- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Help Rebuilding Credit

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help Rebuilding Credit

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit

FAKO scores don't matter, so don't try to guess why they change.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit

Update for today:

So, I called Holloway Credit and paid the $77 and $74 to have them removed from my credit report. Also, I called Medical Data Services and paid the $815 in full. They said they would mark it PAID IN FULL, but that they do not delete the items. I will try some GW letters in a month or so to try and get it taken off. So, the only things still lingering as negative are the Credit One Bank charge off, and the Marks & Morgan charge off. How should I handle the M&M? I paid the bill in full to C&E Acquisitions a few years ago, and they removed their tradeline, but Marks & Morgan is still showing it as Charged Off with a balance of $0, Sold to CA. I disputed this back in 2015 to try and have it removed, but it just caused them to update for Nov. 2015. The DOFD is Oct. 2011, so it's set to come off next year, but I'd like it removed now. What steps should I take in getting that removed? I've tried calling M&M, but I can't get past their automated system because I don't have an account number or anything with them. Also, on the Credit One Bank, I emailed the CEO trying to work something out for that charge off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit

You are going in the right direction. The hardest part is being patient.

To get your actual FICO score - go to Experian $1 trial and get all your reports. You can also get your actual report(s) depending which product you chose from myfico, too.

This gives you a basis to know how you are growing. CK is good info for quickly seeing what's being reported, but their scores are not accurate and the cards they recommend is marketing. YMMV there!

3/16/18 FICO9 TU-700 EQ-669 EX-716

6/26/18 FICO9 TU-750, EQ-672, EX-789

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit

@SomewhereIn505 wrote:You are going in the right direction. The hardest part is being patient.

To get your actual FICO score - go to Experian $1 trial and get all your reports. You can also get your actual report(s) depending which product you chose from myfico, too.

This gives you a basis to know how you are growing. CK is good info for quickly seeing what's being reported, but their scores are not accurate and the cards they recommend is marketing. YMMV there!

I've tried going to places and getting my FICO score, but it tells me it can't calculate them due to my credit report being too thin. Not enough open accounts, etc. Believe me, I'd love to know what my true score was.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit

@Anonymous wrote:

@SomewhereIn505 wrote:You are going in the right direction. The hardest part is being patient.

To get your actual FICO score - go to Experian $1 trial and get all your reports. You can also get your actual report(s) depending which product you chose from myfico, too.

This gives you a basis to know how you are growing. CK is good info for quickly seeing what's being reported, but their scores are not accurate and the cards they recommend is marketing. YMMV there!

I've tried going to places and getting my FICO score, but it tells me it can't calculate them due to my credit report being too thin. Not enough open accounts, etc. Believe me, I'd love to know what my true score was.

Once your oldest account is 6 months old, FICO can calculate a score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit

Congrats!

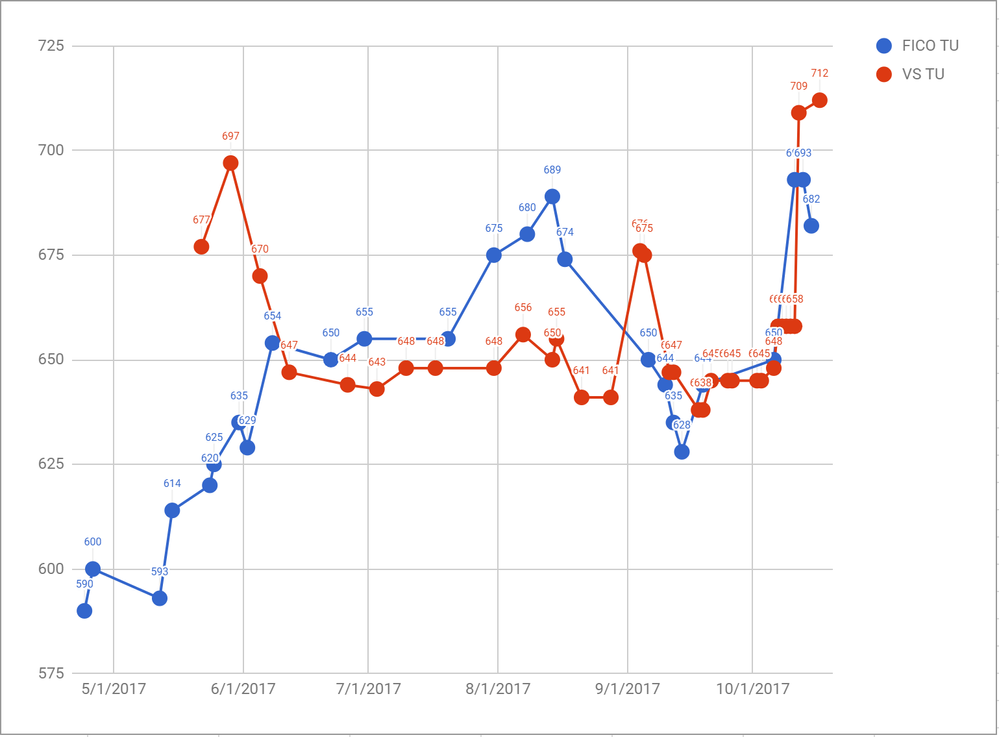

CK isn't a good place to know how your useful FICO scores change because CK is clueless when it comes to being close to FICO. Here is a glance at my FICO versus CK (VantageScore) comparison over time, and as you can see, as I deleted derogatories and lates and chargeoffs, the scores sometimes moved in opposite directions.

So sometimes when VantageScore (CK) moves up, FICO went down below an approval line for cards. When FICO went up, VantageScore (CK) went down telling me I might not be approved for a card.

Credit Karma is fine for simple reviewing of your accounts but don't trust CK/Vantage Score for anything before an application. Pull your FICO scores using the CCT $1 trial and immediately call to cancel the trial.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Rebuilding Credit

So today I received an email stating my Capital One Secured card was being mailed out and I should have it by the 20th. Still waiting on my Discover Secured card also. In the meantime, I've opened the Alliant SSL, made a lump sum payment of $450, bringing the balance to $50, with a scheduled auto pay for 10/17/17, which should bring me to around $40. I noticed it said they report towards the end of the month, so hopefully I'll start seeing some progress. Also, is it hard to get approved for the Citi Secured card? I applied the same time as I applied for the Discover and Capital One cards, but I just checked my status, and it said not approved.