- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: How to Pay it Down?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How to Pay it Down?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Pay it Down?

Hi,

I'm looking for some advice from you guys regarding the best strategy to pay down some balances. My situation is completely manageable but I want to eliminate this CC debt as fast as possible. I opened a few 0% & travel cards last year to payoff some medical expenses and items that had gone into collections while getting either no interest or points to use for future travel. In doing so I cleaned up my report and had family members add me as an AU on their cards (no harm done doing so for either party) to help raise my limits and lower untilization. However, in the process I ended up carrying a balance across 3 cards since at the time I didn't have a score good enough to open 1 card with a high starting limit.

Recently, I got a new job making more money than I was before and just paid my car off a few days ago. Between those two events I have plenty of extra money to chip away at this debt while saving still. I've planned out a budget from my takehome pay each check (2 checks/mo) taking into account all my fixed expenses and a few variable ones that I anticipate. I've deferred my student loans for a few months to allocate that money for this plan to work as well.

So here it goes:

Wells Fargo Platinum Visa | $3,415 @ 0% until 1/25/20 | Min. Payment $35 | $3,700 limit

Chase Unlimited | $2,000 @ 25% | Min. Payment $59/mo | $39.94 interest/mo |$5,500 limit

Venture One | $1,846 @ 24.24% | Min. Payment $56/mo | $38.68 interest/mo | $2,900 limit

AMEX Blue | $1,740 @ 26.24% | Min. Payment $57/mo | $40/17 interest/mo | $3,000 limit

Based on my budgeting I'll have $800-970/mo (leaving some room for flexibility) to put towards getting this **bleep** paid off.

1) Should I tackle the Wells Fargo @ 0% first and have that paid off in ~3.5months?

2) Or focus this money and pay off the other cards individually and wait out the 0% until January '20 on the WF...at which point I'd have to Balance Transfer but with minimal utilization and recovering score. I've seen cards at 15-21mo but opening another card is terrifying at this point and I'd like to avoid the hard pull.

If I tackle the WF first it would mean I'd be accruing in total $118.79/mo in interest on othe cards over the course of those 3.5 mo I'm paying it off. I definitely think this plan is workable but would like some feedback on the smartest way to do it. I want this paid off so I can get myself back into the good credit graces! Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Pay it Down?

@Anonymous wrote:Hi,

I'm looking for some advice from you guys regarding the best strategy to pay down some balances. My situation is completely manageable but I want to eliminate this CC debt as fast as possible. I opened a few 0% & travel cards last year to payoff some medical expenses and items that had gone into collections while getting either no interest or points to use for future travel. In doing so I cleaned up my report and had family members add me as an AU on their cards (no harm done doing so for either party) to help raise my limits and lower untilization. However, in the process I ended up carrying a balance across 3 cards since at the time I didn't have a score good enough to open 1 card with a high starting limit.

Recently, I got a new job making more money than I was before and just paid my car off a few days ago. Between those two events I have plenty of extra money to chip away at this debt while saving still. I've planned out a budget from my takehome pay each check (2 checks/mo) taking into account all my fixed expenses and a few variable ones that I anticipate. I've deferred my student loans for a few months to allocate that money for this plan to work as well.

So here it goes:

Wells Fargo Platinum Visa | $3,415 @ 0% until 1/25/20 | Min. Payment $35

Chase Unlimited | $2,000 @ 25% | Min. Payment $59/mo | $39.94 interest/mo

Venture One | $1,846 @ 24.24% | Min. Payment $56/mo | $38.68 interest/mo

AMEX Blue | $1,740 @ 26.24% | Min. Payment $57/mo | $40/17 interest/mo | $57

Based on my budgeting I'll have $800-970/mo (leaving some room for flexibility) to put towards getting this **bleep** paid off.

1) Should I tackle the Wells Fargo @ 0% first and have that paid off in ~3.5months?

2) Or focus this money and pay off the other cards individually and wait out the 0% until January '20 on the WF...at which point I'd have to Balance Transfer but with minimal utilization and recovering score. I've seen cards at 15-21mo but opening another card is terrifying at this point and I'd like to avoid the hard pull.

If I tackle the WF first it would mean I'd be accruing in total $118.79/mo in interest on othe cards over the course of those 3.5 mo I'm paying it off. I definitely think this plan is workable but would like some feedback on the smartest way to do it. I want this paid off so I can get myself back into the good credit graces! Thank you!

Could you place what the credit card limit is also? Need to know util on each card. You'd want to tackle the highest interest card first and work your way down.

Ex: Wells Fargo CL; xxxx Balance: xxxx APr:xxx (Monthly payment we dont neeed)

Wells Fargo Platinum Visa | $3,415 @ 0% until 1/25/20 | Min. Payment $35

Chase Unlimited | $2,000 @ 25% | Min. Payment $59/mo | $39.94 interest/mo

Venture One | $1,846 @ 24.24% | Min. Payment $56/mo | $38.68 interest/mo

AMEX Blue | $1,740 @ 26.24% | Min. Payment $57/mo | $40/17 interest/mo | $57

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Pay it Down?

Added the limit at the end of each line. I agree that it makes sense to start with the highest interest - what's throwing me off is the card with the highest balance having 0% and thinking if I can't offload that before the promo APR expires that the interest will be huge and it might be hard to open up another card trying to BT that. Does that make sense?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Pay it Down?

Ok I broke it down to the basics. Which to pay first and with util % considered. And in order to pay to the most and tackle the others at the same time.

Wells Fargo Platinum Visa $3,415/ $3,700 limit 0% until 1/25/20 I would tackle this one the most before the interest kicks in. Also it is considered maxed out over 89% and killing your score.

AMEX Blue $1,740/$3,000 limit @ 26.24% 2cd pay off

Chase Unlimited $2,000/ $5,500 limit @ 25% 3rd payoff

Venture One $1,846/$2,900 limit @ 24.24% last one

As they all pass util % thresholds in your way down to paying them off. You'd be helping your score at the same time. Only reason i say is go after the 0% first is like I said maxed. You dont want any AA against you if its been a high balance for a long period of time. Then move on down the list until its done. The others are around 50+% but thats not a danger zone really. Hope this helps. Good Luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Pay it Down?

^ this plan

the only thing I would change is to make the monthly payments on the last 3 CC’s $75/month, then using the rest for the 1st one (Wells)

that way you are showing all 4 companies that you aren’t just making the minimum payments.

And you will see a monthly decrease on all 4, without heavily impacting your first pay down.

Jan 25/2024 EX. 774 EQ. 751 TU 758

Inq. EX 2 EQ 3 TU 6 - - CC 2x24, 0x12

Amex BCP $35k - Apple GS $21k - BMW/Elan $19k - Cap1 QS $16.7k - Chase Amazon $13.6k - Chase Bonvoy Bountiful $10k - Chase United Club Infinite $26k - Citi CustomCash $3k - Citi DC $14.5k - CreditUnion1 $9k - DiscoverIT $31.5k - PayBoo - $15.6k - Penfed Gold - $19.3k - USB AltitudeGO -$19k- USBank Cash+ -$25k - PenFed LOC - $20k - USB LOC - $15k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Pay it Down?

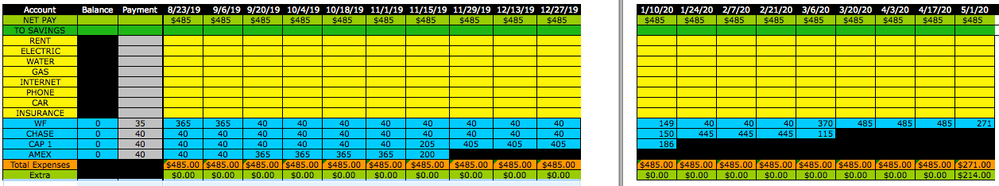

Here's a paycheck by paycheck plan to pay everything down ASAP, based off of $970/mo available. GL!