- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Help raise my FICO 20 points

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help raise my FICO 20 points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help raise my FICO 20 points

So I have great news.... after8 long months battling with a Collection Agency( IC Systems), I have prevailed and I'm back in the 700 club. TU- 711, Eq-716, Ex-700. Total utilization at 33%,(14k) plan to knock that down to 25% this month. I am preparing for an Auto loan ASAP and would like my score above 720 as to not get **bleep** by the interest rate. I thought about applying for a new card to transfer the 14k under one account. Any and all sugestions welcomed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help raise my FICO 20 points

Congratulations nice work.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help raise my FICO 20 points

Congrats on the Collections battle, the struggle is real!

Pay that $4620 in debt down and you will see a bump... Not sure any other tips are needed. Good luck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help raise my FICO 20 points

@Anonymous wrote:So I have great news.... after8 long months battling with a Collection Agency( IC Systems), I have prevailed and I'm back in the 700 club. TU- 711, Eq-716, Ex-700. Total utilization at 33%,(14k) plan to knock that down to 25% this month. I am preparing for an Auto loan ASAP and would like my score above 720 as to not get **bleep** by the interest rate. I thought about applying for a new card to transfer the 14k under one account. Any and all sugestions welcomed.

Just pay it down. Why get another HP , a hit to your AAoA, New account, and so on. The next hits against you should be for the car. Try to get a pre-qual from a lender that will give you the check to take to the dealer and then pick what you want without 50 HP's to see the best kick back they can get. Good Luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help raise my FICO 20 points

I second what FireMedic said.

& what I was going to say before I read the other replies was *AZEO! (All Zero Except One).. I dont know what your balances are spread out on, but you should try and get over half of your cards down to reporting $0 balance and the others down to around 9%. This will most likely raise your scores at least a little during the months they report this way. the effect only lasts as long as you continue having them report like this. Good luck ![]()

Edited to add: if you only have 3 cards have 2 report $0 balance and 1 report at about 9% (or as low as possible anyway). if you have 5 cards you could do it with 2 cards having a balance. ALSO, if its too much to be able to get them that low, I have seen luck with moving the balance to less than half the cards but having it be over the 9% as well.. long as over half dont carry a balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help raise my FICO 20 points

|   |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help raise my FICO 20 points

@Anonymous wrote:So I have great news.... after8 long months battling with a Collection Agency( IC Systems), I have prevailed and I'm back in the 700 club. TU- 711, Eq-716, Ex-700. Total utilization at 33%,(14k) plan to knock that down to 25% this month. I am preparing for an Auto loan ASAP and would like my score above 720 as to not get **bleep** by the interest rate. I thought about applying for a new card to transfer the 14k under one account. Any and all sugestions welcomed.

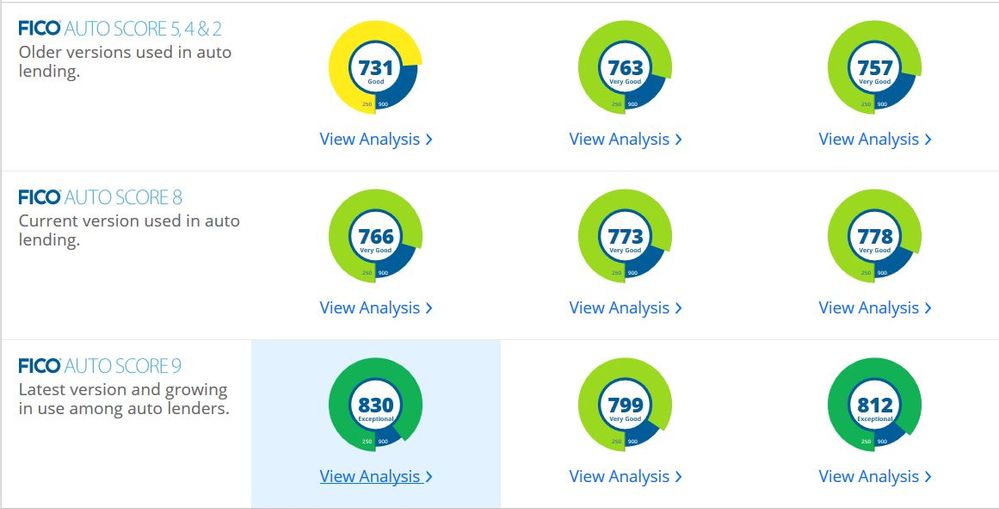

Maybe I am wrong in this but those are your FICO scores correct? Isn' there auto scores which might be different? Also, I believe some places might use an internal number that might not be based on FICO. Someone correct me if I am wrong, please.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help raise my FICO 20 points

The FICO Auto Score 8 is the most recent version and is used across all credit bureaus. Some dealerships or finance companies may use one of the older versions: FICO Auto Score 2, FICO Auto Score 5, or FICO Auto Score 4. So you are correct @VoltaicShock. MyFICO 1B or 3B will show the Auto Scores. Mine: (just as an example. Educational. All over the place)