- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Help Dealing With Portfolio Recovery

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help Dealing With Portfolio Recovery

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help Dealing With Portfolio Recovery

I got an alert on my Experian credit monitoring service this morning that a new collection was added to my report. Turns out its Portfolio for a Cap One charge off thats been deleted for a while off my reports. I email them a pfd for 40% of original balance immediately. I also state that by me offering a settlement Im not acknowledging the debt & retain my right to ask for verification & validation at a later time if need be.

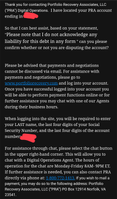

Attached is their response. Wondering how should I go about this now. Should I mail them a letter instead?? Im thinking bout calling as well but not too sure of my negotiating skills & not trying to get caught up with "trick" questions & possibly make matters worse for myself. Any thoughts & input is greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Dealing With Portfolio Recovery

@Anonymous wrote:I got an alert on my Experian credit monitoring service this morning that a new collection was added to my report. Turns out its Portfolio for a Cap One charge off thats been deleted for a while off my reports. I email them a pfd for 40% of original balance immediately. I also state that by me offering a settlement Im not acknowledging the debt & retain my right to ask for verification & validation at a later time if need be.

Attached is their response. Wondering how should I go about this now. Should I mail them a letter instead?? Im thinking bout calling as well but not too sure of my negotiating skills & not trying to get caught up with "trick" questions & possibly make matters worse for myself. Any thoughts & input is greatly appreciated.

Call them with your offer for PFD. Asked for it in writing. They will tell you that they cannot email or send via standard mail, but may be able to fax. (they do this a lot, because they know a lot of people don't have a fax number). Get a fax number before you call. Check these boards and Google re experiences w them as well. I have had a collection with them, and they removed the item as per the PFD agreement.

Don't send template emails acknowleging what your rights are and what you are not "admitting to" etc. Keep it simple and civil, otherwise it muddies things up. You want; 1. them to accept your offer 2. confirm PFD in writing before you pay 3. removal of the collection item from your reports.

I am not sure that they will accept 40% unless you have an idea of what they will accept nowadays. Give yourself room and when you call tell them you can pay $___ now if they can fax the PFD letter. (don't tell them you have a fax number; wait until they say, "we can't email or mail the PFD...do you have a fax number???" You can really get inexpensive secure faxing services online w a monthly fee.

Good luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Dealing With Portfolio Recovery

Portfolio was super easy to deal with when I had a CA with them. As recommended above, I just called, politely talked about what I could pay. They wanted around 70%. I was honest and said I could only pay 30%. We agreed on around 40% and I set up a 3 month payment plan with them. They updated monthly that the balance went down. After final payment they marked it at $0 left. About 3 weeks later the tradeline was deleted. I asked for them to mail me a payment arrangement letter, which they did. Painless, to be honest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Dealing With Portfolio Recovery

Their FAQs state that they will delete the account once it's closed. As long as the original account is older than 2 years, you're fine. Pay them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Dealing With Portfolio Recovery

@Brian_Earl_SpilnerGot them backwards. Its Midland that has the 2 yr deal. PRA doesnt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Dealing With Portfolio Recovery

@FireMedic1 wrote:@Brian_Earl_SpilnerGot them backwards. Its Midland that has the 2 yr deal. PRA doesnt.

Yup, you're right. Midland requires the debt to be 2 years old. PRA deletes it once it's paid regardless.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Dealing With Portfolio Recovery

Thank you guys for the responses. Called them this morning & it was alot easier than I expected. Ended up paying around 55% of the original balance but its fine with me seeing as I was willing to pay 60% from the start. My original 40% was just a lowball offer to see if theyd bite.

Once we agreed on the amount & the terms & I told them I was ready to pay asap they were willing to email the pfd agreement with me waiting on the line. Once I received it & verified, I payed & the lady said if after 30 days its still on my report to call them back & see whats going on but that she was certain I wouldnt be calling back. 30 days cant come soon enough!! Lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Dealing With Portfolio Recovery

Congrats. I think it took about 2-3 weeks for me. The settlement payment updated in a day or two. Then it disappeared a couple of weeks later.