- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Frustrated and could really use some guidance!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Frustrated and could really use some guidance!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustrated and could really use some guidance!

@Anonymous wrote:

@RobertEG wrote:In order to dispute, you must identify a specific, actual inaccuracy in information that has been reported to the CRA.

What is the asserted inaccuracy in reporting that would be the basis for your dispute?

Additionally, a dispute is limited only to the verification, correction, or possible deletion, of the specific information that is subject of the dispute. Finding some inaccuracy in reporting will only lead to the correction or deletion of that information, and will not compel deletion of the entire collection unless the basis for the dispute is that the debt is not legitimate.

The inaccurracy is that the collections is over 5 years old and they're reporting as if it's only 2 months old.

I'd be willing to bet that the date you are seeing is simply the date the CA updated/added their account on your CR. The DOFD should not change and is not not found on credit reporting sites like Credit Karma or even myFICO, I think. To get the DOFD on an account, you'd need to inquire directly of the CRA (or look at copies of old reports if you have them).

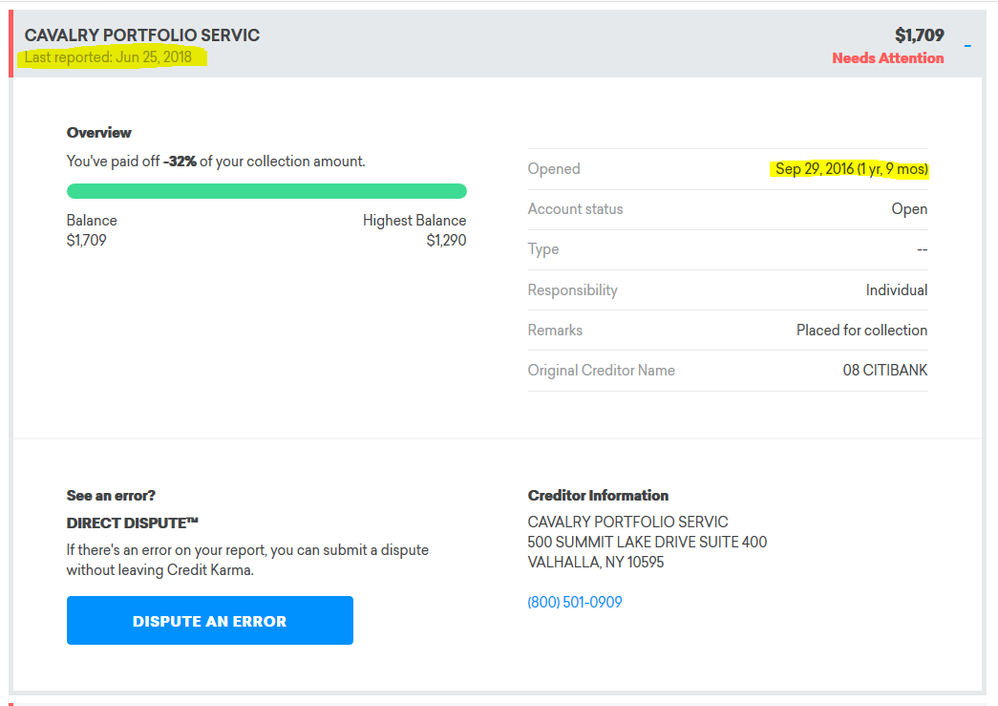

Using an example from my own collections with a screenshot from my CK account:

Cavalry Portfolio Services received collection authority over my Citibank account on 9/29/2016 and last updated the account on 6/25/2018. Neither of these changes to my CR affect the DOFD which is June 2013. Cavalry was simply updating that the account continues to remain delinquent. This is perfectly legal and in line with CRA reporting guidelines. While their continued updating of the account does not change the DOFD, it does keep my score depressed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustrated and could really use some guidance!

It disappeared off my credit report completely for two months and then reappeared under a new collector and with a new open date and now it's bringing my score down nearly 100 points. So yah the date definitely has to be wrong. My credit report sees it as if it's brand new, and it isn't.

To update everyone. I filed the disputes. With transition I went with what one of the members up above recommended and simply said I have no knowledge of any accounts in collections in early 2018.

The other two I disputed the time line and dates.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustrated and could really use some guidance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustrated and could really use some guidance!

If the account is accurate and the debt is indeed yours I wouldn't dispute it. You're not suppose to dispute accurate information and doing so would probably annoy them. Instead, I would offer a PFD. They are not required to accept your PFD offer but they'd probably be more amenable to accept if you don't annoy them with a frivolous dispute.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustrated and could really use some guidance!

How is it dropping my score by 100 points when before it was bought out it was only lowering it by maybe 20?

When it was on my credit report as 11 Charter Communtions and an open date of 01/2013 it barely effected my score.

Now all of a sudden it's bought by a different CA and the date is different and I'm seeing a 100 point drop. All other variables the same. Can you explain that? That's the part I'm having the most trouble with. How can one account drop your score 100 points.. **bleep**. All for 380 bucks that's almost six years old. That's why I'm saying something had to of changed with the account when it was rebought.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Frustrated and could really use some guidance!

@Anonymous wrote:

Well it is accurate, it is my debt, but I still don't believe the time line is correct.

How is it dropping my score by 100 points when before it was bought out it was only lowering it by maybe 20?

When it was on my credit report as 11 Charter Communtions and an open date of 01/2013 it barely effected my score.

Now all of a sudden it's bought by a different CA and the date is different and I'm seeing a 100 point drop. All other variables the same. Can you explain that? That's the part I'm having the most trouble with. How can one account drop your score 100 points.. **bleep**. All for 380 bucks that's almost six years old. That's why I'm saying something had to of changed with the account when it was rebought.

As I mentioned in a previous reply, CAs are permitted to regularly update a collections account on a CR, even if nothing has changed. They are simply updating that the account remains delinquent. This is what keeps scores with collections depressed. Sometimes though, CAs stop updating even if an account remains unpaid. When a CA stops reporting the last update of the collection ages and this aging of the collection allows a credit score to increase.

I assume that Charter Communications had stopped updating your account which allowed your score to increase as the delinquency aged. When the new CA bought/was assigned the account, it is reported as a new collection which will drastically lower your score if a deliquency hadn't been reported for an extended period of time. Reporting of the new account does not change the DOFD, the expiration of the SOL, or when the account will fall of your reports.