- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- How to improve this?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How to improve this?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to improve this?

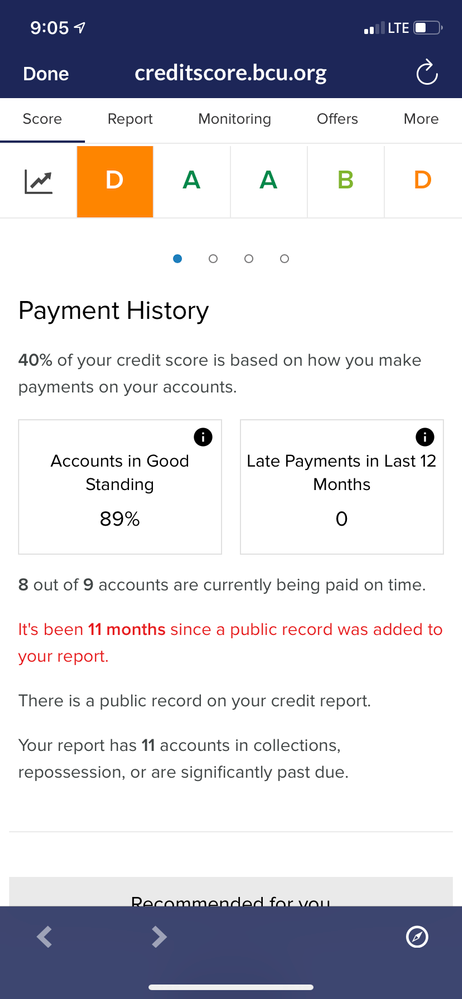

so this is on BCU. How do I get the 11 accounts thing to improve? Those are the IIB Ones. And the one negative of the 8/9 is my ETFCU Car Loan that was IIB but it still factors into the 8/9 idk why.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to improve this?

@Anonymous514 wrote:so this is on BCU. How do I get the 11 accounts thing to improve? Those are the IIB Ones. And the one negative of the 8/9 is my ETFCU Car Loan that was IIB but it still factors into the 8/9 idk why.

If I understand your question, you are asking how to make improvement for the 11 accounts that are being reported as past due or in collections?

At the risk of stating the obvious, you have to bring them current, pay them off in full or settle for lesser amounts where that option exists, or otherwise work to get them removed.

In order for the membership here to offer advice, best if you list out the accounts/collection agencies that make up these 11 accounts with the balances owed, credit limits where applicable, and if you agree that the debts are themselves valid.

Basically, more data points are needed in order to give some guidance for how to go about eliminating these derogatories and making improvement to your overall credit profile.

For a previous late payment reported on an auto loan (or any other account) that is valid, the only recourse is a goodwill campaign to the creditor (many threads about GW here in the forums) to request that the item be removed in good faith based on your otherwise positive payment history or unforeseen circumstance that may have caused the late pay to begin with.

If I have misunderstood your question for advice, please elaborate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to improve this?

Yeah so like I said the 11 were included in bankruptcy. But they're still showing that kind of status.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to improve this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to improve this?

Ahh ok that's what I was looking for! Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to improve this?

@Azuieldrago wrote:Thats the way its gonna be until they fall off in about 7 yrs. Unless you can get them to remove it or the tradeline via a goodwill campaign. If they were IIB, thats a derogatory mark. Not much you can do.

+1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to improve this?

Bankruptcy removes your legal obligation to pay those accounts IIB, however, bankruptcy will be a derogatory on your CR for 7-10 years after discharge. Goodwill letters might have a chance in removing derogatory accounts but not the bankruptcy. The derogatory accounts will fall off before your bankruptcy, which is the worst derogatory to have so IMO it would be a waste of time to try a GW campaign.

Your FICO credit scores are not just numbers, it’s a skill.

30 day post DC

30 day post DC

60 days post DC

60 days post DC

94 days post DC

94 days post DC