- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- How many accounts enough to build credit?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How many accounts enough to build credit?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

So capital one updated my $0 balance and sure enough I got all 19 points back that I had lost last month when I let it report a balance. My EQ fico8 is now 736 with just 2 credit cards, total CL of $2,100 with a total balance of $10 ($2,090 available). Average and newest account age of 7 months and oldest age of 8 months.

I'm still waitng for my Self account to get added back on EQ.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

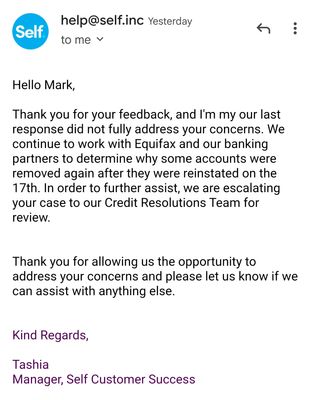

Still going back and forth with Self via email. I reached out to a "manager" who had told me "all accounts were reinstated with Equifax on 11/17/22" and asked me for a screenshot of my Equifax report for verification. After I showed her there's no account listed on there, I got another response saying they can issue me a "letter to your lender" verifying the account. I told her I don't need a letter, I need my account added back on my credit report. I explained the account was added on 11/17 but then was removed again 2 days later on 11/19. I attached their latest response below. It seems like there are many more affected accounts they are dealing with than just mine.

I had read somewhere that Equifax doesn't report loans under a certain balance threshold. I can't find the source but I know for a fact I read that. Not sure how true that is but even if it were, I don't believe EQ would remove all traces of the account from record.

I have to say, I regret joining Self. Even their emails are full of poor grammar and at times nonsensical. I'm trying to hang on until I apply for that auto loan and once I do, this account is getting paid off and I am cutting ties with them forever.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

My Self account was relisted on Equifax today as expected from the automatic monthly reporting. I'm not going to get too happy though because it'll possibly get removed again. I hope not but time will tell. I'm waiting on myfico to update my EQ score but I did check my report directly from EQ site which I get daily for free as part of their gold membership and the account is definitely back on there as of today.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

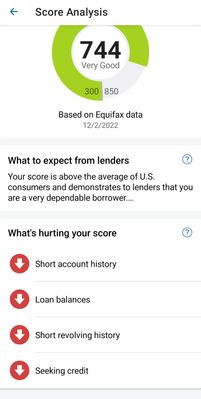

I got a couple score updates. On Dec 1st I got a 2 pt bump on EX, 3 pt bump on TU and a 3 pt bump on EQ due to my accounts aging to 9 months oldest and 8 months newest/average. The following day on Dec 2nd my Self loan account had been relisted on my EQ file which gave me an additional 5 pt bump there. I’m now in the “very good” credit range on EQ with a score of 744.

I have a 663 on TU and 661 on EX. I look forward to getting the collection account removed next month from those reports so the scores can match up with EQ.

I gained 27 pts in 10 days with EQ. My score factors state "seeking credit" when I only have 1 inquiry that's 8 months old. I assume once it hits 12 months it won't factor anymore?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

EASY Transunion Early Exclusion (EE)!

What's up everyone!

I wanted to make a dedicated thread about this for anyone that's looking to get a derog account removed early from their Transunion report.

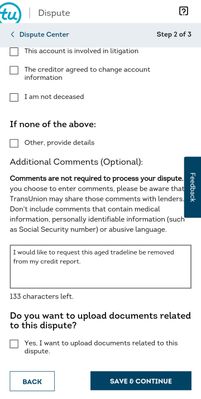

I have a collection account on my TU and EX reports. It's the only derog I have. It's due to drop off TU on 6/2023 and I realized that I was in that 6 month EE window.

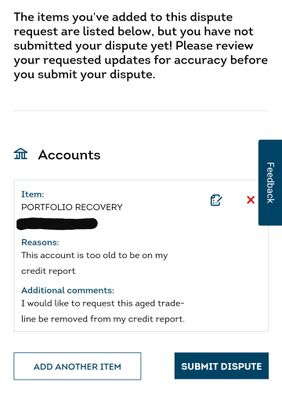

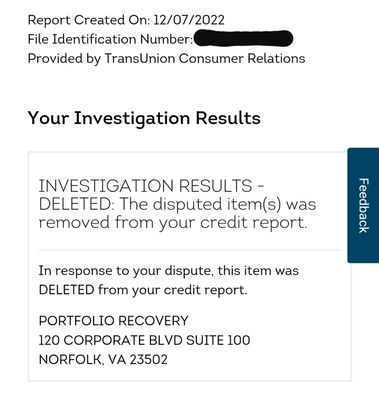

I went online and filed a dispute directly with TU on their site and the account was INSTANTLY removed! There was no waiting period whatsoever. The moment I clicked the "submit dispute" button it was deleted off my report. Instantaneous results.

I posted some screenshots below showing exactly how I disputed it. It's clear that TU has a automated system regarding EE. Once you're in the 6 month window and claim the account is "too old" it will get removed on the spot. Just make sure you mark it as "too old" as shown in the screenshots. I heard some ppl used the "other" option with success but that wasn't a instant removal. They had to wait an hour or so for the results.

I'm so happy and can't wait to get my refreshed score! I hope this post helps anyone in the same situation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

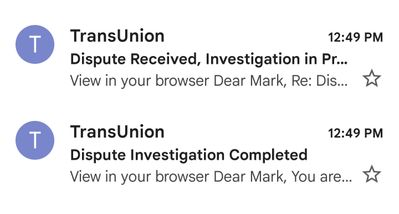

Just to add one more thing. The dispute result was so instantaneous that I received the dispute results email seconds before the dispute submission email, lol. Emails are listed newest to oldest from the top down.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

Congrats. Here's hoping it doesnt re-list if its outside the 6 month window. Some things are removed until final results. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EASY Transunion Early Exclusion (EE)!

@FireMedic1 wrote:Congrats. Here's hoping it doesnt re-list if its outside the 6 month window. Some things are removed until final results. Good luck.

Thank you. This is the final result. The dispute is complete and closed. My concern is whether the CA can relist the account by updating it next month as they normally do. Does TU notify them not to report anymore or does TU simply block it from being added again? I wonder how that works? I couldn't find anyone that had a EE account come back but I'm always skeptical when something good happens to me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EASY Transunion Early Exclusion (EE)!

@MarkyB you have been doing an amazing job at fixing your credit. I just thought I would give you some kudo's for it. I have been busy as heck lately and not on here as much as I would like to be but I will continue to drop in to see how all is going. I can't wait to see the post once you get that auto loan you are striving for. It is coming for sure and at this rate it should be sooner than later. I wish you could get back in with NFCU as they are awesome with auto loans and to my surprise not scared to give a large amount on a first time buyer. Best of luck to you and keep moving forward!!!!

>

> >

> >

> >

> >

> >

> >

> >

> >

>

Starting Score:

0

Current Score:

My highest 818

Goal Score:

850

Take the myFICO Fitness Challenge

/

/