While many commercial credit reports choose not to show the DOFD, creditors are required under FCRA 623(a)(5) to separately and explicitly report the DOFD no later than 90 days after they have reported a charge-off, so it will be in your credit file.

You can usually see the reported DOFD by obtaining a copy of your credit report from annualcreditreport.com.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Drop off from report

Sir,

Thank you for your reply and information. I will be requesting my free credit report soon(pending some dispute updates) and will definitely look for that date and revisit this thread for additional guidance if needed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Drop off from report

A couple things to note - the bureaus each offer Early Exclusion upon request. TU will exclude 6 months early, EX does it 3 months early, and EQ will do it 30 days early (although EQ has been such a pain for many people that I’d say just let it ride that last month and fall off naturally). Therefore if you have a debt that would age off naturally as of 12/2019, you could request that it be removed from TU as of 6/2019, EX as of 9/2019, and EQ 11/2019.

Second, if you happen to live in NY, the purge law here allows exclusion after 5 years naturally, rather than 7 in the rest of the country.

Good luck with this and hopefully this helps!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Drop off from report

ImTheDevil,

I appreciate the gouge and plan on following your advice and asking for an Early Exclusion. I assume that you submit this via a formal letter or could you elaborate on this? I am going to search for Early Exclusion on the forum and see what I find. Thank You once again for the feedback!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Drop off from report

Early exclusion is great but it can also spectacularly backfire. I'd be very cautious if requesting one. I suggest you search for those stories, too

I am really not sure if removing something one to six months early is worth all the problems it may cause

Here is one example https://ficoforums.myfico.com/t5/Rebuilding-Your-Credit/So-irritated-with-Experian-EE-mess/m-p/55686...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Drop off from report

SSgt, all I did was get the account number from my reports, call in, and tell them “I’m calling to request an early exclusion and I understand that it has to be done at the supervisor level. Could you please transfer me?” 5-7 min later I was off the phone and the derog was wiped.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Drop off from report

Be sure to get your reports via US Mail they will show the DoFD and scheduled exclusion date over online reports

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Drop off from report

Back to provide updates since I was able to call today:

Transunion: Removed two accounts via early exclusion (one was chargeoff due to fall off Oct '19 and other was a collection due to fall off May '19)

Experian: Removes one account via early exclusion (Collection due to fall off May '19). Verified chargeoff acct due to fall off Sep '19 so will call back June '19)

Equifax: They had problems verifying my identity so I have to fax over documents to them although from what I read, they are very strict on early exclusions.