- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Help with Charge Off Account...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help with Charge Off Account...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with Charge Off Account...

Hi,

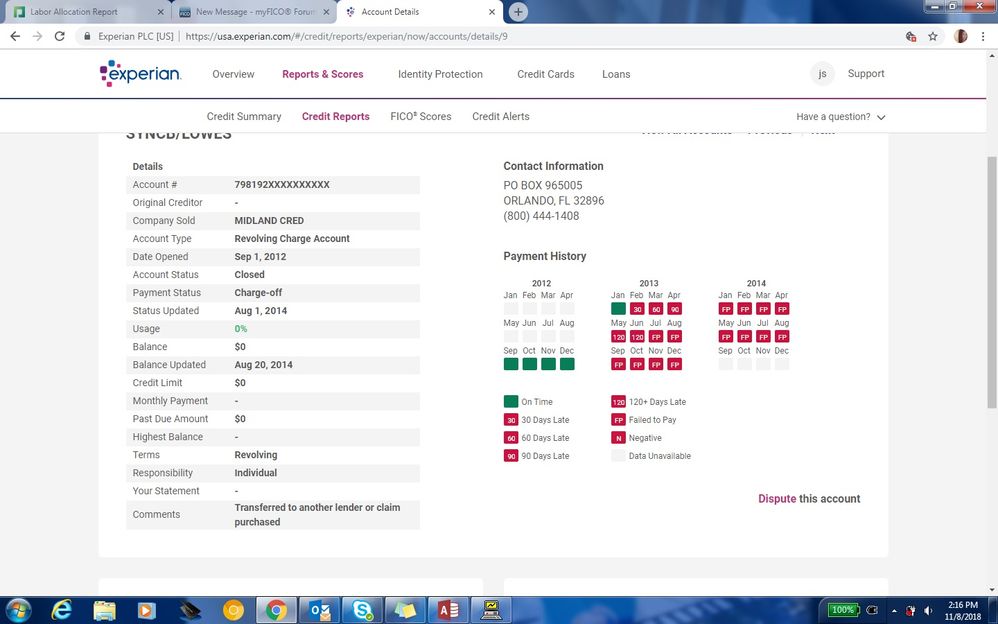

I had a question if there was anything that I could do with this 1 charge off account from Lowes/Synch on my credit that is hurting me besides my bankruptcy. How can I attack this? It was sent to midland credit and paid with them afew years ago. I no longer have any collections on my reports. The only baddie that shows up is this one. If goodwill campaigns are recommended I would not know how to ask to remove it. Do i ask for all the dates of delinquincies to be removed or just a few of them? I'm still trying to get the jist of this. Any advice is welcomed and appreciated.

Thank you all ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with Charge Off Account...

In my case I simply asked that the entire tradeline be removed from my reports.

Check out this thread, you may be in luck. I didn't read through all of the posts, but you may be able to reach out to Midland and request deletion without having to write a goodwill letter.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with Charge Off Account

The payment history profile infers that the account first went delinquent in Jan 2013 based on their first reporting of a 30-late in Feb 2013.

It does not specifically report a charge-off status in the prior payment history profile, but they apparently presented either a special comment of current status of charge-off, as the credir report does reference a CO status, as further exhibited by it apparently having reached 180-late as of August 2013, which is the federal regulatory period of required charge-off of a revolving debt.

The creditor then apparently sold the debt to Midland, and properly updated the balance to $0 to reflect that they no longer owned the debt.

Thus, it appears that their taking of a CO was legit and proper, and the post does not contest the validity of the debt, as it was subsequently paid to the new owner.

The creditor, upon sale of the delinquent debt, thus apparently complied with all reporting requirements.

Subsequent payment of the debt to the new owner did not impose any requirement on the original creditor to delete any reporting of derogatory history on their account, and thus there does not appear to be any basis for disputing the accuracy of their reporting.

The debt collector cannot delete any reporting made by the original creditor, so contacting Midland would not be the appropriate step.

The proper process for pursuing removal of the original creditor derogatory reporting of delinquences and/or a CO or of their entire account prior to its expected exclusion date of after Jan 2020 would be to send a good-will request to the orginal creditor.

With their having taken a net loss on the debt, as they received no part of the payment ultimately made to the new owner, it may be a bit difficult to gain their good-will. Do you have compelling reasons for not having paid the debt to the creditor for that extended period that might elicit some sympathy on their part?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with Charge Off Account

Thank you for correcting me, RobertEG. I did not think that even though Midland may delete, the OC would still be on the reports.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with Charge Off Account...

@Anonymous wrote:In my case I simply asked that the entire tradeline be removed from my reports.

Check out this thread, you may be in luck. I didn't read through all of the posts, but you may be able to reach out to Midland and request deletion without having to write a goodwill letter.

Thanks for your response. Its not actually to midland. Its to the original creditor which is Lowes/Synch, sorry it was cut off in the picture. But I will check out the link definitely.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with Charge Off Account

@RobertEG wrote:The payment history profile infers that the account first went delinquent in Jan 2013 based on their first reporting of a 30-late in Feb 2013.

It does not specifically report a charge-off status in the prior payment history profile, but they apparently presented either a special comment of current status of charge-off, as the credir report does reference a CO status, as further exhibited by it apparently having reached 180-late as of August 2013, which is the federal regulatory period of required charge-off of a revolving debt.

The creditor then apparently sold the debt to Midland, and properly updated the balance to $0 to reflect that they no longer owned the debt.

Thus, it appears that their taking of a CO was legit and proper, and the post does not contest the validity of the debt, as it was subsequently paid to the new owner.

The creditor, upon sale of the delinquent debt, thus apparently complied with all reporting requirements.

Subsequent payment of the debt to the new owner did not impose any requirement on the original creditor to delete any reporting of derogatory history on their account, and thus there does not appear to be any basis for disputing the accuracy of their reporting.

The debt collector cannot delete any reporting made by the original creditor, so contacting Midland would not be the appropriate step.

The proper process for pursuing removal of the original creditor derogatory reporting of delinquences and/or a CO or of their entire account prior to its expected exclusion date of after Jan 2020 would be to send a good-will request to the orginal creditor.

With their having taken a net loss on the debt, as they received no part of the payment ultimately made to the new owner, it may be a bit difficult to gain their good-will. Do you have compelling reasons for not having paid the debt to the creditor for that extended period that might elicit some sympathy on their part?

Hi,

Disputing wasn't an option for me because it is 100% my fault it not paying, so I'm not contesting to that. I had lost my job and had a 5 cards go to collections. 4 went to Portfolio and they were deleted last month. Midland reported for a year and then they deleted themselves on their own. So now I am trying to see about this orginal creditor one which is Lowes. So my question now would be, do I ask for a goodwill for the entire time I was late and defaulted?