- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: FCRA 623(a)(8) - right to dispute directly wit...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FCRA 623(a)(8) - right to dispute directly with furnisher - data share

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FCRA 623(a)(8) - right to dispute directly with furnisher - data share

After another round of rejections on GW removal on my student loan defaults, despite that there are multiple inaccuracies and double the number of tradelines there should be, I think I have found a solution.

FCRA Section 623(a)(8) allows the consumer to follow up with the data furnisher if they believe that the previously disputed account is innacurate by requesting an investigation be done by the furnisher to prove the accuracy of what has been reported. Do this by mail, and send it certified USPS.

The furnisher has 30 days to conduct and complete an investigation and notify the consumer of the results, similar to a dispute with the credit bureaus. If the furnisher does not comply, they are slapped with a $1000 fine and must remove the tradeline. If the furnisher finds the tradelines are inaccurate, they must update immediately, or again, be knocked with a fine and remove the tradeline.

If the furnisher responds that the tradeline is reported accuratately and you have proof it is inaccurate, you may now file a complaint and send an ITS letter with proof they are knowingly furnishing inaccurate information. You can offer to settle for a deletion.

Ultimately I'd like to have these tradelines removed, but updating them would cut the number from 9 lines to 4 and move the dofd back to 2012 from 2013, so even if they DO update them, it would be a win.

I am popping my request for an investigation in the mail in the morning and will keep this thread updated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FCRA 623(a)(8) - right to dispute directly with furnisher - data share

The direct dispute option under FCRA 623(a)(8) does not provide a second bite at the dispute apple.

If a consumer files a dispute with a CRA that is concluded, then a direct dispute that is substantially the same as the prior dispute filed with the CRA can be dismissed without any requirment to investigate as being "frivolous or irrelevant."

Stated differently, the consumer cannot compel the furnisher to conduct repeated investigation of the same issue.

When a dispute is filed with a CRA, the CRA is required to forward the dispute to the furnisher, and the furnisher is then requried to conduct a reasonable investigation and reply back to the CRA. The consumer cannot thereafter compel a second investigation of substantially the same issue by then filing a direct dispute.

See 16 CFR 660.4(f) for the implementing rule stating that a direct dispute that is substantially the same as a prior dispute filed with a CRA can be dismissed as frivolous or irrelevant without any requirement for investigation of the dispute.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FCRA 623(a)(8) - right to dispute directly with furnisher - data share

@RobertEG wrote:The direct dispute option under FCRA 623(a)(8) does not provide a second bite at the dispute apple.

If a consumer files a dispute with a CRA that is concluded, then a direct dispute that is substantially the same as the prior dispute filed with the CRA can be dismissed without any requirment to investigate as being "frivolous or irrelevant."

Stated differently, the consumer cannot compel the furnisher to conduct repeated investigation of the same issue.

When a dispute is filed with a CRA, the CRA is required to forward the dispute to the furnisher, and the furnisher is then requried to conduct a reasonable investigation and reply back to the CRA. The consumer cannot thereafter compel a second investigation of substantially the same issue by then filing a direct dispute.

See 16 CFR 660.4(f) for the implementing rule stating that a direct dispute that is substantially the same as a prior dispute filed with a CRA can be dismissed as frivolous or irrelevant without any requirement for investigation of the dispute.

Hi Robert, with all due respect, this is clearly about factually incorrect reportings that are being verified as accurate, despite the fact that records show that the tradelines are in fact inaccurate as described above.

Therefore the clause in the section you quoted, 660.4(f).b (with respect to which the person has already performed the person’s duties under this paragraph or subsection) is NOT satisfied, as there was no investigation done into the information to verify its accuracy the first time.

From my letter:

"Per FCRA Section 623(a)(8), I am formally requesting you conduct an investigation as to the accuracy of what has been furnished to the credit reporting agencies, and how these were verified in August of 2016."

As I said in my original post, there are 9 tradelines where there should be 4, and nearly all of the information contained in them is incorrect. The default date, the date of first deliquency, the amounts of the loans, and the month they were paid in full are also wrong. During my dispute with the credit bureaus, they only changed that they were unpaid to having been paid.

If they do respond that my request is frivilous, I will be following up the exact same way, because they have been knowingly furnishing inaccurate information since at least August 2016. I am certainly not going to be forced to deal with an extra year of these things sitting on my credit reports AND an extra 5 accounts that didn't ever exist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FCRA 623(a)(8) - right to dispute directly with furnisher - data share

Out of curiosity, is it possible that the "duplicate" tradelines are actually being reported by whoever purchased the debt from the original creditor?

For example, if you default on a $1,000 balance with Discover, they may charge it off. This is one tradeline. When they sell that debt to Midland Funding, the junk debt collector will create another tradeline - a collection account for $1,000. So for every default/charge off, you really COULD in theory have a second collection associated with it. The OC is accurately reporting that you defaulted, and the JDC is accurately reporting that you owe THEM money.

Now, if you have TWO tradelines from Discover for that same $1,000, that is definitely odd.

Would you mind giving us an example of a tradeline and its duplicate from your report?

NFCU MR: $25K | Venture: $21K | Amex ED: $18K | NFCU CR: $18K | Amex BCE: $15K | IT #1: $17.5K | PNC Core: $15K | PPMC: $12K | Wells Fargo: $11K | Savor: 12K | Cap1 QS: $8.5K | Barclays Rewards: $7.75K | IT #2: $7.3K | MLife: $9.5K | Sportsman's Guide: $8.7K | PenFed PR: $5.5K | Elan Plat: $2.3K | TRV: $3.6K | BotW: $3K

Current FICO 8 Scores: EQ: 828| TU: 805 | EX: 814

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FCRA 623(a)(8) - right to dispute directly with furnisher - data share

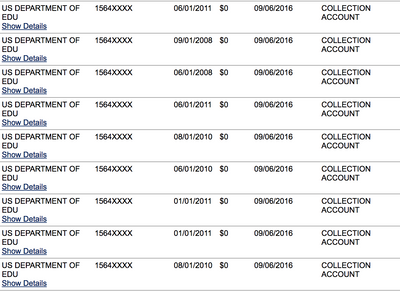

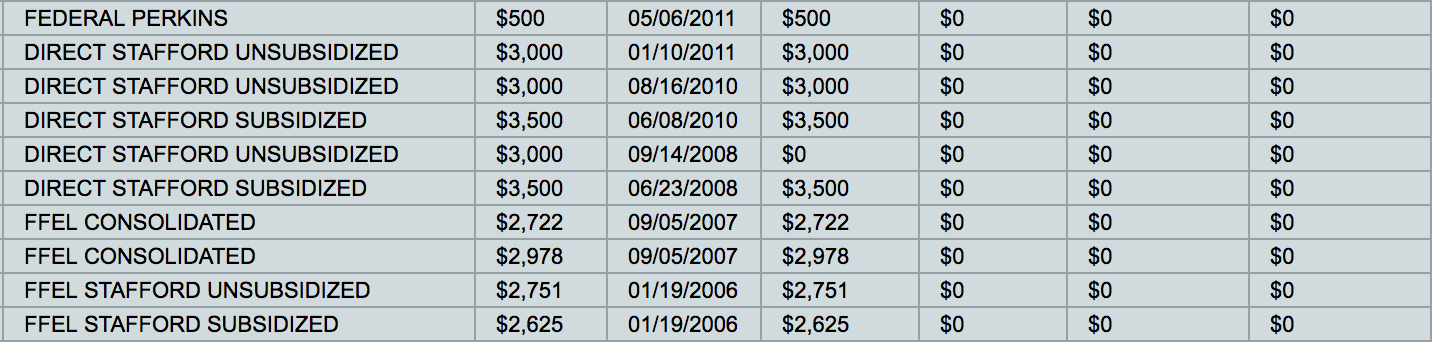

No, these are student loans. The collection accounts are all with the Department of Education, and because they are student loans guaranteed by the government from the same school, they all share the same account number, so there's no way to really tell how many there should be without looking directly at the NSLDS.

Also, these loans are all paid in full as of February of 2014.

^^ The 4 from 2008-2011 were the defaulted loans. As you can see a loan that wasn't even disbursed is also listed as a collection account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FCRA 623(a)(8) - right to dispute directly with furnisher - data share

When you filed a dispute with the CRA, they investigated and verified the accuracy back to the CRA.

You may differ as to their finding, but they did investigate and verify.

Direct disputes are limited to issues identified under 16 CFR 660.4(a), which include the terms of an account/debt, and the consumer's performance concerning the account.

The reasonableness of a prior investigation of a dispute filed with a CRA is not identified as a permissible basis for a direct dispute.

If you disagree with the outcome of the prior dispute, you have remedy either by way of a complaint with the CFPB or by bringing your own civil action under FCRA 623(c), which explicitly authorizes private civil action asserting lack of a reasonable investigation of a dispute filed with a CRA.

You are certainly welcome to file a direct dispute relating to reasonableness of their prior investigation, but in my opinion, that is not proper basis for a direct dispute based on either 16 CFR 660.4(a) as to substance, and 660.4(f) as to procedure, and can be dismissed without any requirment to investigate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FCRA 623(a)(8) - right to dispute directly with furnisher - data share

@RobertEG wrote:When you filed a dispute with the CRA, they investigated and verified the accuracy back to the CRA.

You may differ as to their finding, but they did investigate and verify.

Direct disputes are limited to issues identified under 16 CFR 660.4(a), which include the terms of an account/debt, and the consumer's performance concerning the account.

The reasonableness of a prior investigation of a dispute filed with a CRA is not identified as a permissible basis for a direct dispute.

If you disagree with the outcome of the prior dispute, you have remedy either by way of a complaint with the CFPB or by bringing your own civil action under FCRA 623(c), which explicitly authorizes private civil action asserting lack of a reasonable investigation of a dispute filed with a CRA.

You are certainly welcome to file a direct dispute relating to reasonableness of their prior investigation, but in my opinion, that is not proper basis for a direct dispute based on either 16 CFR 660.4(a) as to substance, and 660.4(f) as to procedure, and can be dismissed without any requirment to investigate.

That is really not possible. Everywhere the data is located is correct, EXCEPT the CRAs. There are 3 places this data is located: ACS (original accounts), NSLDS (FSA), and the Department of Education office. All three of these sources have the same truth. They all show 4 accounts, with the dates listed in the NSLDS, and that they defaulted in 10/2012, with the dofd of 9/2011, and paid in full in 2/2014. On my credit reports, they show there are 9 accounts, dofd in 3/2013, and defaulted in 10/2013, paid in full in 9/2016. The *only* pieces of accurate information are 4 of the accounts in questions, and that there is $0 due.

When I call and speak to them, they reiterate the information found in all three of these places. So if an investigation was done and the information in my credit report was verified as accurate, why doesn't it match their own data???

I'm not particularly interested in suing a government entity unless it's the absolute last resort.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FCRA 623(a)(8) - right to dispute directly with furnisher - data share

That is an argument for your brief if you pursue civil action or your complaint to the CFPB if you wish to contest the reasonbleness of the investigation conducted by the furnisher or the reinvestigation conducted by the CRA.

I am not arguing the merits of your case.

I am only opining that the direct dispute process is not now the avenue to pursue review of their determination.

The elected dispute process was to dispute via the CRA, in which the furnisher already conducted their investigation.

Your avenue now is to contest the reasonableness of that dispute resolution, which is not via a direct dispute.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FCRA 623(a)(8) - right to dispute directly with furnisher - data share

@RobertEG wrote:That is an argument for your brief if you pursue civil action or your complaint to the CFPB if you wish to contest the reasonbleness of the investigation conducted by the furnisher or the reinvestigation conducted by the CRA.

I am not arguing the merits of your case.

I am only opining that the direct dispute process is not now the avenue to pursue review of their determination.

The elected dispute process was to dispute via the CRA, in which the furnisher already conducted their investigation.

Your avenue now is to contest the reasonableness of that dispute resolution, which is not via a direct dispute.

According to the laws as I have read them, this is merely me asking for proof that they investigated the accuracy of what was being reported in the first place, and giving them the opportunity to correct the information as I can clearly see that it is incorrect.

I'm not a huge fan of civil action, and I'd rather get the proof now or just get it correct swiftly.

A company essentially stole $1400 from me last year and I'm still waiting on the AG for action against them to get my money back and have only gotten the "we got your complaint!" letter.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FCRA 623(a)(8) - right to dispute directly with furnisher - data share

FCRA 611(6)(B)(iii) and 611(7) permits a consumer to request a description of the procedure used by a CRA in their investigation of a dispute, such as the name of the furnishers that they referred a copy of the dispute to and/or responded back to the CRA. That is typically called a Method of Verification (MOV) request.

You can make such a request to the CRA if you wish to obtain their statement of the procedure used to verify the dispute filed with them.

That might be a step to now take if you contest the reasonableness of the reinvestigation by the CRA.

There is no equivalent procedure for an MOV request under the direct dispute process, as the dispute is directly investigated by them, and not referred by a CRA.