- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Help Rebuilding Credit (FICO UPDATE, OCT)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help Rebuilding Credit (FICO UPDATE, OCT)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help Rebuilding Credit (FICO UPDATE, OCT)

Hello,

I once had good credit, I was paying my bills on time, opening cards... Eventually getting my first Amex Blue Cash Everyday with a 2k starting limit. While opening all these cards and using them a small amount worked for awhile, I got myself into trouble at the very end of 2015, early 2016.

I have been in college 2 years, however, I unenrolled this semester so I can get my financial situation in order, working a full-time factory job, 7 days a week.

So, what happened is hard to explain in full detail so here is the breakdown:

1. I was only able to find a work-study job that paid 7.25 hr, only able to get 8 hours a week. *this was fine for some time, I was able to pay my bills I needed*

2. My 2nd year of uni, dorm prices spiked, tuition spiked, campus food plans spiked (already paying out of state tuition, stuck in final year of campus housing contract). Had trouble attaining any scholarships.

3. Ran out of meals as I had to lower my meal plan to afford attending.

4. Started using CC's to be able to eat.

5. Used my card to catch up on tuition payments not covered by aid (could not get a cosigner; no one in my family has good credit)

7. Bought a laptop on Amazon for my hobby of music production (ended up selling it recently to pay off some debt).

8. Managed to pay min on all cards for some time, then I gave up as they reached a point I could no longer afford.

9. Considered bankruptcy (decided not to).

Now here I am: Months of late payments stuck on my report, managed to arrange payments to remove collection accounts, but, the late payment history is still hurting me bad. Still playing catch up on Amex, and others.

I called Lexington Law on the 16th to see if they could help. I paid 14.99 for the credit report and am deciding to pay the $99 on the 1st of Oct.. but I am thinking now it is best not to, and to just get help here. I figure, I can write GW letters, etc on my own.. and pay off my debt faster.

I got denied a personal loan from Navy Federal (due to late payment history with creditors..), which I was going to use to pay off my Amex and catch up with that as Nationwide Credit is collecting on their behalf, charging me late fees even on a payment plan... (Amex said they can do nothing to help).

I need help and am unsure where to go from here. I have a busy work schedule, but am willing to put in the time that I can.

Lexington Law Credit Report Score: 531

*You currently have 3 NEGATIVE ITEMS affecting your credit score.*

| Accounts | 14 | Collection Accounts | 0 |

| Installment Accounts | 7 | Public Records | 0 |

| Revolving Accounts | 7 | Derogatory Accounts | 5 |

| Mortgage Accounts | 0 | Derogatory Historical Items | 18 |

| Credit Lines | 0 | Revolving Balances | $123.00 |

| Open Accounts | 0 | Revolving limits | $500.00 |

| Unspecified Accounts | 0 | Utilization Ratio | 24.60% |

| Inquiries | 16 |

My Discover CC ($500) is the only card that I was always on time with, but they suspended my use due to past delinquencies with other cards (they will review my credit every month till I can use it again). My Discover is less than $40 balance (not updated till end of this month on CR).

5 Negative Accounts (accross all 3 agencies)

Account Type Date Open

| AMERICAN EXPRESS | 120+day Late Payment | Jan, 2015 | |

| CAPITAL ONE BANK USA NA | Charge Off | Jan, 2015 | |

| NAVY FEDERAL CR UN | 120+day Late Payment | Jan, 2015 | |

| SYNCB/AMAZON PLCC | 90-day Late Payment | Jan, 2015 | |

| SYNCB/WAL-MART | Charge Off | Jan, 2015 |

9 Positive Accounts

| DEPT OF ED / NELNET | Positive Installment | Sep, 2014 | |

| DEPT OF ED / NELNET | Positive Installment | Feb, 2016 | |

| DEPT OF ED / NELNET | Positive Installment | Sep, 2015 | |

| DEPT OF ED / NELNET | Positive Installment | Sep, 2015 | |

| DEPT OF ED / NELNET | Positive Installment | Sep, 2014 | |

| DEPT OF ED / NELNET | Positive Installment | Sep, 2014 | |

| DISCOVER FINCL SVC LLC | Positive Revolving | Jun, 2014 | |

| ------- UNIV OF PA | Positive Installment | Aug, 2014 | |

| SYNCB/WAL-MART *Walmart reported card twice, this $0* | Positive Revolving | Jan, 2015 |

*------- hid school name for privacy

Thank you in advance..!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit (Debating Lexington Law)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit (Debating Lexington Law)

Oops didn't see the dropdown didn't paste in.

Amex:

$2376.00

Cap 1:

$2306.00

Navy Fed:

$440

Amazon:

$2015.00

Walmart:

Negociated: $500 (800 on report, till pay off deal next month)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit (Debating Lexington Law)

Negotiated*^

Anyone have any tips on my next steps? Maybe GW letters...? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit (Debating Lexington Law)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit (Debating Lexington Law)

Save your money and dig into Goodwill letters when you can. Use this forum, set aside one day a week (or part of one day), and just hammer away at it. You can do it! And save yourself the money that you would have put into Lexington, use that money for this debt.

You can fix this.. on your own. Use this forum, all the tips, and just work at it week by week.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit (Debating Lexington Law)

Thanks righthererightnow!

I sent 1 GW to Navy Federal so far and 1 PFD to Walmart collector (Firstsource Advantage) (looking at templates on this forum and changing it to fit my reasons).

I will start sending more GW's and getting everything back in order using these forums as my resource.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit (Debating Lexington Law)

Would it be wise to get a secured card for now? My Discover is in good standing, but they put my spending on hold due to them getting nervous due to missing payments in the past with other creditors... (with good reason).

They said they will review my CR monthly and reinstate it when they can.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit (Debating Lexington Law)

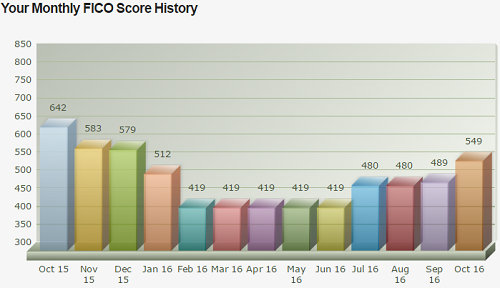

UPDATE 10/14/2016:

I started rebuilding around end of June, beginning of July and just got my latest FICO score from PSECU, and, I wanted to post the graph to show my progress!

I'm very proud of the progress of recovery and I can now see the light at the end of the tunnel!