- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Experian Paid Collections / Charge Off Question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Experian Paid Collections / Charge Off Question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Paid Collections / Charge Off Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Paid Collections / Charge Off Question

@Anonymous wrote:

Yes, sorry this post has gotten out of hand and we've forgotten the original issue. But in summary, it was always a derogatory account but had come out if collection. It was showing a missed payment (or Experian was reading something as a missed payment). Which was translating to a "recent delinquency" on my credit report.

Something has changed today after my dispute updated so I'll report back in a couple days when the dust settles.

Any updates?

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 5.23, EX: 812 / EQ: 825 / TU: 815

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Paid Collections / Charge Off Question

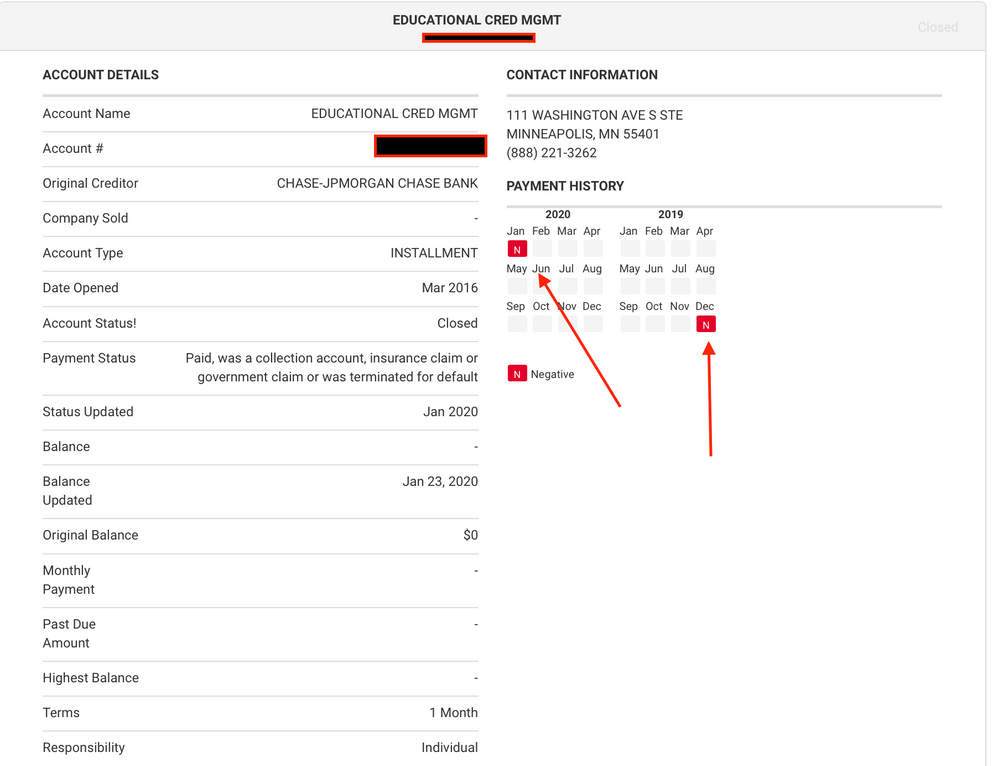

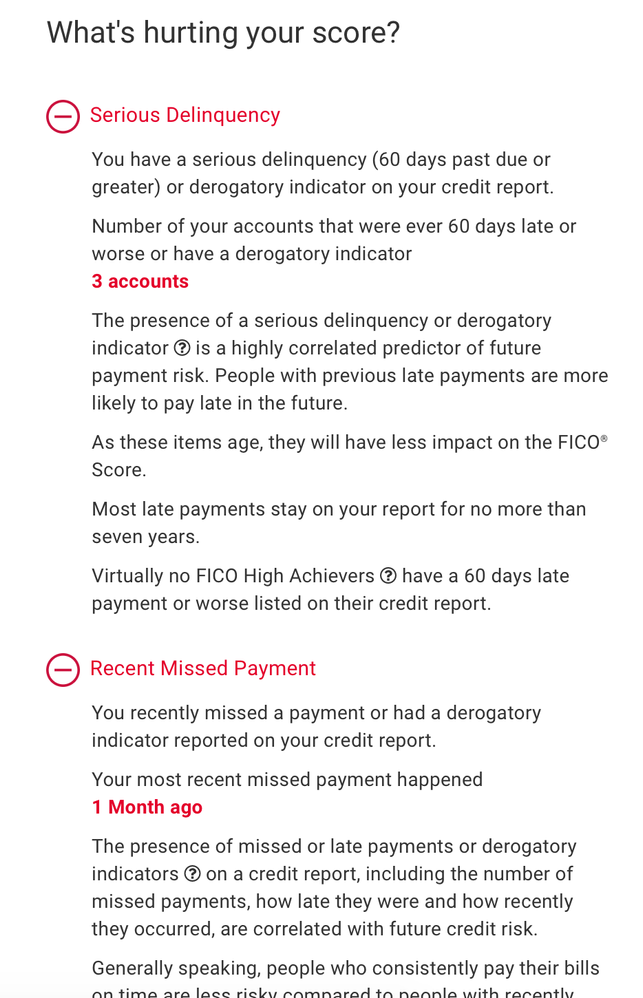

Yes. And I am concerned and confused. (I can post photos now so here are some snapshots). My credit score went up 4 points (660 > 664) and is holding. But after the dispute closed, I now have an N next to the 2 ECMC accounts for Dec and Jan (this is when I did the disputes). They both look the same so I am posting 1 from the hard report from Experian as of today.

Additionally. In the "What's hurting your score" section in the report all the way at the bottom, I see 3 delinquencies (which I am assuming are 1 CapOne account from 2013 which had 5 late payments that is about to fall off this March and then 2 of these ECMC accounts). What is most concerning is that it also reads that my most recent missed payment was 1 month ago. This account was not even open in Jan of 2020.

FACT: ECMC said that they dont report payment history. So what is this late payment? There is no way its any other account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Paid Collections / Charge Off Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Paid Collections / Charge Off Question

Well, something clearly isnt right here.

@sjt what do you think?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Paid Collections / Charge Off Question

This may have been the backlash from disputing accurate info. It can bite you and mess things up even more. If its still there next month. I'd file a complaint with the CFPB on the late that was posted after an account was closed. Stay away from the CRA's for now. Get you papers together to upload that shows when it was paid and the document that you just uploaded and let the CFPB have it. See what happens. I'll ping @RobertEG on what other steps to take when inaccurate info like this arises and what else can be done.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Paid Collections / Charge Off Question

But still, soemthing should be done here. ECMC claims they don't report payment history, they gave me the codes they do report. And I also believe them because I just found some more proof in my reports from months ago that no payment history was coming from them.

This has to do with how Experian is reading the results of the disputes and that's not correct. And with them, it's like talking to a wall. All they want to do is file more disputes (which will make stuff worst!)

This is pretty infuriating. Specially after paying the thing in full!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Paid Collections / Charge Off Question

Let ECMC handle it with the CFPB complaint. It is affecting them and the CRA's reporting inaccurate info. Even though it isnt really them. Maybe they can tell them to remove it and that they didnt authorize the CRA to report false info on their behalf. If that doesnt cut it once the CFPC responds. Then repeat the same process with EX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Paid Collections / Charge Off Question

And if Experian did it on their own that would be pretty crazy. Can you imagine a CRA putting It in black-and-white that they received an update in January when they did not?

I think a CFPB complaint is correct.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Paid Collections / Charge Off Question

ECMC said they only update 3 things.

If the account is current, if its closed and paid or if its in default and open. You can see from the screenshot that I posed that the same screen also says "you've made 100% of the payments on time for this account" or something like that in green. Also, TransUnion and Equifax dont see these updates even though theyve rec the date the same dates as Experian.

Something messed up when I did the 2 disputes with Experian. Whatever data ECMC is sending, Experian is reading as "N" and thinks im missing payments.

I will call ECMC tomorrow and get a super on the phone. I will explain this again and tell them that whatever updates they are sending, its taking me a step back and then I will tell them that if they dont delete the account completely, I have to get the CFPB involved.